With $NVIDIA Corp(NVDA)$ setting the pace as the "global AI barometer," Wall Street's ongoing optimism has sparked an AI gold rush in the US stock market.

$Vertiv Holdings LLC(VRT)$ , known for its power and cooling infrastructure solutions, offers a range of air-cooled, liquid-cooled, and power distribution services tailored for compute-intensive AI workloads. Their liquid cooling solutions, including the Liebert XDM split indoor chilled water unit and Liebert XDU coolant distribution unit, are integral to their offerings.

Vertiv recently launched the AIGC full-stack liquid cooling solutions in April 2024, featuring both cold plate and immersion options. The cold plate solution, with its 1mm precision to isolate impurities, ensures zero server hotspots, while the liquid cooling setup—comprising coolant distribution units (CDUs), server water tanks, and connecting pipes—employs insulated coolant to achieve a unit pPUE below 1.04, reducing energy consumption by 15% and boosting efficiency by 200%.

Vertiv, designated as NVIDIA's exclusive liquid cooling supplier due to their involvement in the COOLERCHIPS program (which received funding from the US Department of Energy in May 2023), collaborated for three years with NVIDIA's expert team to develop advanced cooling solutions for high-density data centers.

Regarding their stock performance, Vertiv's share price has surged 83.02% year-to-date and skyrocketed by 251.81% over the past year, significantly outpacing the S&P 500 index.

First Quarter Financial Report

In Q1 2024, Vertiv achieved $1.639 billion in revenue, a 7.8% year-over-year increase, exceeding both the upper end of the company's guidance ($1.575 billion to $1.625 billion) and Bloomberg's consensus estimate ($1.623 billion).

Adjusted operating profit was $249 million, a substantial 41.5% year-over-year increase, well above the company's guidance ($200 million to $220 million). Vertiv is expected to continue surpassing expectations in their upcoming Q2 earnings report on July 24, 2024.

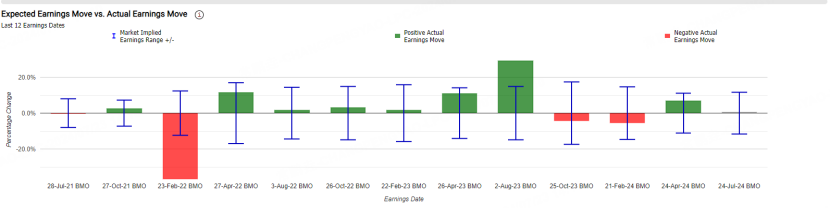

Back-testing over the past 12 quarters indicates that the options market has overestimated Vertiv's stock price movement 83% of the time. The expected average deviation post-earnings is ±13.5%, compared to an actual average deviation of 9.6% (absolute value).

However, Vertiv often experiences significant upward or downward swings, with a maximum increase of 29.2% and a maximum decrease of 36.7%. Investors might consider capitalizing on Vertiv's volatility—whether by betting on its ups and downs or hedging against volatility.

What is a "Straddle"?

A straddle is a neutral options strategy involving simultaneous purchase of both a call option and a put option on the same underlying security with the same strike price and expiration date.

When the price of the option rises or falls relative to the strike price by more than the total cost of the premium paid, the trader will profit from the bull straddled option. This strategy thrives on high volatility, offering nearly unlimited profit potential.

A bear straddle involves selling both a call option and a put option with the same strike price and expiration date. It's used when traders anticipate minimal movement in the underlying asset during the option contract's lifespan. The maximum profit is the premium collected from selling the options, but potential losses can be unlimited.

Straddle can provide traders with two important clues as to how the options market feels about a stock. The first is the expected volatility of securities. The second is the expected trading range of the stock before the expiration date.

Straddle strategies are often employed ahead of significant corporate events, such as quarterly earnings reports. When uncertain about market direction, investors may opt for straddle to mitigate risk. However, they are most effective during periods of heightened market volatility and may not succeed in stable market conditions.

Case Study: Bear Straddle on VRT

Step1: Taking the VRT option with a strike price of $78 and an expiration date of July 26, selling a put option at the opening price of $1.4 and gets a premium of $140.

Step2: Taking VRT option with the same strike price of $98 and an expiration date of July 26, selling a Call option at the opening price of $1.63 for a premium of $163.

In this trade, the total premium received is $300. However, it comes with obligations: first, from the put option, where the buyer can sell VRT to the investor at $78 at any time. Second, from the call option, where the investor must satisfy the buyer's demand to deliver VRT at $98 at any time.

Profit is realized only if VRT's closing price falls between $78 and $98 (excluding commissions), with a maximum profit of $300. However, if the stock price sees unlimited upside or downside after the earnings report, investors could face unlimited losses.

For investors engaged in a bull straddle, betting on volatility, simply switch the two sell actions to buy actions. Profit is realized if VRT's closing price is below $78 or above $98 (excluding commissions).

The basic idea behind volatility trading strategies is to construct an options strategy that hedges out other factors affecting option prices, leaving only the impact of volatility on the option strategy related to stock options.

Comments