Stock prices usually take a wild swing after companies release their financial reports. If you're looking to make some money by betting on the direction of these moves before earnings announcements, options trading can be a powerful tool to amplify gains and minimize risks.

Betting on earnings with options is arguably one of the simplest strategies, offering massive returns when you get it right. But remember, it's not just about guessing the direction; you need a significant price swing to overcome the odds stacked against you as a buyer. The sellers, on the other hand, have the upper hand, silently collecting premiums and capitalizing on the reduced volatility around earnings.

To stay ahead in the earnings game, aim to be the option seller. Your goal is to cash in on those juicy premiums and profit from the narrowing volatility around earnings announcements. How? Enter the short straddle and long strangle strategies.

What's a Long Strangle?

Long Strangle is an options strategy where you simultaneously hold both out-of-the-money call and put options with different strike prices but the same expiration date and underlying asset. If you think the underlying stock will experience significant price movements but aren't sure which way, a long strangle could be your play. If you expect limited movement, a short strangle is the way to go.

In a long strangle, you buy an OTM call and an OTM put. The call's strike is above the current market price, while the put's strike is below. The upside is huge – unlimited upside potential for the call if prices rise, and profit potential for the put if prices fall. Your risk is limited to the premiums paid for both options.

A short strangle, on the other hand, involves selling OTM call and put options at the same time. It's a neutral strategy with limited profit potential, but you win when the stock trades within a narrow range around the break-even points. Your max profit is the net premium received minus transaction costs.

Betting on AbbVie and AstraZeneca Earnings

Both $AbbVie(ABBV)$ and $AstraZeneca PLC(AZN)$ are set to report earnings on July 25, 2024.

Abbvie, incorporated on April 10, 2012, is a global, research-based biopharmaceutical company. Abbvie develops and markets advanced therapies to address some of the world's most complex and serious diseases. Abbvie's products are primarily focused on chronic autoimmune diseases, including rheumatoid arthritis, psoriasis and Crohn's disease, psoriasis and Crohn's disease; Low testosterone, HIV, endometriosis; Thyroid disease; Parkinson's disease or other health problems.

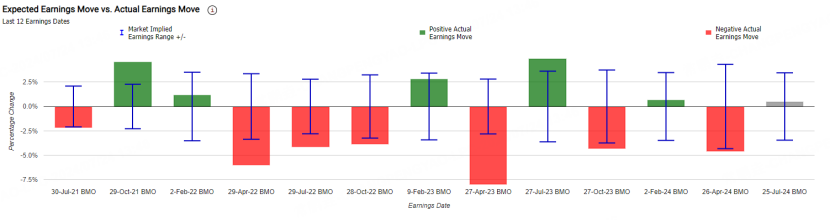

The options market has overestimated ABBV's stock earnings movement by 25% over the past 12 quarters. The average forecast change after an earnings announcement was ±3.2%, while the average change in actual earnings was 3.9% (absolute). This suggests that ABBV tends to be more volatile than the options market predicts in terms of earnings share price reaction.

ABBV's biggest gains have been 4.9% and its biggest declines -8% over the past 12 quarters.

Based on the current price of $173, investors can choose to sell a call option with a strike price of $185 and a put option with a strike price of $160.

$AstraZeneca PLC(AZN)$ is a leading global pharmaceutical company with total 2022 revenues of $44.4 billion, formed by the merger of the former Swedish Astra and the former British Zeneca in 1999. As an innovation-driven global biopharmaceutical company, Astrazeneca employs approximately 61,500 people worldwide with operations in more than 100 countries and production sites in 17 countries.

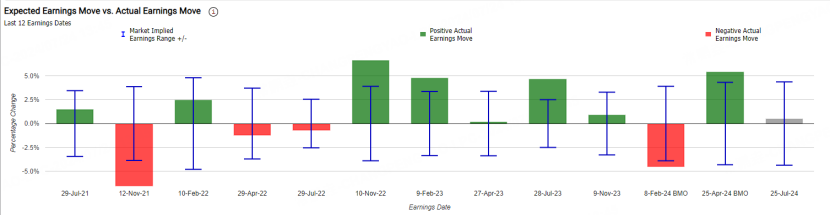

The options market has overestimated the AZN stock's earnings movement by 50% over the past 12 quarters. The average forecast change after the earnings announcement was ±3.6%, while the average actual earnings change was 3.3% (absolute).

$AstraZeneca PLC(AZN)$ 's maximum gain over the past 12 quarters has been 6.6% and maximum decline -6.5%. Based on the current price of $79, investors can choose to sell a call option with a strike price of $85 and a put option with a strike price of $70.

Remember, past performance doesn't guarantee future results, but it can serve as a guide. You might consider widening your strike prices for added safety. Happy trading!

Comments