Summary

- Google continues to be well-positioned in the AI play, with robust Q2 results in its core Search advertising business and persistent momentum in Cloud monetization.

- The latest earnings outperformance continues to assuage previous concerns about AI-driven cannibalization of Google's search dominance, and reinforces its reputation in actively monetizing the nascent technology.

- However, the stock's post-earnings response continues to highlight the increasing disparity between Google's fundamental outlook and its valuation premium at current levels.

400tmax

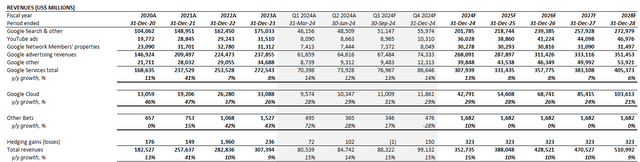

Google (NASDAQ:GOOG/NASDAQ:GOOGL) has been one of the biggest gainers this year, alongside digital advertising peer Meta Platforms (META). Previous concerns over potential cannibalization of Google’s online search dominance with the advent of generative AI tools like OpenAI’s ChatGPT have largely subsided. Google’s continued demonstration of resilience at its core search advertising and Google Cloud segments are also buoying the stock’s upsurge towards all-time highs. The company’s recent roll-out of AI Overviews to supplement native search results on Google is also in line with our previous expectations for further monetization of Search Generative Experience (“SGE”) developments. This was evident in the sequential acceleration in Google Search & Other revenue growth during Q2, which expanded at +5% q/q to $51.1 billion, despite softness in seasonality.

Specifically, Google’s outperforming results in Q2 continue to corroborate its capabilities in monetizing the substantial AI investments that have been and are still being made. The company’s consistent positive progress in growing core search advertising and Google Cloud revenues, while maintaining profit margins by balancing incremental AI-related costs have also played a key role in alleviating previous investors’ angst over competitive threats. Yet, we see limited new catalysts in the near-term that could enable further multiple expansion for Google's stock from current levels, as AI monetization opportunities through its core advertising and Google Cloud segments are likely already priced in.

AI is Still in the Driver’s Seat

Google Search advertising and Google Cloud remain key focus areas. Management has continued to emphasize Google’s strategy in integrating generative AI capabilities into its core operating segments in order to capture relevant emerging growth opportunities. However, we believe the realization of incremental AI-driven monetization opportunities across Google Services and Google Cloud have already been priced into the stock at current levels.

Specifically, supporting underlying fundamental estimates likely already reflect the incremental growth outlook and efficiency gains stemming from Google’s AI strategy earmarked for its core search advertising and Google Cloud Platform (“GCP”) businesses. The stock’s current price of $179 per share after earnings is largely in line with our updated base case forecast, which considers actual Q2 results and its forward outlook.

Our updated base case projections reflect a long-term revenue CAGR of 7.6%.

Author

The assumption applied is in line with the historical growth performance at Google’s core services and cloud segments, with consideration of incremental AI-drive TAM expansion for GCP. Meanwhile, we expect AI-related efficiency gains for Google’s core advertising business to be more evidently reflected in its long-term profitability. This is because the advent of generative AI tools is likely to disrupt and enhance existing advertising technologies, with the integration expected to help Google reinforce future demand instead of expanding its search advertising TAM. Yet incremental efficiency gains and ensuing return on ad spend improvements are likely to help Google command premium pricing from advertisers, which would be a key accretive factor to its profitability.

Specifically, AI-enhanced content creation and ad placements are not only expected to drive efficiency gains to advertisers, but also help Google reduce its operating costs as well. This is consistent with results observed from recently introduced generative AI tools for Google’s advertising business:

- Smart Bidding with AI: In Smart Bidding, advertisers can customize their respective performance targets, goals, audience and other attributes, and leave the rest to Google AI. Google AI works with advertisers’ customized information and automatically engages in ad auctions to bid for placements that will optimize conversion. The feature aims to improve key performance metrics like conversion and return on ad spend (“ROAS”) for advertisers, while also maintaining Google advertising’s technology advantage at scale.

- Broad Match: The advertising feature relies on its foundation models to optimize ads served based on end-users’ searches. For instance, relevant ads can be served based on a related keyword in the end user’s query, even if the keyword itself was not used. The tool aims at serving ads to a wider, yet more relevant audience base, and help advertisers optimize engagement and conversion, and, inadvertently, ROAS. This is consistent with the average 25% gain in conversions observed at advertisers who have adopted Google’s core Performance Max format alongside Broad Match and Smart bidding in their search ad campaigns.

- Gemini for Performance Max: As discussed in a previous coverage, Performance Max (“PMax”) is Google’s primary AI-enabled advertising tool. It simplifies the ad campaign creation process and optimizes ad placements by considering advertisers key performance targets (e.g. ROAS, cost-per-ad, etc.) and desired attributes (e.g. location, target audience, etc.) by leveraging AI/ML capabilities. And further integration of the Gemini LLM into PMax for all U.S. advertisers this year, with gradual global availability, has been yielding favourable results. With Gemini capabilities embedded into PMax, advertisers can now automate the generation of “text and image assets” critical to ad campaigns with greater variety and quality. For instance, Gemini for PMax can enable automatically created assets (“ACA”), which leverages advertisers’ existing campaign assets to generate additional assets to better reach and performance. Google has reported that ACA has driven on average 5% better conversion rates for advertisers, while maintaining similar cost metrics as native search and PMax campaigns. It also enables greater efficiency gains for advertisers by reducing the amount of time and labour spent on campaign creation.

With embedded AI enhancements into its core advertising business driving incremental performance and efficiency gains for advertisers, Google continues to be a format of choice. Not only does this reinforce demand, but the AI-driven enhancements in advertising are also favourable to Google’s prospects of “commanding premium pricing from advertisers” over the longer-term and help bolster the profit-driving segment’s margins.

Author

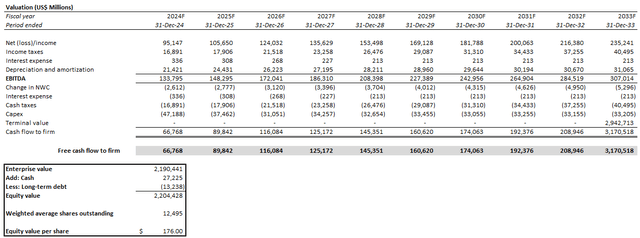

Considering relevant cash flows in a DCF analysis, with the application of a 9.9% WACC and 2% implied perpetual growth rate to determine Google’s terminal value at steady-state, the stock presents an estimated intrinsic value of $176 per share. This is in line with the stock’s current trading levels at about $179 following its Q2 earnings update, and reflective of our view that impending opportunities from Google’s AI strategy has likely already been priced in.

Author

Author

Potential New Growth Drivers

But an upside scenario is not yet entirely out of the picture. Google still presents several levers it can pull, in our opinion, to drive incremental growth and unlock further valuation gains from current levels.

A key incremental growth driver includes further monetization of YouTube through the greater inclusion of live sports programming. This is in line with recent trends observed at YouTube’s streaming peers, with live sports programming gradually migrating from traditional linear TV to streaming platforms.

Specifically, YouTube has been a bright spot for Google in recent quarters, with both its advertising and subscription revenue accounting for a growing mix of consolidated sales. YouTube ad revenue grew 13% y/y to almost $9.0 billion during the second quarter, while sales generated from its subscription offerings continue to flourish with a growing number of paid users. Specifically, management continues to highlight subscription growth momentum in YouTube TV and YouTube Music Premium during Q2, which has likely further fuelled its reach into more than 108 million paid subscribers on the platform last disclosed in Q1. Meanwhile, Shorts viewership has also doubled in the past 12 months, underscoring continued improvements to monetization. The continuing momentum has more than offset a tough PY comp due to YouTube TV price increases implemented in May 2023, underscoring strong organic engagement and ad demand on the platform.

On the subscription front, YouTube TV has benefitted from momentum, primarily from its live sports programming and exclusive streaming of out-of-market Sunday NFL games. For $72.99 per month (ex-discounts), the YouTube TV base plan allows subscribers to stream more than 100 live channels that span live sports, and scripted and non-scripted content. But by adding on Sports Plus, which includes streaming of more than 13 additional sports networks, YouTube TV garners another $10.99 per month. Meanwhile, the exclusive NFL Sunday Ticket tops another $87.25 per month for four months on existing Base Plan subscriptions – or at a standalone subscription premium of $112.25 per month for four months. This is consistent with live sports programming having historically been the “cornerstone” to linear TV viewership, and emerging observations of relevant content being a key growth driver for streaming platforms.

We believe further inclusion of exclusive live sports streaming rights can bolster YouTube’s subscription revenue and complement ongoing momentum for the platform’s ad monetization efforts. This would be additive to the company’s current growth trajectory and unlock incremental valuation gains from the stock’s current levels.

Specifically, YouTube currently commands the largest share of TV screentime in the U.S. at about 10%, making it a platform of choice for advertisers looking to broaden their respective campaigns’ reach. And a deeper foray in live sports streaming through YouTube TV is likely to bolster its streaming market share gains. Specifically, the sporting category has consistently accounted for more than 90% of the 100 most viewed programs on TV each year. This further complements ongoing secular tailwinds in digital advertising, which continues to favour video formats heavily. Specifically, global ad demand for short-form video ad formats are expected to grow by 14% y/y, while ad-supported streaming formats are expected to grow by 18% y/y.

This makes YouTube the key beneficiary of the fastest growing advertising formats going forward, with both skippable and non-skippable ad monetization opportunities present across its core formats spanning videos, Shorts, and YouTube TV. And incremental live sports programming is expected to bolster its share grab of emerging secular tailwinds due to YouTube’s industry-leading global reach, which is in line with results observed to date from its exclusive host of NFL Sunday Ticket. Additional inclusion of live sports programming is also expected to be additive to the growing revenue mix shift towards YouTube, and improve the segment’s margins to better match corporate levels over the longer-term.

Meanwhile, ongoing AI investments could also be incrementally additive to YouTube’s upside potential, given the nascent technology’s assistance to content creation. Specifically, the content creation market attributable to generative AI is expected to grow at a 10-year CAGR of more than 30%, with an estimated 70% of future ad content likely to be overtaken by AI-enabled automation in the longer-term.

And Google’s continued innovation through AI-enabled content-creating technologies features like Dream Screen, Veo, Google Vids, and Imagen are expected to further bolster YouTube’s participation in emerging opportunities. And ensuing efficiency gains realized by content creators are expected to further feed into YouTube’s current content feedback loop and become additive to its current TAM – the more efficiency gains brought to content creators will lead to more content uploaded to YouTube, which then encourages engagement and drives more resources for the platform to give back to creators, essentially incentivizing further creation to fuel the feedback loop.

However, these endeavours aimed at driving an incremental uplift to Google’s overall growth outlook may require additional investments to the currently elevated investment outlay that is being primarily earmarked for AI infrastructure. YouTube is estimated to be paying $2 billion per year for NFL Sunday Ticket under a seven-year deal signed in late 2022. With an estimated two million active subscribers to the sports package every year, YouTube is generating a minimum $698 million in subscription revenue from NFL Sunday Ticket per year under its discounted premium pricing, alongside incremental ad revenue. The extent of YouTube’s current returns on the relevant investment remains uncertain, but live sports programming has been fundamental to subscriber acquisition and retention amid intensifying competition, and has played a key role in driving engagement critical for advertisers.

This is consistent with soaring prices for exclusive lives sports programming rights on streaming platforms, which is evident in recent deals announced by rivals Amazon Prime Video (AMZN), Apple TV+ (AAPL) and Netflix (NFLX). Specifically, Amazon paid $11 billion for exclusive streaming rights to Thursday Night Football for 10 years; Apple TV+ paid $595 million for exclusive streaming rights to MLB Friday Night Baseball for seven years; and Netflix is estimated to pay about $150 million for exclusive streaming rights to each NFL Christmas Day game between 2024 and 2026.

Close to $30 billion of exclusive sports streaming rights will be up for bids this year, representing an opportunity for YouTube to bolster its appeal to prospective subscribers. With YouTube being a margin accretive business to Google Services, alongside Google’s deep pockets, the platform exhibits great prospects of deepening its foray in live sports streaming, enabling participation in incremental growth opportunities ahead.

In addition to YouTube, Google has also been mulling potential growth investments in Cloud through mergers and acquisition activities. Although recently speculated deals that involve HubSpot (HUBS) and Wiz have fallen through, management remains committed in diversifying Google’s investment portfolio, which leaves the door open for further growth synergies ahead.

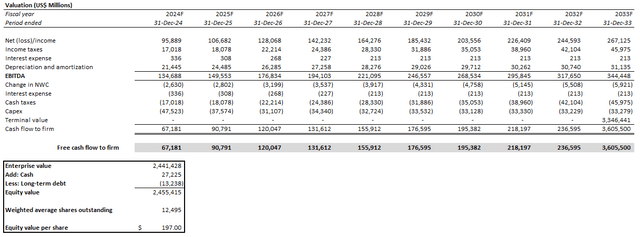

Under the upside scenario, we forecast cash flows based on an 8.7% 10-year CAGR for revenue (vs. 7.6% 10-year CAGR in base case), with YouTube ads and subscriptions, and Google Cloud garnering the largest growth percentage-point increase from the base case. By applying the same valuation assumptions as the base case DCF analysis, upside scenario cash flows yields an estimated intrinsic value for Google at $197 per share.

Author

Final Thoughts

Google’s Q2 outperformance has continued to highlight its capability in capturing secular AI tailwinds through its core monetization formats – namely, search ads and GCP. This is in line with expectations that the foundational components to ongoing AI developments – primarily chips and compute capacity – will be key beneficiaries of incoming secular tailwinds. It is also consistent with substantial training capacity and cloud storage required to support burgeoning AI experiments industrywide today – even if they do not materialize into a monetizable product in the future.

Meanwhile, Google’s core search advertising business’ utilization of internally-developed generative AI tools to enable efficiency gains for both itself and its advertisers underscores a significant opportunity for the company to keep monetizing relevant investments. AI integration into its core advertising business makes Google one of the few generative AI innovators in the market that sees a narrowing deficit on relevant investments. A recent report that uses prospective Nvidia (NVDA) data center sales as a proxy for industry spending earmarked towards AI infrastructure shows ensuing returns are currently about $500 billion short of the $600 billion investment outlay. And only hyperscalers like Google, Microsoft, Meta Platforms and Amazon, alongside generative AI innovator OpenAI, represent the concentrated bunch that has been capable of narrowing the harrowing cost-returns gap on relevant investments so far.

Yet Google’s upsurge this year is, in our opinion, increasingly falling out of balance from an immediately overhanging risk – namely that returns on currently elevated investments continue to rely heavily on the outlook of an AI strategy that remains uncertain. Further upside potential will likely require incremental growth drivers, as we believe the stock’s current valuation premium already reflects full realization of the underlying business’ existing AI monetization strategy.

Comments