Summary

- Bitcoin experienced significant market fluctuations, with a crash to USD 49,577 followed by a strong bounce to USD 62,729.

- Global stock market pressures, interest rate hikes, and recession fears led to selling pressure on US technology stocks and the strongly correlated Bitcoin.

- Thus, sentiment has turned bearish. A final panic has an increased likelihood until the end of September or mid of October and should bring the start of a new uptrend.

- Technically speaking, Bitcoin might not need to make a new low but could shake of the remaining weak hands with a tricky and tenacious sideways consolidation over the coming one or two months.

peshkov

Not surprisingly, Bitcoin (BTC-USD) has experienced significant market fluctuations over the last few weeks. While Bitcoin spent most of the spring with a boring sideways consolidation, volatility has exploded in recent weeks. Hence, the exuberant ETF euphoria is gone and pessimism is spreading among investors.

Review

Since the new all-time high of USD 73,793 on March 14th, Bitcoin and all those new Bitcoin spot ETFs like IBIT, FBTC, BITO, ARKB, BITB, HODL, BRRR, EZBC, ARKW, BITX, BITQ, WGMI, BTCW, BTF, STCE and BETH as well as the Grayscale Bitcoin Trust (GBTC) initially only digested its enormous price gains slowly and sluggishly through a sideways consolidation until mid-June. From mid-June onwards, there was a first sharp pullback down to USD 53,550, from which Bitcoin was able to recover in no time. However, the round psychological resistance of USD 70,000 could not be recaptured again.

Instead, due to numerous factors, global stock markets came under pressure from the end of July. A treacherous mix of geopolitical tensions, an interest rate hike by the Bank of Japan, weak US economic data and fears of recession led to selling pressure on US technology stocks.

As expected, the closely correlated Bitcoin could not escape this massacre. Hence, over the first weekend of August until Monday, 5th of August, there was a dramatic crash in the crypto sector, too. With a low at USD 49,577, Bitcoin fell to its lowest level since February 12th. Almost all of the gains since the launch of the Bitcoin Spot ETFs were temporarily wiped out, and the correction we had been expecting for months finally became reality.

Strong bounce: +26.5% in four days

But Bitcoin wouldn’t be Bitcoin if it hadn’t immediately staged a sharp and impressive bounce back to USD 62,729 in the following days. This rapid recovery shows that confidence in Bitcoin’s long-term prospects remains intact, despite existing macroeconomic risks such as recession concerns and geopolitical tensions.

At the same time, however, the general mood in financial markets has quickly improved again over the course of last week, too. This may have contributed to the positive dynamics in the crypto sector in recent days as well.

Overall, it is still too early to call for the end of the correction in the stock markets. Accordingly, caution is still advisable when it comes to Bitcoin.

Technical Analysis for Bitcoin in US-Dollar

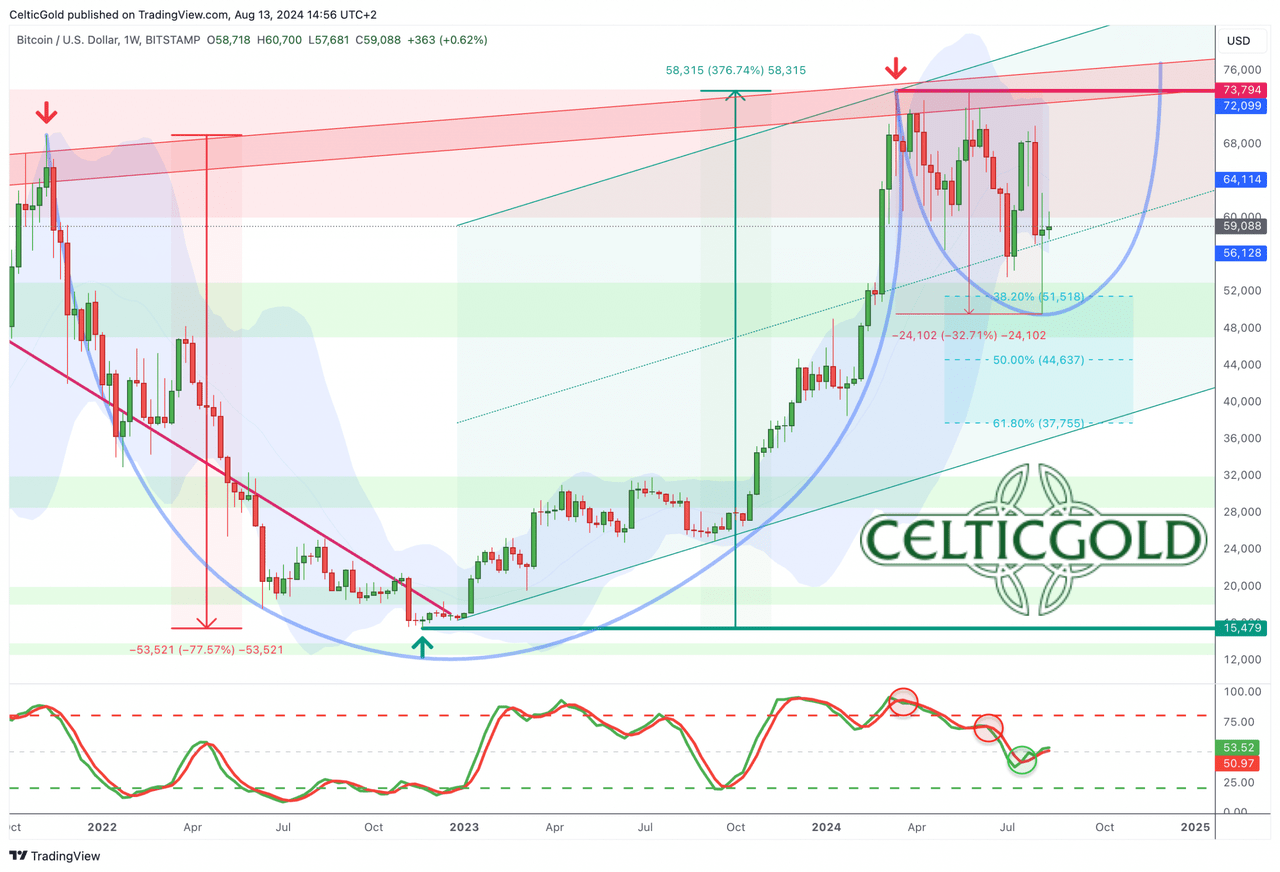

Bitcoin Weekly Chart – Buyers are waiting below USD 55,000

Bitcoin in USD, weekly chart as of August 13th, 2024. (Tradingview)

Since the new all-time high of USD 73,794 on March 14, Bitcoin has been in an extended consolidation for almost five months. With a pullback of almost 33%, one can now also speak of a correction.

Nevertheless, this correction is still very manageable in the bigger picture. From the bear market low of USD 15,479 to the new all-time high of USD 73,794, Bitcoin rose by almost 377% and has now corrected slightly more than the classic 31.8% Fibonacci retracement (USD 51,518). The long wick of last week’s candle in the range between USD 50,000 and USD 55,000 also makes it clear that there were plenty of new buyers lurking below USD 55,000. A similar development was already observed at the beginning of July when prices fell to USD 53,550, only to immediately attract a lot of new buyers.

Tenacious and boring sideways consolidation might be enough to get rid of all the weak hands

However, we suspect that Bitcoin may still need to correct a bit further, especially in terms of time. If, for example, the cup and handle pattern that was identified months ago continues to manifest itself, the consolidation could possibly even drag on until the end of the year. However, this does not necessarily have to lead to new lows below USD 50,000. A tenacious and boring sideways period could also be enough to push the last weak hands out of the market right in time before the next big rise will start.

Overall, the weekly chart is more or less neutral, as the rapid recovery in recent days has initially made up for much of the technical damage. However, the stochastic oscillator has challenges to activate a clear buy signal, while the candlestick structure of recent weeks makes a rather bearish impression. As of now, the correction will only come to a clear and unambiguous end if the bulls manage to break free with a weekly closing price above USD 74,000.

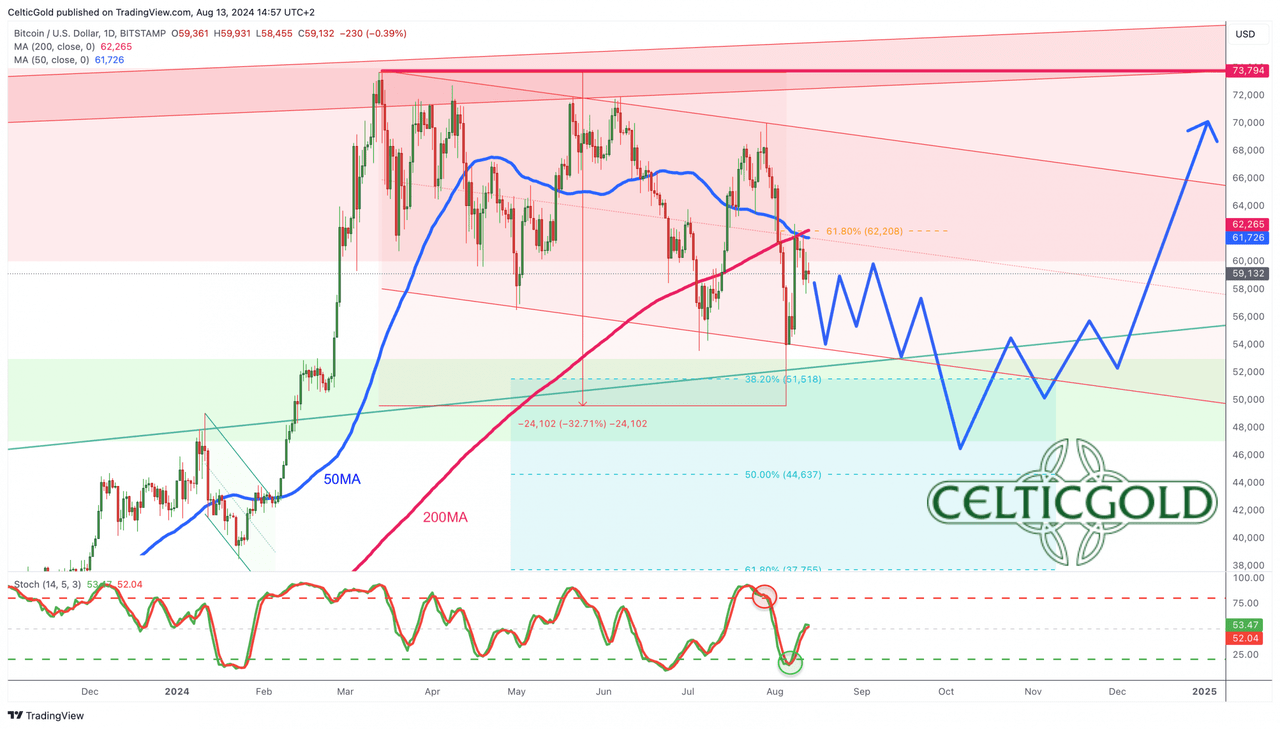

Bitcoin Daily Chart – Strong resistance around USD 62,000

Bitcoin in USD, daily chart as of August 13th, 2024. (Tradingview)

On the daily chart, Bitcoin has slipped significantly below its 200-day line (USD 62,174) during the sell-off and has not yet been able to regain it despite the rapid recovery.

Nevertheless, the countermovement has led to a new buy signal from the stochastic oscillator. If the bulls can clear the double resistance of the falling 50-day line (USD 61,732) and the rising 200-day line (USD 62,174) in the area around USD 62,000 in the coming days, further recovery potential to around USD 68,000 to USD 70,000 should open up immediately. If the bulls fail to recapture the 200-day, however, the technical picture will become significantly cloudier. Accordingly, at least a reunion with the zone between USD 53,500, and USD 55,000 should be taken into account.

Overall, the daily chart briefly turned bullish due to the strong countermovement/recovery. However, the significant pullback since last Friday does not bode well. Below USD 62,000, the bears are still in control.

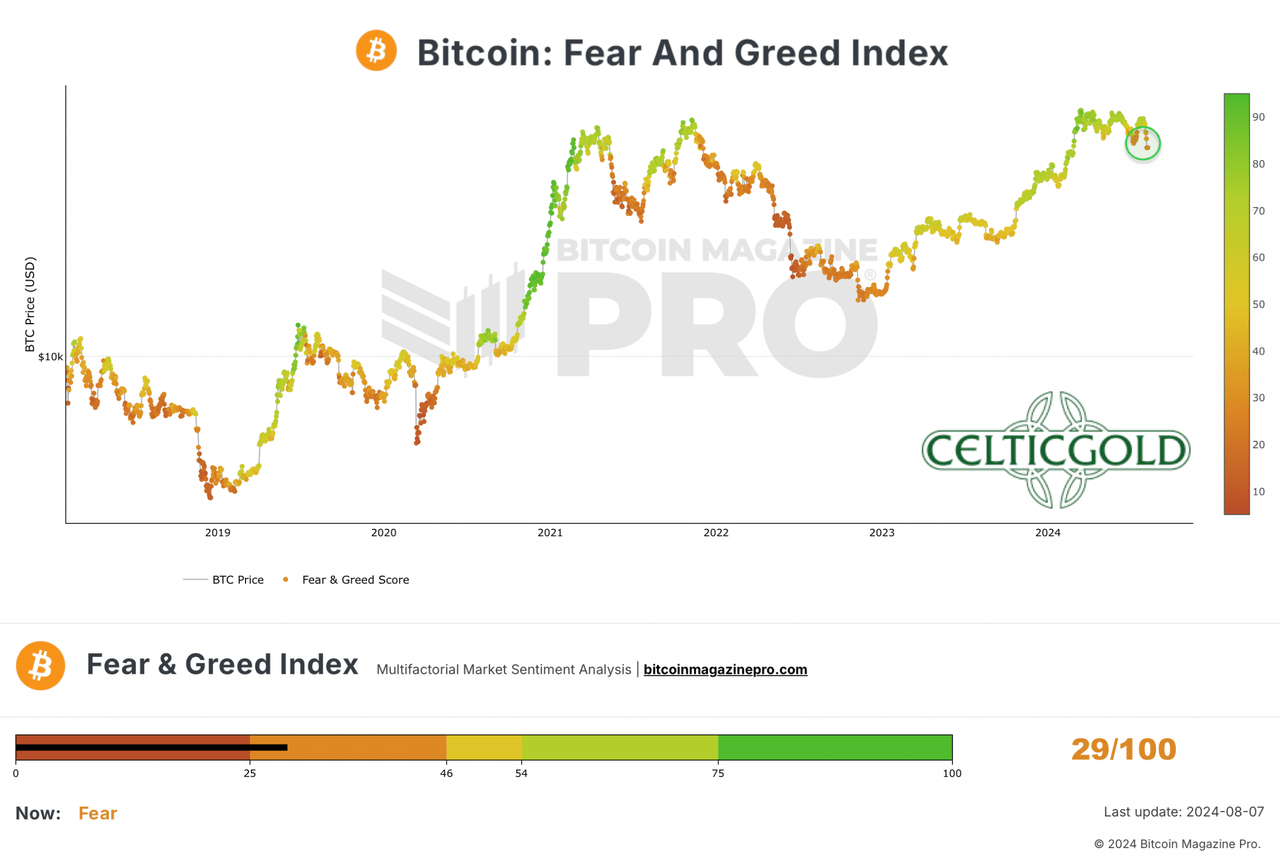

Sentiment Bitcoin – First signs of panic

Crypto Fear & Greed Index, as of August 7th, 2024. (Bitcoin Magazine Pro)

For the first time since the end of 2022, the “Crypto Fear & Greed Index” shows a sharp increase in panic among market participants, with a low of 29 out of 100 points.

CMC Crypto Fear & Greed Index as of August 7th, 2024. (Coinmarketcap)

So far, it has only been a brief panic. In the past, however, such uncertainty usually needed to lasted longer than just a few days. The sharp price drop within just a week is likely to have thrown highly leveraged market participants out of the market. But it usually takes more time and pain to get rid of all the weak hands in time for the next big rise. Only then will the potential for surprise be sustainably on the upside again.

Overall, from a contrarian point of view, sentiment is slowly but surely becoming very interesting again. However, we would like to see at least several weeks of a depressed mood. So far, that is not yet the case. In this respect, the sentiment analysis still urges patience.

Seasonality Bitcoin – Seasonality extremely unfavorable until the end of September

Seasonality for Bitcoin, as of May 3rd, 2024. (Seasonax)

According to seasonal statistics, Bitcoin is in its worst phase of the year. On average, over the last 14 years, Bitcoin prices have mostly fallen sharply from mid-August to the end of September or the beginning of October. In addition, there is a strong correlation with the stock markets, for which unfavorable seasonal trends (“Sell in May”) have also been active since the beginning of May.

In summary, the seasonality is extremely unfavorable until at least the end of September. The seasonal traffic light is therefore still dark red.

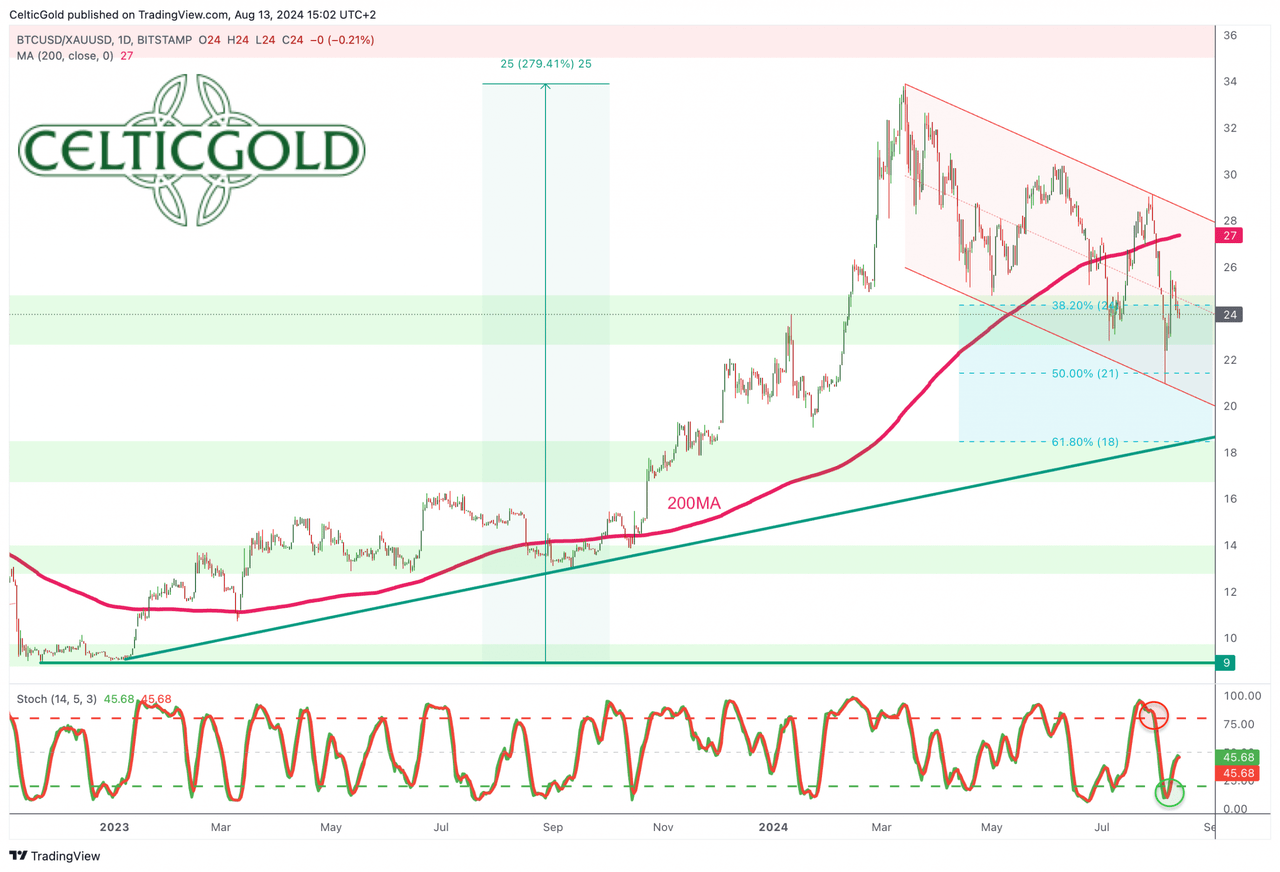

Sound Money: Bitcoin vs. Gold, Bitcoin -This correction is probably not over yet

Bitcoin/Gold ratio, daily chart as of August 10, 2024. (Tradingview)

With prices of around USD 58,400 for one Bitcoin and around USD 2,462 for one ounce of gold (XAUUSD:CUR), you currently have to pay around 23.72 ounces of gold for one Bitcoin. Put another way, one ounce of gold currently costs around 0.042 Bitcoin.

While the correction in Bitcoin against the US dollar since mid-March has by no means been very obvious, a surprisingly clear picture emerges against gold. Thus, the Bitcoin/Gold-ratio has been falling in a defined downward trend channel since March 14th. With the crash at the beginning of last week, Bitcoin had already corrected more than 50% of its previous upward movement against gold. Accordingly, the Bitcoin/Gold-ratio has fallen very significantly within around five months from values of around 34.5 down to around 21.4. In addition to the classic 61.8% retracement at around 18.8, the uptrend line that started in January 2023 is waiting at around 19 as the ultimate support. At the very latest, the Bitcoin/Gold-ratio should be able to turn upwards again in this area.

Overall, Bitcoin’s correction against the price of gold has already progressed quite far. Nevertheless, it is conceivable that the seasonally weak months of September and October could still see a final exaggeration towards the south. The Bitcoin/gold-ratio should come up with the turning point and subsequently with a trend reversal in the area of around 19

Macro Update – Interest rate hike in Japan triggers stress in the global financial casino

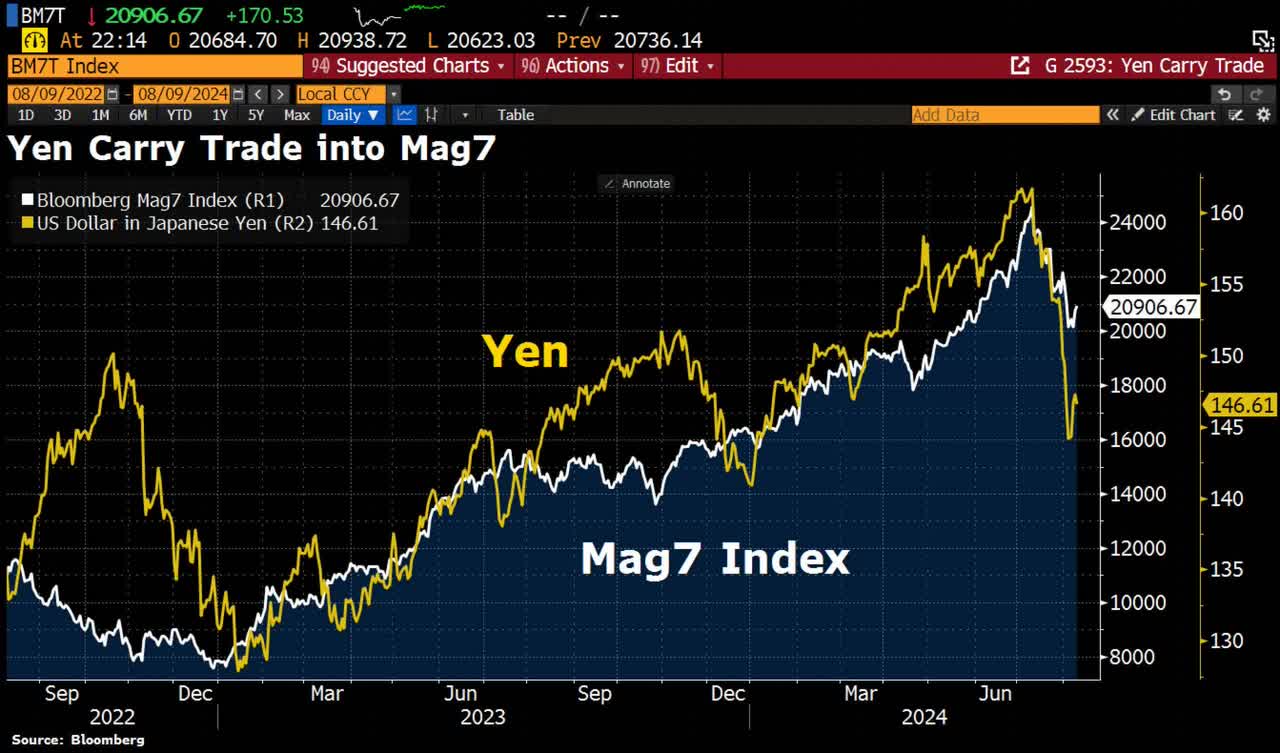

Yen vs. MAG, as of August 9, 2024. ( Holger Zschäpitz)

Since the end of May, we had increasingly anticipated a correction in the markets. Indeed, the global financial casino finally came under significant pressure at the end of July. In particular, the unwinding of yen carry trade positions caused increased stress from July 23rd onwards. We had already analyzed the unfavorable constellation for the Bank of Japan in May and warned at that time against an interest rate hike in Japan (EWJ).

After investors and speculators had taken out low-interest loans in Japanese yen for many years and invested in higher-yielding currencies and US assets, these loans had to be unwound or reversed very suddenly and quickly from mid-July onwards. The Bank of Japan’s interest rate hike on July 31st ultimately led to a sharp rise in the yen (FXY)(USD:JPY), which weighed on exporters’ earnings forecasts and led to panic selling in the markets. This particularly affected the Japanese market, where the Topix (OTC:TPXXF) (SPTOPIXUSDNTRWM) index fell by over 24% from its record high.

VIX with record spike

Volatility S&P500 index (VIX) spikes , as of August 10th, 2024. (Holger Zschäpitz)

As a result, the VIX volatility index exploded by 150% to 59.2 on Monday, August 5th, indicating a high level of panic & selling stress. This spike in the VIX thus reached the third-highest level in the last 35 years. Only the collapse of Lehman Brothers in 2008 and the Covid crash in 2020 caused greater panic swings. The stock and crypto markets initially slid deep into the basement accordingly. Even the price of gold fell from USD 2,477 down to USD 2,366 within just 24 hours.

However, the sharp spike in the VIX on Monday afternoon already indicated a short-term, completely exaggerated panic. Not surprisingly, the situation calmed down quite quickly in the following days. The markets also stabilized thanks to the Bank of Japan’s announcement that it would not raise interest rates any further for the time being.

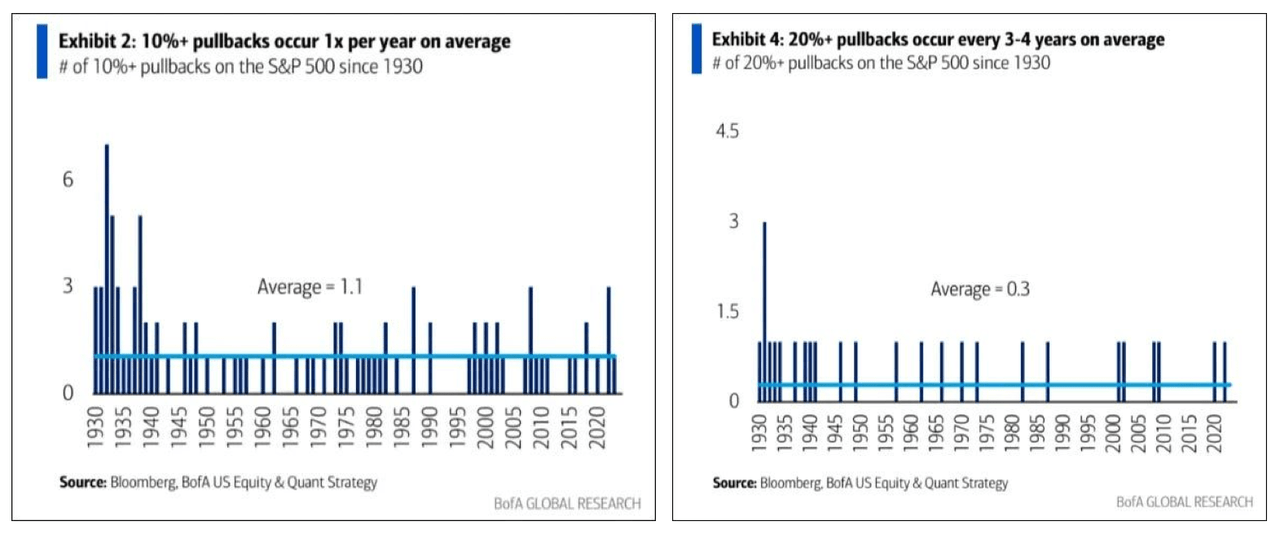

A 20% setback occurs approximately every four years

Frequency of 10% and 20% pullbacks, as of August 7th, 2024. (Bank of America)

A new Bank of America’s analysis highlights the following.

– 5% pullbacks occur approximately 3 times per year– 10% pullbacks occur approximately once per year– 15% pullbacks occur on average every two years– 20% pullbacks occur approximately every 3 to 4 years

The recent pullbacks in the DAX and S&P500, each of around 10%, correspond roughly to the magnitude of corrections that occur once a year. The last time the markets corrected by more than 20% was four and a half years ago, though! Hence, the sharp pullback at the beginning of August may have cracked the market psychology, meaning that further distortions and turbulence could occur in September and October.

And despite the quick recovery, the increased volatility is likely to have eroded the yen’s safe-haven status and will make carry trades less attractive due to the increased risk. So, despite the interest rate differentials still being desirable, it may take at least some time before investors and speculators consider returning to these trades.

First US interest rate cut in September

The increasingly weak economic data from the USA has not improved with the panic sell-off, either. In fact, the US economy is likely to be in a worse state than previously assumed. The financial markets have now abruptly started to price in justified fears of a recession and a first US interest rate cut in September. However, we suspect that this step by the Fed will come too late.

The euphoria surrounding artificial intelligence, which had previously driven technology stocks in particular since December 2022, is also likely to continue to subside or let off some more hot air. Accordingly, the revaluation of many tech stocks is particularly weighing on the Nasdaq 100, with which Bitcoin is closely correlated.

The intense U.S. election campaign is unlikely to calm tempers, but rather has the potential to increase uncertainty and tension until at least early November.

In addition, the well-known geopolitical tensions remain virulent and are likely to continue to cause increased volatility and growing uncertainty on the financial markets. At the moment, one can only hope that Iran’s announced reaction against Israel will not lead to an uncontrolled conflagration in the Middle East.

Possible panic sell-off in September and October

S&P500 seasonality over the last 25 years, as of August 12th, 2024. (Seasonax)

In addition to the numerous macro factors and escalating geopolitics, the seasonal pattern for the S&P 500 and thus essentially for the entire financial system shows a significantly increased probability of a pullback, correction or crash in the two autumn months of September and October. The markets very often come under pressure during this period and then find an important low point, from which a rally can typically start until the end of the year.

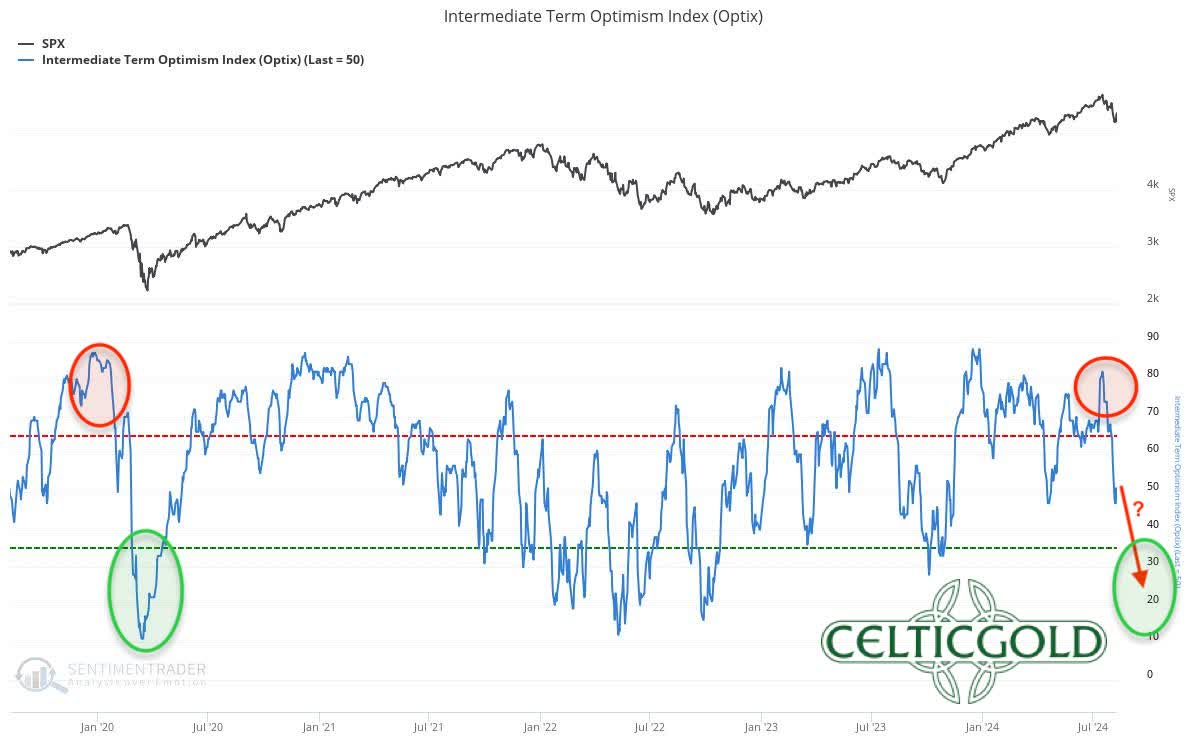

S&P500 Sentiment, medium-term optimism index (Optix), as of August 12th, 2024. (Sentimentrader)

With the significant pullback, the mood among investors has already been affected. On this basis, an extension of the correction to over -20% would also be conceivable. Such corrections typically occur every four years. With the sentiment index for the S&P 500, one can currently draw parallels to the last slump in February 2020. Consequently, there are quite a few indicators pointing to the likelihood of experiencing the typical four-year low in the financial markets this autumn.

Overall, the outlook for the stock markets and thus for Bitcoin, as it is closely correlated with tech stocks, appears unfavorable until approximately mid to late October. The current market conditions could potentially trigger a panic sell-off this fall. Therefore, we recommend maintaining a relaxed approach during the remaining summer weeks, with a higher liquidity ratio. Ideally, by October, the market will be dominated by pessimists, who could then become the driving force (wall of worry) for the next rally and the continuation of the crack-up boom.

Conclusion: Bitcoin – This correction is probably not over yet

To the surprise of many and within just a few days starting at the end of July, the unwinding of the yen carry trade accelerated. A liquidity crisis immediately spread throughout the entire financial system. All sectors were sold off in blind panic. Bitcoin in particular came under severe pressure, falling by 30% within a week. Even the price of gold was also unable to escape the sell-off.

In the middle of summer or mid-August, the stress in the stock markets, which undoubtedly have considerable correction potential due to the strong price increases alone, is most likely not yet over. We suggest bracing for more, as more challenges are looming! On top, the seasonal pattern typically delivers significantly more stress into autumn. And Bitcoin will not be able to escape this.

“Patience is bitter, but its fruit is sweet.” – Aristotle

We therefore expect the correction to intensify over the next one to two months, and would not be surprised if the markets crashed temporarily. A panic sell-off lasting several weeks should then provide patient investors with very good entry opportunities in September or October, or at the latest, after the US election in early November.

Comments