"Black Myth: Wukong" has taken the global gaming market by storm, breaking records across all platforms. According to the national game sales rankings, it has sold over 3 million copies on Steam alone, with total sales exceeding 4.5 million copies and revenue topping ¥1.5 billion.

High expectations for "Black Myth: Wukong" were highlighted by Goldman Sachs, which called it a significant turning point for the Chinese console game industry and a key step for Chinese games on the global stage. This success may spur increased investment in Chinese games, especially in the 3A category.

Goldman Sachs believes that $TENCENT(00700)$ $Tencent Holding Ltd.(TCEHY)$ and $NTES-S(09999)$ $NetEase(NTES)$ may continue to invest in high-quality PC and console games to compete globally.

As "Black Myth: Wukong" rides high, NetEase, one of the gaming giants, is set to release its earnings report before the market opens on August 22. The report is expected to discuss future plans for creating more top-notch domestic games like "Black Myth: Wukong."

What to Expect from the Earnings Report?

Morgan Stanley’s latest report suggests a downgrade for NetEase’s stock.

Due to weak recent performance of titles like "Naraka Bladepoint," "Fantasy Westward Journey" PC edition, and "Party Animals," along with a limited pipeline of new games in the next six months, Morgan Stanley has lowered NetEase’s target price from $100 to $90.

They have also reduced NetEase’s revenue growth forecast for the next two years to 5% and their earnings per share forecast for 2024-2026 by 3% to 9%.

The revenue of "Fantasy Westward Journey" PC edition is expected to be negatively impacted by about ¥1 billion due to changes in the game’s economic system. However, the relaunch of "World of Warcraft" and "Hearthstone" in China is expected to offset some of this decline.

Analysts predict NetEase’s Q2 2024 revenue to reach ¥26.09 billion, up 8.66% year-over-year, with earnings per share expected to be ¥11.04, a 12.97% decline from last year.

Stock Price Movement During Earnings Report

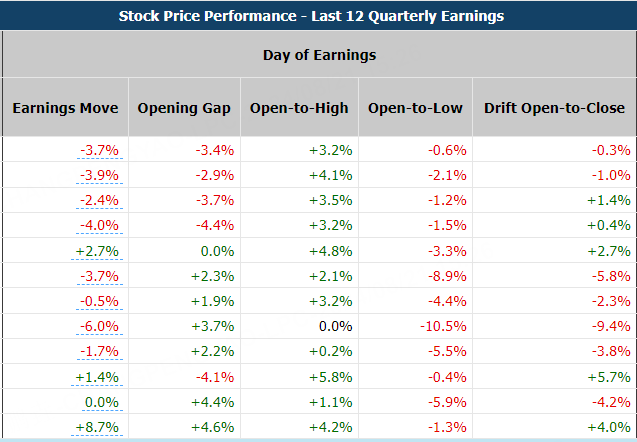

On average, options expected a post-earnings volatility of ±6.7%, while the actual average post-earnings volatility (absolute value) was 3.2%. In the last five quarters, NetEase’s stock has moved -3.7%, -3.9%, -2.4%, -4.0%, and +2.7% after earnings.

Historically, options tend to overestimate earnings-related volatility for NetEase. Investors can exploit this by using Short Volatility strategies around earnings reports.

How to Trade a Strangle Strategy?

For example, NetEase’s stock usually shows limited movement. On August 20, NetEase closed at $90.22. If we expect the stock will not move more than 8% after the earnings report, we predict it will stay between $83 and $97.

We can set up a strangle strategy by selling corresponding options.

Step 1: Sell a call option with a strike price of $97, betting that the stock won’t rise above $97, and collect a premium of $60.

Step 2: Sell a put option with a strike price of $83, betting that the stock won’t fall below $83, and collect a premium of $44.

After completing these steps, the strangle strategy is in place. If NetEase’s stock ends up between $83 and $97 after the report, you’ll make $104. However, be cautious: if the stock experiences significant movement up or down, the losses could be substantial.

Comments