$Snowflake(SNOW)$ a representative of software growth companies, plunged 8% after announcing Q2'25 results, the stock's biggest drop since Warren Buffett liquidated his position in Q2.Let's just say that Buffett liquidated his position just in time.

Key Financial Indicators

Revenue

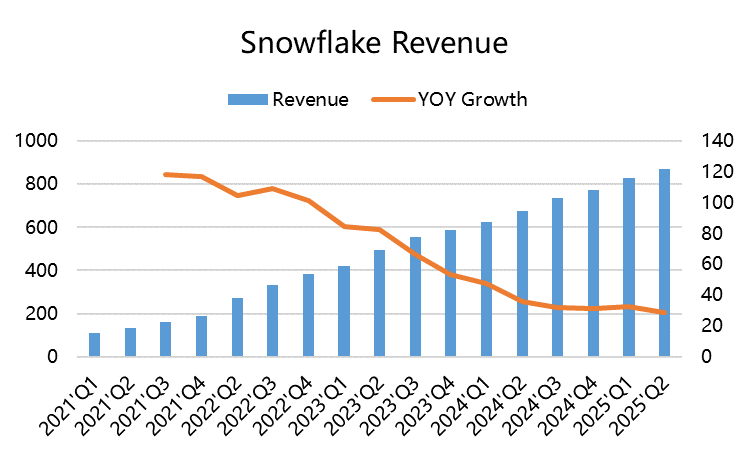

Total revenue reached $868.8 million, a 29% year-on-year growth rate, beating the market consensus of $850.15 million.

Of this, product revenue grew 30% year-over-year to $829.0 million, also slightly exceeding market expectations

Earnings per share (EPS)

Adjusted EPS was reported at $0.18, beating the market consensus estimate of $0.16.

Billings

Billings for the quarter were $779.0 million, below expectations of $831.9 million.

Remaining Performance Obligations (RPO)

RPO reported at $5.2 billion, up 48% year-over-year, a steady performance in these quarters

Deferred Revenue

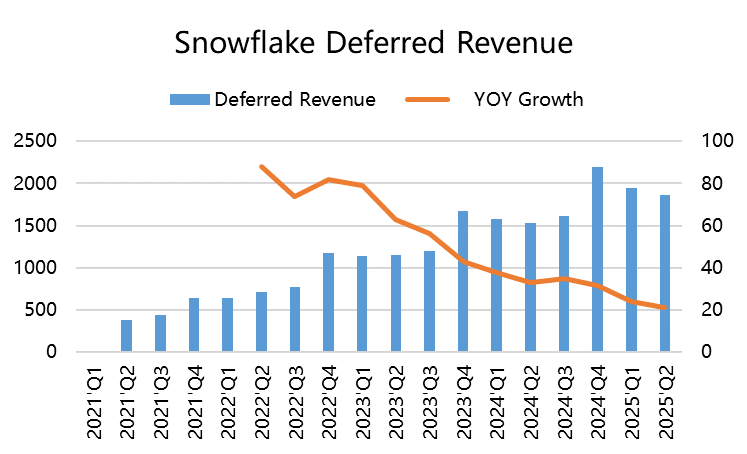

Deferred revenue was $1.86 billion, up 21% year-over-year and below market expectations.

Net Dollar Retention

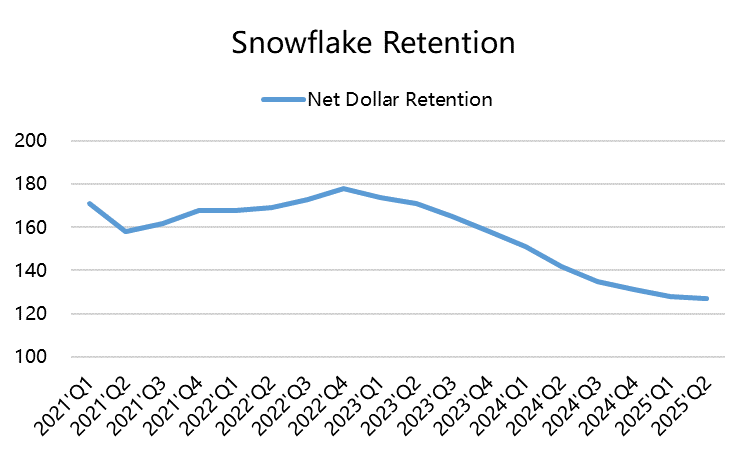

Net Dollar Retention in Q2 declined to 127%, not much different from the previous quarter's 128%, but also down considerably from the previous level of over 150%.

Guidance and Outlook

For the Q3 ending October 2024, the company expects product revenues to be in the range of $850 million to $855 million, with a midpoint of $852.5 million, which is slightly higher than the market expectation of $848 million.

Full-year product revenue guidance was raised from $3.3 billion to $3.36 billion, in line with market expectations.

Investment Highlights

Why the big drop despite lifting guidance?

Despite beating revenue expectations for the quarter, declines in several metrics continue to worry the market

Total billings fell short of expectations, while up 48% year-over-year to $779 million, the market was expecting $832 million;

Deferred revenue fell short of expectations, with the market expecting $1.96 billion and the company actually coming in at $1.86 billion;

Decline in retention rates.Since Q1'24, the level of retention rate has declined from a level of over 150% to below 130%, which is a reaction to the fact that the product is not as sticky for users as it was before, even though there are a lot of new customers as well.Investors will also be concerned about competition from other companies' AI products, which will affect future performance.

Operating costs remain high and cash flow is not healthy.The company's Snowflake's have risen sharply to 31.61% y/y, and operating expenses reached $936 million in Q2, exceeding market expectations, and operating loss widened to $355 million.There's also a significant stock-based compensation entitlement that could later weigh on the company's stock price.

Fear of customer loss.In May of this year, Snowflake suffered a data breach in which a large amount of customer data was stolen.Although the company's CEO said on the call that the cybersecurity incident had little impact on Snowflake's consumption, and the CrowdStrike outage only briefly affected a handful of customers, the overall business was not damaged.But shortcomings in cost management and workload management technology compared to other competitors such as Amazon Redshift, Microsoft Fabric, and Databricks could hurt its marketability.

The aura of high growth has faded.The company grew 106% in FY2022 and 70% in FY2023, but only 38% in FY2024.Snowflake's management expects this slowdown to continue, with only 24% growth projected for FY2025.

Comments

High growth is melting away, and competition is closing in. Will Snowflake find its footing or keep sliding downhill?

Despite impressive revenue, the stock took a dive. Seems like even Buffett knew when to take cover!