Summary

- Advanced Micro Devices, Inc. has been consistently furthering its consolidation strategy in an aim to better compete against end-to-end AI solutions provided by industry leader and key competitor Nvidia.

- This is expected to complement ongoing efforts in extending its AI market share gains by bolstering uptake of its core data center hardware offerings, particularly its latest Instinct MI300 accelerators.

- The additive growth outlook will also underpin sustained margin expansion as new products, especially within the more profitable data center segment, continue to scale.

JHVEPhoto

Catching up to rival Nvidia’s (NVDA) AI prowess has long been a milestone in the works for Advanced Micro Devices, Inc. (NASDAQ:AMD) after it beat Intel (INTC) at its own game in server processors. To better equip itself as an adequate competitor of Nvidia’s, AMD has been consistently taking a page from its rival’s all-encompassing hardware-software full-stack business model through acquisitions like Xilinx and Pensando recently.

And to further bolster its AI competitive advantage against the industry leader, AMD has also introduced its next-generation Instinct MI300 accelerators this year, which has proven success in winning market share. This was evident in AMD’s robust 2Q24 results and reinforcing 2H24 outlook, complementing above-seasonal tailwinds expected in client segment sales driven by an emerging cyclical recovery and AI PC opportunities. Better-than-expected market share gains across its core data center and client segment sales have not only been key to offsetting ongoing pressure in AMD’s declining gaming and slow-recovering embedded segments. It also has improved operating leverage and, inadvertently, margins for the company.

Ensuing cash flow growth has also been supportive of AMD’s increasing priority over AI investments to better its competitive positioning against Nvidia. The company has deployed more than $1 billion into AI company acquisitions and organic R&D activities over the last 12 months in an aim to bolster its reach into opportunities within the burgeoning AI ecosystem. They include the acquisition of Silo AI, an enterprise-focused large language model (“LLM”) developer, which closed earlier this month. More recently, AMD has entered into an agreement to acquire server systems designer and manufacturer, ZT Systems, for $4.9 billion.

Looking ahead, the continued ramp of new products – particularly those supporting emerging AI developments – alongside the integration of Silo AI and ZT Systems should enable further share gains and unlock greater growth synergies for AMD. The following analysis will provide an update on AMD’s fundamental outlook based on its latest 2Q24 earnings update, and also gauge the implications from the impending ZT Systems acquisition. The stock remains in an opportunistic set-up at current levels, in our opinion, with AMD’s prospective share of the AI market across hardware and software applications still underappreciated.

An Overview of AMD’s AI Progress

AMD’s 2Q24 outperformance provides structural support of its growing AI prowess. Its data center revenue mix is nearing 50%, doubling from a year ago after the segment’s sales soared 115% y/y driven by strong uptake of both its server processors and AI accelerators. The increasing mix of higher-margin data center sales has also been a key margin accretive factor for AMD. While consolidated revenue grew a modest 9% y/y during the second quarter, GAAP net income surged more than eight-fold over the same period and more than doubled sequentially.

AMD’s latest Instinct MI300 accelerators were in the spotlight, as management disclosed a steep ramp for the company’s newest product. Specifically, AMD’s data center GPU revenue contributions continue to set records, with quarterly MI300 accelerator sales exceeding $1 billion for the first time during 2Q24. As a result, management has raised their estimate for full year 2024 MI300 revenue contributions to $4.5 billion, up from $4 billion guided in April and $3.5 billion guided in 2023. This implies further acceleration in MI300 sales through 2H24, with about $2.8 billion to go before hitting the newly raised target for completely additive growth within the data center segment.

Recall that AMD’s Instinct MI300 is a competitive alternative to Nvidia’s best-selling H100 and H200 data center GPUs. AMD’s latest accelerator builds on the CDNA 3 architecture, and enables up to 5x energy efficiency on training AI workloads. The MI300 consists of 153 billion transistors, which is almost double of the H100’s, enabling superior performance efficiencies to peers, especially in processing complex AI workloads. The MI300 accelerator also boasts 192GB of HBM3 memory, offering more than double the memory of Nvidia’s H100 and highly competitive with its rival’s H200 GPUs. The competitive TCO metrics make AMD’s MI300 a favorable choice for inferencing when stacked against industry leader Nvidia, which reinforces the product’s prospective demand environment and market share gains.

The MI325X shipping later this year will be further accretive to AMD’s data center GPU sales growth prospects. The upgraded accelerator will consist of 288GB of next-generation HBM3E memory, punting it as a direct competitor to Nvidia’s H200 and upcoming Blackwell B100 GPUs. The diminishing performance and cost efficiency gap between AMD’s Instinct accelerators and its competition is likely to reinforce confidence in AI-related data center sales through the back half of 2024. This will be essential to driving incremental margin accretion for the segment towards corporate levels, giving further adjustments to operating leverage and scale benefits already observed through robust MI300 volumes shipped in 1H24.

In addition to accelerators, AMD’s EPYC server processor sales have also delivered a better-than-expected showing. This was critical to assuaging previous investors’ fears over the potential obsolescence of general-purpose server CPUs in the ongoing AI-driven transition to accelerated computing. The sustained double-digit percentage increase in EPYC CPU sales during the second quarter continues to highlight AMD’s strengths in addressing structural enterprise optimization trends.

As discussed in our previous coverage on the stock, AMD’s EPYC server processors have been key enablers of adding incremental “general purpose and AI compute capacity without the need to materially change the physical footprint and power needs of existing infrastructure.” While the fourth generation Genoa EPYC server processors offer the same level of compute with “45% fewer servers compared to the competition,” which enables up to 40% and 50% in initial opex and capex reduction for customers, the upcoming Zen 5 Turin EPYC CPU is expected to further optimize the product segment’s “leadership performance and efficiency.”

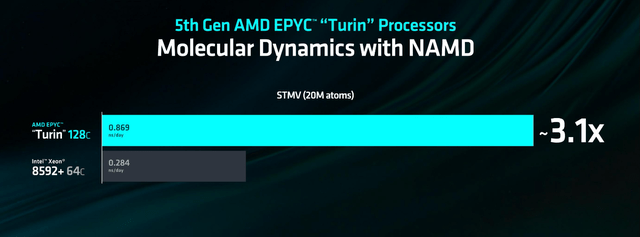

The Zen 5 Turin EPYC processors, which is currently in public preview and will start volume shipments later this year, is compatible with existing fourth generation EPYC platforms. Coupled with up to 192 cores and 384 threads, the Turin EPYC processor extends the product segment’s competitive TCO, with currently previewing customers highlighting the product’s “significant performance advantages in multiple compute-intensive workloads”. This is further corroborated by performance stats recently released by AMD on the 128-core configurated Turin EPYC processors in processing AI workloads, which outperformed Intel’s latest Emerald Rapids Xeon processors by wide margins. The comparison also highlights the competitive technology advantage of the 192-core configurated Turin in the AI-first era.

Taken together, we believe AMD remains well-positioned for further acceleration in its data center segment sales, which entails incremental margin expansion ahead. This will benefit cash flows underpinning the stock’s valuation prospects.

AMD

AMD

AMD Continues to Consolidate to the Top

As discussed in a previous coverage, AMD continues to utilize the consolidation strategy effectively in bolstering its competitive advantage and technical capabilities. The effectiveness is evident in the combination of additive growth and cost synergies realized through ongoing M&A activities at AMD recently to better position itself against intensifying competition. In addition to the acquisition of Xilinx and Pensando, which has deepened AMD’s hardware-software full stack capabilities, the company has also been investing heavily into furthering its AI ecosystem. This includes the recent acquisition of Silo AI, which provides AMD with direct access to expertise in enterprise-focused LLM developments. The acquisition of Silo AI is expected to bolster AMD’s provision of AI development and deployment solutions against competing offerings such as Nvidia’s “NeMo” platform and “NIM” inference microservices.

The company has also recently entered into an agreement to acquire server designer and manufacturer ZT Systems for $4.9 billion, with a contingent consideration of $400 million subject to the completion of certain milestones. Similar to server makers like Super Micro Computer (SMCI) and Dell (DELL), which have benefitted from resilient AI infrastructure investments over the past year, ZT Systems also provides rack-scale solutions for rapid data center deployments. AMD’s upcoming acquisition of ZT Systems, which it intends to settle through a combination of cash and stock, will directly extend the chipmaker’s reach into the increasingly lucrative server industry, while also bolstering AI-related market share gains.

Specifically, AMD intends to sell ZT Systems’ manufacturing capabilities post-close, while keeping the subsidiary’s server design expertise. This implies the impending launch of AMD AI supercomputer systems, which will potentially compete directly against Nvidia’s HGX and DGX solutions for market share across hyperscaler and enterprise customers. The integration of ZT Systems’ expertise in the server market is expected to further AMD’s end-to-end AI capabilities, effectively extending its reach into the burgeoning AI TAM.

Admittedly, the acquisition of ZT Systems also has its fair share of downside risks. The transaction is expected to be margin-dilutive initially due to the combination of integration costs, as well as lower profitability from ZT Systems’ manufacturing-weighted business. Specifically, market research currently estimates LTM revenue of $10 billion at ZT Systems, with the majority generated from its manufacturing business. Server companies such as Dell, SMCI and Hewlett Packard Enterprise (HPE) currently trade at under 1x NTM sales, pressured by their capital-intensive manufacturing arms. This is in line with the ~0.5x sales that AMD has offered for the acquisition of ZT Systems based on the proposed consideration of $4.9 billion and estimated LTM revenue of $10 billion at the computer maker, generated primarily from lower-margin manufacturing sales.

However, the transaction is expected to be fundamentally accretive for AMD over the longer-term. Specifically, AMD management intends for the acquisition of ZT Systems to be “accretive on a non-GAAP basis by the end of 2025,” which implies immediate disposal of the computer maker’s manufacturing arm post-close in 1H25. Management also disclosed that AMD will keep about 1,000 engineers upon the completion of ZT Systems’ integration strategy, highlighting intentions to bolster its expertise in systems design through the acquisition.

The transaction is expected to be net additive in the long-run for AMD’s AI strategy by adding systems design to its resume of expansive AI capabilities that span networking (e.g., Ultra Accelerator Link and AMD Infinity Fabric), software (e.g., ROCm), hardware (e.g., Instinct and EPYC) and services. In addition to bettering AMD’s stance against key rival Nvidia, the acquisition of ZT Systems’ server design expertise will also be a complementary effort in driving uptake of AMD’s data center processors, given its supportive end-to-end solutions ecosystem. This will accordingly reinforce the sustained long-term growth trajectory of AMD’s higher-margin data center sales and, inadvertently, bolster cash flows underpinning its valuation outlook.

Fundamental Considerations

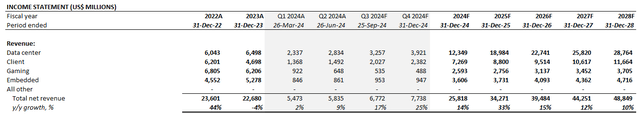

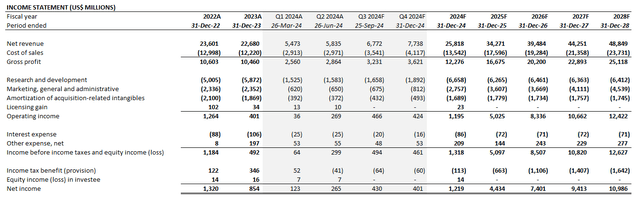

Adjusting our previous forecast for AMD’s actual 2Q24 results and forward outlook, we expect the company to grow revenue by 14% y/y to $25.8 billion in 2024. The updated estimates also reflect our continued confidence in an upcoming upgrade supercycle for AMD across the data center, client and embedded segments as discussed in our previous coverage.

Author

The continued ramp of new products – which include the Instinct MI300 and upcoming MI325X accelerators, Ryzen Pro 8000 and Ryzen 9000 Series CPUs, and second generation Versal Adaptive SoCs – is also expected to drive further accretion to margins. This is expected to extend the pace of sequential margin expansion observed in recent quarters, which has been primarily driven by scaling up more profitable data center sales and improving operating leverage across all operating segments.

Author

Valuation Considerations

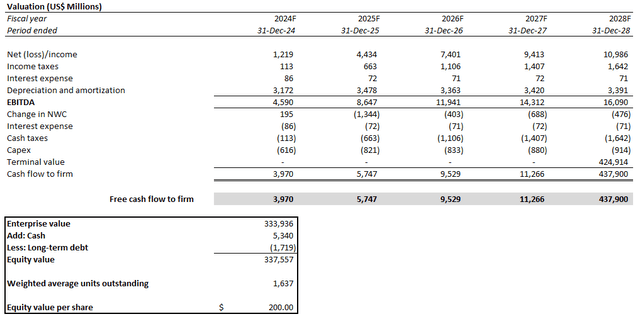

We maintain confidence that AMD continues to represent a favorable risk-reward set-up at current levels, given additive growth and margin accretive opportunities ahead. Our base case price target for the stock remains at $200 apiece.

Author

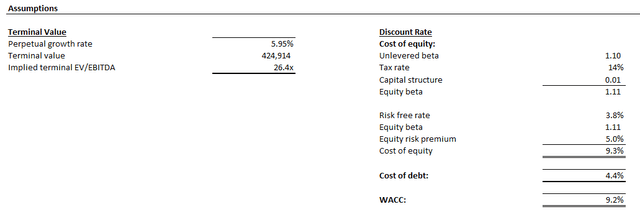

The price target is derived from the discounted cash flow approach, and considers cash flow projections taken with the base case fundamental analysis discussed in the earlier section. A 9.2% WACC in line with AMD’s risk profile and capital structure is applied. The analysis also considers a perpetual growth rate of 6.0% applied to projected 2028E EBITDA in determining AMD’s terminal value. The premium valuation assumption is consistent with the application of a 3.5% perpetual growth rate on projected 2033E EBITDA when AMD’s growth profile is expected to normalize in line with the higher-range pace of estimated economic expansion. The assumption applied is also reflective of AMD’s mission-critical role in enabling next-generation growth technologies critical to economic expansion across its core operating regions.

Author

Author

AMD’s upside potential is further corroborated by its modest valuation on a relative basis to peers with a similar growth profile. Under the multiple-based approach, AMD is currently trading at about 8x 2025E sales, which lacks the premium currently exhibited by comparable peers in the Philadelphia Semiconductor Index (SOX) despite continued market share gains in margin accretive segments. We believe the stock remains well-positioned for an impending upward valuation re-rate driven by several prospective catalysts that include a stronger-than-expected ramp-up of higher-margin data center revenues, and server market synergies with the integration of ZT Systems’ design unit in 1H25.

As discussed in the earlier section, AMD expects about $2.8 billion in data center GPU sales – a new revenue stream for the segment – in 2H24, representing growth of 65% from 1H24. This represents continued sequential acceleration in data center GPU shipments, supportive of incremental economies of scale benefits for the high-margin data center segment. Coupled with a potential pricing tailwind stemming from the persistently tight supply chain through 2025, and strong uptake for its Instinct MI Series accelerators bolstered by an expanding ecosystem of supportive solutions, AMD exhibits prospects for an upside surprise. Full integration of ZT Systems’ design unit into AMD’s Data Center Solutions Business Group in 1H25 and further scale of related solutions in 2H25 is likely to drive further margin accretion as well. This remains underappreciated at the stock’s currently traded levels, in our opinion.

Conclusion

Admittedly, AMD’s share of AI opportunities and ensuing revenues continues to trail Nvidia’s by wide margins. But AMD’s ongoing efforts in bolstering its end-to-end ecosystem capabilities continues to showcase the company’s commitment to narrowing its competitive gap with the industry leader. AMD also continues to exhibit an effective consolidation strategy, which represents a bargain route that optimizes capex deployments on a relative basis to its prospective growth and margin expansion trajectory. This accordingly assuages growing investors’ concerns over potential risks of overspending on AI coming out of the latest earnings season. Taken together, we believe AMD’s current market valuation continues to represent a conservative fundamental outlook that underappreciates the additive growth and margin accretive factors ahead of ongoing execution of the underlying business’ AI strategy.

Comments