Summary

- Concerns about a U.S. recession persist despite mixed economic signals. Leading indicators suggest a downturn, but some market metrics remain strong, adding uncertainty.

- Rate cuts are anticipated, providing a potential buffer against economic weakness. The dollar’s trajectory is crucial for investors, particularly those with international exposure.

- Despite high valuations, certain sectors offer attractive opportunities. Strategic investments can capitalize on resilient trends and the potential for future growth.

Dmytro Synelnychenko/iStock via Getty Images

Introduction

Is the U.S. about to enter a recession?

Going into this month, that seemed to be the consensus, as poor nonfarm payroll numbers caused investors to believe the Fed may have gone too far by keeping rates too high for too long.

For most market participants, predicting the next recession is similar to sports bettors predicting the winner of the Super Bowl. However, just like predicting the Super Bowl, predicting a recession is tough.

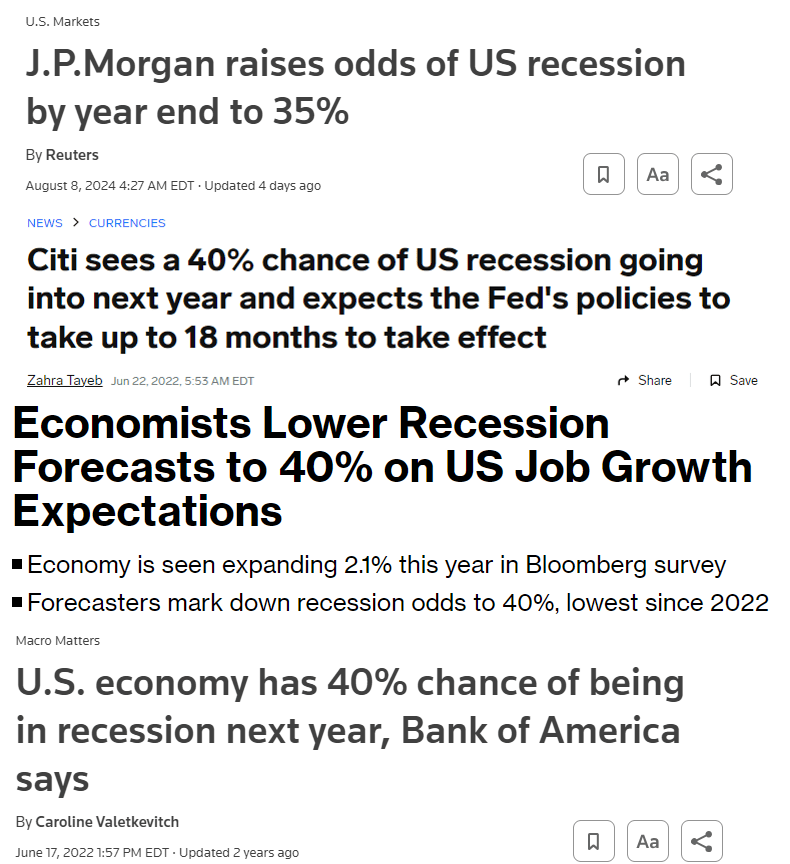

On August 13, Ben Carlson wrote an interesting blog about recession prediction, where he included several screenshots from "recent" recession calls going back to 2022.

A Wealth Of Common Sense

As we can see, for more than two years, the smartest people in the room have warned about recessions.

Don't get me wrong. I'm not showing you this to make these people look bad. I have had my share of bad calls as well.

The difference is that I don't have to make recession predictions. Large institutions, however, are somewhat obligated to update their clients on recession odds. Large corporations like to have this data to incorporate it into their financial forecasting.

I care about trends in leading indicators that can tell us if the risk/reward of the market is good and what the most attractive places are to put our hard-earned money. Just like Bloomberg's Jonathan Levin, I can focus on the trajectory alone. I think he really hit the nail on the head when he wrote this:

Reasonable people can disagree about the exact number, but the trajectory still seems important, and there's decent news on that front - we've gone from "pretty low" to "somewhat higher" to "oops, not quite that high!" And given the tremendous uncertainty implicit in recession forecasting, it still feels like we're within spitting distance of "normal." - Bloomberg (emphasis added).

With that in mind, in prior articles, I have written that macroeconomic data is currently perplexing.

For example, the just-released Leading Economic Index tells us a recession is certainly going to happen. The LEI consists of indicators like the average workweek, ISM new orders, consumer expectations, interest rate spreads, leading credit index, consumer goods orders, stock prices, building permits, and jobless claims.

As we can see below, the index is at recession levels. Going back 24 years, a level this bad has always resulted in an official recession.

The Conference Board

Moreover, as Wells Fargo research shows, the spread between coincident and leading indicators is at a new multi-year high. This suggests that poor leading indicators have not yet resulted in a decline in coincident indicators.

Or, to put it differently, "real" economic data is still good.

Wells Fargo

That said, it's not all bad.

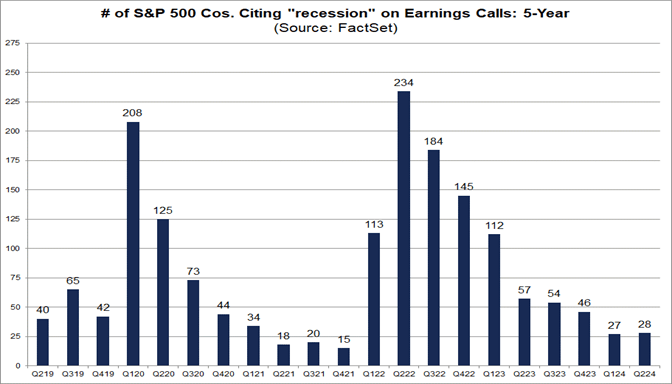

Using FactSet data, the number of S&P 500 companies mentioning a "recession" on their earnings calls was 28 in 2Q24. That's very low and nothing compared to the numbers we saw in 2022 and 2023. Back then, the U.S. economy avoided a recession.

FactSet

This makes sense, as revenue growth is accelerating, with 2Q24 revenue growth of 5% reaching the highest level since 4Q22.

FactSet

Although S&P 500 earnings are not "leading" indicators, it is hard to make the case that the economy is about to fall off a cliff.

Moreover, there is one critical factor at play here.

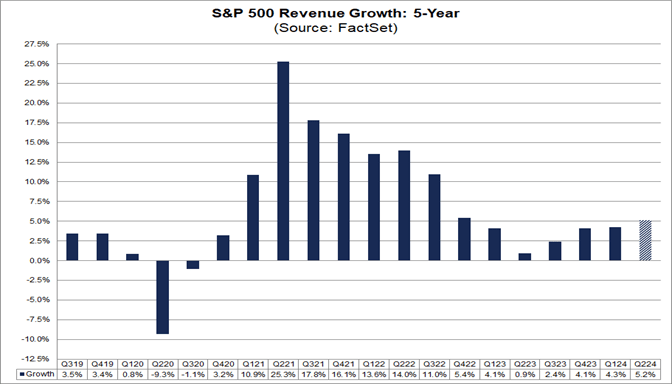

Currently, the Federal funds rate is 5.25% to 5.50%. Investors expect weaker economic growth to result in significant central bank easing.

- September is expected to see a 25 basis points rate cut.

- After September, rates are expected to gradually decline to the 3.25% to 3.50% range in July 2025.

While all of these numbers are subject to change (I do not expect this many rate cuts unless the Fed is forced to cut this aggressively, which isn't bullish), they clearly tell us that the market isn't worried because the Fed has so much room to support the economy.

CME Group

For now, this strategy works, as we can assume that a series of rate cuts can turn sluggish economic growth into growth. A deeper recession would be a different story. Luckily, we're not there yet.

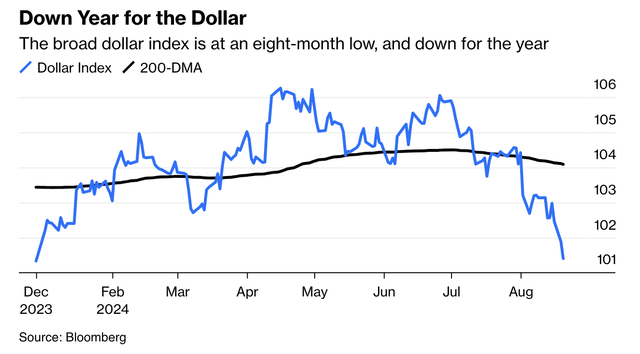

What's important is to keep an eye on the implications. Currently, the dollar is becoming a hot topic again.

Especially non-U.S. investors like myself need to keep an eye on the dollar, as it impacts the value of our dollar assets. In my case, that's 100% of my portfolio (including some Canadian dollar exposure).

Bloomberg

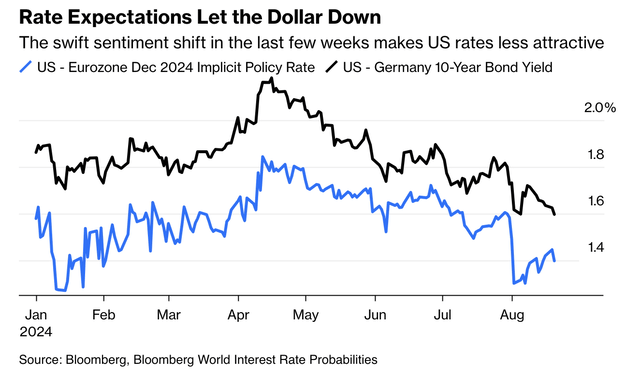

It makes sense that the dollar is weakening, as the U.S. is late to the easing cycle. The European Central Bank, for example, has already cut its rate once. Now, the U.S. is expected to cut rates, which is making U.S. bonds less attractive on a relative basis. This hurts dollar demand, as it is now relatively more attractive to buy debt in, i.e., European nations.

Bloomberg

While the current equity bull market, supported by lower rates, is fun, I believe the dollar will be increasingly important, which is why I am incorporating potential dollar weakness in my investment decisions. This includes the picks of this article.

Speaking of investment decisions, I have a hard time dealing with this market.

After the recent stock market surge, valuations have come up again. I believe most of you will agree with me when I say it is increasingly tough to find bargains in a market that trades close to 21x forward earnings. This is the highest valuation since the Dot-com bubble if we ignore the pandemic.

JPMorgan

However, as the title suggests, there are still investments that I have been buying more of lately.

In the second part of this article, I'll discuss these investments and explain why they stand out in a market with an overall lofty valuation and challenging macroeconomic outlook.

LandBridge Company LLC (LB) - My Highest-Conviction Investment

LandBridge is a somewhat complicated investment.

For starters, the company went public at the end of June and does not yet pay a dividend.

However, as I wrote on August 10, the company could be "A Once-In-A-Generation Investment." On a side note, please feel free to read this article, as I cannot give the company the attention it deserves in this multi-stock article.

That said, while I like catchy titles, I wasn't kidding. I truly believe LandBridge is a company with a very bright future that provides me with several benefits:

- It will provide me with income. After 3Q24, the company will reveal its dividend plans.

- It provides me with super-high-margin exposure to the energy industry.

- It offers real estate benefits due to its land ownership.

- It provides tech-like features due to data center operations.

Essentially, I believe LB is quickly turning into a high-margin dividend grower with significant inflation protection.

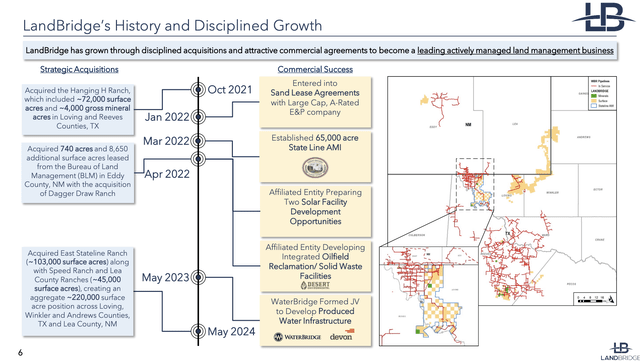

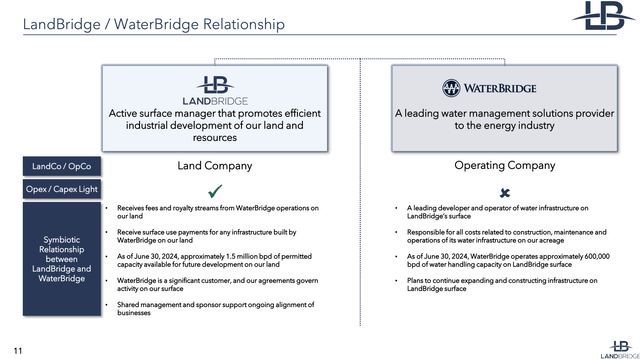

So, what's LandBridge?

LandBridge is a landowner. It does not produce anything. It just owns the land.

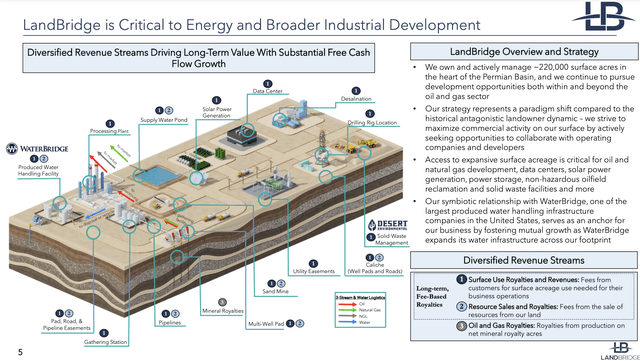

However, that's a genius business model, as the company owns 220 thousand acres of valuable land in the Permian Basin in Texas and New Mexico. This land has tremendous benefits, as the company has surface, water, and mineral rights in the most important oil basin in the United States.

LandBridge Company LLC

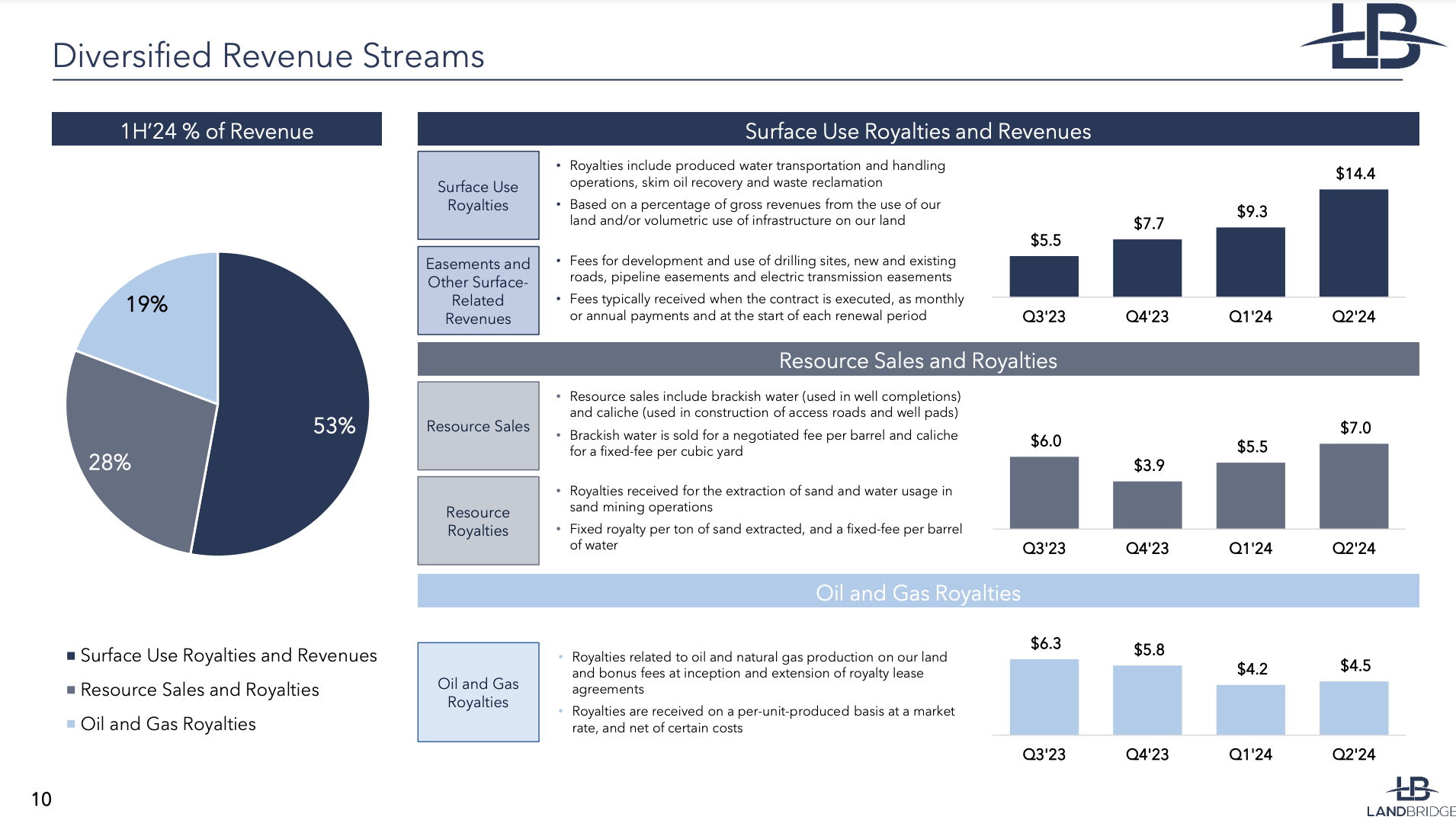

The company makes money from oil and gas royalties when oil producers are active on its land. These revenues are roughly 20% of its total revenues and allow it to benefit from oil and gas production without any of the operating expenses.

Most of its revenues come from surface royalties. This includes anything that happens on its land. A big part of this is water. Oil and gas drilling requires a lot of water, as chemicals are injected into the ground. However, oil and gas operations also produce water. In some areas of the Delaware Basin (part of the Permian Basin), every barrel of oil produces four barrels of water.

LandBridge Company LLC

This requires a lot of water infrastructure. This is handled by WaterBridge, a company that shares a management team and majority owner with LandBridge.

LandBridge Company LLC

Moreover, the Permian has other benefits:

- Because of accelerating oil and gas production, demand for water operations is exploding.

- Natural gas production is growing so rapidly that in some areas of the Permian, natural gas is burned, as it is cheaper to get rid of it than to ship it to customers.

The abundance of water and cheap energy is perfect for a wide range of industries, including data centers, cryptocurrency mining, hydrogen production, and related.

Currently, LandBridge is working with a tech company to build a data center on its land. This could be a 100-year ground lease that provides the company with risk-free income. Moreover, these operations would come with solar and other assets that increase surface income.

The land of LB is perfect for these operations, as it is mostly continuous land in Texas, where it enjoys a mostly unregulated transmission network, making it easier to build data centers.

LandBridge Company LLC

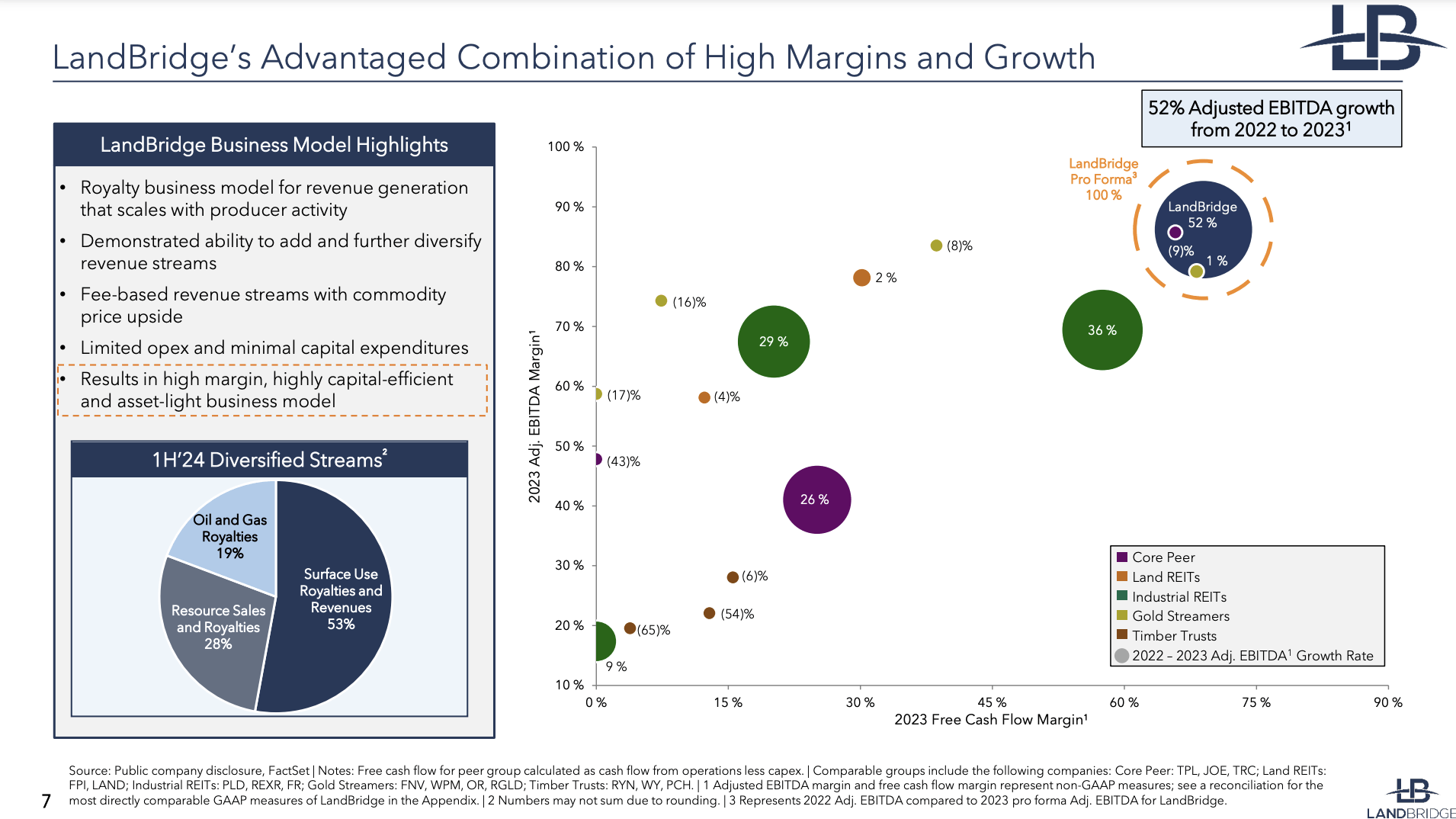

Valuation-wise, it's tricky, as we are dealing with a company with EBITDA margins of roughly 90% and free cash flow margins close to 75%. These numbers deserve an elevated P/E ratio because the company squeezes more profits out of every revenue dollar than almost any company on the stock market.

LandBridge Company LLC

Moreover, it is tough to estimate just how much growth LB can create on its land.

Special Situations Investing had a good estimate, as it projects more than $350 million in annual revenues (emphasis added).

Among his estimates for the next three to five years, he predicted the following: revenue from water royalties between 200 and 300 million per year, revenue per data center between 30 and 40 million per year, along with continuing, but less significant, revenue from oil & gas, sand, and other infrastructure projects. If we assume 250 million in revenue from water, 30 million from a single data center, and another 70 million from oil & gas and other infrastructure projects we come to 350 million in total revenue.

Its peer Texas Pacific Land Corporation (TPL) - my largest investment - trades at a market cap of roughly $20 billion on $600 million in revenue. Over time, this could justify a $10 billion market cap for LB.

I get the same number when applying a 35x multiple and an 87% net income margin. This would turn $350 million in revenues into $300 million in net income, justifying a market cap of more than $10 billion.

As the company currently trades at a $2.7 billion market cap, I see room for 3-4x gains in the next 5-10 years, making it one of my favorite plays, which will announce a dividend later this year.

I also expect tailwinds from a weaker dollar, as this usually benefits commodities like oil and gas. Moreover, *if* the situation in the Middle East escalates, the U.S. Permian will be an increasingly important source of oil and gas.

Deere & Company (DE) - Cheap For A Reason, With Recovery Potential

In a market with a lofty valuation, we often have to seek companies that are "struggling" with a high chance of recovery. One of these companies is Illinois-based Deere & Company, the owner of John Deere farm and construction machinery. It also owns brands like the German Wirtgen, Kemper, and others.

On August 15, I wrote an article titled "I'm Buying Much More As Deere Surprised When It Matters Most."

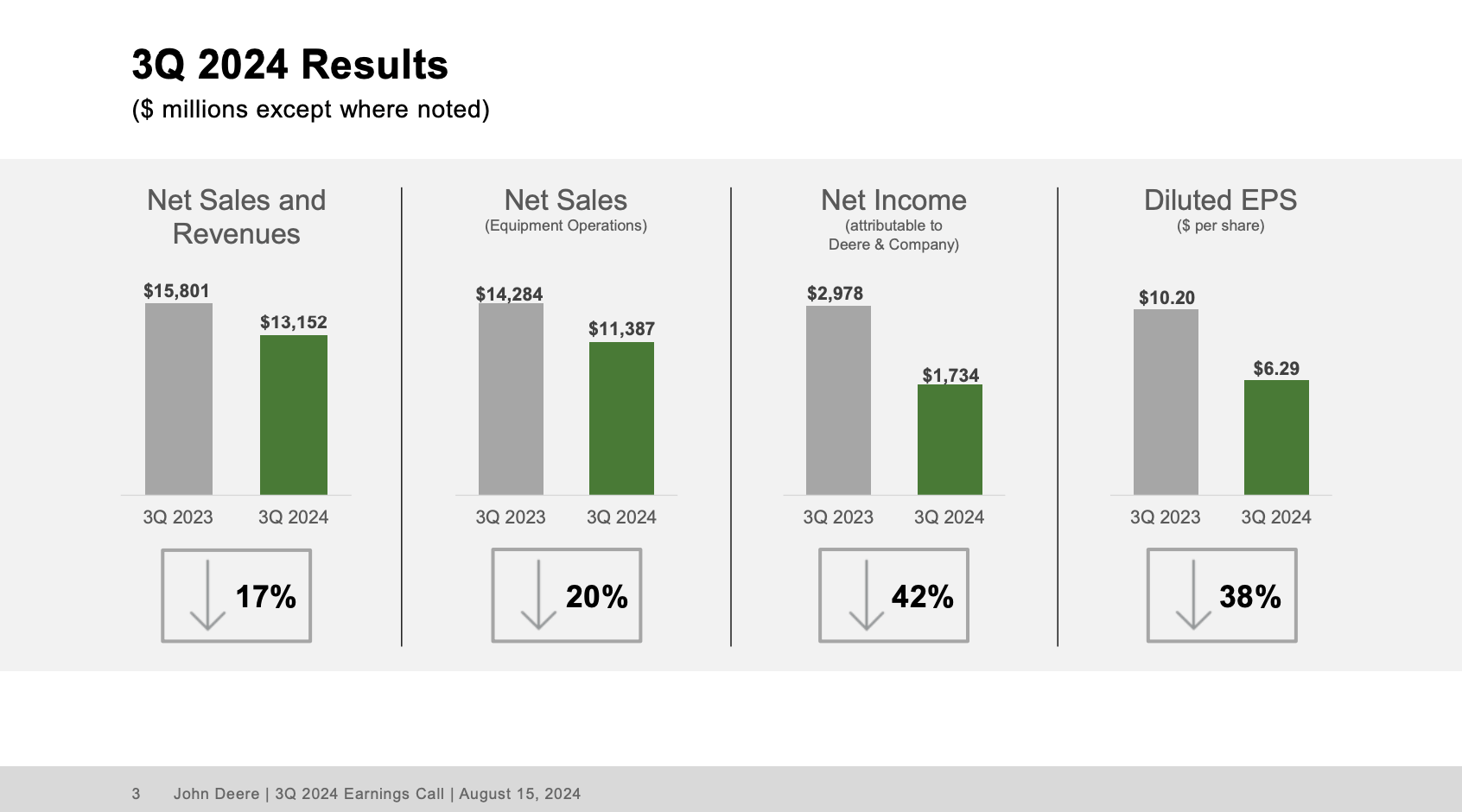

The giant with a $103 billion market cap has been hit by a wide range of economic headwinds, including poor crop prices, elevated rates pressuring farmer spending, weakening construction demand, and general economic uncertainty.

As a result, in 3Q24, net equipment sales fell by 20%, dragging net income down 42%.

Deere & Company

However, after earnings, the stock surged more than 5%.

That was based on Deere cutting production. Unlike prior cycles, Deere was quick to act, as it reduced production to keep dealer inventories from rising. It anticipated weak demand and made sure it did not overproduce.

It also made clear that it is seeing tailwinds from an elevated fleet age. When adding aggressive investments in efficiency-improving tractors and machines, the company benefits from farmer's needs to reduce costs and streamline operations.

One important note regarding fleet fundamentals is that in North America, we continue to see an elevated fleet age, which enables replacement purchases. Additionally, strong balance sheets are providing support in a downturn, driven by farmland values that are up nearly 5% year-over-year. So while it's definitely a challenging market for customers, there are some supportive factors to account for. - DE 3Q24 Earnings Call.

The moment crop prices surge and rates come down, I expect this to create a very favorable demand environment for Deere, especially because inventory control will provide it with pricing power.

Deere also did not lower its net income guidance, which was a sign of confidence.

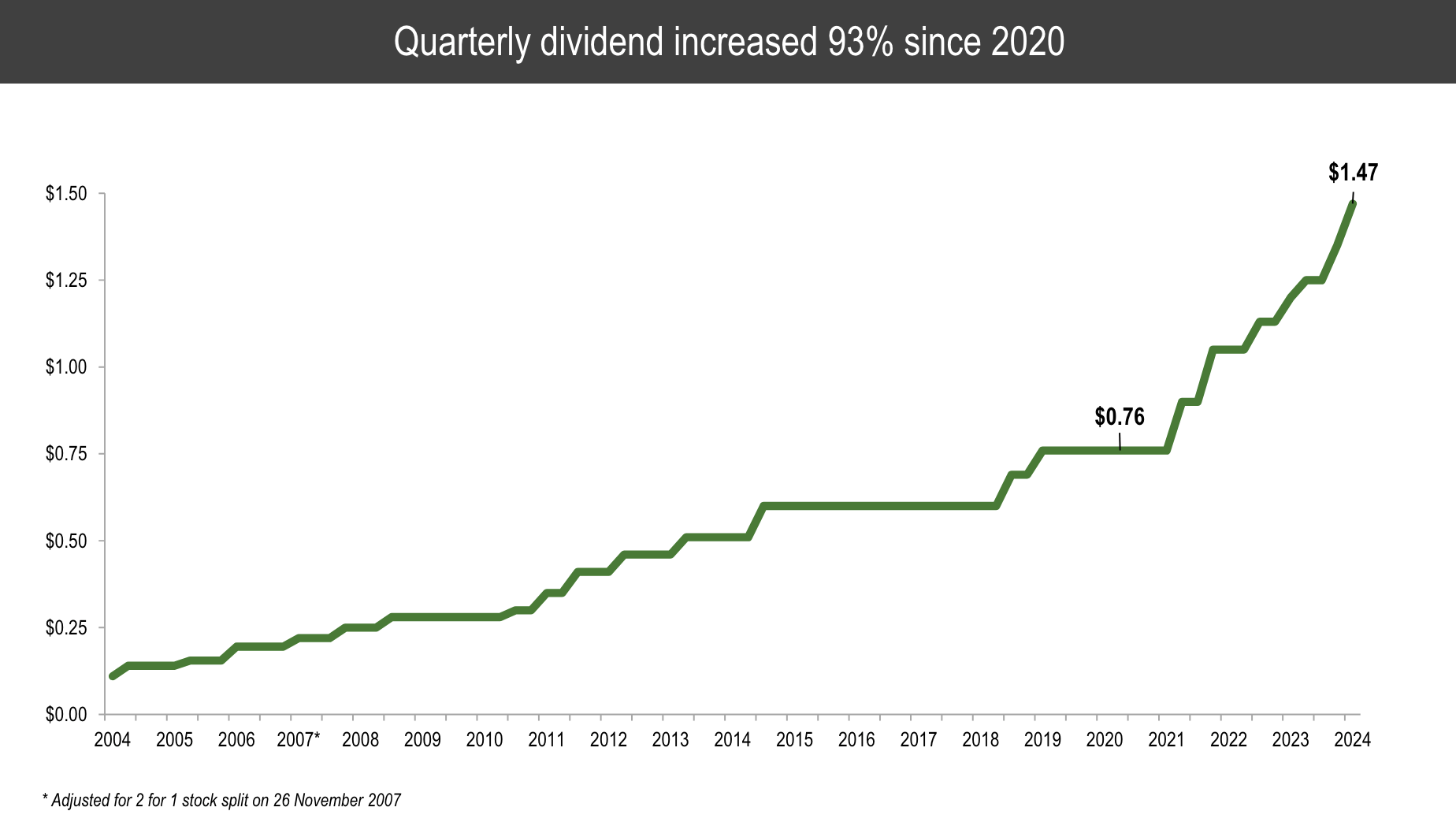

Regarding its dividend, the company yields 1.6%. Although this yield is not spectacular, dividend growth is impressive. Since 2020, the dividend almost doubled!

Deere & Company

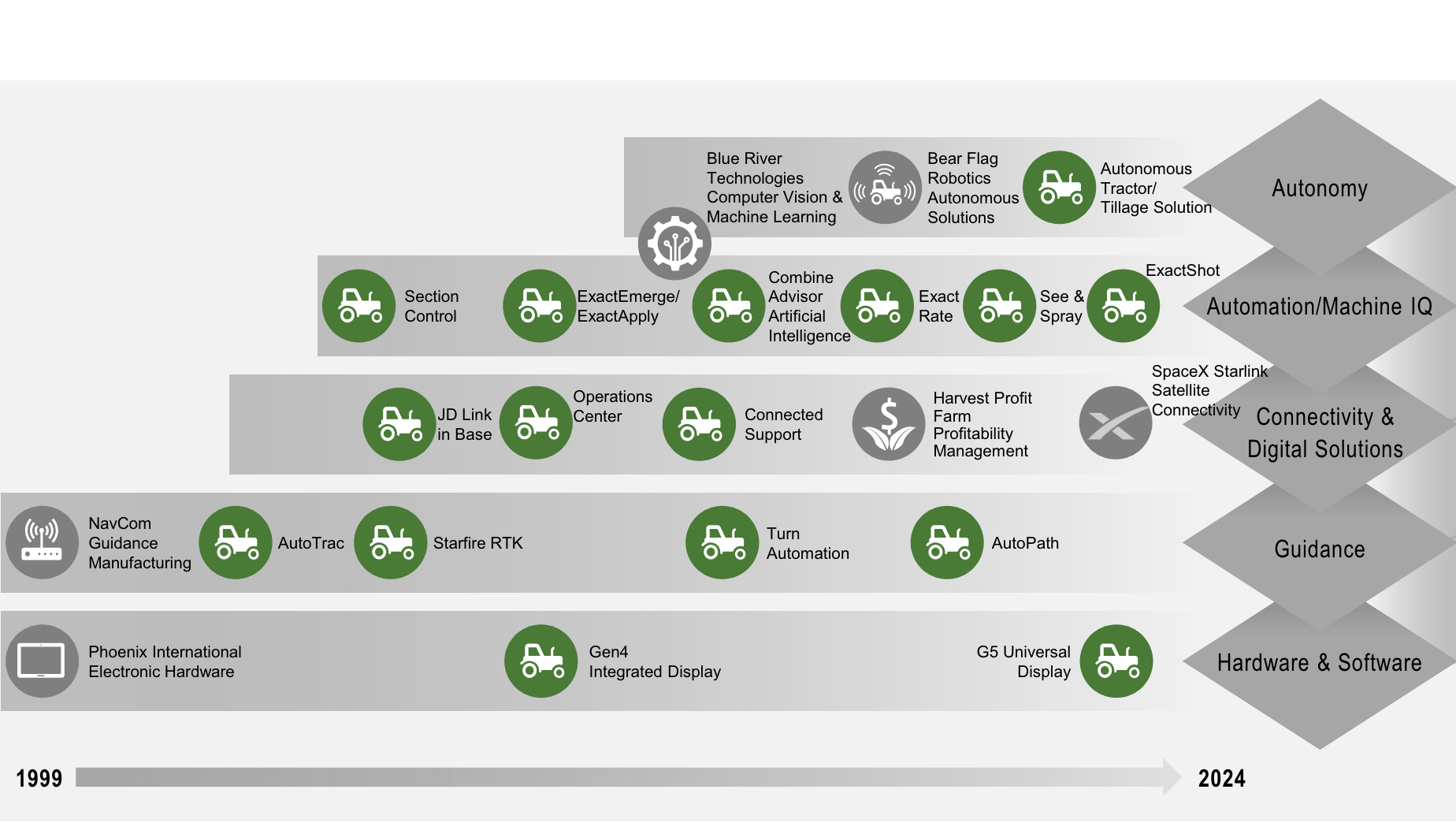

Moreover, the company maintains a credit rating of A and leadership in next-gen agriculture.

Deere & Company

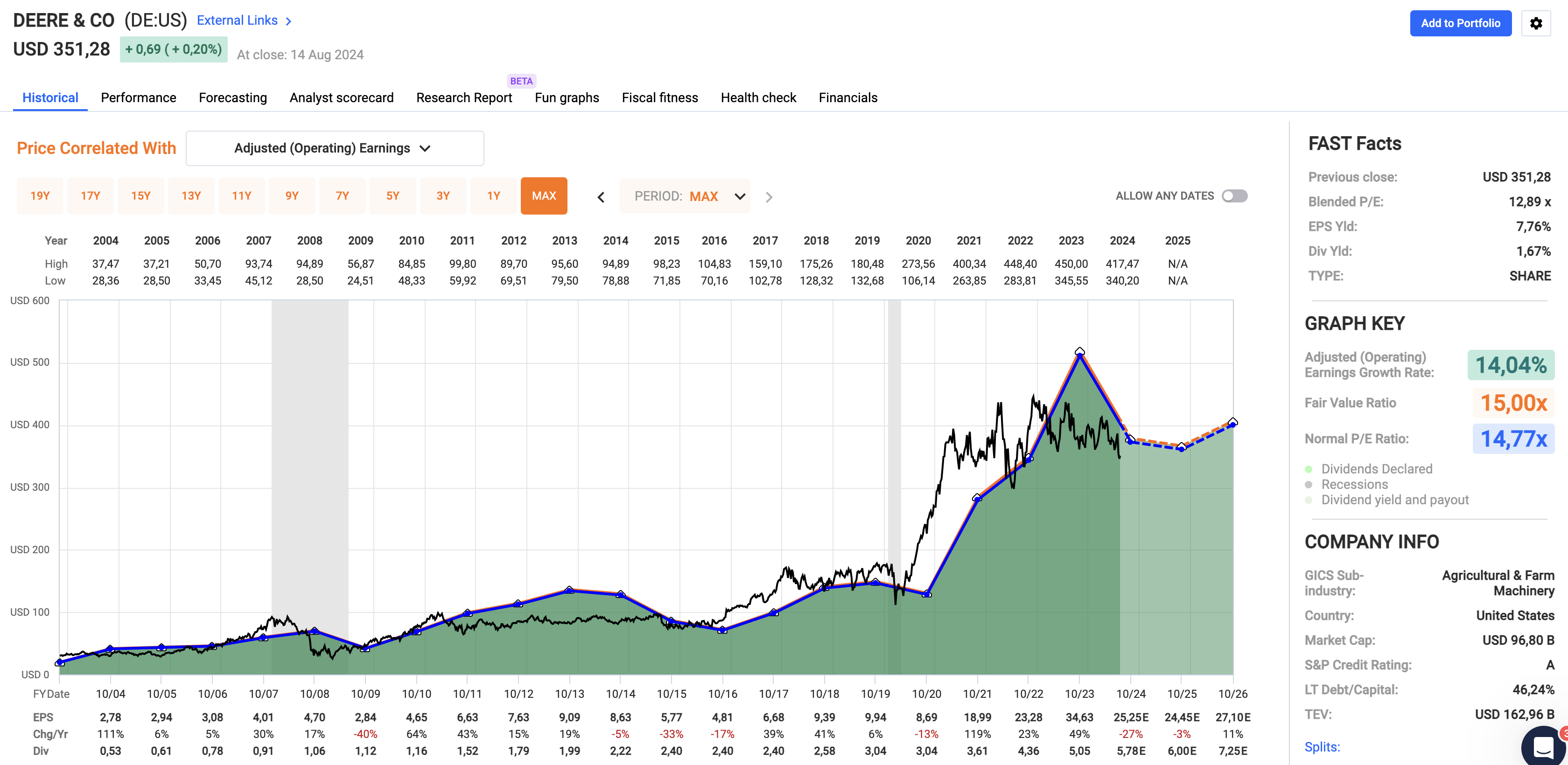

As such, I stuck to my $600 stock price target.

Purely theoretical, this implies a fair stock price of $406, using its normalized P/E ratio of 14.8x. That's roughly 8% above its current stock price. While I am writing this, Deere is trading 7% higher after earnings.

To show you how much expectations have changed, six months ago, analysts expected $29.10 in 2026 EPS. This would imply a $450 stock price using the ten-year average P/E ratio of 15.5x.

Hence, I stick to my long-term target that Deere is likely a $600 stock. While the current environment is tough, the moment we get a synchronized demand recovery, Deere will be in a fantastic spot to service this demand thanks to current measures. - DE Article, August 15.

FAST Graphs

Moreover, if we get a weaker dollar, I expect this to benefit commodity prices and demand for tractors and equipment.

The next stock has a higher yield and much more favorable demand.

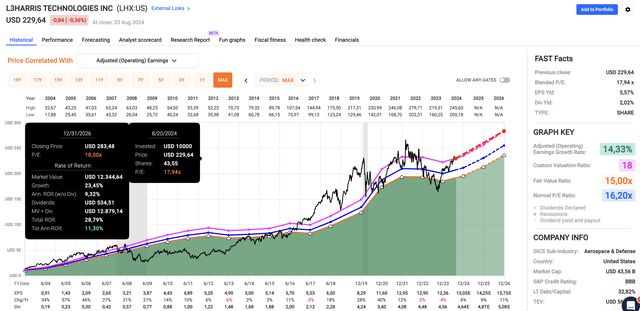

L3Harris Technologies, Inc. (LHX) - Undervalued Defense Growth

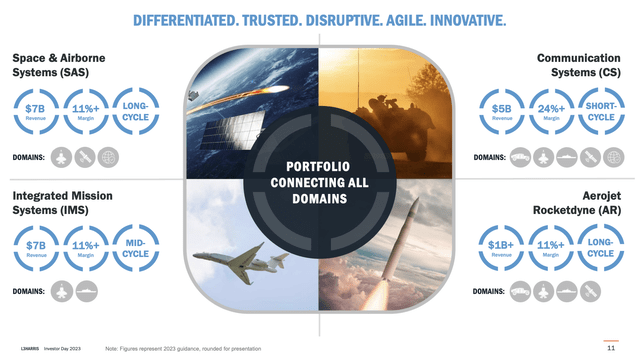

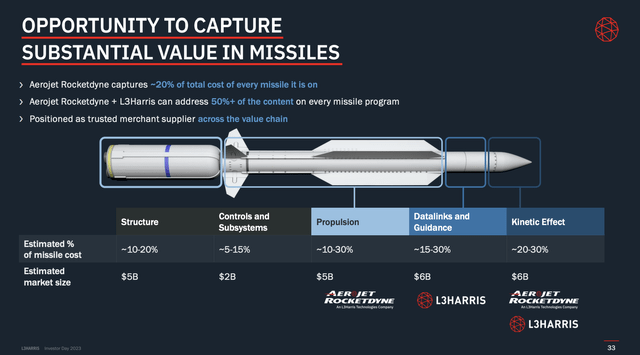

L3Harris is one of my four defense investments. The company is the result of a 2019 merger between L3 Technologies and Harris. After several divestitures and major M&A projects - including the acquisition of Aerojet Rocketdyne - the company has a well-diversified portfolio with operations in all major defense domains.

L3Harris Technologies

In addition to producing an almost countless range of supplies for major defense contractors, it also supplies more than half of the content on every single missile program, including propulsion, controls, and structure.

Especially in light of geopolitical uncertainties and the need for advanced missile innovation, LHX is in a great spot to deliver.

L3Harris Technologies

Thanks to these tailwinds, the company hiked its revenue and earnings guidance, expecting at least $12.85 in full-year EPS and $2.2 billion in free cash flow, 5.0% of its current market cap.

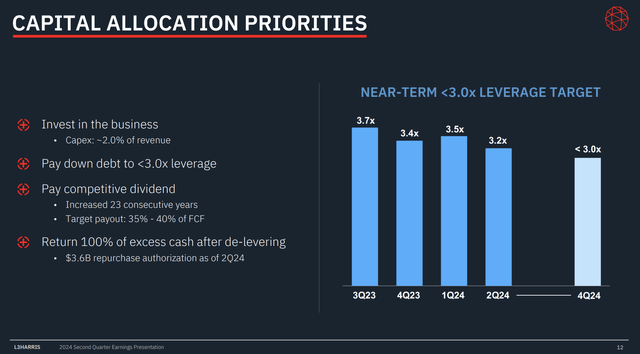

Currently yielding 2.0%, the company has hiked its dividend by 1.8% in 2024 and 2023. Although this keeps its dividend growth streak of 23 consecutive years alive, it's relatively disappointing dividend growth.

However, this is due to its focus on post-M&A balance sheet debt reduction. At the end of this year, the company is expected to reach its leverage target.

L3Harris Technologies

This bodes well for shareholders. Not only has the company pledged to return 100% of excess free cash flow to shareholders, but it also is expected to generate $2.8 billion in FCF by 2026. This translates to more than 6% of its market cap.

This implies consistent double-digit annual dividend growth and aggressive buybacks.

Currently trading at 18x earnings, I believe this is a fair valuation, as analysts expect an EPS acceleration from 6% in 2024 to 11% in 2026. This paves the way for 10-12% annual total returns.

FAST Graphs

In an environment of strong defense demand, easing supply chain issues, and a bigger focus on dividend growth and buybacks, LHX is one of my favorite picks in a market with a lofty valuation.

Takeaway

Predicting recessions is like predicting the Super Bowl winner. It's tough and often unreliable.

Despite mixed economic signals, including leading indicators suggesting a recession, the market remains resilient, which is partially due to expectations of Fed rate cuts.

While this won't likely provide a path to sustained growth, I believe it's keeping the economy from slipping into a deeper downturn.

Hence, as the market remains challenging, I'm focusing on investments with high-growth potential and solid fundamentals.

LandBridge offers unique exposure to the energy sector, Deere is poised for an agriculture recovery with strong fundamentals, and L3Harris stands out in the defense sector with elevated future cash flow, likely supporting aggressive dividend growth and buybacks.

As these picks perfectly align with my strategy, I have high hopes for these investments.

Comments