Summary

- Sprouts has seen significant growth over the past three years, with extremely high momentum over the past six months.

- Sprouts benefits from consumer trends favoring low-cost or high-cost outlets, which gives it a widening market share as the "middle" middle-class shrinks.

- Despite a strong balance sheet and business model, Sprouts may face recession risks and potential pricing pressure on non-essential goods, though that may be offset by competitors' closure risks.

- The company's valuation is much higher than when I first became bullish in 2021; however, its growth trajectory makes it likely cheaper than COST.

- At its current price, it may be best to wait for a correction before taking a bullish position in SFM.

SDI Productions

Three years ago, I published a very bullish outlook on the grocer Sprouts Farmers Market (NASDAQ:SFM) in "Sprouts Farmers Market: Health Equals Wealth." At the time, the stock was trading at a very low valuation while achieving record profits and solid sales growth. I believed it had a competitive advantage over inflation because I expected the price difference between its products and others would decline as input costs rose faster for cheaper brands (as a percentage of their retail price). Lastly, I viewed the pandemic as encouraging healthier eating, which would improve its long-term prospects.

Although much of that thesis remains in effect, one thing is different today: SFM's valuation. SFM has skyrocketed 284% higher since that article was published, seeing accelerating gains over the past three years with (generally) consistent outperformance to its competitors and the stock market at large. SFM has risen by around 148% over the past year and has doubled in 2024 alone, giving it extremely high momentum.

Stocks with high momentum can often continue to rise. However, we must be mindful of its valuation if we're considering a long-term investment in SFM, as I was in the past. A poor company at a very low valuation may be better than a good company at a very high valuation. In the past, SFM was among the few great companies at a low valuation. That is not the case today, as its forward "P/E" is now around 30X, which is exceptionally high compared to most grocers at ~8-15X. Thus, we must make an updated outlook for the company concerning its industry and macroeconomic conditions.

Sprouts Benefits From Consumer Bifurcation

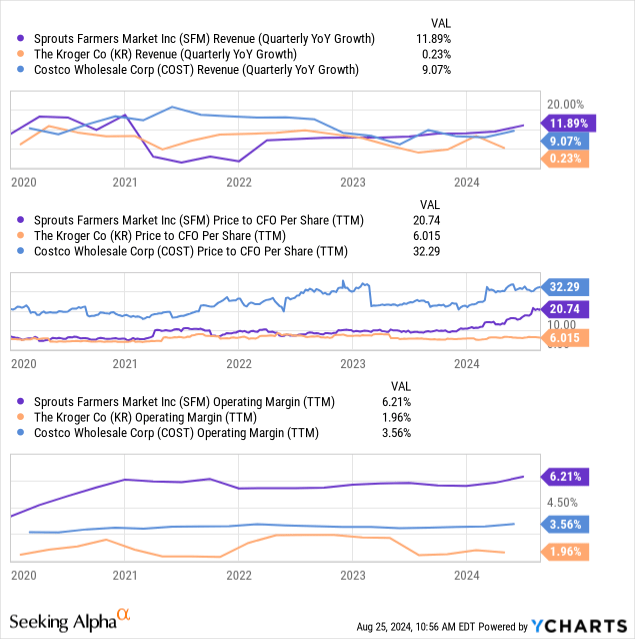

One of the most important long-term economic trends over the past decade that I expect will continue is the bifurcation of the American consumer class. This trend has significantly impacted various industries, but food and groceries are perhaps one of the most clear. Mostly, people are flocking to low-cost or high-cost outlets, away from those in the middle. For example, the lower-cost bulk food (and other) grocer Costco (COST) has had the best growth in recent years, thus giving it the highest valuation. Sprouts has performed similarly, operating at the other end of the spectrum. However, the middle, now dominated by just Kroger (KR) and Albertsons (ACI), has faced tremendous pressure, encouraging immense consolidation over the past twenty years. See below:

Data by YCharts

Data by YCharts

Sprouts has the best profit margins as the "premium" choice. Costco is also strong and highly stable due to its bulk-focused business model. Kroger's business model is poor, as its groceries do not have the quality appeal of Sprouts or the cost appeal of Costco.

In my view, Sprouts was a no-brainer investment in 2021. At that point, it had better revenue growth than Kroger, a lower valuation (on an "EV/EBITDA" and "P/E" basis), and much better margins. However, it was discounted due to a forecasted decline in sales growth as the firm wisely slowed expansion during the rising cost environment. However, as I expected, the appeal for Sprouts remained strong, and the company could quickly renew expansion without compromising its profit margins.

Sprouts May Face Greater Recession Risk

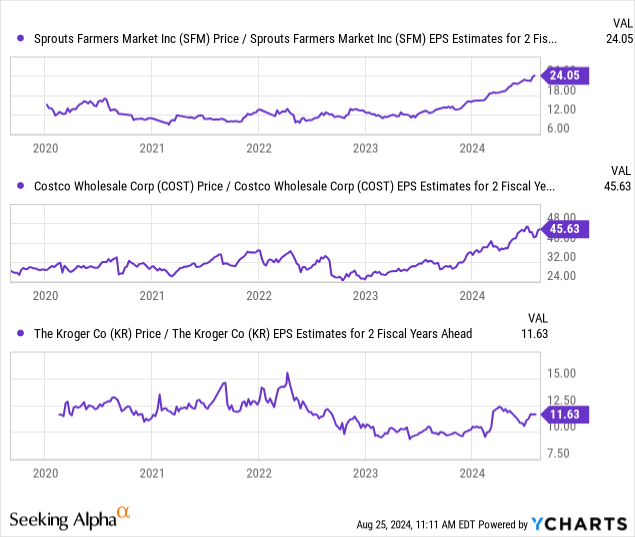

Further, because Sprout's items are not as integrated into the US processed food supply chain, I believe it benefited from not seeing the same associated cost growth factors. Whole Foods (AMZN) and Trader Joe's likely have had similar benefits, but are not independently publicly traded. That may be an issue as SFM may be getting too much speculative momentum, being among the few grocery stocks with strong profitability and growth. Of course, even if we use two-year ahead EPS estimates to account for growth rates, Costco comes out as the most expensive of the three:

Data by YCharts

Data by YCharts

Despite its immense momentum, SFM appears cheap compared to COST. It may be expensive to KR, but its long-term growth is likely to be much better, as secular trends seem to benefit Sprouts and Costco at the direct expense of Kroger (or Kroger Albertson's), which are vying for a shrinking "middle" middle class (as the upper and lower middle class grow).

Still, just because SFM is cheap compared to COST does not mean it is undervalued, as Costco may be overvalued. To that end, we may consider that Costco's natural valuation may be higher because it is the likeliest beneficiary of inflationary pressures straining middle-income households. Unlike Costco, Sprouts may have more significant recession risks, while Costco may be a beneficiary.

While I think Sprout's business model gives it some isolation against food inflation, I do not believe it has significant protection from a recession. Put simply, if people lose their jobs or their wages fail to keep up with prices, they will be more price-sensitive. These people may continue to shop at Sprouts, but Sprouts may lose its ability to maintain abnormally high margins. If so, Sprouts may run some risk of falling into Kroger's "middle" market, where it is forced to sell lower quality products to try to maintain customers. However, this remains to be seen, as the company has maintained decent sales growth and gross margin expansion over recent years despite weak consumer sentiment.

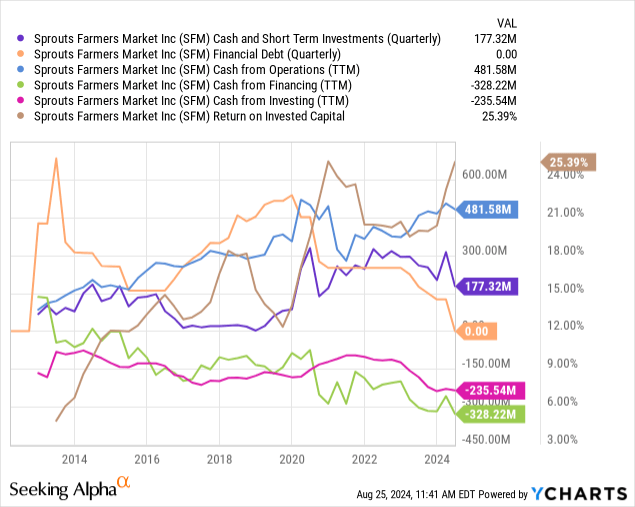

Sprout's Balance Sheet Strengthening

While Kroger and Albertson's are caught in a loop of debt-based mergers, Sprouts has reduced its financial debt to zero and is now paying its shareholders through significant stock buybacks. TTM its cash from financing was—$328M, or around 3.5% of its Enterprise Value, pointing to a decent shareholder yield trend. Importantly, it has repaid shareholders while investing a fair amount into growth investments, at a very high return on invested capital of 25%. Its overall cash position is decent and is supported by solid growth in its cash from operations. See below:

Data by YCharts

Data by YCharts

I think Sprout's cash flow and balance sheet are ideal. There is little volatility in all of its three cash-flow contributors, the rare company with positive operating cash-flow and negative CFF and CFI, pointing toward organic growth with direct returns to shareholders through stock buybacks. Likely, those buybacks will slow now that its valuation is higher, as I believe it was wisely repurchasing equity when it was trading at an egregiously low valuation. It has no financial debt, while nearly all its competitors do (including Costco). This is a great sign, giving it added protection against a recession and less exposure to interest rate volatility.

The Bottom Line

Looking at SFM's stock price trend, I expected to reanalyze the company with a bearish outlook due to overvaluation. Those who follow my work likely know I tend to air caution and feel that most stocks are overvalued today. A decent portion of speculators appear bearish on SFM, with a short interest level of 9.5%. Indeed, based purely on its stock price momentum, I feel there is a risk that SFM will face a correction.

Further, despite my love for its balance sheet and business model positioning, I do not think it is remotely as discounted as it was in the past. In 2021, I gave it a fair-value target of ~$60, which was over twice its price then but nearly 40% below its current price. Of course, SFM traded at $60 just five months ago.

In my view, there is a risk that SFM is overvalued in the event of a long-term recession that causes higher unemployment in "upper middle class" jobs, such as in the technology sector. There is a fair amount of evidence that, since 2020, wage growth has been weakest for higher income brackets and best for lower income groups.

Realistically, I expect higher-middle-income groups to reduce durables spending before changing grocery stores, assuming grocer preference is "sticky." Most likely, Sprouts may still face pricing pressure on non-essential goods, which will often have the best margins. Though outside of extreme circumstances, I do not believe its recession risk is too high, mainly when that may result in Kroger and Albertson's closing more stores, benefiting Sprout's market share.

Overall, I believe SFM is fairly valued today. Although its forward "P/E" is nearly 30X, its EPS is expected to be over $5 by the decade's end. Although an economic slowdown could slow its growth, I think that is a very reasonable outlook. I am neutral on SFM today but may become bullish if its stock price declines on recession concerns as I expect turbulence in financial markets to harm the most indebted grocers like Kroger and Albertson's.

Comments