Large Moves Expected for Friday’s Unemployment Report

By Matt Amberson, ORATS

Tomorrow, the market will focus on the release of the U.S. unemployment report, arguably the most crucial economic data point in the near term. The anticipation surrounding this report is reflected in the options market, signaling heightened volatility as traders brace for the announcement. While international events have made headlines, this unemployment number remains the key to shaping market sentiment and guiding Federal Reserve policy.

The unemployment number provides:

- Critical insights into the state of the U.S. labor market.

- Serving as an indicator for future economic growth.

- Inflation trends.

- Potential monetary actions by the Fed.

As such, traders are already positioning themselves for what could be a significant move in the market following the release.

Why the Unemployment Number is the Market’s Focus

In an environment where inflation concerns continue to weigh heavily on investors’ minds, unemployment is one of the most influential metrics in determining the Federal Reserve’s next steps. A higher-than-expected unemployment rate may signal that the economy is slowing, reducing the likelihood of further rate hikes. On the other hand, a lower unemployment number could reignite inflation fears and lead to tighter monetary policy.

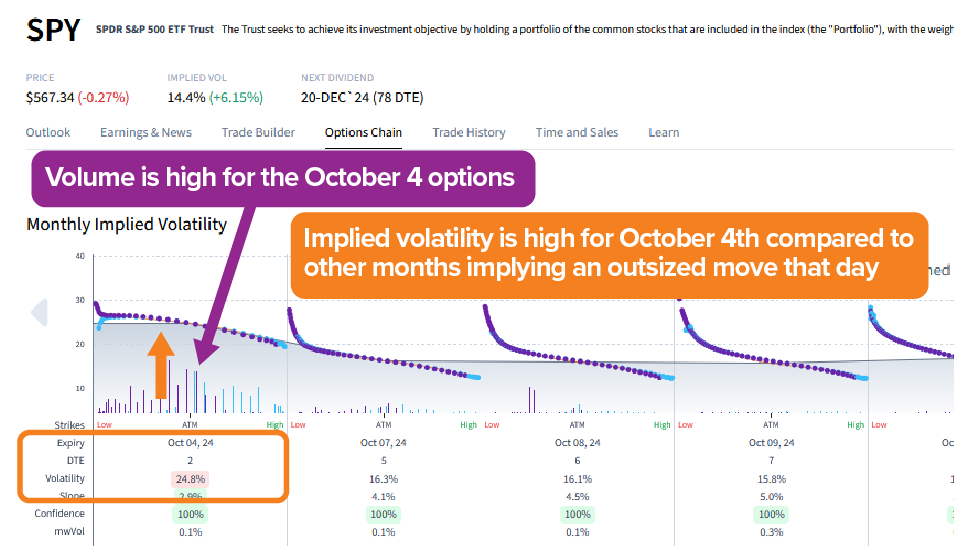

Given the centrality of this report, traders have been adjusting their positions accordingly. SPY is currently pricing in a 1.0% move for tomorrow, a slight reduction from the 1.1% move expected two days ago. The other major ETFs, QQQ and IWM, show expected moves of 1.2% and 1.7%, respectively, as traders prepare for the report’s impact on the tech and small-cap sectors.

While these expected moves are slightly lower than earlier in the week, the market’s focus on the unemployment data remains clear. The implied volatility for October 4th options is still elevated compared to other expirations, signaling the importance of this data release.

How the Market Anticipates the Unemployment Announcement

Comments