$Netflix(NFLX)$ is set to release its Q3 earnings report on October 17. Analysts expect revenue of $9.765 billion, up 14.32% year-over-year, and earnings per share of $5.09, a solid 36.44% increase.

The stock has been trending upward this year, reaching a new all-time high of $736 last Friday. Looking ahead, investors will be keenly watching user growth and forward guidance.

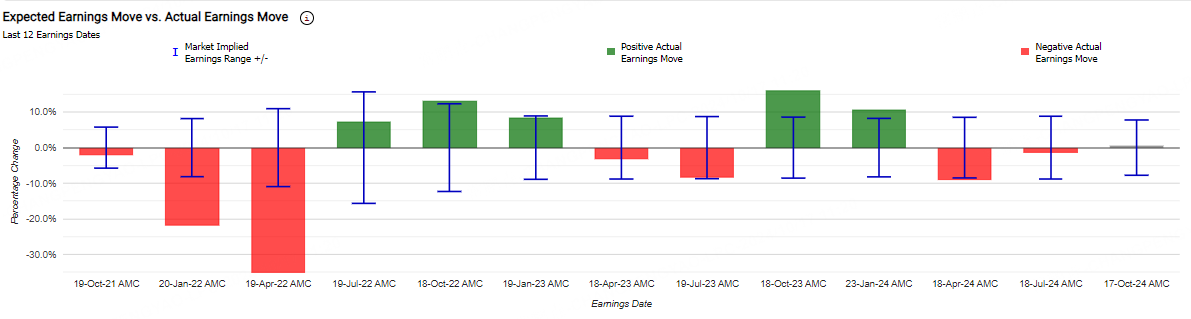

Netflix’s implied move for this earnings release is ±7.9%, which signals that the options market is pricing in a potential 7.9% swing. However, this is lower than the average 9.3% post-earnings move over the past four quarters—suggesting that current options might be undervalued.

Market Chameleon’s data on Netflix’s last 12 earnings days shows a 58% probability of a post-earnings drop, with an average move of ±11.4%. The most dramatic swing saw a 35.1% drop and a 16.1% rally.

For those looking to trade on this earnings event, a short straddle could be the way to go.

What is a Straddle Strategy?

1.Long Strangle

In a long strangle, the investor buys both an out-of-the-money call option and an out-of-the-money put option. The call’s strike price is set above the current market price, while the put’s strike price is below it. This strategy offers significant profit potential.

If the underlying asset’s price rises, the call can theoretically generate unlimited gains. If the price falls, the put option can provide substantial profits. The risk here is limited to the premiums paid for both options, which is the cost of entering the trade.

2.Short Strangle

In a short strangle, the investor sells an out-of-the-money call and an out-of-the-money put simultaneously. This strategy is neutral, and profit potential is limited. The goal is to benefit from low volatility—if the stock price stays within a narrow range, the investor keeps the premiums collected from selling the options.

The maximum profit is the total premiums received, minus transaction costs. However, if the stock price moves significantly, losses can be substantial.

Netflix Short Strangle Example

Netflix stock is currently trading at $702. To implement a short strangle strategy, an investor can take the following steps:

Step 1: Sell one call option with a strike price of $800, receiving a premium of $260.

1.Premium Income

- Selling the $800 call: Receive a premium of $260.

- Selling the $600 put: Receive a premium of $97.

- Total premium income = $260 + $97 = $357.

2.Profit and Loss Analysis:

- Maximum Profit: $357. The maximum profit is the total premium collected, which happens if Netflix’s stock price stays between $600 and $800 at expiration, meaning neither option is exercised.

- Loss Scenario:

Above $800: The $800 call will be exercised, and losses will grow as Netflix’s stock price increases beyond $800.

Below $600: The $600 put will be exercised, and losses will increase the lower Netflix’s stock price falls below $600.

3.Breakeven Points:

- Upside breakeven = $800 + $357 = $1157. If the stock price rises above $1157, the investor starts losing money.

- Downside breakeven = $600 - $357 = $243. If the stock price falls below $243, the investor begins to incur losses.

Conclusion

Maximum Profit is $357. If Netflix stays between $600 and $800, the investor earns the full premium. If the stock price moves beyond these levels, losses start to grow.

Comments