In recent months, concerns about AI have loomed over the market. However, $Taiwan Semiconductor Manufacturing(TSM)$ responded with strong earnings, stating clearly during its earnings call, “The demand for AI is real.” This sparked enthusiasm, with TSMC’s stock soaring over 13% at one point.

Market Validation

Nomura’s latest analysis highlights that TSMC’s confidence aligns with its position: this strong cycle is driven by AI demand. They firmly believe they hold orders from nearly all leading AI companies. Additionally, TSMC is reaping returns on investments through AI in its own R&D.

The robust AI demand is supporting TSMC’s trajectory with its N5/4/3 process nodes. Management now anticipates that AI-related revenue could triple in 2024, contributing mid-double digits to overall revenue growth, up from previous low double-digit guidance. This expected boost could drive around a 30% increase in total revenue for 2024.

AI is playing a key role in TSMC’s advancements in cutting-edge processes. According to Barclays, TSMC is racing ahead in advanced technologies, preparing greater capacity for N2 than for N3. The strong demand for AI server chips, particularly for the A16, indicates TSMC’s confidence in future growth. Concerns about declining demand for N2 capacities have been eased by this outlook.

For investors looking to go long on TSMC, consider using a bull put spread strategy.

Bullish Strategy: Bull Put Spread

A bull put spread involves selling a put option while buying another put option with the same expiration date but a lower strike price, both on the same underlying asset. Since the premium received from selling the put is typically higher than the premium paid for buying the other put, investors usually end up netting a profit from the premiums.

This strategy is ideal for investors who expect the market price to rise, but only to a limited extent. It also offers protection against significant market downturns, allowing investors to benefit from a moderate increase while mitigating risks.

Example Case: TSMC Bull Put Spread

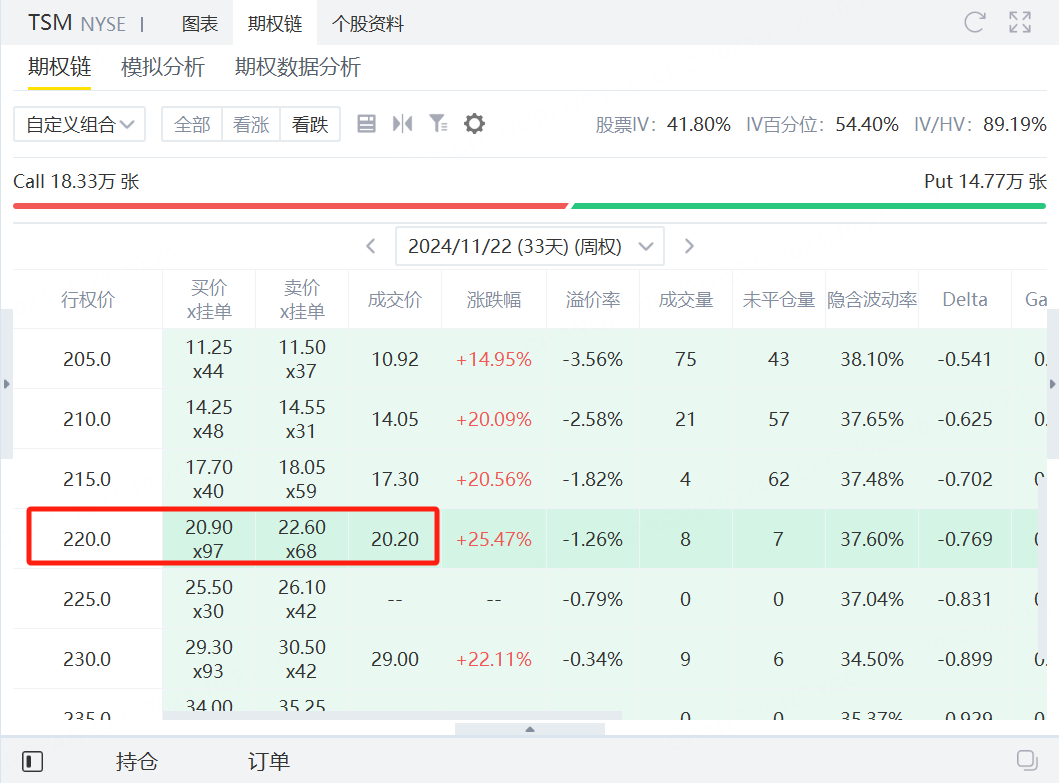

Let’s take TSMC as an example. On October 21, just before the U.S. market opens, TSMC's trading price stands at $200.78. An options trader predicts that the stock could rise to $220 within the next month, but is also concerned about potential downside risks.

1.Trade Setup

Step 1: Sell a put option with a strike price of $220 and an expiration date of November 22, receiving a premium of $21, which totals $2,100.

2.Net Premium Income

- Income from selling the put option: $2,100

- Cost of buying the put option: $850

- Net income: $2,100 - $850 = $1,250

3.Profit and Loss Analysis

- Maximum Profit: If TSMC’s stock price is above $220 at expiration, both put options will expire worthless. The trader keeps the net premium of $1,250.

- Maximum Loss: If TSMC’s stock price falls to $200 or below, both puts will be exercised. The maximum loss is the difference between the strike prices minus the net premium received.

Strike Price Difference = $220 - $200 = $20

Total for 100 shares = $20 x 100 = $2,000

Maximum loss = $2,000 - $1,250 = $750

4.Break-Even Point

The break-even point occurs when TSMC’s stock price drops to the point where the net premium received equals zero.

- Break-Even Point: $220 - $12.50 (net premium per share) = $207.50

- Maximum Profit: $1,250 (when TSMC stock price ≥ $220)

- Maximum Loss: $750 (when TSMC stock price ≤ $200)

This strategy allows the trader to benefit from an anticipated rise in TSMC's stock while limiting potential losses from downside risk.

Comments