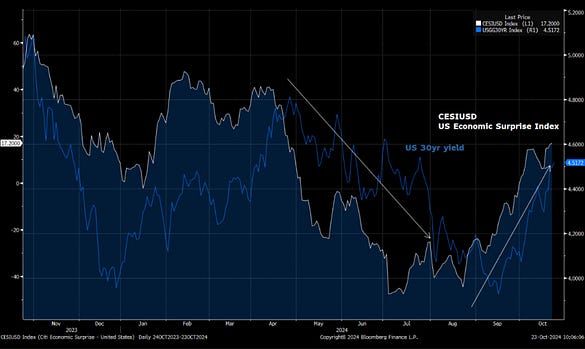

This is a bit of a rehash of a note I wrote back in April but the current conditions seem fitting again as US yields move sharply higher. The turn weaker in the US data from April until August of this year meant that there was renewed demand for bonds as the market began to expect a sharp Fed easing cycle. We have to remember that with the US currently running such large deficits there is constant anxiety about oversupply of US Treasuries that has popped up a couple of times over the last few years. I find it interesting that it has been into 24th October both in 2022 and 2023 that US 30yr yields moved sharply higher and then peaked (this was when fear of inflation/treasury over supply and Fed hawkishness all peaked in both years). These concerns had started to re-emerge in April 2024 but the turn weaker in the US data then drove demand for bonds and we since forgot about these underlying issues. ALTHOUGH… the turn stronger in the US data since then means US yields are on the march higher again so I think it is worth reassessing this. See US 30yr yield and US economic surprise index here:

Since the pandemic it has felt like global central bankers have been treading a difficult tight rope. They want to support growth and to have some inflation so that they can grow out of the large debt piles they built up when they funded emergency Covid measures. Some inflation reduces their nominal debt piles but too much can lead to a loss of confidence in their debt, higher financing costs and negative impacts on growth (see Truss budget for evidence). This is where the delicate balancing act comes in. When inflation was running hot in 2022 and 2023 the Fed moved aggressively to tighten financial conditions, but it is important to note that they do not want to crash the economy and therefore they are quick to shift back to easing every time it seems like they might. We saw this during the Regional banking crisis and then again in early November 2023 and more recently with the 50bps cut in September. Tightening and then loosening financial conditions are how the Fed have balanced the economy so far since Covid.

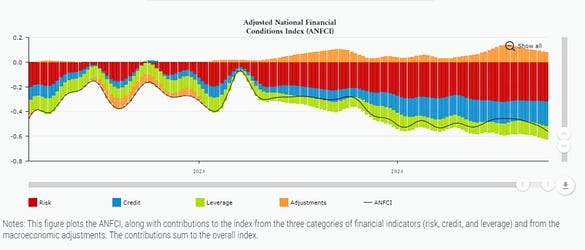

The Fed’s path this year has been complicated by the upcoming US election and the US Treasury. The Fed has to take US fiscal policy as given but there is a lot that the US treasury can do to impact US financial conditions which adds another complication to Powell’s balancing act. The upcoming election has led to measures by Yellen that seem aimed at stimulating the US economy and also Powell’s actions to balance the economy have looked one sided… In November 2023 we had the dovish shift from the FOMC, a weak CPI print, and a move by US Treasury Secretary Yellen to issue more short term debt and therefore add less duration to the market. The rally in treasuries into the end of the year was large and US financial conditions have remained loose since then as you can see from the chart below. There have been phases of strength and phases of weakness in the US economy this year but Powell has chosen to keep financial conditions loose throughout. I have to admit that I have been surprised by the sharp turn stronger in the US data since September, as has the Fed, but given recent data it now feels like these loose conditions could tip the US economy over the edge of overheating. Especially when you add the possibility of either US election winner pushing for increased fiscal spending. The market is now starting to price that risk in. An overheating economy means higher inflation and a loss of confidence in Government debt. The USD status as reserve currency of the world means a complete loss of confidence is unlikely but the sudden gap that has opened up between US yields and Gold shows that the market is choosing to move away from Treasuries as a store of wealth and towards anything else that they feel can protect them from inflation.

National Financial Conditions Index: Current Data – Federal Reserve Bank of Chicago (chicagofed.org)

This financial conditions index takes into account 105 different indicators across credit, leverage and risk and provides a more accurate picture of market financial conditions rather than just looking at where the Fed base rate is compared to a hypothetical R*. This was last updated 11th October.

Given all of this I am concerned about long end US treasuries. I also think it is interesting that US 30yr yields have had sharp run ups in October the last 3 years in a row. Im not sure if that is just coincidence. Previously I thought it was all about the quarterly Treasury refunding announcement from August that showed large Treasury supply that led to sharply higher yields into October but then yields turned sharply lower from November to end of the year because the TRA in early November showed reduced supply or focus on short end. So seemed to be a seasonal aspect to it. There also seemed to be some seasonality to CPI. It surprised higher in October in 2022 and 2023 then weak in November. I’ve seen some research suggesting that there is seasonality to CPI misses. I thought this year would be different as the TRA in August didn’t show increased duration supply and at the time US data was weak so there was demand for treasuries. But now we’ve had the turn around in the data US treasuries just trade extremely weak again just like they have the last couple of Octobers. In 2022 US 30yr yields had a sharp spike and then peaked on 24th October. Then 2023 they had a sharp spike then peaked on 23rd October. See Chart of US 30yr yield below. Both in 2022 and 2023 the higher US yields eventually led to a sharp drop in asset prices, these highs in 30yr yield coincided roughly with lows in S&P500. Although this time around S&P500 is still sitting near all time highs. It seems as though asset prices are staying supported as they expect increased US fiscal stimulus but are simultaneously losing confidence in holding treasuries for the same reason. The fact that Gold continues to outperform equities shows that the current moves seem more about fear of currency debasement rather than expectations for a healthy US economy. An additional concern for the Treasury market here is that the holders of Treasuries has shifted from solid buyers like central banks towards hedge funds, one of my favourite people to follow on this topic is Luke Gromen here is a podcast where he goes into these details: Luke Gromen: Why The Gold Recycling Trade is Accelerating (macrovoices.com). The conclusion here is that as central banks have been reducing their Treasury holdings, most notably the Fed via QE, Japan and China it has been hedge funds stepping in as buyers. The problem with this is that hedge fund sentiment towards Treasuries could flip quickly and exacerbate any treasury sell off. With the risk of a sharper US Treasury sell off I think it makes sense to stay long USD, long Gold and defensive of a risk off move, current risk sentiment is high with the CNN fear and greed index at Greed levels Fear and Greed Index – Investor Sentiment | CNN. Gold may also come under pressure if US yields move sharply higher but it still remains the best hedge against USD debasement which is why it has stayed bid despite the moves higher in US yields this cycle.

The next US Quarterly Refunding Announcement is due on 28th October and should get some attention Most Recent Quarterly Refunding Documents | U.S. Department of the Treasury. In previous years this has marked the turning point for US yields (along with weaker October CPI published in early November). Given that US Treasury General Account could be spent down into the next debt ceiling limit which comes on January 1st 2025 the Treasury may not need to borrow as much in the 4th quarter so that could end up being supportive of treasuries. Of course the election outcome complicates all of this but is worth monitoring this for a possible turning point in US yields.

Comments