The Communication Services Select Sector SPDR Fund (XLC) has taken the lead as the top-performing industry ETF of 2024. Tracking the S&P 500’s communication services sector, XLC includes major players like Meta (Facebook’s parent company), Alphabet (Google’s parent company), and Disney. Strong growth in digital advertising, online entertainment, and new technologies like virtual reality has positioned XLC as a standout in a turbulent market year.The XLC has risen over 28% year-to-date, compared to the S&P 500 ETF's increase of over 21% so far this year.

Key Holdings Driving XLC’s Success

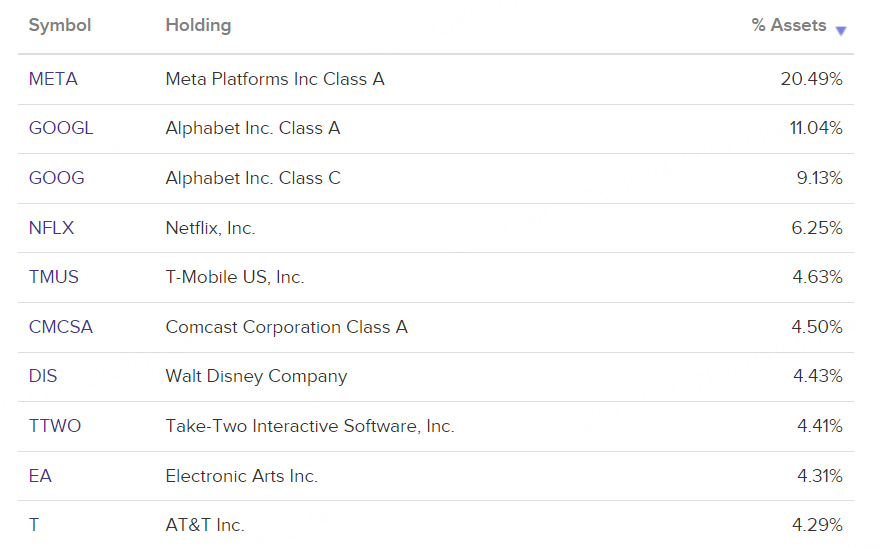

XLC’s major holdings—Meta, Alphabet, Netflix, and Disney—play critical roles in the digital economy. In 2024, rising consumer demand for online entertainment, digital ads, and cloud services has helped these companies thrive.

Meta & Alphabet: As leaders in digital advertising, Meta and Alphabet provide XLC a steady growth base. With brand ad spending rebounding, both have seen notable ad revenue recoveries.

Netflix: Known for its premium content, Netflix’s subscriber growth has added strong support to XLC’s performance.

Disney: Despite challenges in traditional media, Disney’s streaming platform, Disney+, continues to expand, adding stability to XLC’s portfolio.

Key Drivers Behind XLC’s Growth

The main factors driving XLC’s growth in 2024 include the rebound in digital advertising, increased demand for streaming, and the communication sector’s relative defensiveness.

Advertising Growth: As brands increase digital ad spending, Meta and Alphabet’s ad revenues are surging, directly boosting XLC.

Streaming Demand: Rising demand for online entertainment has led to user growth for companies like Netflix and Disney, strengthening XLC.

Innovation & Technology: New tech developments in VR, AR, and AI are enhancing the competitive edge of XLC’s holdings, drawing investor interest.

XLC’s Edge in Today’s Market

With high volatility in 2024, XLC’s concentrated holdings in stable, high-growth companies have delivered strong returns. The Fed’s shift toward lower rates has further boosted these companies, as the communication sector often benefits from a low-interest environment.

Potential Risks

Despite XLC’s impressive performance, the fund faces risks such as regulatory pressure on data privacy and content moderation. High valuations could also lead to pullbacks if the economic outlook shifts significantly.

Conclusion

The Communication Services Select Sector SPDR Fund (XLC) has been a top performer in 2024, thanks to digital advertising growth, streaming demand, and innovation in new technologies. While regulatory and economic risks remain, XLC’s high-growth and defensive characteristics make it an appealing choice for today’s market.

$Communication Services Select Sector SPDR Fund(XLC)$ $SPDR S&P 500 ETF Trust(SPY)$ $Meta Platforms, Inc.(META)$ $Alphabet(GOOG)$ $Alphabet(GOOGL)$ $Netflix(NFLX)$ $Walt Disney(DIS)$

Comments