- Builders FirstSource fell by 7% on Tuesday, a week before its Q3 report, potentially reflecting potential investor sentiment shifts and macroeconomic concerns impacting homebuilding demand.

- With mortgage rates failing to decline and home inventories increasing, there are more signs that builders will pull back on lower new home sales prices.

- Builders FirstSource risks a significant decline in its profit margins as it loses sales and pricing power if the industry shifts back toward a materials glut.

- The company has had excellent core growth through accretive acquisitions but faces a potential slowdown with much higher debt and lackluster cash savings.

Thomas Bullock/iStock via Getty Images

The construction materials company Builders FirstSource, Inc. (NYSE:BLDR) fell by around 7% on Tuesday. This occurred a week before its Q3 report, coinciding with little news regarding the company directly. I have held a historically bearish view of the firm over the past year. Obviously, my view has not reflected in its share price, which has risen by about 32% since I last covered it, just below the S&P 500's 33% increase.

Keep in mind, although my view on BLDR over the past year has been ostensibly wrong, I was bullish on it from early 2020 due to its valuation and my expectation for improved single-family demand; it had risen by triple digits between that time and when I downgraded it.

Although the homebuilding market and investor sentiment have not slowed as quickly as expected, data over the past year has supported the view that homebuilding demand is fundamentally slowing. Further, the sharp decline in BLDR on Tuesday may indicate that investor sentiment is crumbling. As we look at its Q3 report, I think investors may be wise to take a cautious perspective and perhaps avoid the stock for the time being. Key reasons include both company-specific issues and macroeconomic factors.

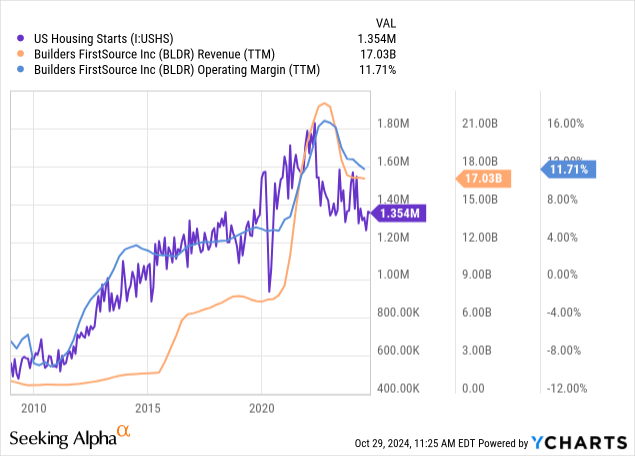

Mortgage Rates are Unlikely to Fall

Some investors point to BLDR's recent revenue growth and forward "P/E" valuation of ~16X in recent years. Indeed, a non-cyclical firm with double-digit sales growth and expanding operating margins would normally be undervalued at that valuation. However, BLDR is fundamentally cyclical, and its revenue is tied directly to homebuilding activity, which can fall to near zero during the negative economic cycle. Further, its profit margins are tied to that cycle and are unlikely to remain near TTM levels as building starts slow. See below:

Data by YCharts

Data by YCharts

Builders FirstSource gained immense pricing power during the mortgage-stimulus homebuilding boom of 2020-2022, as demand for homebuilding goods far outweighed artificially depressed (lockdowns, etc.) supply levels. Today, it is losing pricing power as homebuilding activity normalizes, potentially pushing construction resources back into a glut. In the past, starts were not far below current levels, and BLDR had negative operating margins.

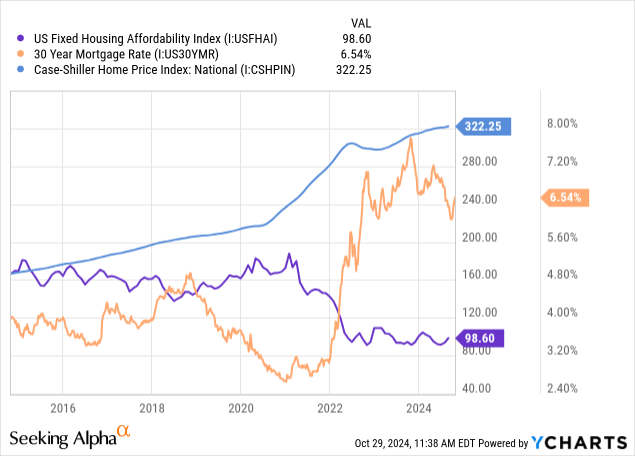

Changes in home prices will largely drive housing starts. Home prices skyrocketed in 2020 as affordability improved on Fed-driven mortgage rate stimulus (through QE buying of mortgage-backed securities), while the opposite is true today, pushing mortgage rates higher as the Fed sells MBS securities. Combined with higher prices, that has resulted in an immense decline in affordability. See below:

Data by YCharts

Data by YCharts

There was widespread hope that the Federal Reserve's dovish pivot would push mortgage rates back down. However, the 30-year mortgage rate has risen by ~50 bps over the past two months as it has become less apparent that the US economy is slowing, causing a resurgence in inflation concerns. As I've detailed in many articles, it seems the Fed is teetering between a potentially significant recession and likely persistent inflation. Fundamentally, I think a persistent "soft landing" is impossible because public and private debt leverage has become too high, particularly in the last decade (2020 specifically).

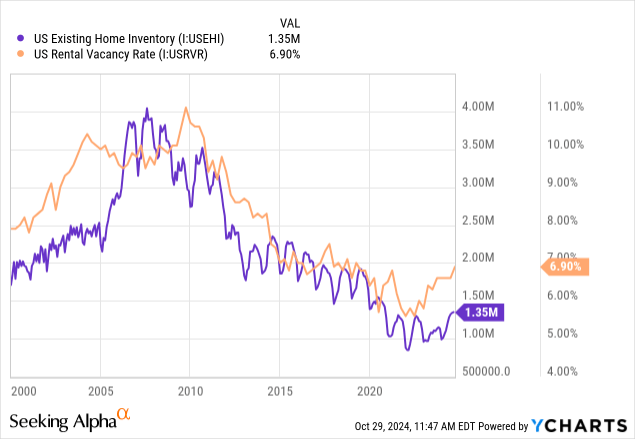

Rising Inventories Point to Lower Prices

At any rate, home prices have been supported by low inventories and low rental vacancies. However, current multifamily and single-family construction levels may be sufficient to end that trend. See below:

Data by YCharts

Data by YCharts

Pending home sales are very low, below levels seen during the height of the housing bubble implosion from 2007-2011. As such, there is likely greater sensitivity to inventory to changes in new supply. In other words, as homebuilders create new homes amid low sales, inventories should rise more quickly than in the past due to low demand. As inventories continue to increase, I expect to see more regional downward pressure on home values (multifamily residential/rent). Eventually, that should discourage builders, often late to changing economic trends, exacerbating the potential glut.

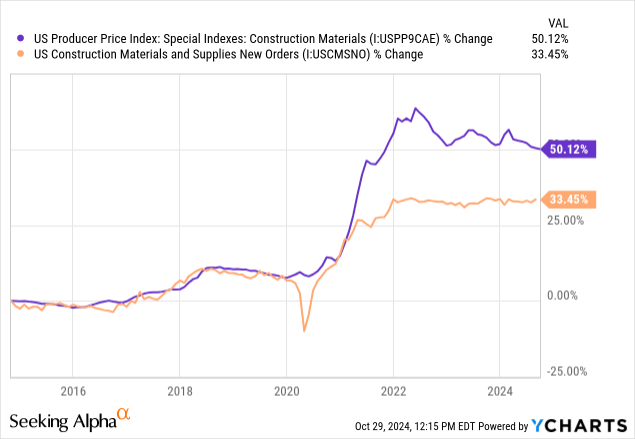

Materials Prices Likely to Fall with Demand

Still, for now, BLDR is only facing minor pressures. The PPI for construction materials indicates minor deflation in the market, offsetting immense shortage-driven price growth ~2021. New orders are still high, resulting from elevating housing starts. However, they're not rising, indicating little natural growth potential for BLDR beyond expanding its market share. See below:

Data by YCharts

Data by YCharts

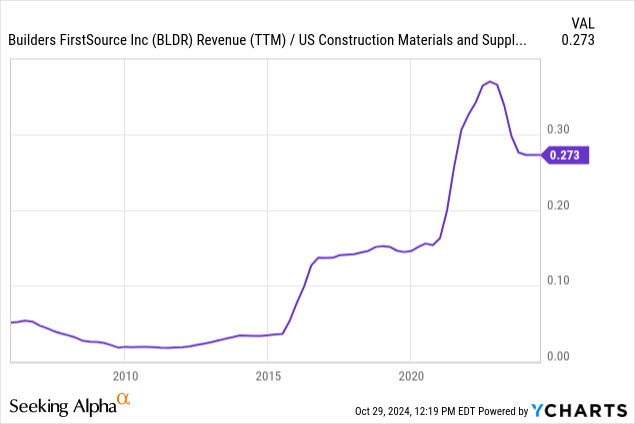

We can estimate BLDR's market share by dividing its sales by overall construction materials and supplies shipments. However, the latter is measured on a seasonally adjusted monthly basis and may account for factors that are not relevant to BLDR, while some of BLDR's sales likely come from sources not counted in that data. Thus, the numerical data is not consequential, but the trend is. From this, BLDR likely had substantial market share expansion coming out of 2020 but is now at a lower plateau, potentially resulting from prices. See below:

Data by YCharts

Data by YCharts

Builders FirstSource estimates its market share at 11% of the single-family residential market and multifamily. Combined with the generally positive trend above, that is a positive note for the firm, indicating it may have growth potential over competitors. The company is comparatively large in a market still dominated by smaller firms. With recent technological progress, it may gain more significant long-term economic scale advantages, leading to continued accretive acquisitions.

Builders FirstSource Has Inadequate Defenses

That said, it is not clearly expanding its market position today. Further, given the cyclical economic trend facing homebuilding, it may not benefit from significant capital investments for the foreseeable future. I think BLDR is a fundamentally strong company from an operational and manager standpoint, but investors are overvaluing it based on what, I feel, are unreasonable economic expectations. It may be argued that, although BLDR's size gives it potential economic scale benefits, that may also give it more significant overhead and less nimbleness during downturns, perhaps explaining its negative operating profits for most of the 2010s.

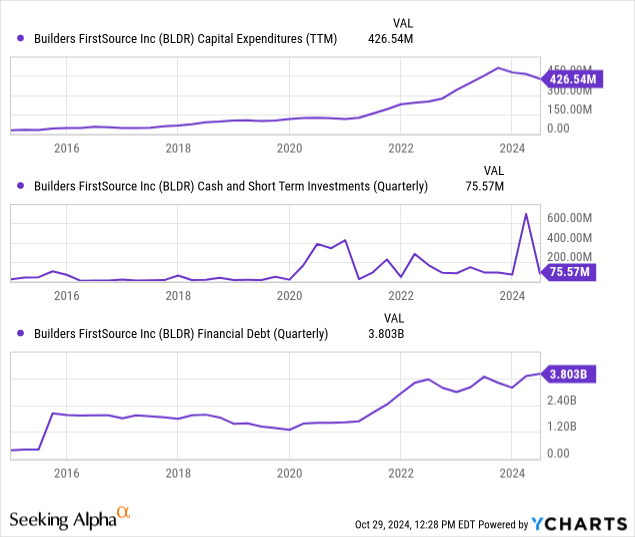

I believe Builder's managers are good at growth but not necessarily wise in managing cyclical risk. In homebuilding, downturns are a virtual inevitability, particularly when real estate fundamentals are weakening. The company has dramatically increased its CapEx spending and has been slow to decrease it despite clear signs that homebuilding demand is not rising (and some signs that it's falling). Further, the company has minimal cash and ST investment liquidity and has expanded its financial debt to $3.8B. See below:

Data by YCharts

Data by YCharts

The firm's debt may not appear problematic against its $2.5B TTM EBITDA. However, in 2019, which was not a bearish year for homebuilding, its EBITDA was around $400M. Given the rapid expansion in its financial debt, the company could have solvency risks if it returned to that level.

Its total employees have risen from around 15K in 2019 to 29K in 2023. That indicates significant core growth for the company, but its debt and market capitalization have risen far faster. Without a housing recession (which I expect), it is unlikely its EBITDA will fall back to $400M, given it is a larger company than in 2019.

The Bottom Line

Since I last covered it, I believe there have been continued signs that homebuilding activity will slow. There has only been a slight decline in homebuilding demand, but the sharp rise in rental vacancies and inventories and persistence in high mortgage rates point to a potential decrease in new home prices. Low inventories supported the construction market, but that is no longer a reliable protector, implying we may see lower home prices and housing starts in 2025.

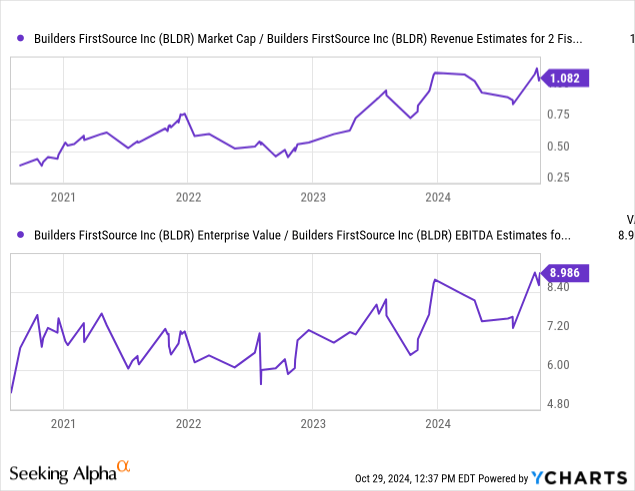

Despite the slowdown, BLDR's valuation, based on two-year-ahead EBITDA and sales estimates (higher than I expected), has continued to rise. See below:

Data by YCharts

Data by YCharts

I think the forward price-to-sales measure is the most telling because its EPS and EBITDA estimates assume its profit margins will remain abnormally high. Although that is possible, I believe it is unlikely since BLDR's margins are significantly correlated to its sales, stemming from changes in pricing power with rapid changes in demand and slow changes in supply. From a two-year-ahead forward price-to-sales standpoint, BLDR is trading twice as high as it was in late 2022. From 2010 to 2020, its TTM price-to-sales was usually between 0.25X and 0.5X, implying that BLDR may be at risk of falling 50-75% if its margins decline to normal levels.

I remain bearish on BLDR and have a short stock position. That is undoubtedly a riskier position, given the positive momentum BLDR has had over the past three years. Short interest on the stock is relatively low at 2.5% and lacks material borrowing costs. At this point, my view is certainly not widely shared and contrary to the consensus view. Still, it is among my higher conviction views, given my understanding and expectations for the single-family real estate market.

Key risks to my position include continued strong investor sentiment in the stock (despite economic signals) and a positive change in economic signals, namely, a sharp decline in mortgage rates. Although that is possible, I do not think it is likely for mortgage rates to fall back below 5% without the housing market also entering a recession, which I expect would offset any benefit of lower rates.

My view is relatively long-term, and I do not have strong expectations regarding its Q3 earnings. I think the sharp decline in the stock on Tuesday may indicate disappointment. As far as I'm concerned, there are few concrete explanations for its gap down, though that may change by the time this article is published. Analysts currently expect a $3 EPS at $4.45B in revenue, both of which are down YoY. Its earnings are expected on November 5th, which is also election day, potentially making for a volatile session next week.

Comments