- Trump's Polymarket election odds have a 73% R-squared to the 10-year Treasury rate, indicating that a Trump win would lower high-duration bond prices.

- A Republican sweep of the House and Senate may exacerbate losses by making deficit spending policies more feasible. However, the same can be argued for a Democrat sweep.

- My long-term view on high-duration Treasury bonds is decidedly bearish, given the bipartisan consensus against fiscal responsibility and pro-inflationary Fed policies.

- The bond-Trump correlation may result from foreign investment risk, with China potentially divesting US Treasuries in a trade conflict.

- The manufacturing economy is in a recession, but the service economy has strengthened, creating a complex outlook for 2025 unemployment.

J Studios

There is much speculation regarding how the election may impact financial markets. Most people invest in stocks, so the equity market is of primary interest to many. However, in the past two elections, the immediate response of stocks was muted. In both 2016 and 2020, the stock market rose directly after the election. Ultimately, elections bring uncertainty, which usually suppresses valuations, so it may be that having a result is beneficial for stocks.

That said, the bond market has usually experienced greater volatility following elections. Ultimately, Treasury bonds are more closely tied to changes in fiscal and monetary policies than equities. The bond market did not move much after the 2020 election, potentially because it was already buoyed by immense QE stimulus. However, in 2016, the bond market crashed immediately after the election, coinciding with a rise in both inflation expectations and real interest rates (rates after expected inflation). See below:

Data by YCharts

Data by YCharts

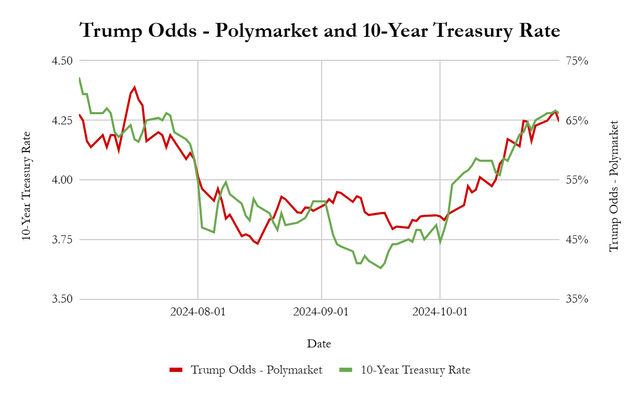

This pattern becomes very interesting if we compare the 10-year Treasury rate to the Polymarket odds of Trump winning. From July to September, the Treasury rate fell, coinciding with Trump's odds following Biden's departure from the race. We see the opposite from September to the end of October as Trump's odds rose. See below:

Trump Polymarket Odds vs. 10-Year Treasury Rate (Federal Reserve Economic Database and Polymarket)

This reversal brought the popular bond ETF (NASDAQ:BND) ~4% lower. Duration bond funds like the 20+ year Treasury fund (EDV) have fallen by 14% since the September reversal. Of course, we cannot confidently say that the stark correlation between these two figures is not coincidental. However, it is set by the 2016 precedent that saw bonds gap down immediately after the election. In my view, though many may see positive and negative factors regarding the Trump administration's impact on the economy, there are valid reasons why we should expect higher long-term rates given that economic policy. Regardless of one's political view, it may be essential to understand what to expect in bonds over the coming weeks and in the long term.

For more reasons than the election, my view on BND and long-term bonds is again shifting in a bearish direction. Although I agree with the market's implication that Trump is bad for bonds and potentially suitable for stocks if corporate tax rates are further reduced, there are signs that inflationary forces have not fully subsided. In my view, regardless of who wins, dovish Fed policy and latent inflation may push BND lower over the next year. I've had a historically bearish view of BND for these reasons.

I covered BND last September with a neutral outlook, given a more bearish view of stocks. Though only two months have past, the economic trend has shifted sharply since, necessitating I revise and update my previous view.

Bond Volatility is Set to Surge Tuesday

BND is set for a massive move following the Tuesday election. BND's 30-day option implied volatility was around 4-5% during most of the summer but has sharply risen to about 9% today. As such, we should expect BND to be twice as volatile as usual over the next month. This trend is mirrored in higher duration-risk bonds such as the 20-year Treasury ETF (TLT), which has seen its 30-day implied volatility surge from 11% in early October to about 20% today.

TLT has a much more liquid options market than BND and is the most immediately exposed to election risk. TLT is trading at about $92.5. The $92.5 strike price call option for the November 6th expiration has a 24% implied volatility, while the put contract is 28%. This indicates that the downside risk assumption is greater than the upside, as more are hedging with put options, with open interest heavily skewed toward puts. These IV levels point to a roughly 2-3X sigma move this week. BND will not see as much volatility as TLT, but I expect it will see similarly abnormal volatility compared to its usual stability.

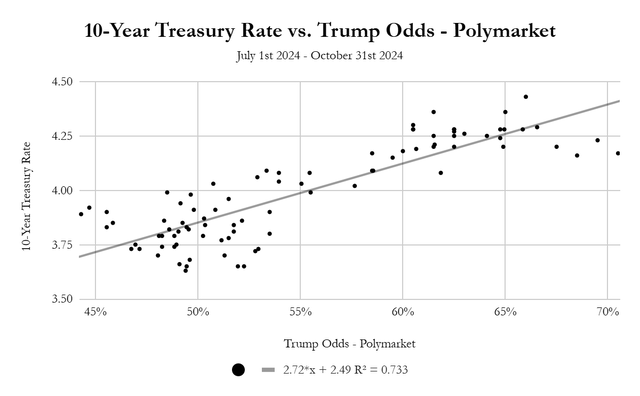

To see how significant the Trump-bond correlation is, see the same data as above in a scatter chart:

Trump's Odds vs. 10-Year Treasury - Scatterchart (Federal Reserve Economic Database and Polymarket)

Note that the current Polymarket odds are 55%, around the middle of the above range. The R-squared between the Trump odds and the 10-year Treasury rate is very high at 73.3%. I tested the same data against the 10-year real interest rate, based on inflation-indexed Treasury bonds, and the 10-year implied inflation rate, based on the spread between the two. Both are taken over the same period of July to October. The R-squared between Trump's odds and the 10-year real Treasury rate was 63%, while it was 54% on implied inflation.

Although we must be careful drawing conclusions over a short period of data, I think these inferences are reasonable. The strongest relationship is Trump's odds and the rate overall, implying a Trump win is expected to weaken demand for Treasury bonds. The data suggests a Trump win would also undermine demand for inflation-indexed bonds, but not to the same degree. It also implies a Trump win is pro-inflationary, but again, to a lesser degree.

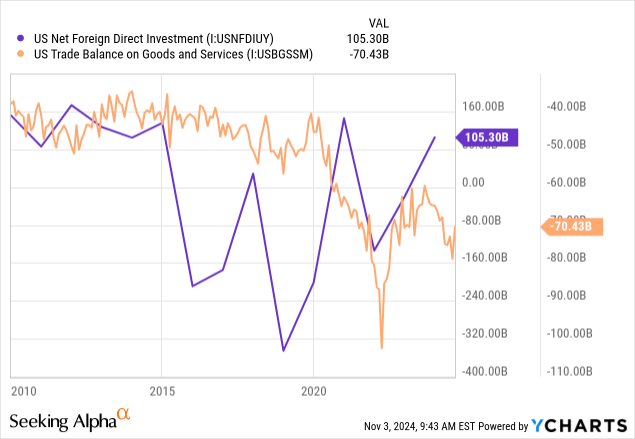

The data implies inflation risk is not the greatest threat to bonds, though it is of minor concern. I think the most significant factor to consider is foreign demand for Treasuries, as that could raise bond yields without necessarily raising inflation. It is probably fair to say Trump's aims are more protectionist. I speculate that if Trump looks to reduce the trade deficit with China, China would likely reduce its investment in the US. Indeed, from 2016 to 2020, net foreign direct investment in the US was relatively low, with significant net outflows. Conversely, the US trade deficit fell dramatically from 2020 onward:

Data by YCharts

Data by YCharts

To be fair, the US trade balance crashed in 2020 due to the pandemic, which occurred during Trump's administration. However, it has failed to recover during the past three years. FDI also crashed in 2016, during Obama's administration, but may have resulted from increased uncertainty from foreign investors.

Bipartisan Deficit Spending Harms Bonds

From a fiscal policy standpoint, tariffs will likely increase prices on imported goods. Large tax cuts without equally significant budget cuts would likely be inflationary, although potentially economically stimulative. However, a substantial increase in US oil production that lowers oil prices could be disinflationary, though the US government lacks direct control over US oil production.

More importantly, neither candidate aims to balance the budget; both offer policies that will likely increase deficit spending. I believe there is a relative bipartisan consensus that balancing the budget and reducing the national debt is no longer a goal, so I would never buy long-term Treasury bonds with a plan to hold them to maturity.

Though presidents have limited power over monetary policy, both seem to support keeping Jerome Powell as Fed chair, in my view, that makes short-term rate cuts relatively likely, even despite the general stability of labor and financial markets. Again, I think the Federal Reserve has a similarly pro-QE consensus view. Though QE and rate cuts have historically benefited long-term Treasuries, I doubt that will continue, as rate cuts and QE would promote long-term inflation expectations, potentially steepening the yield curve.

A Tale of Two Economies

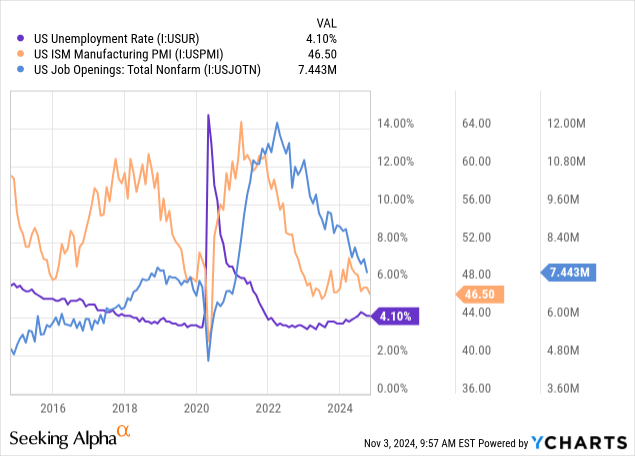

When I covered BND last, there were more indications of rising unemployment. A rise in unemployment is historically bullish for BND because it lowers inflation expectations and encourages direct investment into bonds via Federal Reserve QE spending. However, unemployment has remained flat over recent months, reducing the immediate labor-driven recession odds. That said, job openings have declined, while the manufacturing PMI has fallen back to 46.5, prolonging the manufacturing contraction over the past two years. See below:

Data by YCharts

Data by YCharts

There is a wide discrepancy between the US manufacturing and service economies. If we look only at manufacturing, we would see clear recessionary patterns, given low order volumes, production, and job growth since 2022. Given the sector's weakness for so long, I argue US manufacturing is in a depression.

That said, the services sector, particularly technology, healthcare, and government, has been very strong. Compared to the past, the US economy is heavily skewed toward services at 70%, with manufacturing at just 11%. The US ISM services PMI has remained above 50 for nearly every month since 2020. It had slipped to the upper 40s to lower 50s over the summer, indicating a potential service economy recession. However, the measure shot up to 54.9, reducing immediate recession concerns dramatically.

This bifurcation is also seen in employment. Since January of 2023, total private employees have risen by 2.5%. However, government employees have increased by 4.3%, though manufacturing employees have declined by 0.50%. In my view, this indicates that government hiring efforts partly support the service economy's resilience. Further, although the overall US economy is fine, there is an apparent reason why those in manufacturing regions or jobs may feel it is not. Theoretically, tariffs would aid US manufacturing, while other potential Trump policies may decrease government jobs.

The Bottom Line

Overall, I am bearish on BND and think investors are best avoiding the fund and high-duration ETFs like TLT, EDV, or (ZROZ). Two-thirds of BND is in Treasuries, with the remaining third potentially having minor recession risk due to downgrades on corporate debt. Its average duration is 6.0 years, meaning a 1% rise in its rate should push its price about 6% lower. Thus, if Trump wins, we should expect BND to decline immediately after, but unlike TLT, EDV, and ZROZ, its duration is low enough that it would not be catastrophic. I expect a 3-5% decline by the end of the week if Trump wins and a 2-3% rise if Harris does.

To be very clear, I am speaking of short-term expectations based on the correlations and option-implied volatility data. Looking long-term, it is much harder to say how the election may influence bonds. I believe BND's long-term prospects have more to do with Federal Reserve policy. Further, I think neither party is bullish for Treasury bonds because both promote what I believe to be unsustainable deficit spending. I also do not see a recession as bullish for BND due to its corporate bond exposure and the potential for dovish Fed and fiscal policies to promote inflation.

Fundamentally, I don't think Harris or Trump differ tremendously regarding deficit spending. If Trump wins and the Senate and House are swept Republican, then I expect substantial declines for BND, as that would likely accelerate the timeline on deficit spending. However, if the Democrats sweep all three, I think the same is likely, allowing the party to enact spending programs that are unlikely to pass with a Republican senate. Further, if Trump wins without Republicans winning the house, BND may not decline, as tax cut measures would not likely pass without the house.

At the time of writing, there is a 34% Polymarket chance of a Republican sweep and 17% for Democrats. There is also a 30% chance of a Harris presidency, a Democrat House, and a Republican Senate (in the current environment).

At this point, anything can happen. I am bearish on BND long-term because I don't think any party will seek to repay Treasury debt without inflation. That said, I feel BND will face losses if either party sweeps and added declines if it's a Republican sweep. Again, that is not based so much on my opinion but on the market's correlation to Trump's odds. Since that is a relatively likely outcome, I am bearish on BND and (albeit speculatively) expect it to decline markedly this week.

Comments