- Fannie Mae and Freddie Mac continue fluctuating with election odds and face immense volatility risk over the coming week.

- FNMA has been down since June, as Harris's ascent has lowered Trump's odds. Its Q3 results were slightly disappointing and indicated some risk in multifamily.

- Although the election matters over the short term, I think FNMA's 2030 value is more dependent on the economic trend and whether or not the housing market has a "soft landing."

- Home valuation and multifamily cap rates are unsustainably high today but were previously supported by low vacancy rates and single-family inventories.

- With vacancies and inventories rising, I expect housing valuations will decline in 2025-2027. Given high mortgage coverage ratios, FNMA should be safe if they do not fall too quickly.

ablokhin

Fannie Mae (OTCQB:FNMA) reported Q3 income on Thursday. Revenue and net interest income changed little from Q2 but maintained small 1% YoY gains. It also reported an increase in net worth, rising to $90.5B (from $86.5B) as its regulatory capital shortfall declined. Its benefit for credit losses disappointed investors at $27M, vs. $300M in Q2, potentially indicating a slight rise; however, figures remain improved YoY.

I covered Fannie Mae last at the end of June in "Fannie Mae: An Indirect Bet On Trump Polling Numbers." My long-term bullish view of the stock is not based on election odds but on the company's long-term value proposition. In my view, its valuation overestimates its risk based on a past real estate market paradigm. Of course, if Trump does win, there is an increased likelihood that FNMA's value will be unlocked, given Trump has indicated support for ending conservatorship, with his allies being particularly supportive, while Harris does not.

For the most part, FNMA has tracked changes to the election odds. It is down 10% since publication, having fallen after Harris took over the Democratic nomination and then rebounded with Trump's odds during October. However, Trump's Polymarket odds crashed recently, back down to the mid-50 % range from a peak of nearly 70%. This potentially exacerbates losses for FNMA, which has been down ~22% since October 23rd.

Although the election will undoubtedly create volatility for FNMA, I think it is an ideal time to take a long-term view of the company. Assuming the housing market will remain stable for the next four years, it may not matter who wins on Tuesday. I expect FNMA will fall or rise depending on the outcome. Still, its operational fundamentals and financial position should remain upbeat since it entered conservatorship sixteen years ago. In my opinion, the trend is fundamentally bullish for investors willing to ride volatility; however, new economic risks may upset this trend.

Fannie May Soon Face Falling Property Prices

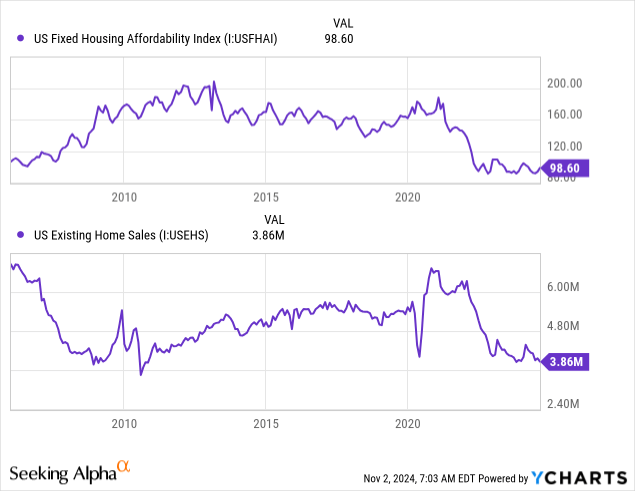

The housing market has been robust since 2008. In 2021, the home price-to-income ratio rose to its 2006 housing bubble peak of ~6.7X and is now well past that figure at 7.2X. With the 30-year average mortgage rate at about 6.7%, mortgage costs are mildly higher than at the pre-crash peak (around 6.2%). Thus, home affordability is abysmally low, leading to low home sales. See below:

Data by YCharts

Data by YCharts

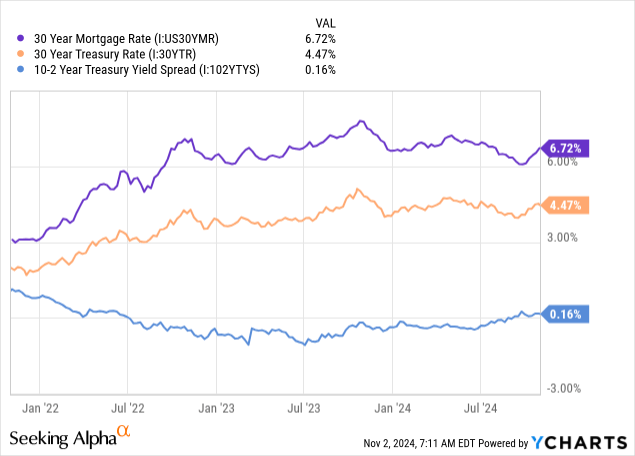

In my view, the housing market has gone full circle since 2006. Home valuations and mortgage rates returned and surpassed those "bubble" levels. Indeed, those facts alone warrant some risk to Fannie Mae, who must pay out delinquent mortgage losses. However, higher home prices also boost Fannie Mae's income as it collects guaranty and servicing fees on mortgages. I believe it is unsustainable for home valuations to remain as high as they are. There was some hope earlier this year that mortgage rates would adjust lower as a result of weak demand, but recent data indicates that is unlikely:

Data by YCharts

Data by YCharts

Long-term mortgage and Treasury rates have firmly rebounded over recent weeks. The yield curve remains flat but has risen since summer, indicating a potentially bullish long-term trend for rates, particularly if the Federal Reserve does not continue to cut rates. Given the surprising stability of the economy, that may be the case. However, in recent days, the Q3 GDP, jobs report, and manufacturing PMI all disappointed.

If the unemployment rate rises slightly, I expect the markets will return to a "recession concern" trend. Higher unemployment, particularly in a recessionary solid trend, would be bearish for FNMA, though I expect a decline in mortgage rates would offset that. The U-6 unemployment rate, which accounts for underemployment, is up notably YoY but is unchanged from July to October.

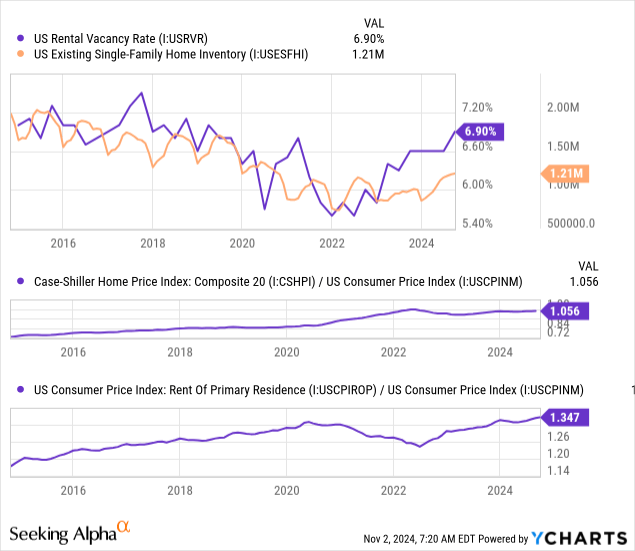

Home prices and rents rose faster than inflation during the 2010s due to weakening inventory and vacancy conditions stemming from low home and multifamily construction levels. The multifamily accelerated in 2020, particularly for home prices, lifted by the immense short-term decline in mortgage rates. However, despite much higher mortgage rates and low sales, homes have sustained higher prices due to low home inventories and low rental vacancy rates. That said, since 2023, both figures have switched to an upward trend:

Data by YCharts

Data by YCharts

Although rental vacancies and home inventories are not high today, they are firmly rising and should continue to rise, given high home construction levels. I expect multifamily (which changes rents) multifamily most significant volatility, given multifamily completions have been twice typical levels since 2022, accelerating rental vacancies.

Although higher supply figures have not lowered rents or home prices, I expect to see that by next year as long as high construction activity continues. A rise in unemployment could accelerate that, depending on the government's response to such an issue.

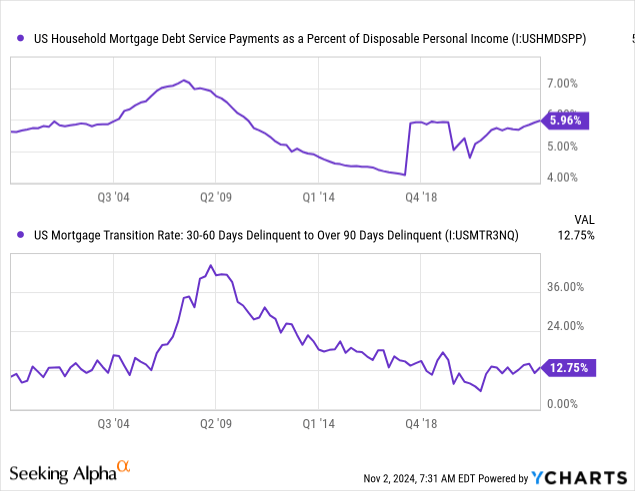

Low delinquencies and relatively healthy mortgage coverage rates offset these price risk factors. Despite high home prices and mortgage rates, most borrowers today did so before the 2020-2022 spike, giving them adequate coverage and low default risk. See below:

Data by YCharts

Data by YCharts

Although home valuations are slightly worse than in 2006, mortgage delinquencies and debt service coverage levels are around where they were in 2004. Thus, if home affordability remains as poor as it is, we could see a repeat of 2006-2010 conditions. That would require a continued rise in home prices despite high mortgage rates and construction activity. In my view, that is unlikely, given home sales are extremely low. Though possible, I believe housing market risk is concentrated on borrowers from 2022 onward who did so at low affordability levels.

Further, given multifamily construction and extreme multifamily valuations, I think multifamily some risk in that smaller segment. FNMA recorded a $424M provision for credit loss on multifamily in Q3, up $176M from the prior quarter. This provision was driven by ARM loans written down due to a "modest decrease in property values." FNMA's managers also reported that the large allowance reflects uncertainty about suspected fraudulent transactions. This was offset by a $91M decline in credit loss provisions on single-family, with FNMA looking to a forecast of increased home prices that boost reserves.

In my view, it is extremely unlikely that rents and home prices will remain as high as they are relative to other consumer prices. In other words, I expect rent and home prices to decline after inflation. As such, these two metrics may merely stagnate while other inflationary trends continue. That would be an ideal situation for FNMA as it would avoid impairment of asset valuations and likely avoid negative "wealth effects" in the economy relating to a decline in home prices.

That said, my economic outlook on FNMA is lower regarding multi-family. Multifamily completion, indicating a broad rent decline that may result in higher multifamily credit losses. At this multifamily that risk is notable but not excessive. Barring a significant negative economic shock (namely a significant spike in unemployment or a problematic geopolitical event), I do not expect those issues to harm FNMA over the coming quarters materially. Still, looking five years out, I expect FNMA will face the most significant credit stress it has since the late 2000s; even then, as long as home valuations (price-to-income) do not continue to rise (for two years or more), I think it is unlikely FNMA faces the same magnitude as pressures as it had then.

What is FNMA Worth?

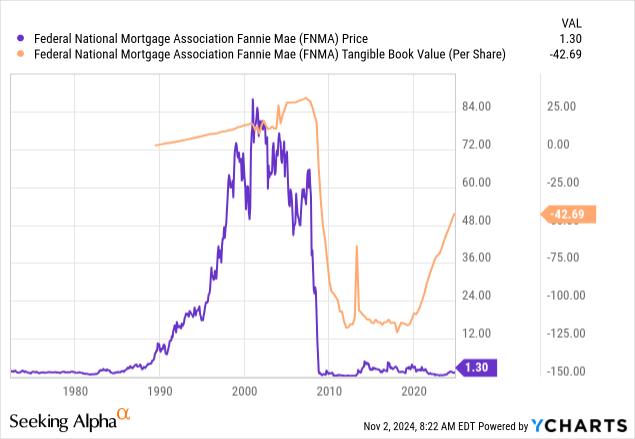

FNMA is challenging to value because it is in conservatorship and is not solely focused on profitability but on stability and achieving governmental socio-economic goals. Due to its immense losses in the late 2000s, its book value remains negative at about -$42. That said, its book value has risen from about -$120 since 2020, meaning it is trending at roughly +$16M per year, indicating a positive book value by 2027. See below:

Data by YCharts

Data by YCharts

Once FNMA's book value is positive, its prospects of going private are likely to improve. However, the company is still not as solvent as it ought to be, with a liability-to-asset ratio of about 98%. FNMA absolutely would not perform well if we saw a repeat of 2006-2010 conditions. As I mentioned, that is not impossible, but it appears to be unlikely given relatively healthy mortgage coverage levels.

If FNMA continues this trend in 2027, I expect its book value to continue rising, making it potentially undervalued today. Its TTM income is ~$16.8B and is stable. However, all that goes to preferred stock dividends on its ~$140B preferred equity, which is vastly more than its common equity market cap of ~$7.5B.

The Bottom Line

I view FNMA similarly to a call option or warrant, in that it lacks value until its equity value rises to a point surpassing its much larger preferred equity. At this point, I think that is likely to occur within the coming years, but is not guaranteed and requires continued stability in the property market. Based on the improving trend in property supply, particularly in multifamily supply, there is reason to believe prices will stop rising.

Ideally, multifamily and single family prices will soon stagnate, and slowly decline relative to overall inflation, allowing for a slow and steady normalization of the housing market that does not result in higher delinquencies. If so, I expect FNMA's book value per share will be below its current price by around 2027-2028. Potentially, if we assume FNMA will eventually leave conservatorship, that should give excellent gains to investors by 2030.

However, that does depend on government policy. Trump may accelerate this timeline. However, it is likely that FNMA will receive more protection in a recession if it remains in conservatorship. In my opinion, FNMA's ability to handle a large drawdown in the real estate market is superior in conservatorship, giving some potentially risk reduction benefit to a Harris administration.

I am neutral on FNMA today for two reasons. One, I don't want to get caught up in upcoming election volatility. I expect FNMA gap-up if Trump wins or decline with Harris. That said, I don't think each candidate will fundamentally change its value if we look out to 2030. By then, barring a large decline in housing prices, I expect FNMA will leave conservatorship regardless of who runs the government given its improving solvency trend.

From a long-term standpoint, I think FNMA is undervalued today and is a worthwhile "hold". After the election passes, I may be bullish on FNMA if it declines closer to $1, as that seems to be an inflection price for the stock. I may also be bullish if Trump wins and, more importantly, his administration makes concrete plans to safely privatize it; which did not occur from 2016 to 2020. At this point, we can only speculate based on previous decisions and comments from each candidate.

From a long-term standpoint, I think FNMA is undervalued at any price below ~$4 (its high price this decade), but I am cautious. If home prices and home sales improve without mortgage rates falling and with inventories rising, I may become bearish on FNMA, as that could cause a repeat of 2006-2010 conditions. In other words, I like FNMA as long as US mortgage coverage levels (debt service to income) do not continue to decline, which requires a soft-landing in housing. I believe that is most likely, but I am not so convinced that I'd make a large position in FNMA right now, given vacancies and inventories are trending up.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Comments