Chip stocks rose and fell on Tuesday. As of press time, $NVIDIA Corp(NVDA)$ rose more than 2%, $Advanced Micro Devices(AMD)$ fell more than 1%, Intel fell 2.74%, $ARM Holdings Ltd(ARM)$ fell 0.52%, and $Taiwan Semiconductor Manufacturing(TSM)$ fell 0.86%.

1. $Citigroup(C)$ : Chip stocks may once again initiate a 'bull market'-like surge in the market.

Citi's research team, in a report released on Tuesday, noted that following the commencement of the third quarter U.S. stock earnings season, while select chip stocks such as $Taiwan Semiconductor Manufacturing(TSM)$ and $NVIDIA Corp(NVDA)$ , which capitalized on the AI boom, demonstrated robust performance, the overall U.S. chip sector experienced an overblown selling wave attributed to the persistently weak non-AI demand."

Citi analyst Christopher Danely says semiconductor consensus estimates have declined 11% during earnings and the $Philadelphia Semiconductor Index(SOX)$ sold off 9%, driven mostly by downside from $Microchip Technology(MCHP)$ , $Nuveen Select Tax-Free Income Portfolio(NXP)$ and $Intel(INTC)$.

However, Citi believes the selloff is “almost over and attention will shift to 2025.” It estimates global semi sales to be up another 9% year-over-year in 2025, following 17% growth in 2024. The downside from the industrial end market will dissipate soon and the correction in the auto end market should end sometime in the first half of 2025, the analyst tells investors in a research note.

The other 75% of semi demand appears to be solid and investors should build positions in semiconductor stocks and “get aggressive” going into Q1, contends the firm. Its Buy-rated names are $Analog Devices(ADI)$ , $Advanced Micro Devices(AMD)$ , $Broadcom(AVGO)$ , $Micron Technology(MU)$ , $Texas Instruments(TXN)$ , $NVIDIA Corp(NVDA)$ and $KLA-Tencor(KLAC)$.

2. AI and Storage Chips: Pillars of the Semiconductor Market

The current demand for AI and storage chips in data center servers is robust, and this trend is expected to persist for the foreseeable future.

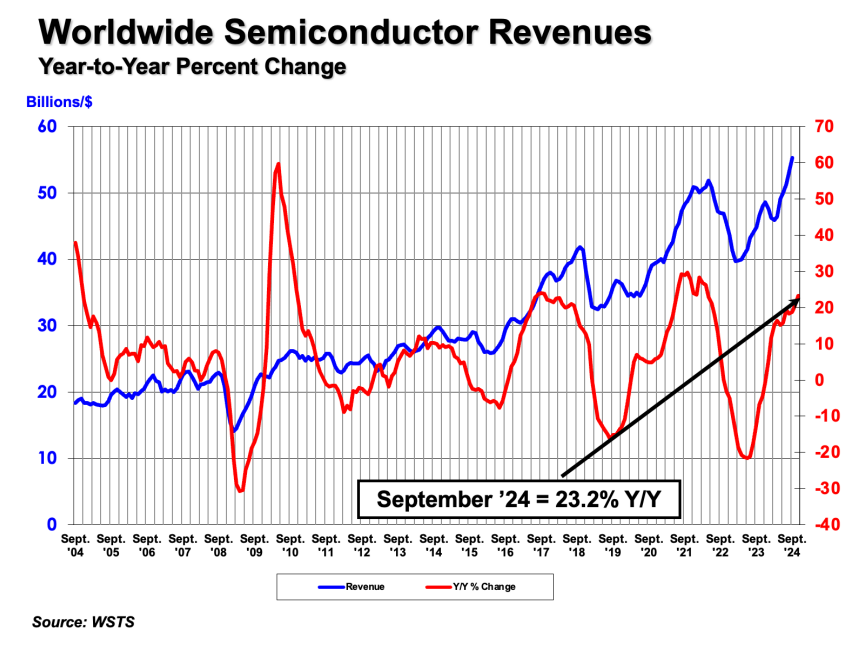

According to the latest data from the Semiconductor Industry Association (SIA), the global semiconductor market sales soared to $166 billion in the third quarter of 2024, a 23.2% increase year-over-year from the third quarter of 2023, and a 10.7% increase sequentially from the already robust second quarter of 2024. This surge was largely attributed to the strong demand for AI chips in data center servers, such as Nvidia's H100/H200 models. For the month of September 2024 alone, global semiconductor market sales were approximately $55.3 billion, marking a 4.1% sequential increase from the $53.1 billion recorded in August 2024.

Gartner Anticipates Global Semiconductor Sales Could Hit $630 Billion in 2024, Suggesting a Substantial Increase of 18.8% Over the Previous Year.

Regarding the semiconductor market demand for 2025, Gartner's latest projections indicate that the global semiconductor market will achieve total sales of around $717 billion, a 14% rise from 2024. This growth is largely attributed to the increased demand for semiconductors related to AI in data centers and the resurgence in demand for consumer electronics with integrated edge AI.

Gartner Forecasts the Storage Chip Market to be the Most Dynamic in 2025, Projected to Grow by 20.5%, with Sales Expected to Reach $196.3 Billion. Within this segment, enterprise-grade NAND flash memory and DRAM are anticipated to be the primary forces driving this expansion.

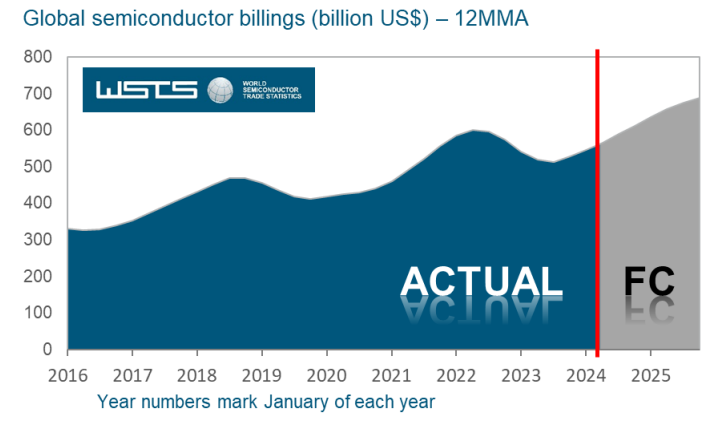

The semiconductor industry outlook data released by the World Semiconductor Trade Statistics (WSTS) in spring showed that the global semiconductor market is expected to show a very strong recovery trend in 2024. WSTS's forecast for the global semiconductor market sales volume in 2024 has been significantly raised compared to the forecast report at the end of 2023.

For 2024, WSTS predicts that the market size will be $611 billion, which means a significant increase of 16% compared with the previous year, which is also a significant upward revision of the forecast at the end of 2023.

Looking forward to 2025, WSTS predicts that the sales volume of the global semiconductor market is expected to reach $687 billion, which means that it is expected to grow by about 12.5% on top of the already extremely strong recovery trend in 2024.

WSTS expects this growth to be driven primarily by the memory chip category and the artificial intelligence logic category, which are expected to soar to more than $200 billion in 2025, driven by the AI boom.

Compared with the previous year, WSTS expects the total sales growth rate of the memory chip category dominated by DRAM and NAND to exceed 25% in 2025, and the total sales growth rate of the logic chip category including CPU and GPU is expected to exceed 10%. At the same time, it is also expected that the growth rate of all other market segments such as discrete devices, optoelectronics, sensors and analog semiconductors will reach single digits.

WSTS predicts that the market size of analog chips, which account for an important share of chips required for electric vehicles (EVs) and industrial ends, will remain sluggish. It is expected that the market size will shrink by 2.7% in 2024 after shrinking by 8.7% in 2023. However, WSTS predicts that the overall size of the analog chip market is expected to expand by 6.7% in 2025, which means that the recovery process of analog chips next year may start slowly in 2025. Analog chips play an indispensable role in a variety of key functional modules and systems of electric vehicles, including power management, battery management, sensor interfaces, audio and video processing, and motor core control systems.

Stay tuned. Comment, like and subscribe to @Tiger_Contra

Open a CBA today and enjoy access to a trading limit of up to SGD 20,000 with upcoming 0-commission, unlimited trading on SG, HK, and US stocks, as well as ETFs. Find out more here.

Other helpful links:

Disclaimer

Not financial advice. Investment involves risk. Cash Boost Account enables you to make purchases using credit limit, allowing you to buy beyond your current available funds and may potentially incur losses exceeding your account balance. Please make decisions according to your own risk tolerance.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comments