Selling covered call options (sell covered call) is a strategy adopted by many large funds. It can also be used by retail investors in the US stock market.You can get income while holding it.

This strategy is very suitable for stocks that have long-term positions, but they have not moved but they are not in a bearish position recently or are in a bearish position recently. It can be a good strategy for mature investors to roll over when holding some targets for a long time.

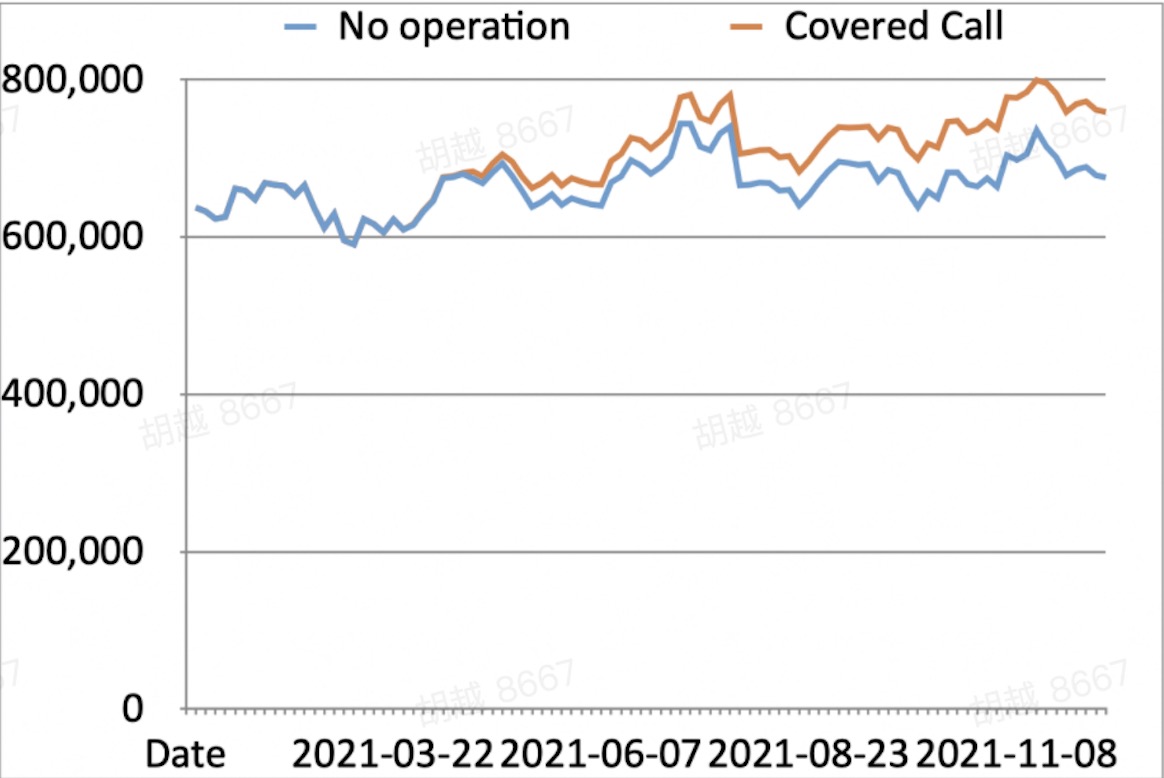

Income comparison

Assume that investors hold 200 shares of Amazon from January 1 to December 17, 2021

If there is no operation during the holding period, the final total assets will be USD 675,484

If the covered call strategy is carried out, it will be operated once a week; if 100 shares are sold after the exercise, another 100 shares will be purchased on the next trading day.The final total assets is USD 728898 (include fees and costs).

Today's Covered Call(for your reference)

| Option | Stock | Expiry Date | Strike Price | Premium | Implied volatility | Annualized rate of return |

|---|---|---|---|---|---|---|

| $TSLA 20241129 407.5 call$ | TSLA | 2024/11/29 | 407.5 | 2.070000 | 0.780000 | 20.28% |

| $NVDA 20241129 150.0 call$ | NVDA | 2024/11/29 | 150.0 | 3.470000 | 0.730000 | 82.16% |

| $PLTR 20241129 73.0 call$ | PLTR | 2024/11/29 | 73.0 | 0.330000 | 0.720000 | 17.87% |

| $COIN 20241129 430.0 call$ | COIN | 2024/11/29 | 430.0 | 4.260000 | 1.270000 | 43.44% |

| $MSTR 20241129 480.0 call$ | MSTR | 2024/11/29 | 480.0 | 11.800000 | 1.520000 | 101.76% |

| $AMD 20241129 155.0 call$ | AMD | 2024/11/29 | 155.0 | 0.400000 | 0.000000 | 9.55% |

| $AAPL 20241129 237.5 call$ | AAPL | 2024/11/29 | 237.5 | 0.360000 | 0.180000 | 5.24% |

| $BABA 20241129 96.0 call$ | BABA | 2024/11/29 | 96.0 | 0.440000 | 0.000000 | 16.34% |

| $SPY 20241129 604.0 call$ | SPY | 2024/11/29 | 604.0 | 0.400000 | 0.110000 | 2.26% |

| $SOXL 20241129 33.0 call$ | SOXL | 2024/11/29 | 33.0 | 0.320000 | 0.910000 | 38.37% |

| $SE 20241129 119.0 call$ | SE | 2024/11/29 | 119.0 | 0.300000 | 0.400000 | 9.16% |

Note:

- Options listed in this table are for reference only during the trading hours of the day;

- Hot stocks are the top 20 stocks with highest number of visits on Tiger Trade;

- Data source:Tiger Trade.

Option Screening Rules

strike >= p * e^{1.04 * sigma * sqrt{days/365}}

p : current stock price

sigma:Stock History Volatility

days :the number of days from the option expiry date ( next Friday)

If you have no experience in trading options, you can try option simulation trading

Guidance for Options Paper AccountQuestions and Answers

What Is a Covered Call?

The term covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security.

How to make extra profits by selling covered callStrategy applicable group:

Hold the positive shares mentioned in the strategy, hold a position of ≥100.

How do I know if a covered call has been completed:

The presence of the word portfolio next to the name of an open stock or option indicates the execution of a covered strategy.

Strategic income:

An annualized return is calculated based on yesterday's closing price by referring to the option strategy filter rule.

(premium per share / yesterday's closing price) * (No. of days in 1 year / duration of option in days)

For example, yesterday's closing price is $100 , the option premium is $1 and expires 30 days from now. Putting it into the equation (1/100) * (365/30) = 12.17% per annum.

Exercise pric:

The option price is calculated according to yesterday's closing price by referring to the option strategy screening rule. Whether to trade at the strike price provided in the strategy depends on how far the share price diverges from the closing price.

Exercise:

Shares held at expiration are sold at a price above the strike price. The stock price on the expiration date is lower than the exercise price, the stock held does not move, the value of the option goes to zero and is automatically cleared by the system.

Risk warning:

If the stock price on the expiration date is higher than the strike price, and the position cost price is higher than the strike price, the stock sold due to counterparty exercising of the option may cause losses.

DISCLAIMER

Options are categorised as Specified Investment Product (SIP) and are generally more complex than other financial products. You will need to go through a Customer Account Review (CAR) before Options can be offered to you.

The information expressed herein is current and does not constitute an offer, recommendation or solicitation, nor does it constitute any prediction of likely future stock performance.

The price of investment instruments can and do fluctuate, and any individual instrument may experience upward or downward movements, and under certain circumstances may even become valueless. Past performance is not a guarantee of future results.

In preparing this information, we did not take into account the investment objectives, risk appetite, financial situation or particular needs of any person or affiliated companies. Before making an investment decision, you should speak to a financial adviser to consider whether this information is appropriate to your needs, risk appetite, objectives and circumstances. Tiger Brokers assumes no fiduciary responsibility or liability for any consequences financial or otherwise arising from trading in securities if opinions and information herein may be relied upon.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Comments