Summary

- Sea Limited is an internet company that reminds me of Amazon in the way it relentlessly pursues new businesses and markets.

- The company's track record of execution is very good, which bodes well for its most recent endeavors.

- The company isn't profitable, but like Amazon's early days, cash flow is bubbling underneath the surface.

When it comes to "generational" investment opportunities, Amazon(NASDAQ:AMZN)is the common "gold standard." The company blazed the trail in e-commerce and relentlessly pursued multiple business segments to create the juggernaut that it is today. Naturally, investors are constantly looking for the "next Amazon".

While we may never again see a success story as lofty as Amazon's, there are companies that can certainly put in a good effort. One such company is Sea Limited(NYSE:SE). Coincidentally rooted in similar industries, Sea Limited is following a similar playbook of aggressive expansion using a multi-faceted approach. The company's strong management and execution track record should instill optimism for the company's newest endeavors. Despite a market cap that has now soared past $100 billion, there is plenty of long-term upside left in the tank. We will outline Sea's recipe for growth and our investment thesis.

Company Overview

Sea Limited brands itself as a global consumer internet company. The company is concentrated in Southeast Asia, but has since expanded into Latin America. The company's roots are in gaming, but today runs three prominent businesses.

Shopee is the company's e-commerce business, launched in 2015. Shopee is the leading e-commerce platform in Southeast Asia and Taiwan. Shopee recently expanded outside of Asia, launching in Brazil in 2019 and Mexico just recently.

Garena is Sea's digital entertainment arm. It is Sea's original venture, forming in 2009. It owns Free Fire, a popular mobile-only Battle Royale game. It was the most downloaded game globally in both 2019 and 2020. Garena also does licensing with global partners and is involved in e-sports.

Finally, SeaMoney is a digital payments and financial services business. It was established in 2014. The segment deals in mobile wallets, payment processing, credit, and are offered under various brands in the region.

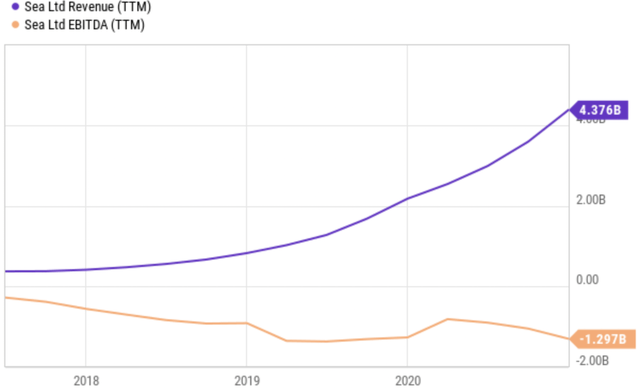

The company's business segments have a degree of overlap, working together to provide a consumer with various products and services that integrate together in many cases. The company did total revenues of $4.4 billion in 2020, a YoY increase of 101%. It was founded (and is still led today) by Forrest Li.

Strong Execution

I have seen some folks try to paint Sea Limited as a "risky" investment, which I think is quite misguided. The company has done nothing but execute across all of its business segments. Chinese internet company Tencent Holdings (OTCPK:TCEHY) took a 20% stake in 2017 and has helped guide Sea Limited.

Garena is a massively successful entertainment business, with Free Fire a huge hit in the rapidly growing mobile gaming industry. Free Fire was the most downloaded mobile game globally in both 2019 and 2020 and continues to drive rapid growth for Garena.

Garena's rapid growth helps fuel Sea's expansion efforts. Similar to how AWS is a cash cow for Amazon, Garena generates strong cash flow for Sea due to high margins. Garena's EBITDA margins are 62% on an adjusted basis.

Most companies get in trouble when they deviate from what they know. Sea Limited has embraced this, getting into e-commerce and succeeding. Sea launched Shopee in Southeast Asia in 2015. In early 2017, this is what the landscape looked like:

Just a few years later, Shopee is the top e-commerce platform in Southeast Asia. Momentum is favoring Sea Limited as well. In 2020, gross orders grew 132% over 2019.

It's not easy to "come from behind" in a space where scale matters so much, but Sea Limited has managed to do just that - and now sits in the lead. For further evidence of Sea's ability to execute, look at Latin America.

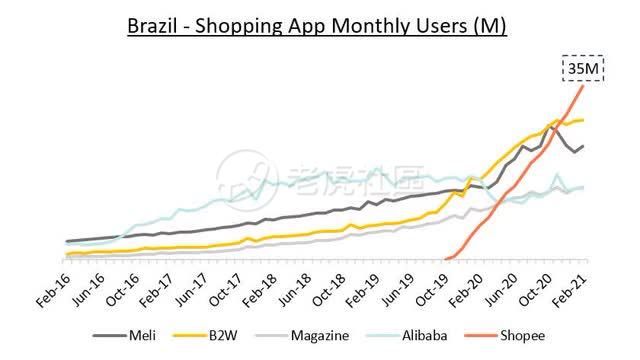

The company launched in Brazil in late 2019, challenging incumbent MercadoLibre (MELI). MercadoLibre is a local favorite and has been in the market for more than 20 years prior to Sea's arrival. Despite all of this, Sea has managed to overtake MercadoLibre by MAU in less than two years! This level of execution instills confidence as Sea continues to expand (currently working on Mexico).

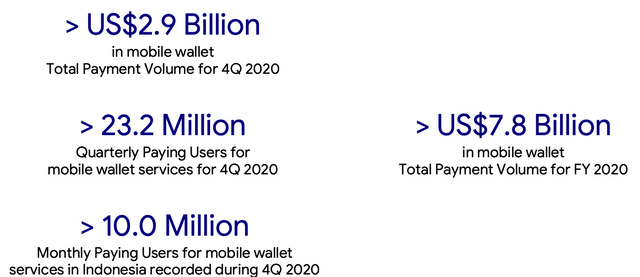

Sea's financial services are almost "along for the ride", as the company has smartly integrated the financial business with consumers who often use Shopee. While the company generated mobile wallet payment volume in Q1 of $1 billion, that jumped to $2.9 billion by Q4 (partly due to seasonality).

It's not easy for a company to run in so many different directions and find a way to have success. Considering what Sea Limited has accomplished across its businesses in just a handful of years, investors should feel optimistic about the latest projects that Sea Limited has unveiled.

New Endeavors

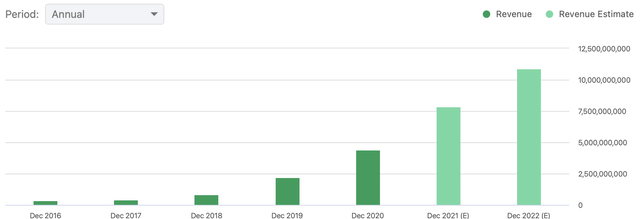

Investors can look at the existing business to find an exciting growth stock. Sea Limited is forecasting strong growth in 2021, and analysts are confident as well.

With revenues projected to hit $7.86 billion this year, Sea's expected growth remains strong at 79%. This doesn't even factor in the company's tendency to beat estimates.

But I want to talk about the aggressive nature that Sea Limited operates with. In Amazon-like fashion, Sea is pushing into new businesses and markets - despite the immense success it's seeing already in its three segments.

During the Q4 earnings call, Sea announced the formation of two new platforms:

- Sea Capital

- Sea AI Labs

Sea Capital will help manage present/future strategic investments by the company, and AI Labs will focus on development and application of artificial intelligence. Furthermore, the company is getting increasingly active in food delivery.

These are very early stage/just announced, so there isn't much context to be added here yet. But when I think of how the company has managed to execute its initial expansions (Shopee and SeaMoney), I think there is a good chance that these will become material contributors to the business down the road.

Accelerating Cash Flow

A complaint I hear about Sea Limited is the company's failure to turn a profit. We can see that EBITDA has turned increasingly negative despite revenues continuing to grow rapidly.

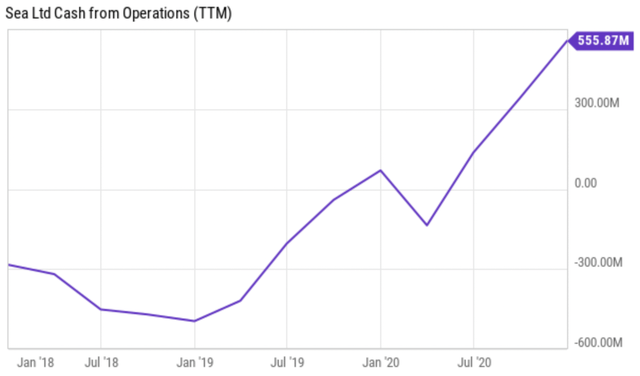

What this argument fails to take into account are the massive investments that are still going into Sea Limited to fund the expansion of its business segments, creation of new business segments, and penetration of new geographies. If we look at the company's cash flow from operations, we see that cash flow is rapidly growing.

What investors should also note is that Garena is currently the company's "golden goose". It generates strong margins and cash flow. If the company's digital entertainment business were to suffer (Free Fire meaningfully declines), it would have a dramatically negative impact on Sea's overall financials. This is the largest risk to an investment in Sea Limited currently.

However, at this time, the gaming division continues to show tremendous strength so that worry isn't at front of mind. It is my expectation that over time (similar to Amazon), the business will reach a level of scale/maturity that causes profitability to surge due to this long tail of expansion spending. This however is likely several years away.

Valuation

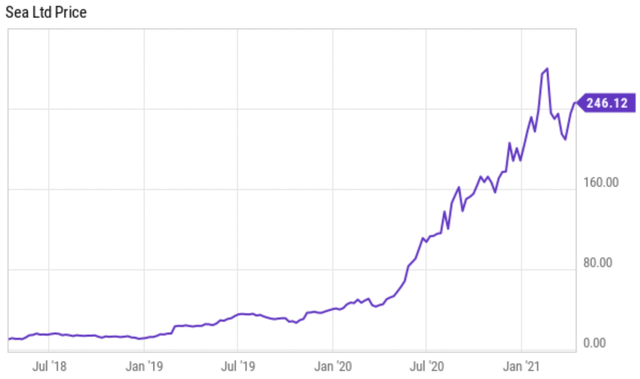

Sea Limited was one of the market's "big winners" during the Covid pandemic in 2020 due to its exposure to industries that benefited from the lockdowns (e-commerce and gaming). The stock has soared from its lows of $50 per share to the $246 it currently trades at.

With an enterprise value of $123 billion, Sea Limited currently trades at an EV to sales of nearly 28X. This is a significant premium even to MercadoLibre which trades at 19X.

However, quality companies can consistently seem expensive - especially when they are growing as fast as Sea Limited. If you buy into an expensive valuation in Sea, it's true that you may need some patience while the company catches up to the stock's valuation.

How fast can a valuation change? If we bought shares today and Sea Limited hit its 2021 analyst estimates of $7.86 billion, that EV/sales multiple gets cut down to just 15.6X. Against next year's estimates of $10.9 billion, Sea trades at just 11.3X.

If you are a long-term investor with a 3+ year holding period, the odds are solid that Sea is going to be a strong investment (as long as growth and execution continues). Sometimes waiting for the "big drop" can backfire because they can happen far and few between while a company like Sea Limited continues to grow at a rapid pace.

Wrapping Up

There may never be a company that is the "next Amazon," but Sea Limited has so far proven to be a great stock with a number of similarities in management style and performance. Like Amazon, Sea Limited can seem expensive considering the valuation and lack of profits generated. But when you look deeper, you see a company that is firing on all cylinders and putting up fantastic growth. This makes Sea Limited, worth considering for any long-term growth investor.

Comments