Last week I mentioned that we might witness the born of a super bull.

A few of you pointed out some of the "red flags" I covered in the past few weeks that seem in a conflict of the super bull view.

There are indeed a number of the red flags brewing and the most obvious is market breadth - the percentage of stocks above 200 MA is deteriorating, which is certainly a divergence with the index.

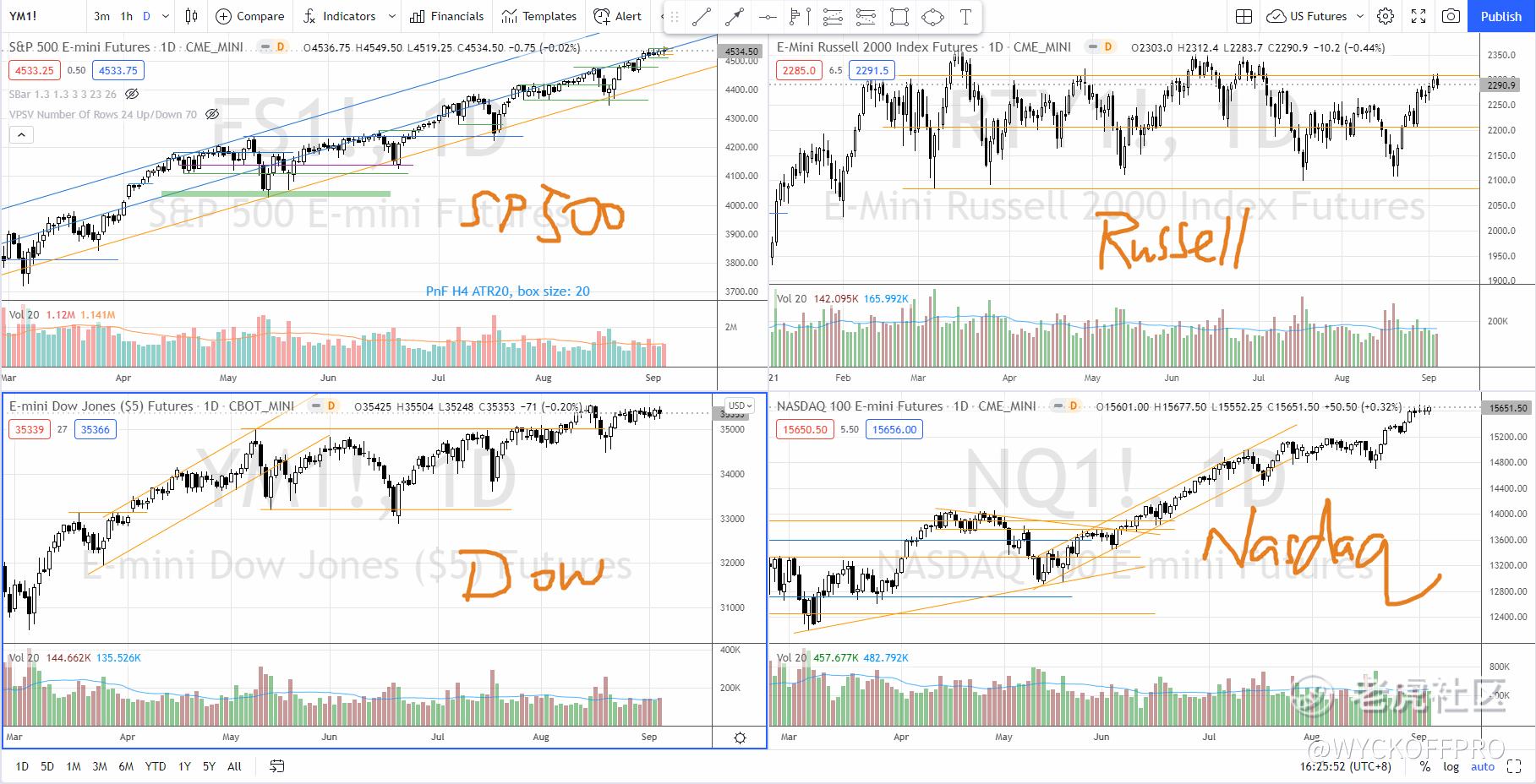

Despite almost the 3 major indices hit historical high (Dow Jones, S&P 500 and NASDAQ) this year, not all stocks are as strong as these indices because only a handful of the stocks, in particular the big & mega cap stocks led the market into historical high. Many stocks especially the small cap (Russell 2000) stocks are laggards.

What's more frustrated is that there were quite a number of rotations happened every times the index made a pullback, which created a big challenge for traders and investors.

By looking at the 4 major US indices below, Nasdaq is in phase E markup after a brief re-accumulation in Jul-Aug 2021, S&P 500 is in a well established up channel since Nov 2020, Dow Jones seems ready to enter into phase E markup after a re-accumulation between May 2021 till current. Only Russell 2000, is still within the potential re-accumulation range since Feb 2021 till now.

Proxy 1: Russell 2000

It is worth noting that Russell 2000 (which is the first proxy I am looking at), especially the growth theme (refer to ETF: IWO), started to outperform. This will accelerate the Russell 2000 index to breakout to test all time high and improve the overall market breadth.

Should this happen, I won't be surprise to see Nasdaq to take a pause or correction as profit taking sets in while some rotation happens between Nasdaq and the Russell 2000.

Proxy 2: ARKK

The second proxy I pay close attention to is $ARK Innovation ETF(ARKK)$ (and the other ARK ETF too). Right now, some of their top stocks (NTLA, $Sea Ltd(SE)$ , $Docusign(DOCU)$ , DKNG, etc...) are showing re-accumulation structures while ARKK is still in a trading range. Could this be the start of phase D, on its way to breakout of the top of the range at 130? Supply has been decreasing after the shakeout type action in May 2021. Quality demand is yet to be seen to start a rally for ARKK.

If the bullish case materializes, we will see a lot of the innovative/disruptive stocks back to focus. This will further boost up the market breadth and by the time will probably no longer an issue. That's why I mentioned previously that divergence is a condition rather than a signal or confirmation to take action.

Now, I am watching Russell 2000 and ARKK closely and look forward to seeing the born of a super bull.

So far it is still a bull run until proven otherwise. Enjoy the bull run and safe trading :) @Tiger Stars

Comments