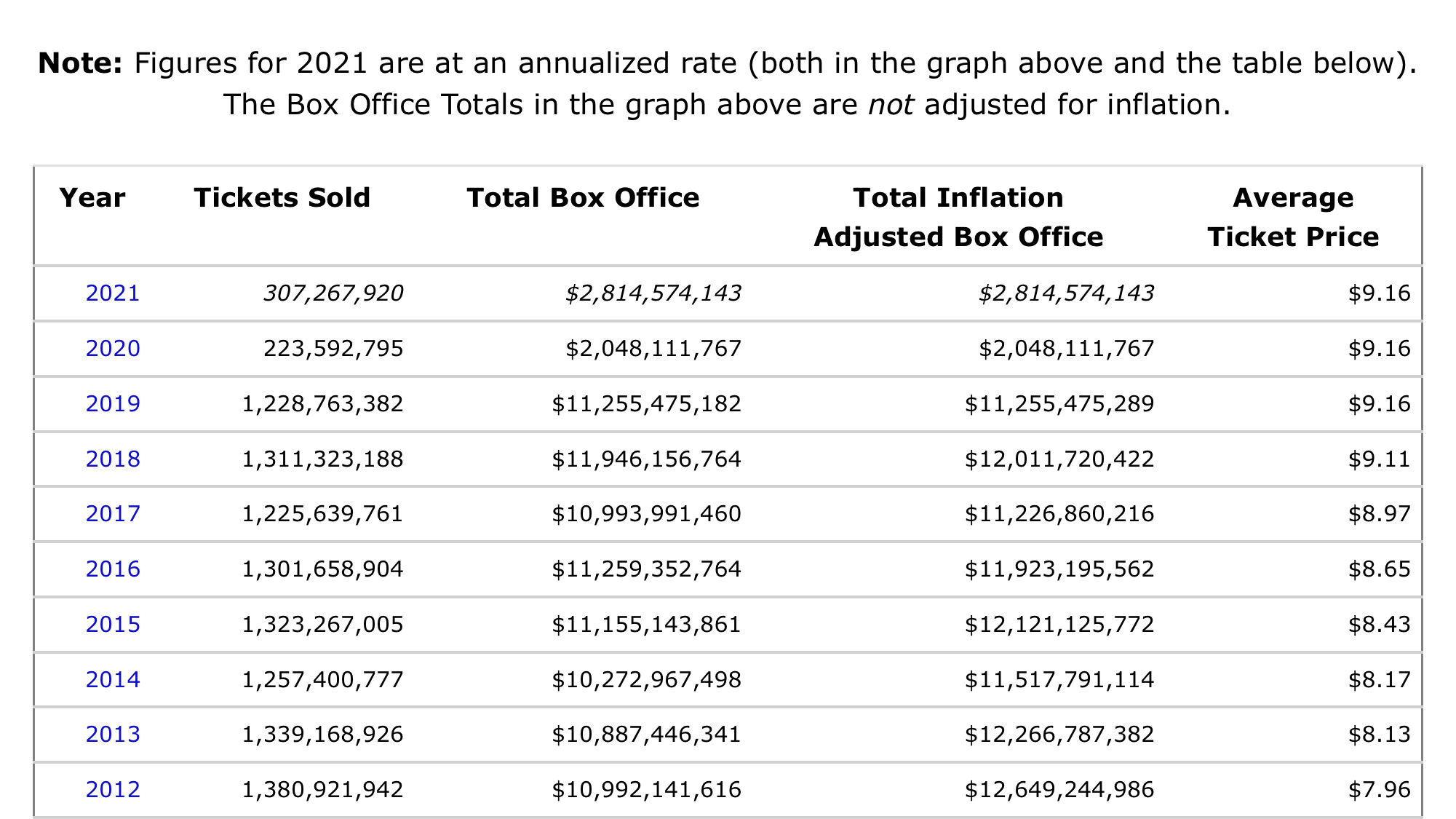

$AMC Entertainment(AMC)$AMC has been on a roller coaster ride for slightly more than half a year! Having gone through their past earning reports down to 2017, I have noticed that they will need more than $1.4 billion per quarter in order for them to be in a profitable quarter.

With more than their 500++ venues opened in US and 110+ venues overseas, majority of their screens are opened. Now, it is important that more movies that held back their release date from last year. As this quarter theirrevenue is only $444million, they will need another $1 billion revenue per quarter to become profitable.

As we are near the end of the summer, let’s see if there will be an increase in the releaseof more movies during the upcoming Q4’2021 festive season.

Adding to this, AMC has announced that they will start accepting of BTC payments in Q4’2021. With growing acceptance of crypto currency across the globe, I foresee that AMC’s investment dollars from holding of BTC will potentially be able to increase their income/profit.

With the Scarlett(Black Widow)’s lawsuit to Disney, I believe it helps cinemas to retain partial of their viewers. Although streaming platforms are gaining user loyalty over cinema over the past years, but viewer experience from a cinema is something that is not easily replaceable.

In the long run, definitely Cinemas will slowlylose more market share, therefore, in order for AMC to remain a buy, they will have to adapt themselves to the trend.

I am now looking for news such as them migrating themselves to have their own streaming services and less their physical cinemas(venues that are on lease). Which will incur less overheads and rental expenses, and converting more of their venues into their asset.

This way, they will be able to hold on to their market share of loyal users to the cinematic experience, at the same time increase their number of revenue streams within their industry.

At their current market share, I believe they can stand at a higher market cap as they have a decent market share and the box office numbers are recovering from last year.

Key earnings period to look out for will be for Q4’2021.

Comments