The price to book ratio, also called the P/B or market to book ratio, is a financial valuation tool used to evaluate whether the stock a company is over or undervalued by comparing the price of all outstanding shares with the net assets of the company. In other words, it's a calculation that measures the difference between the book value and the total share price of the company.

A high price to book ratio indicates that a stock is expensive, while a low ratio indicates that it is cheap.

So-called value stocks often have a low price to book ratio, which indicates that you can buy the stock for a low price relative to the value of its assets.

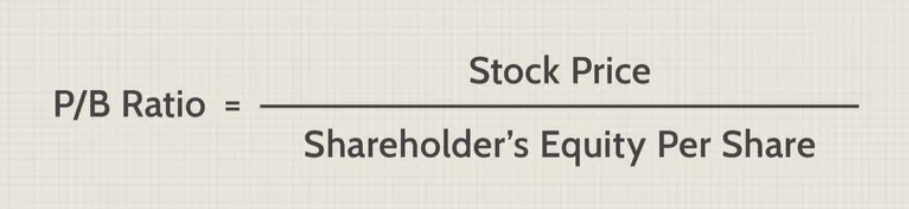

Calculation of P/B Ratio:

Let's calculate the market to book ratio for ABC company.

At the end of 2020, ABC stock was trading for $418 dollars per share, with a market cap of $74 billion.

By looking at their 2020 balance sheet, we can see that they had assets of $34.3 billion and liabilities of $26.2 billion. Their book value was $34.3 - $26.2 = $8.1 billion.

Dividing their market cap by the book value gives them a market to book ratio of $74 / $8.1 = 9.1.

In other words, you are paying $9.1 for each dollar of net assets.

Using P/B Ratio to Evaluate Stock

The price to book ratio, or P/B ratio, is one of the most commonly used ratios to determine if a company's stock is cheap or expensive.

For example, a ratio below 1 indicates that the stock is very cheap, while a high ratio (such as over 3) may suggest that it is expensive.

A price to book ratio of less than 1 implies that you can buy the company for a lower price than the value of its assets.

So, if you were to buy the company, liquidate it and sell its assets and pay its liabilities, you would make a positive return on your investment.

However, keep in mind that a low or high ratio should not be used in isolation to evaluate a stock. When companies are trading for less than their book value, then they are usually cheap for a reason.

In addition, companies with a high price to book ratio may be expensive for a reason. They could be expected to make a lot of profits in the future.

That being said, the price to book ratio is not a good way to value all sorts of businesses. Some types of companies don't need a lot of physical assets to make money.

For example, many information technology stocks have a high price to book ratio. But they can still be immensely profitable and seem cheap according to other metrics, such as the PE ratio.

So, don't make any investment decisions based solely on this ratio. Make sure to look at other financial metrics and also compare the price to book ratio to other companies in the same industry.

Price To Book Ratio Conclusion

1. The price to book ratio determines how undervalued or overvalued a company stock is on the market.

2. The price to book ratio requires two variables: the market price per share and the book value per share.

3. A ratio of less than one means that the company could be undervalued and would provide a better return in the future.

4. A ratio of more than one would suggest that the investment is more secure.

Comments