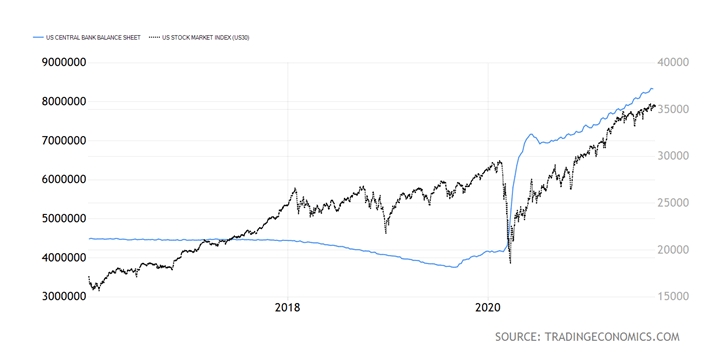

The missing, but long-overdue correction in stocks is probably a factor of the relentless pumping of electronic dollars into the financial system at a rate of $120 billion per month, causing the Fed balance sheet to rise to $8.349 trillion at last count.

Suppressing bond market volatility also means suppressing stock market volatility. That’s why when the Fed finally tapers, both the bond and stock markets will shake.

The pump rate will likely throttle down by the end of the year, so the trillion-dollar question is: By how much?

The missing, but long-overdue correction in stocks is probably a factor of the relentless pumping of electronic dollars into the financial system at a rate of $120 billion per month, causing the Federal Reserve balance sheet to rise to $8.349 trillion at last count. The pump rate will likely throttle down by the end of the year - Powell told us so! - so the trillion-dollar question is: By how much?

My guess is that the reduction will be small - anywhere between $10 billion to $20 billion per month.

QE is not really “printing money,” since the excess reserves that it creates is for financial institutions only, and only those that are under the supervision of the Federal Reserve. If they can’t lend the money, as there is low demand for credit right now, they plow the funds back into the bond market. Buying bonds is a form of lending, but if the supply of bonds is not increasing commensurately, the prices of bonds will rise as their yields fall. That’s how the Fed suppresses bond yields and credit spreads as well as bond market volatility. That’s how it distorts market signals that were quite reliable before the days of QE.

Suppressing bond market volatility also means suppressing stock market volatility. That’s why when the Fed finally tapers - we don’t know exactly when - both the bond and stock markets will shake, the same way they shook in the fourth quarter of 2018 when the Fed was draining $50 billion per month in excess reserves from the financial system. Since any QE intervention would now be more extreme compared to anything Ben Bernanke did, I suspect both stocks and bonds will be more sensitive to any tapering.

Comments