After the news of cooperation with KFC broke out,$Beyond Meat, Inc.(BYND)$Yesterday, it rose by 14.65% for a long time.

Beyond Meat rose more than 10% after news that KFC will launch artificial fried chicken in restaurants across the United States.

Otherwise, Beyond Meat's situation should hit a 21-month low since the 2020 stock market crash.

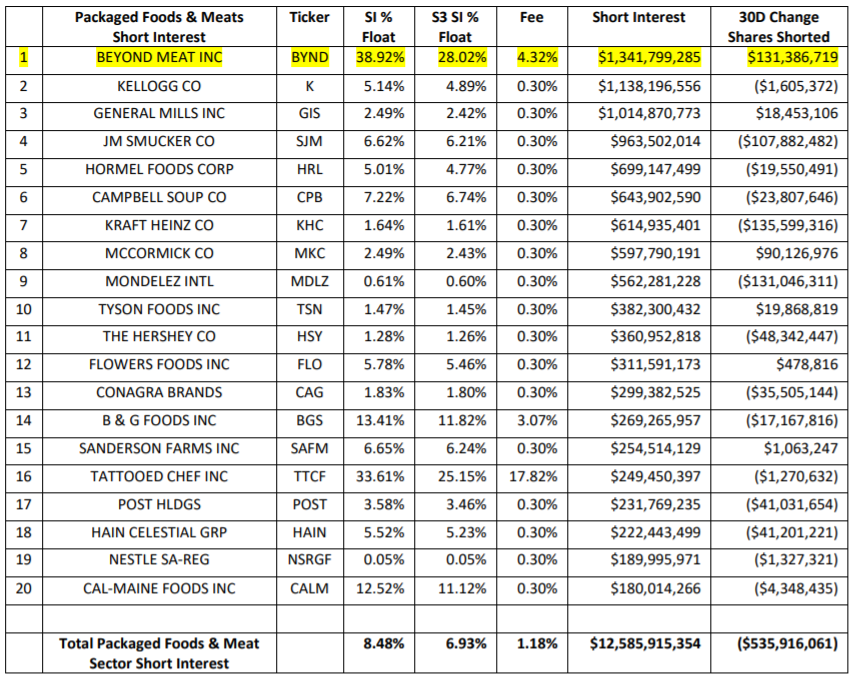

With the stock price at a new low, bears have not forgotten to take care of Beyond Meat, which proves the company's star stock status. Looking further at short data may be an opportunity. According to the S3 report, the value of Beyond Meat's short position has increased by 141 million in the past month and 54 million dollars in the past week. At present, the short position is 21.78 million shares, with a total value of 1.34 billion US dollars. Short positions accounted for 38.92% of tradable shares as a whole, ranking first in the food and beverage industry.

Does such a high short ratio make you feel very dangerous? Actually, maybe you should be excited. There is no short squeeze without a high short ratio. This may be the best speculative reason to see Beyond Meat more now. Otherwise, from a fundamental perspective, what you see will be more pessimistic. To sum up, the unfavorable factors restricting Beyond Meat's current stock price can be roughly divided into three points:

There is a problem with the demand for the company's products. Competition is becoming more and more fierce, and long-term growth and profitability are questionable.

The company's valuation does not reflect the challenges it faces. Given the growth and profitability indicators, the valuation is higher compared with peers.

Recently, the trend is not good, and there is room for further downside.

Expand these three points:

1 Business. In the most recent quarter, Beyond Meat's revenue was $106 million, up 13% year-on-year, which was lower than the company's target of $120 million to $140 million. The American market accounts for about 2/3 of the company's total revenue, but its sales have dropped by 14%. Rising costs affected gross profit margins, resulting in a net loss of $54 million.

Beyond Meat doesn't want to send such a bad financial report again. The financial report exposed many problems of the company, the most important of which was the obvious shortage of demand. The management blamed the epidemic for the decrease in demand, but the data of peers could not support it.$Oatly Group AB(OTLY)$,$Simply Good Foods Company(SMPL)$And$Freshpet(FRPT)$Both show a strong demand environment and consumers' persistent preference for healthier choices.$Wal-Mart(WMT)$And$Kroger(KR)$Recognize customers' demand for healthy food and increase their interest in healthy food. Beyond Meat seems to be the only company that has encountered these problems, and the reduced demand for plant-based products is probably the problem.

In addition, Beyond Meat's net income per pound in US retail sales decreased by 2% year-on-year. According to management, the reason is an increase in discounts. Almost all companies are raising prices because of labor shortages, supply chain problems and rising commodity prices, which lead to higher costs. In such an environment, weak demand and falling prices are worth worrying about Beyond Meat.

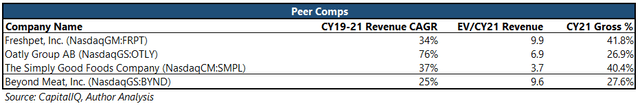

2 Valuation. How much valuation are you willing to pay for a company with annual revenue of $500 million and annual losses of $120 million? Beyond Meat has a market value of $4 billion, which is almost eight times the market-selling rate.

In today's liquidity-ridden market, we have become numb to high valuations. Not to mention comparing with the valuation of traditional food companies, even with other AngCompared with your food company, Beyond Meat is also in a leading position.

The income multiple is in a leading position among peers, and the growth rate and profitability are at the bottom. This is the valuation.

3 Weak. The news of KFC's cooperation saved the company's weak performance for some time. If not, it still has a high short ratio.$Beyond Meat, Inc.(BYND)$$Yum(YUM)$

Comments