Most companies stock price are falling, the tech firms in particular. While I am generally bullish about the market, there are some options strategies where we can apply in to take advantage of the bearish situation.

1. CALL CREDIT SPREAD

We can perform it by selling a Call Option ata lower strike price, while buying a Call Option at higher strike price, both with the sameexpiry date. Ideally, we want to choose the strike price to be significantly above existing stock price, to give us some buffer space toplay with.

This strategy can allow users to make a small profit by hoping that both options turn worthless upon expiry, and in any unfavourable event in which the stock price actually went up above the sold Call Option Strike Price, the loss is capped by the other Call Option purchased.

Using $S&P500 ETF(SPY)$as an example, we can Sell Call strike 453, collect premium of $135, while Buy Call strike 454, paying premium of $113. We will earn $135 - $113 - commission, works out to be about $15.

We will win $15, if the stock price stay below $453 by expiry. We will breakeven at $453.15, and we will lose a maximum of $85 when the stock price goes above $454.

This strategy, can be applied to any stock that you are bearish in the short term. For the risk-reward ratio, you can adjust based on your appetite, but I believe a Delta (probability) of 0.2 or below is on the safer side.

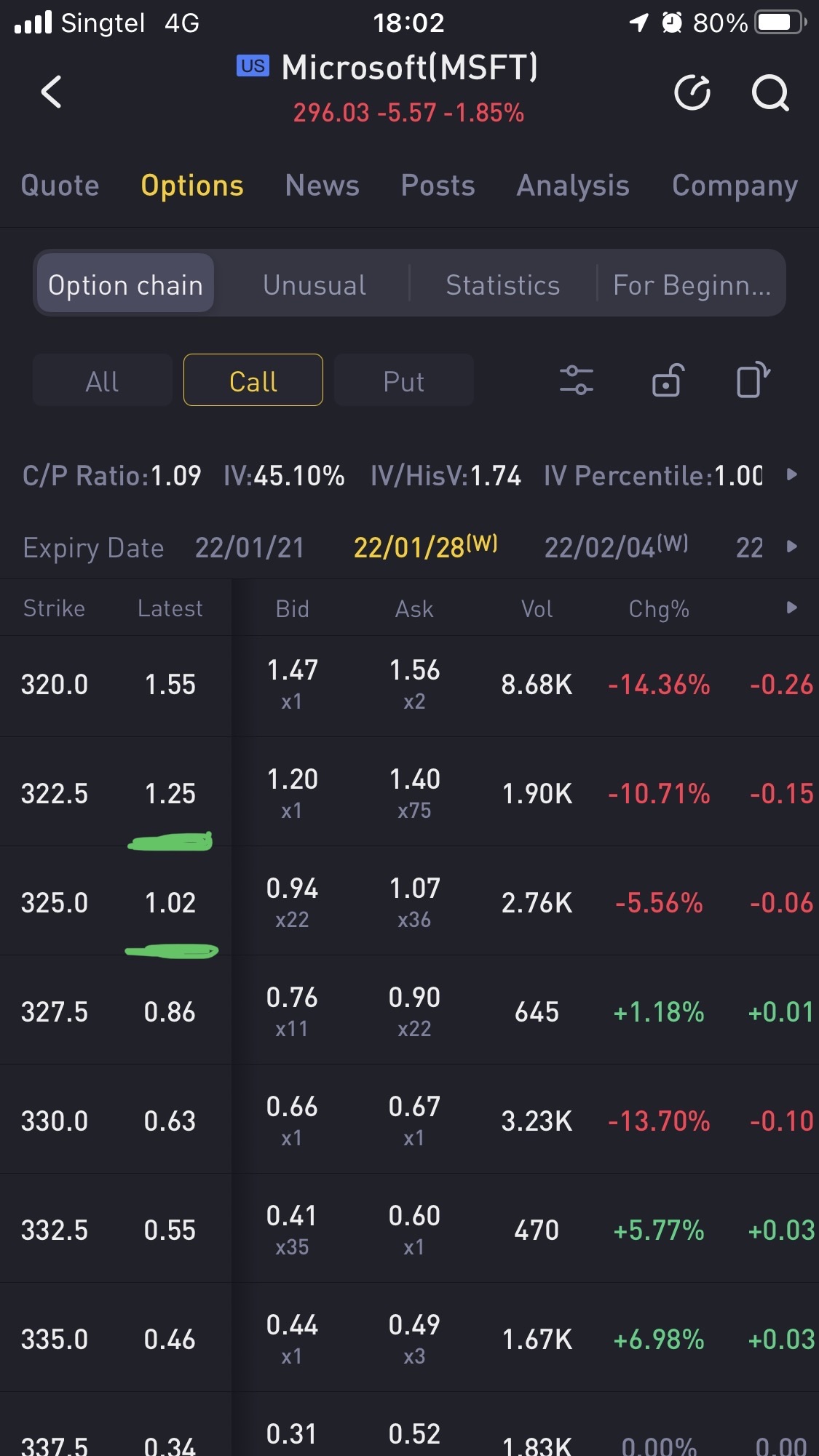

2. BUY PUT OPTIONS

Buy a 'out-of-money' put option with decent expiry dates of at least 2 weeks, and hope for the stock price to fall, before cashing out on the option (or exercise it at expiry). Thisstrategy is straightforward, you incur a smallupfront cost, and your upside can be significant, if the stock price falls a lot. I am suggesting this, simply because I have been a put seller for the past few months, and recently got burnt quite badly [Miser]

Comments