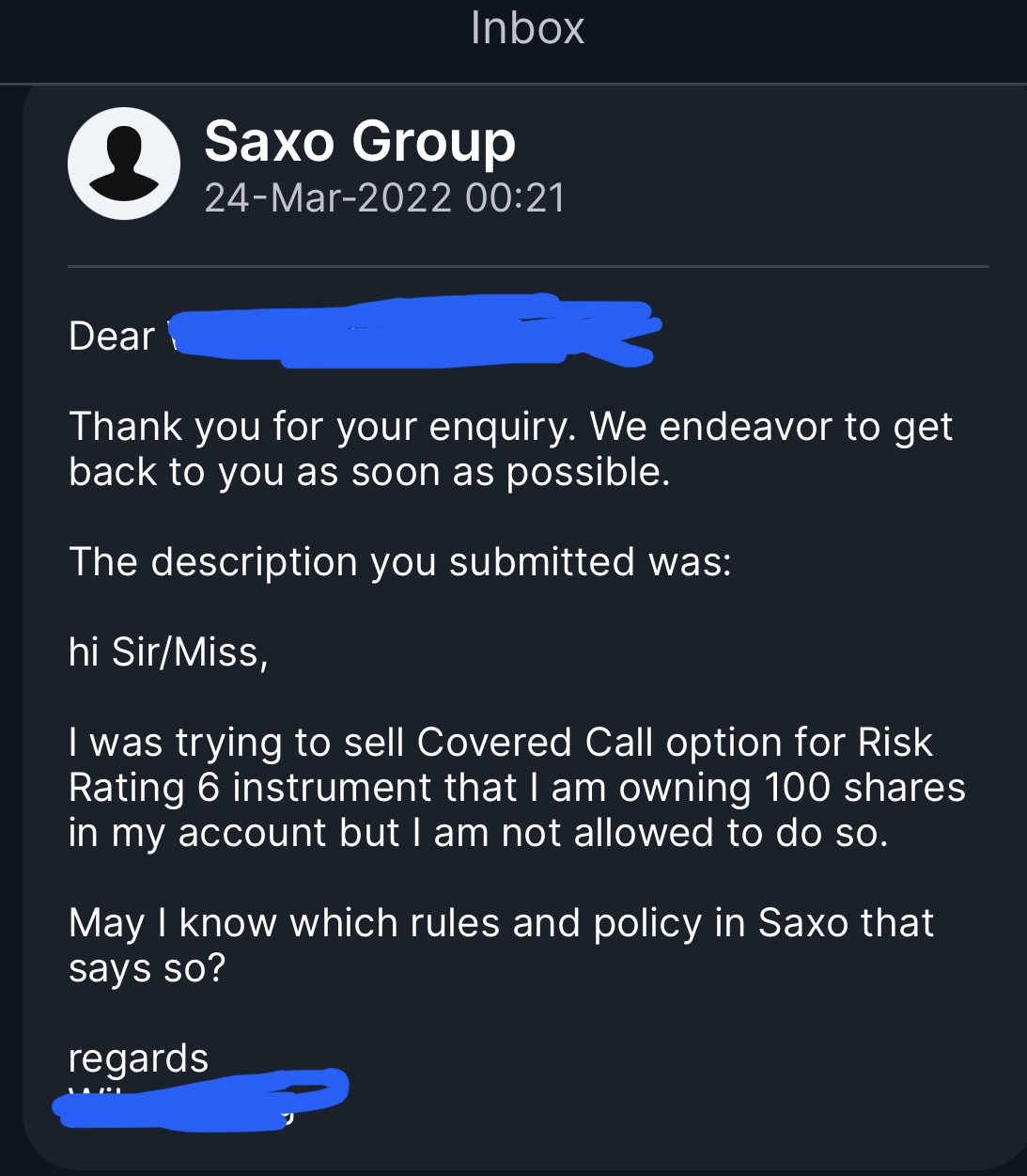

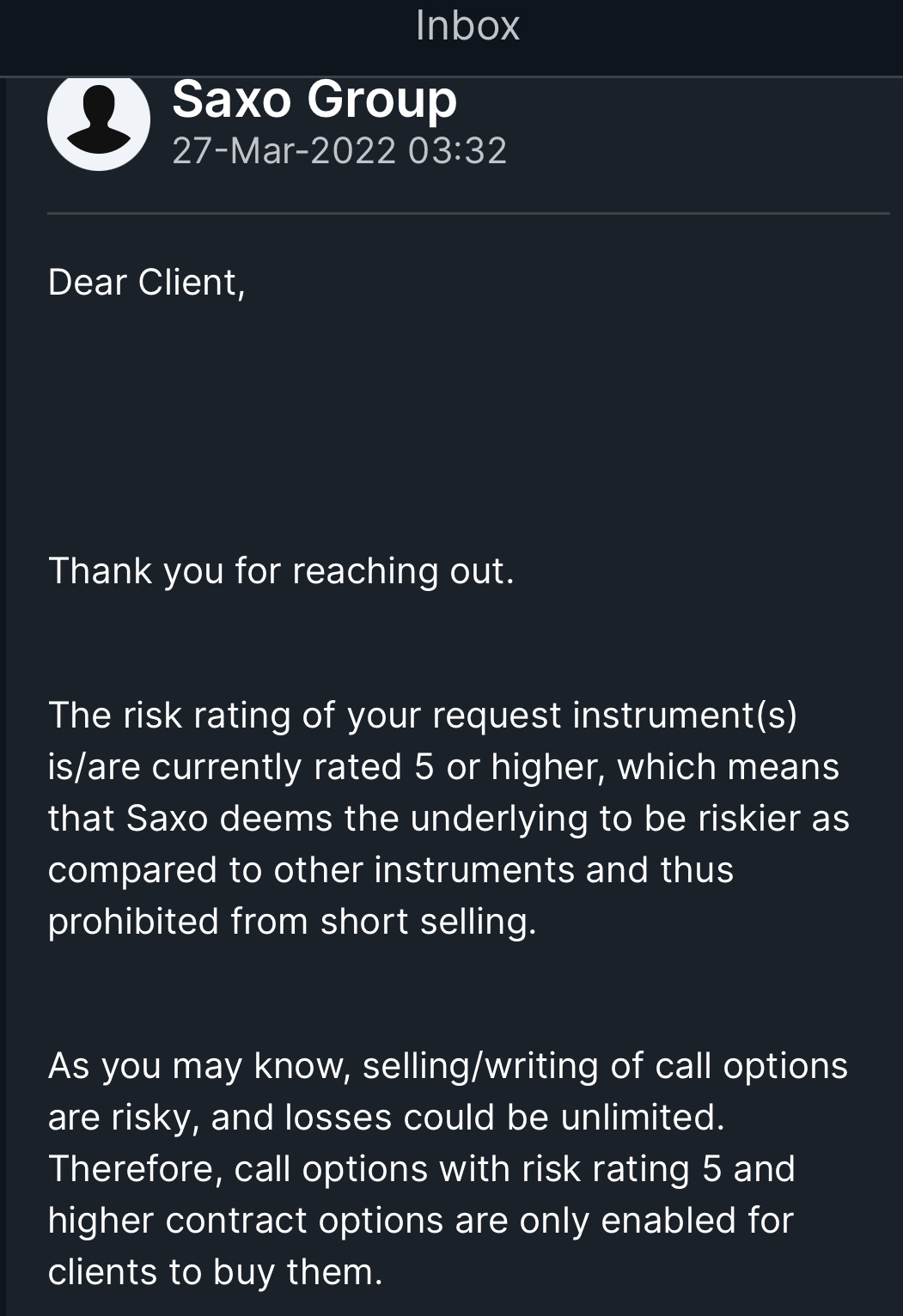

SAXO not allowing to sell Covered Call for Risk Rating 6 equities.

I was trying to sell Covered Call on Huya and TIGR but SAXO doesnt allow me to.

even if I own 100 shares of each stock.

Please take note.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments