After entering 2022, due to the recovery of energy demand and the influence of geopolitics, the global energy supply crisis continues to deepen.

In this context, OPEC + has become the focus of market attention, and its member countries include a large number of oil suppliers such as Saudi Arabia, Russia, United Arab Emirates and Iraq. Although in recent months, the call for OPEC + to increase production to alleviate the shortage of supply has become louder and louder, OPEC + still adheres to the production agreement reached by the organization since 2020.

According to the subsequent version of the agreement reached in 2021, OPEC + member countries will increase the total production by 430,000 barrels per day per month.

However, from the actual implementation situation, the recovery rate of OPEC + production is far lower than the production plan and market expectation.

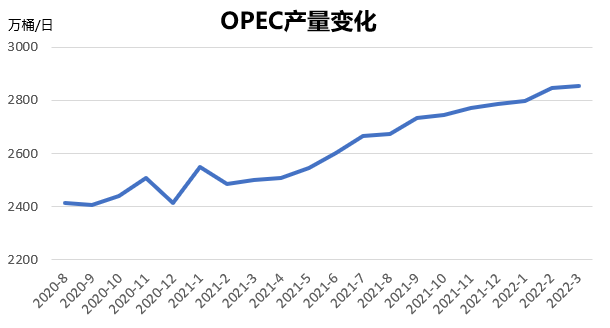

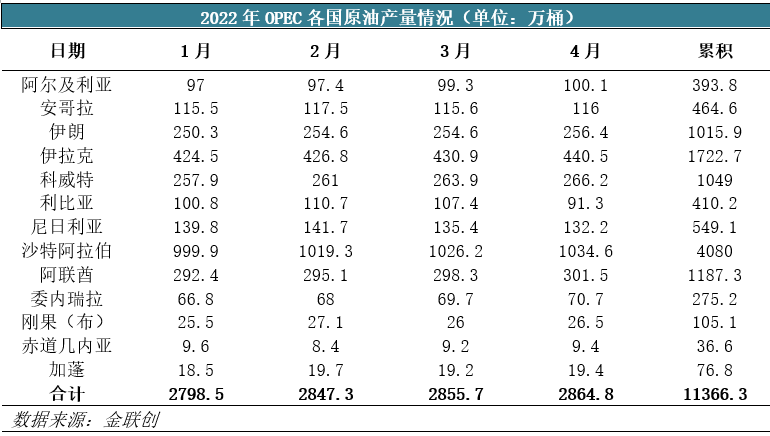

According to OPEC's latest monthly report,The crude oil output of 13 OPEC countries in April was 28.648 million barrels per day, an increase of 151,000 barrels per day compared with that in March.

OPEC + production recovery rate is not as fast as market expectations

On the one hand, from OPEC's point of view, except February, the daily output of OPEC crude oil from October 2021 to April 2022 did not reach the promised increase in production.

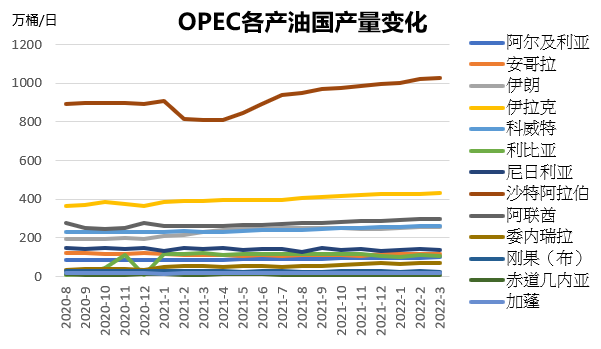

Saudi Arabia, as the leader of OPEC, has always been cautious about increasing production, and has differences with Europe, America and other countries on this issue. Among other oil-producing countries, under-investment and maintenance problems in Nigeria and Angola continue to hinder their oil production, while the domestic situation in Libya leads to frequent accidents, while Iran and Venezuela are currently subject to US sanctions, which makes it difficult to increase their production.

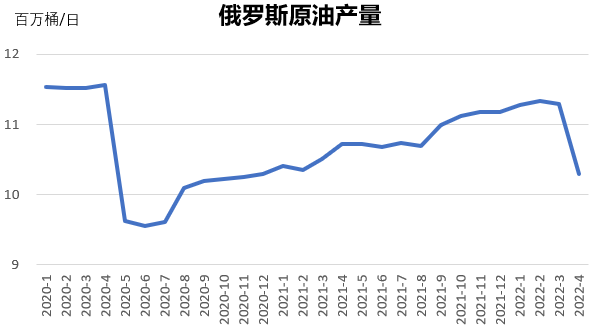

On the other hand, since the outbreak of Russia-Ukraine conflict, affected by European and American sanctions against Russia, the oil output of Russia, a major OPEC + oil producer, has declined.

Market data show that Russia's crude oil output has dropped from an average of about 11 million barrels per day in March to 10 million barrels per day in April.In addition, although no agreement has been reached within the EU at present, the new sanctions against Russia have explicitly banned the import of Russian crude oil. Once the ban is implemented, the daily output of Russian oil may further drop by 3 million barrels per day.

Outlook of the meeting: the energy supply crisis is still difficult to alleviate

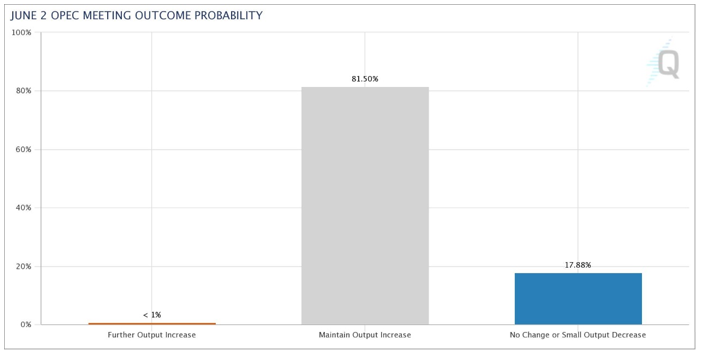

The 29th OPEC and OPEC + Ministerial Meeting will be held on June 2, 2022. Before the meeting, you can use the free analysis tools of Chicago Mercantile Institute OPEC Observation Tool (OPECWatch Tool), predicting the probability of meeting outcome.

According to the performance of WTI weekly options and monthly options due before and after the meeting, the tool obtains the probability, which is dynamic and will be updated with market changes. As of May 27, the forecast meeting has a high probability of maintaining the current production increase plan.

Looking at the prediction results of OPEC observation tools above, the logic behind it is not difficult to understand. As the OPEC + production limit agreement implemented in April 2020 is about to be Within OPCE +, a new production agreement is expected to be proposed at the OPEC + conference in the middle of the year. However, at present, OPEC's production plan is facing great pressure both internally and externally.

Internally, the first thing to pay attention to is whether OPEC's previously planned additional production increase can be implemented. In July 2021, OPEC + made a production base adjustment in response to the dissatisfaction of UAE and other countries with the production reduction agreement. According to the adjusted proposal, OPEC's previous production reduction will be fully resumed in June 2022, and additional production increase will be carried out in the second half of 2022. However, because the recovery of OPEC production is far lower than the market expectation, and the current energy market is in short supply, it is difficult for OPEC + Alliance to achieve its production increase target in 2022, so it is still unknown whether this part of the production plan will be adjusted.

Secondly, it is difficult for OPEC + production to increase significantly in the short term.Judging from the space for OPEC oil-producing countries to increase production, Saudi Arabia and UAE are almost the only OPEC oil-producing countries that have the ability to increase production substantially.

But even so, production growth in these two countries is facing problems. In Saudi Arabia, although Saudi Aramco plans to increase capital expenditure to develop new oil fields, it plans to increase crude oil production capacity from 11.5 million barrels per day to 13 million barrels per day in the next five years, with an annual planned production capacity increase of only 300,000 barrels per day, which leads to a decline in the elasticity of Saudi crude oil supply. The UAE has also made it clear that although the country continues to increase capital expenditure, counter-cyclical investment and develop new oilfields, it may take 3-5 years to increase production by 1 million barrels per day due to the influence of traditional oilfield development and production cycle, which is difficult to alleviate the problem of insufficient energy supply in the short term.

From the outside, with the increasing sanctions imposed on Russia by Europe, America and other countries, which side Saudi Arabia, which has built OPEC + oil-producing countries alliance with Russia, will stand has always been the focus of the market. In particular, Europe relies heavily on Russia's natural gas and oil exports. At present, the EU continues to find new energy suppliers, and OPEC oil-producing countries have become its targets. The Biden administration of the United States has asked Saudi Arabia to set an example more than once and increase crude oil production to alleviate the current global energy supply shortage.

On the whole, although countries such as Europe and America have made many efforts to reduce oil prices, the results are very little at present, and OPEC's production increase is still the main potential solution to solve the shortage of supply. However, due to various pressures from the United States, the relationship between OPEC major members and Russia tends to be close, and OPEC + is not active in increasing production at present. Therefore, if OPEC's production increase is still unsatisfactory in the later period, the crisis of insufficient supply will continue.

Let's talk about your views on the future trend of crude oil. Do you think crude oil will rise to 130 in the short term?

$NQmain(NQmain)$ $ESmain(ESmain)$ $CLmain(CLmain)$ $QGmain(QGmain)$ $NGmain(NGmain)$

Comments

👍🏼👍🏼