$FRENCKEN GROUP LIMITED(E28.SI)$

My 2 cents:

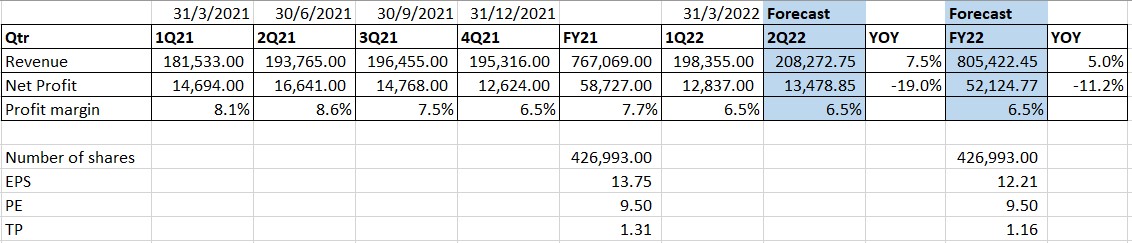

-Disappointed 1QFY22 performance due to lower profit margin amid higher revenue acheived.

-The group could not pass down the rising operation cost to customers, don't have strong moat on its business products and the company's businesses are competitve.

-Continue to push up revenue but sacrifice profit margin. Good for long term if the management is able to reduce cost or increase selling price.

Did a simple calculation, my target price to FY22 Frencken is 1.16 and is a sell call.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments