Nothing comes easy, right? A sentimentRivian (RIVN)– and its investors – can relate to right now.

As RBC’s Joseph Spak notes, the EV maker is “highly vertically integrated and is launching 3 new products (off two platforms) at the same time, in a new plant.”

As such, the company has plenty to deal with. “The production ramp was always one of the biggest near-term risks to the story, and we expected there would be some hiccups along the way,” the analyst went on to say.

And that has turned out to be true. Spak’s comments come in the wake of what has been a testing period. To make tweaks to the vehicle lines, Rivian shut down its plant in January. Additionally, according to CEO RJ Scaringe, more than 800 plant workers were out for a few weeks with Omicron. Getting hold of semiconductors remains an issue too.

With all the above as backdrop, Spak forecasts fewer deliveries than previously anticipated. The analyst has lowered 2022’s expected tally from 42,700 to 24,800. Consensus has 41,400. For 2023, Spak has “prudently” dropped his forecast from the prior ~100,000 (same as the Street’s) to ~80,000.

Rivian will announce Q4 earnings on March 10 and Spak will be hoping for guides on deliveries, revenue, gross margin, opex trends and capex plus an order update. By now, the analyst sees the first three of those metrics coming in below consensus.

While the near-term might have its fair share of challenges, Spak remains behind the EV startup.

“We believe that RIVN will sell as much as it can produce for a while, and we don’t want to over-emphasize near-term issues too much believing it doesn’t impact the medium/long-term story,” the analyst summed up. “We continue to view this phase as trial by fire but one that can help forge RIVN's DNA, setting it up for future success.”

That said, the RBC analyst cut his price target on Rivian stock from $165 to $116. Yet, the new figure still suggests room for ~128% growth over the next 12 months. Spak’s rating stays an Outperform (i.e., Buy).

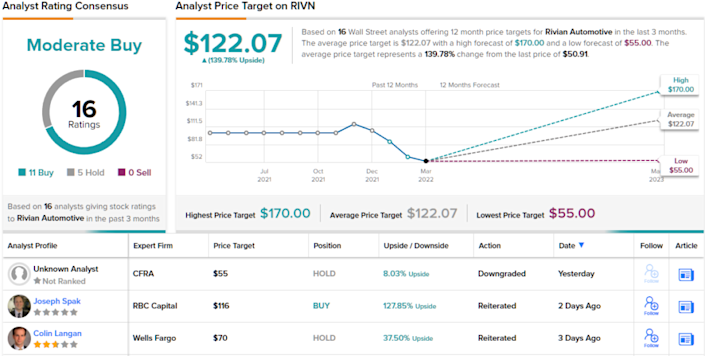

So, that’s RBC's view, let’s turn our attention now to rest of the Street: RIVN's 11 Buys and 5 Holds coalesce into a Moderate Buy rating. There’s plenty of upside – 139.78% to be exact – should the $122.07 average price target be met over the next months.

Nothing comes easy, right? A sentiment Rivian (RIVN)– and its investors – can relate to right now.

As RBC’s Joseph Spak notes, the EV maker is “highly vertically integrated and is launching 3 new products (off two platforms) at the same time, in a new plant.”

As such, the company has plenty to deal with. “The production ramp was always one of the biggest near-term risks to the story, and we expected there would be some hiccups along the way,” the analyst went on to say.

And that has turned out to be true. Spak’s comments come in the wake of what has been a testing period. To make tweaks to the vehicle lines, Rivian shut down its plant in January. Additionally, according to CEO RJ Scaringe, more than 800 plant workers were out for a few weeks with Omicron. Getting hold of semiconductors remains an issue too.

With all the above as backdrop, Spak forecasts fewer deliveries than previously anticipated. The analyst has lowered 2022’s expected tally from 42,700 to 24,800. Consensus has 41,400. For 2023, Spak has “prudently” dropped his forecast from the prior ~100,000 (same as the Street’s) to ~80,000.

Rivian will announce Q4 earnings on March 10 and Spak will be hoping for guides on deliveries, revenue, gross margin, opex trends and capex plus an order update. By now, the analyst sees the first three of those metrics coming in below consensus.

While the near-term might have its fair share of challenges, Spak remains behind the EV startup.

“We believe that RIVN will sell as much as it can produce for a while, and we don’t want to over-emphasize near-term issues too much believing it doesn’t impact the medium/long-term story,” the analyst summed up. “We continue to view this phase as trial by fire but one that can help forge RIVN's DNA, setting it up for future success.”

That said, the RBC analyst cut his price target on Rivian stock from $165 to $116. Yet, the new figure still suggests room for ~128% growth over the next 12 months. Spak’s rating stays an Outperform (i.e., Buy).

So, that’s RBC's view, let’s turn our attention now to rest of the Street: RIVN's 11 Buys and 5 Holds coalesce into a Moderate Buy rating. There’s plenty of upside – 139.78% to be exact – should the $122.07 average price target be met over the next months.

source:TipRanks

Comments