Bottom Line

Oil ETFs provide investors with exposure to the price of oil without taking direct possession of the asset.

What Are Crude Oil ETFs and How Do They Work?

Crude Oil ETFs are exchange-traded funds that seek to track the price of crude oil, less expenses. Oil ETFs provide indirect exposure to the price movements of WTI or Brent crude oil without having to physically hold the underlying asset. To achieve this objective, oil ETFs may purchase crude oil futures contracts.

Common uses of crude oil are to create engine fuel, such as gasoline, diesel, and jet fuel, as well as heating oils, tar, asphalt, and lubricating oils. Oil is a commodity that some investors use as a way to diversify a portfolio beyond traditional investment assets, such as stocks or bonds. There are currently 11 oil ETFs on the market, 7 of which are commodity-based crude oil ETFs. The other 4 oil funds are either leveraged, equity-based oil and exploration ETFs, or ETNs.

Note: WTI stands for West Texas Intermediate. Also called Texas light sweet oil, WTI is one of the three major oil benchmarks, along with Brent crude and Dubai/Oman. Light sweet oil has a low density and low sulfur content, which makes it easy to refine. Brent crude is mostly drilled from the North Sea and is the most traded of all oil benchmarks. Dubai/Oman is pricing reference for crude oil delivered primarily from the Middle East Gulf, Russia, and Mexico.

Evaluating an Oil ETF

As with any other investment type, the process of choosing the best oil ETFs to suit an investor's needs may begin by narrowing down the choices with an ETF screener. Most screeners will include oil ETFs within the commodities category or asset class and then in the "commodities focused" sub class.

Some of the selection criteria investors can use for evaluating oil ETFs are:

Performance: 1-year return is the primary selection criteria for evaluating performance on our list of top oil ETFs. However, investors are wise to also review longer periods, such as 3-, 5-, and 10-year returns before considering the purchase of shares.

Expenses: When ETFs track the same index or commodity, the one with the lowest expense ratio will typically outperform those with higher expenses. The oil ETFs on our list have lower expense ratios than other ETFs tracking the price of a crude oil benchmark.

Structure: Many Oil ETFs are structured as partnerships; whereas, most equity and bond ETFs are structured as open-ended investment companies. Some oil funds are structured as ETNs, or exchange-traded notes, which are debt securities that track an index. Our list of oil ETFs does not include ETNs.

Objective: To make our list of top oil ETFs list, only those that seek to track the price of crude oil, less trust expenses, are considered. Other oil ETF objectives and strategies, such as gas and natural gas ETFs, oil and gas exploration ETFs, inverse ETFs and leveraged ETFs were ignored for this list.

Portfolio holdings: ETFs that track the price of crude oil don't have holdings like stock or bond mutual funds; they typically hold futures contracts that track the price of an oil benchmark.

Quant Ratings and Factor Grades: Seeking Alpha’s Quant Ratings and Factor Grades can be used for evaluating stocks or ETFs. In this article, we provide Factor Grades, which rate ETFs by five "factors" - Momentum, Expenses, Dividends, Risk, and Asset Flows. To do this, we compare the relevant metrics for the factor in question for the ETF to the same metrics for the other ETFs in its asset class. The factor is then assigned a grade, from A+ to F.

Important: Oil ETFs that are structured as limited partnerships treat shareholders as partners, not as investors. Because of this, these funds are pass-through investment vehicles and instead of paying federal taxes at the fund level, they pass along annual income and gains/losses to the partners/fund shareholders. Therefore, these futures-contracts ETFs provide investors with a Schedule K-1, instead of Form 1099, to report the capital gains allocated to them each year.

3 Best Performing Oil ETFs

To make our list of best oil ETFs, we measure the top performance for 1-year returns, through January 31, 2022. Investors should keep in mind that past performance is no guarantee of future results and that oil ETFs invest in futures contracts, which can produce large, unpredictable swings in price.

1. United States Oil Fund ETF

United States Oil Fund ETF ($(USO)$) is an exchange-traded fund that seeks to track the price, in percentage terms, of the spot price of light sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in the Benchmark Oil Futures Contract.

As of date: January 31, 2022

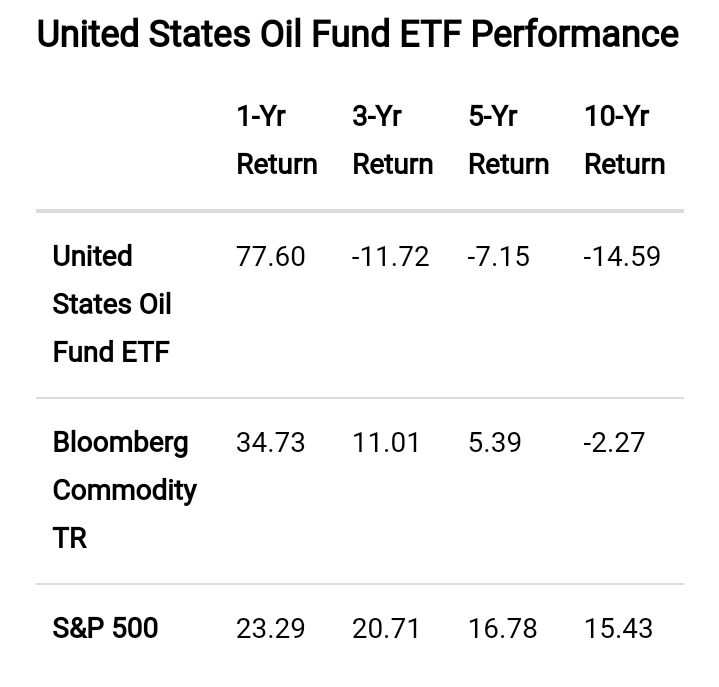

1-year performance: 77.60

Expense Ratio: 0.83%, or $83 annually for every $10,000 invested

Annual Dividend Yield: None

Three-Month Average Daily Volume: 8.4 million

USO significantly outperforms the broader index, Bloomberg Commodity TR, as well as the U.S. equity index, S&P 500, for the 1-year return. However, USO's longer period returns are far lower compared to a basket of commodities or to the S&P 500.

Here is where a $10,000 investment in USO, 1 year, 3 years, 5 years, and and 10 years ago, would be as of January 31, 2022:

1 year ago: $17,600

3 years ago: $6,880

5 years ago: $6,901

10 years ago: $2,066

USO ETF Structure, Objective & Holdings

Inception Date: 04/10/2006

Sponsor: United States Commodity Funds LLC

Ticker: USO

Primary exchange: NYSE Arca

Structure: Partnership

Objective: Track the price of WTI crude oil.

Holdings: WTI crude oil futures.

2. United States Brent Oil Fund LP ETF

The United States Brent Oil Fund LP ETF $((BNO)$) is an exchange-traded fund that seeks to track the daily price movements of Brent crude oil. BNO's benchmark is the near-month futures contract traded on the ICE Futures Exchange.

As of date: January 31, 2022

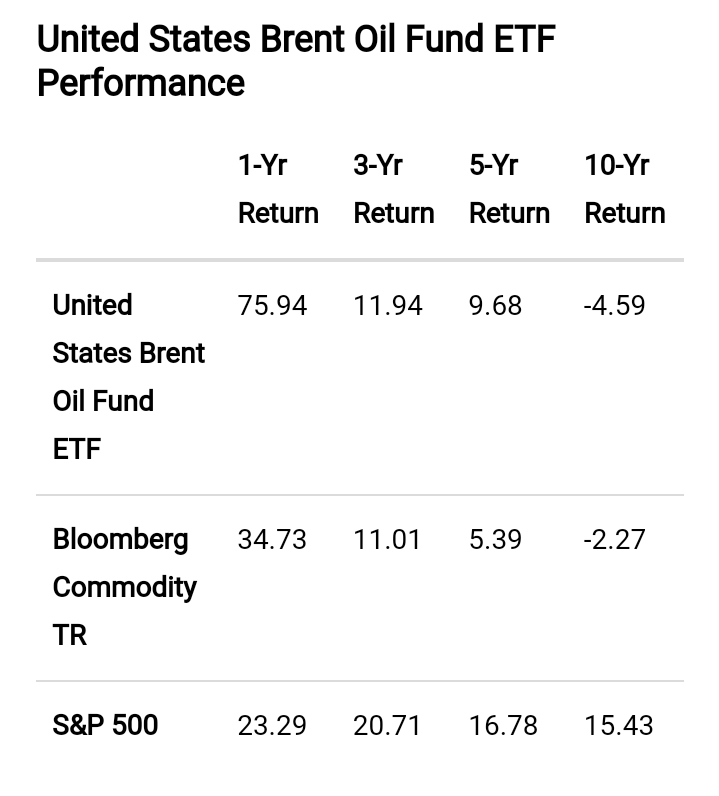

1-year performance: 75.94%

Expense Ratio: 0.90%, or $90 annually for every $10,000 invested

Annual Dividend Yield: None

Three-Month Average Daily Volume: 1.9 million

BNO significantly outperforms the broader index, Bloomberg Commodity TR, as well as the U.S. equity index, S&P 500 for the 1-year return. BNO's returns also outperform the commodity index in longer periods. However, USO's longer period returns are far lower than the S&P 500.

Here is where a $10,000 investment in BNO, 1 year, 3 years, 5 years, and 10 years ago, would be as of January 31, 2022:

1 year ago: $17,594

3 years ago: $14,027

5 years ago: $15,782

10 years ago: $6,251

BNO ETF Structure, Objective & Holdings

Inception Date: 06/01/2010

Sponsor: United States Commodity Funds LLC

Ticker: BNO

Primary exchange: NYSE Arca

Structure: Partnership

Objective: Track the price of Brent oil.

Holdings: Brent crude oil futures.

BNO ETF Quant Rating Grades

3. K-1 Free Crude Oil Strategy ETF

ProShares K-1 Free Crude Oil Strategy ETF ($(OILK)$) seeks investment results, that track the performance of the Bloomberg Commodity Balanced WTI Crude Oil Index. OILK is the first crude oil ETF that does not issue a K-1 to its shareholders, which may be attractive to some investors who wish to invest in oil ETFs but instead receive a 1099.

As of date: January 31, 2022

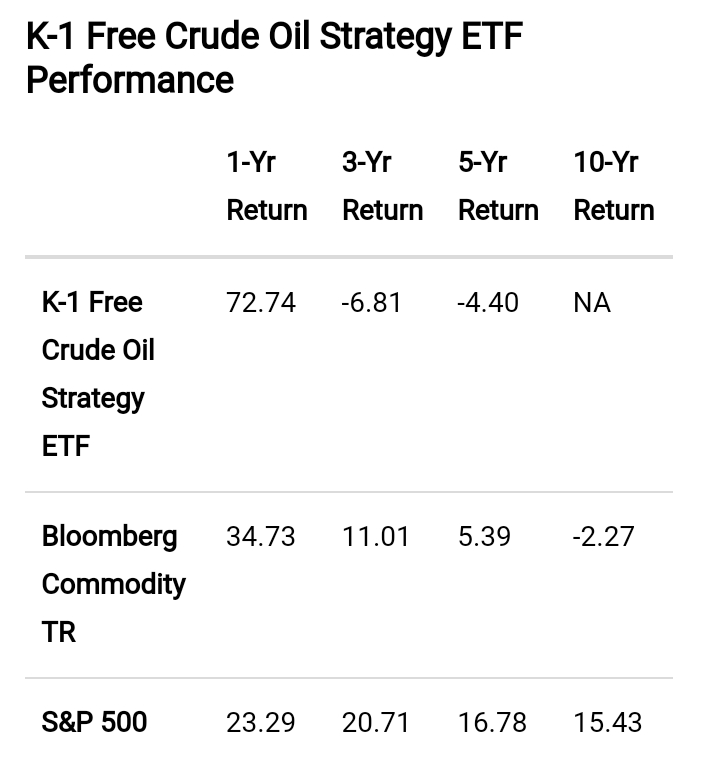

1-year performance: 72.74

Expense Ratio: 0.67%, or $67 annually for every $10,000 invested

TTM Yield: 43.77%

Average Daily Volume: 47,744

USO significantly outperforms the broader index, Bloomberg Commodity TR, as well as the U.S. equity index, S&P 500, for the 1-year return. However, USO's longer period returns are far lower and negative, compared to a basket of commodities and to the S&P 500.

Here is where a $10,000 investment in OILK, 1 year, 3 years, and 5 years ago, would be as of January 31, 2022:

1 year ago: $17,274

3 years ago: $8,093

5 years ago: $7,985

OILK ETF Structure, Objective & Holdings

Inception Date: 09/26/2016

Sponsor: ProShare Advisors LLC

Ticker: OILK

Primary exchange: BATS

Structure: Open Ended Investment Company

Objective: Track the price of WTI crude oil.

Holdings: WTI crude oil futures contracts.

Tip: In many cases, commodity ETFs with the lowest expense ratio outperform their peers with higher fees, but that is not always the case. Different ETFs can use different investment methods and experience different degrees of tracking error.

Oil ETFs seek to replicate the price movement of an oil benchmark, such as the WTI or Brent crude. Many oil ETFs utilize futures contracts, so shareholders of these ETFs do not take possession of the physical asset. Investors should keep in mind that the price of oil can significantly fluctuate in the short term.

Comments