1. Starbucks

Starbucks $星巴克(SBUX)$is one of the largest coffee chains in the world with more than 34,000 stores worldwide. The company has demonstrated its resilience during the pandemic even though it had to temporarily shut the bulk of its stores.

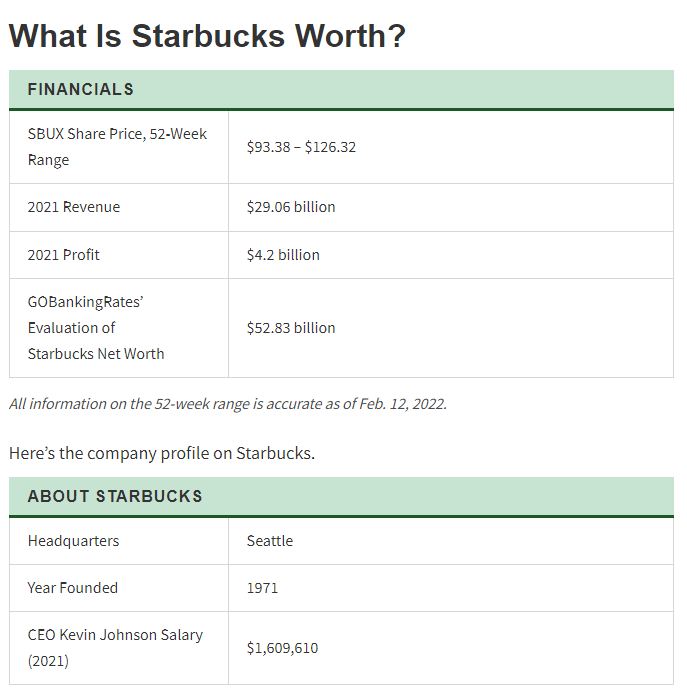

Net revenue for its fiscal year 2020 (ended Sept. 30) dipped to $23.5 billion from $26.5 billion in the previous year but has surged to $29.1 billion in fiscal 2021 as economies reopened. Net income has also shown a similar pattern, falling sharply from $3.6 billion in 2019 to $928 million in 2020, only to rebound to $4.2 billion in the following year.

Its momentum has continued into the first quarter of 2022 with 19% year-over-year growth in revenue to $8.1 billion. Its loyalty program, Starbucks Rewards, also saw membership in the U.S. surge by 21% year over year to 26.4 million. Net income jumped by 31% year over year to about $816 million. The company also increased its quarterly dividend from $0.45 to $0.49, its 11th consecutive yearly increase.

When Starbucks issued its guidance for the fiscal year 2022 in its fourth-quarter 2021 earnings report, it said it expected to see global comparable store sales growth increase in the high single digits and global net new Starbucks stores increase by 2,000. In addition, it anticipated global revenue between $32.35 billion and $33.08 billion — a solid increase over its $29.1 billion revenue for 2021. During the first-quarter 2022 earnings call, Ruggeri reiterated Starbucks’ comparable store sales growth and revenue guidance but revised its earlier margin and earnings guidance to reflect high inflation levels and an industry-wide labor shortage.

Last year, the company announced that it would increase wages in 2022 to attract and retain talent. By this summer, all hourly retail workers in the U.S. will average almost $17 an hour.

One way Starbucks encourages stability in its share price is by buying back stock, thereby reducing the number of outstanding shares. Between the buybacks and dividends, Starbucks still expects to return $20 billion to shareholders over the next three years.

2. Apple

The company has over 25 manufacturing units in different countries. Apple Inc. $苹果(AAPL)$ Is considered as the five greatest companies in the IT sector of America with some of the big guns like Microsoft, Google, Amazon and Facebook. Though the products are very expensive but the quality of their products is unmatched and that’s the very reason of their success. The logo itself is kind of a status symbol for many.

Apple is a pioneer in smartphones, which heralded an entirely new industry and spawned a wave of app developers. Today, it also manufactures iPads and wearables like its Apple Watch, and offers services including Apple TV and iCloud.

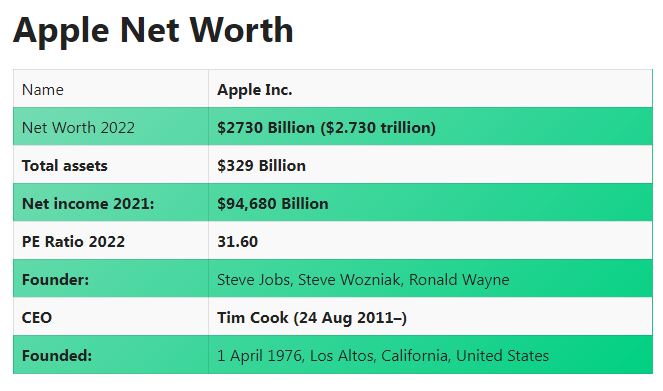

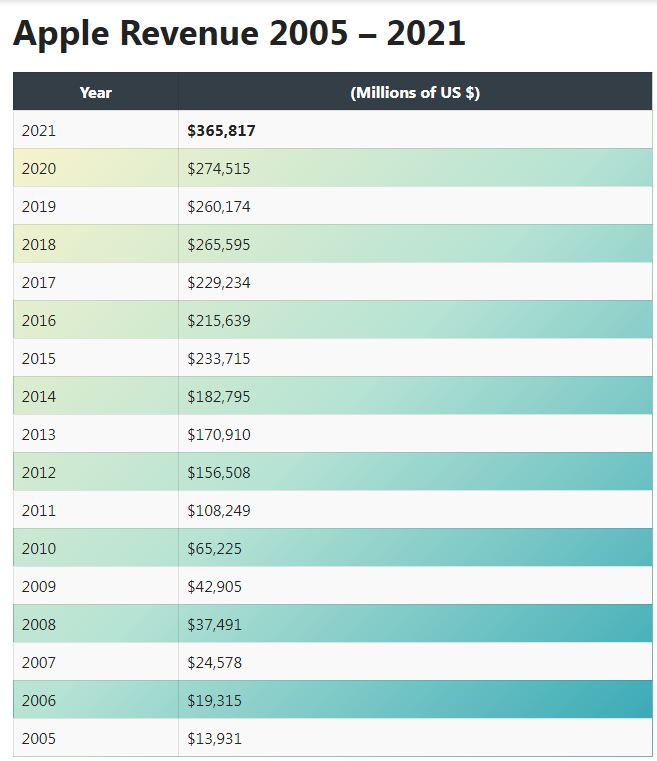

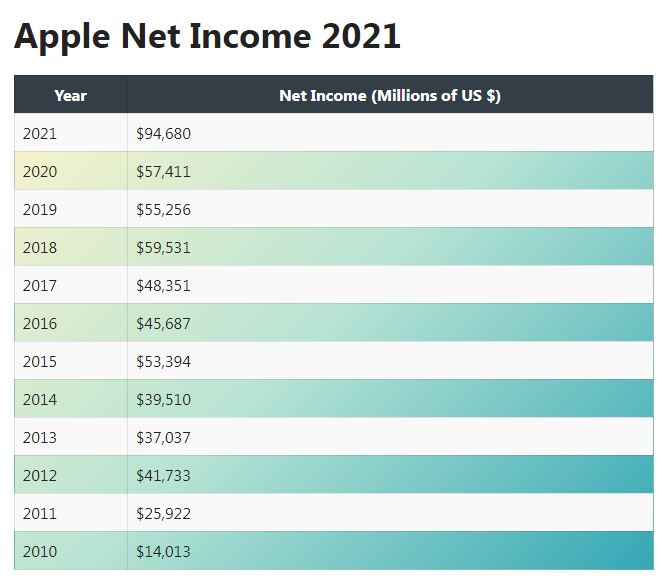

Apple Net Worth is $2.730 Trillion ($2730 Billion) in 2022: Apple Becomes First who have touched $3 Trillion mark. Net sales rose from $260.2 billion in 2019 to $365.8 billion by 2021, while net income soared from $55.3 billion to $94.7 billion over the same period. The company as a whole worth more than many other companies combined. iPhone despite their high cost holds the third place in terms of highest sold smartphones. In terms of other electronic devices and gadgets too Apple holds a commanding position. Its Air Pod these days is becoming a sensation as earlier Apple used to sell massive amount of iPod. The company is trying its level best to become feasible for everyone and to broaden its services.

Apple has continued its innovative streak by releasing a new iPhone and Apple Watch every year to much fanfare, and its loyal base of customers should ensure its brand stays at the top of people's minds.

The company continued to report an impressive set of earnings for its 2022 first quarter with net sales rising 11.2% year over year to $123.9 billion and net income jumping by 20.4% year over year to $34.6 billion. Aside from its rapid growth, Apple has also steadily increased its quarterly dividend since it started paying one in 2012.

Investors should rest assured that Apple can continue to wow its audience with cool, new products while increasing its services revenue over time, leading to an overall higher gross margin and, consequently, higher earnings and dividends.

Apple Inc. Is undoubtedly the most successful company ever and its shares and value costs more than any other. If Steve Jobs was alive then he surely would’ve been the richest person in this world. There isn’t any specific award which the company has won. Also there isn’t a lot of knowledge too about the awards and nominations which the company has witnessed.

3. PepsiCo

PepsiCo products are enjoyed by consumers more than one billion times a day in more than 200 countries and territories around the world. PepsiCo generated more than $79 billion in net revenue in 2021, driven by a complementary beverage and convenient foods portfolio that includes Lay's, Doritos, Cheetos, Gatorade, Pepsi-Cola, Mountain Dew, Quaker, and SodaStream.

Moving on to snacks and beverages, PepsiCo $百事可乐(PEP)$is one of the market leaders in this industry. As the owner of famous global brands like Pepsi-Cola, Lay's, Mountain Dew, and Doritos, the company commands the pole position in the snacks market and has a strong second position in the beverages industry.

PepsiCo has recorded a steady increase in revenue from 2018 through 2021, rising from $64.7 billion to $79.5 billion. That growth occurred even throughout the pandemic while net income rose by 7% year over year for 2021 to $7.6 billion.

The company has also been a consistent dividend payer and earlier this month announced a 5% increase in its quarterly dividend to $1.075 per share. Last year was PepsiCo's 49th consecutive dividend increase, which means the company is just a year shy of becoming a Dividend King.

PepsiCo believes there is still significant room for growth. In the global beverages industry, it estimates that it has just a 9% share in a market that is worth around $570 billion. For global snacks, it has a 7% share in a $550 billion market. Both markets are projected to grow around 4% to 5% per year for the next five years, opening up ample opportunities to grow its top and bottom lines.

Comments

I must start to snack soon. 😋