Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like $OVERSEA-CHINESE BANKING CORP(O39.SI)$ . Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

How Fast Is Oversea-Chinese Banking Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Like a wedge-tailed eagle on the wind, Oversea-Chinese Banking's EPS soared from S$0.80 to S$1.08, in just one year. That's a impressive gain of 35%.

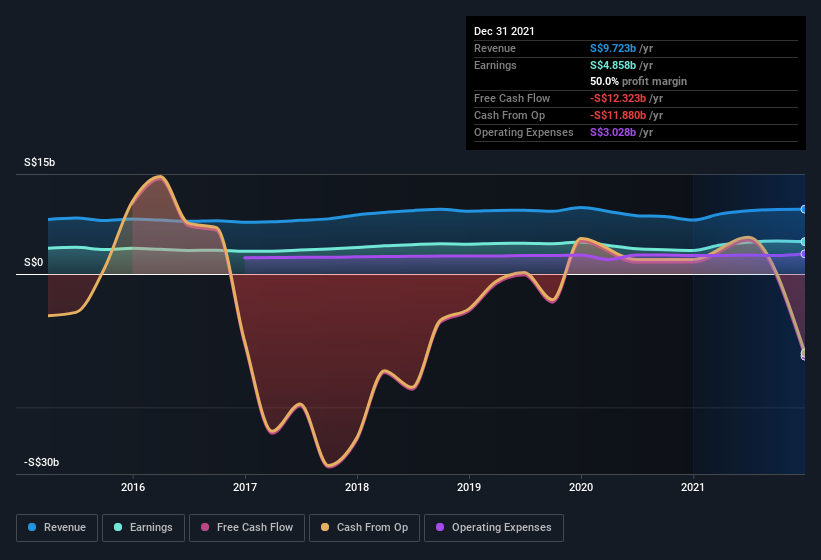

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Oversea-Chinese Banking's revenue this year is revenue fronm operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Oversea-Chinese Banking maintained stable EBIT margins over the last year, all while growing revenue 20% to S$9.7b. That's a real positive.

Are Oversea-Chinese Banking Insiders Aligned With All Shareholders?

Are Oversea-Chinese Banking Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One positive for Oversea-Chinese Banking, is that company insiders paid S$18k for shares in the last year. While this isn't much, we also note an absence of sales.

Along with the insider buying, another encouraging sign for Oversea-Chinese Banking is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth S$260m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Is Oversea-Chinese Banking Worth Keeping An Eye On?

You can't deny that Oversea-Chinese Banking has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares.

Comments