When markets turn volatile as a reaction to political turmoil as well as the promise of rising interest rates to combat rising inflation, smart investors need to remember the importance of dollar-cost averaging when buying stocks.

Whether starting a new position by buying in thirds or adding a few bucks every week (thanks to fractional shares), it is going to be advantageous to your portfolio long-term to continuously add money to the market -- regardless of where we are in an economic cycle.

With that in mind, let's look at three high-growth stocks that are great candidates fordollar-cost averaging, especially after being roughed up by the market recently.

1. SoFi Technologies

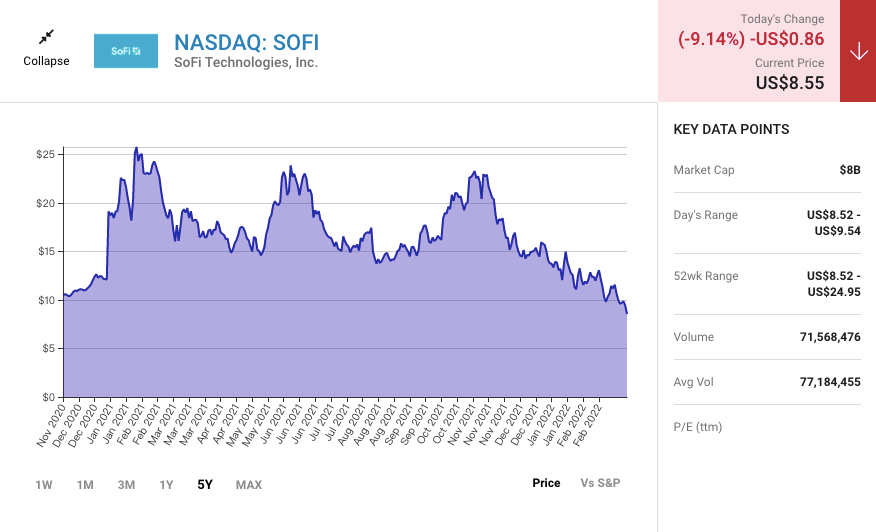

Following its 2020initial public offering(IPO), financial technology specialistSoFi Technologies($SoFi Technologies Inc.(SOFI)$ has been one of many volatilespecial-purpose acquisition companies(SPACs) to hit the markets in the last couple of years.

$SoFi Technologies Inc.(SOFI)$ is trading within a share price range of $9 and $24, and its current mark of $10 is almost exactly where it was at its IPO, suggesting it might be worth a second look.

Through its mission "to help people reach financial independence to realize their ambitions," SoFi operates across three business segments: lending, its Galileo Technology platform, and financial services. Initially famous for its new-age approach to helping people refinance student loans, it has quickly blossomed into a full-service fintech.

Thanks to this operational expansion, SoFi has seen a massive uptake in its offerings across the board, posting 87% member growth and 54% sales growth year over year for the fourth quarter. The company has almost quadrupled its customer count in just the last two years and now has nearly 3.5 million members.

In addition to this member growth, what makes SoFi attractive to investors is its tremendous product optionality. First, its young financial services unit (think checking, savings, investing, credit cards, etc.) quintupled its revenue year over year during the fourth quarter, strengthening SoFi's overall ecosystem.

Second, its$1.1 billion all-stock acquisition of Technisysshowed its ambitions to be the go-to provider for any behind-the-scenes infrastructure needed by fintech companies. Paired with Galileo, which holds a dominant share of the neobank processing market in North America, SoFi is ready to power transactions in an increasingly digital world.

Thanks to this optionality and management's guidance for $180 million in earnings before interest, taxes, depreciation, and amortization (EBITDA) in 2022, SoFi is poised to grow well beyond its current market capitalization of $8 billion.

2. Upstart Holdings

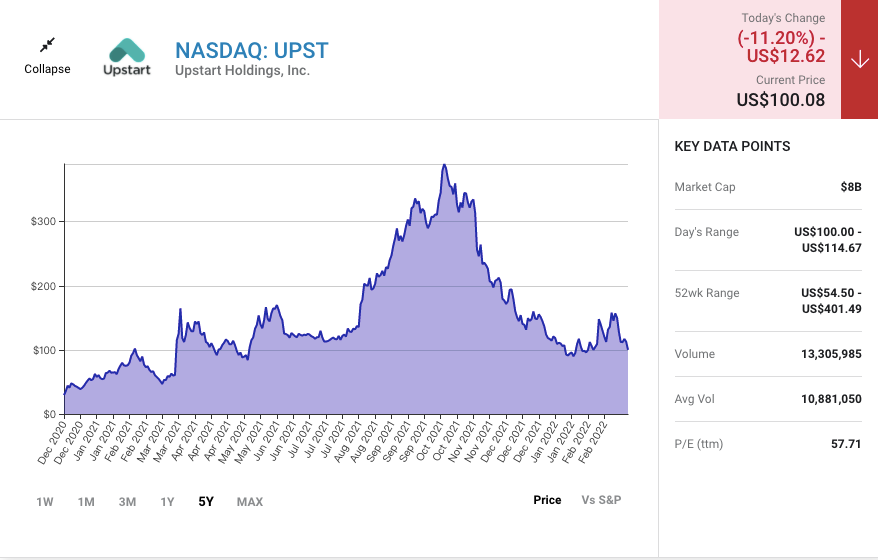

Upstart Holdings($Upstart Holdings, Inc.(UPST)$ )is reimagining the way credit risk is analyzed by usingartificial intelligence(AI) andmachine learning, and it grew annual sales 264% year over year for 2021. Posting massive growth like this has made Upstart's share price incredibly volatile, as the market grapples with trying to pin a valuation on the young credit-risk specialist.

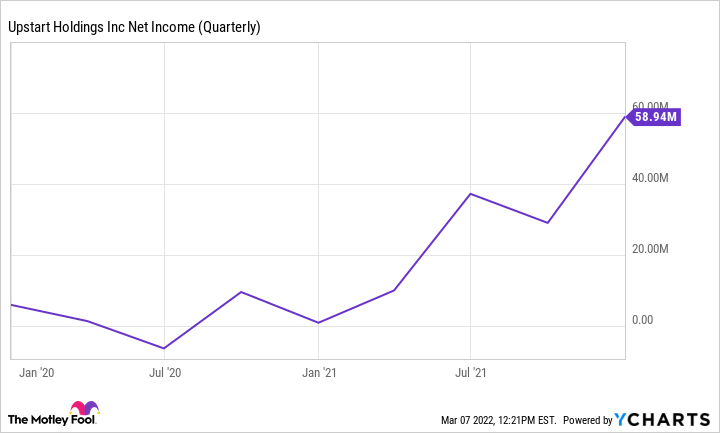

Despite this volatility and its incredible growth measurements, Upstart offers something most of its high-flying growth and technology peers do not: profitability.

Upstart has quietly developed a highly profitable growth machine with a 16% profit margin by connecting consumers to its banking partners through its AI-powered lending platform.

Best of all, despite working in the intimidating world of lending and credit risk, 94% of the company's revenue comes from banking fees and services that expose it to no actual credit risk, such as loan performance. Furthermore, during the fourth quarter of 2021, 70% of consumers were instantly approved for a loan without needing to provide further documentation or contact customer service.

This automation creates a win-win-win for consumers, banks, and investors alike and should only grow stronger as Upstart's AI improves. Its stock might look expensive trading at 70 times earnings, but if you are willing to let time work on your side and allow it to continue growing at an incredible rate, it should be a profitable investment.

3. Global-e Online

Global-e Online($Global-E Online Ltd.(GLBE)$ )is becoming a force in the worldwide e-commerce market by enabling global direct-to-consumer (DTC) sales to entrepreneurial start-ups and large businesses alike. With its suite of cross-border e-commerce solutions, Global-e generates revenue through service fees and fulfillment services, which account for 39% and 61% of sales, respectively.

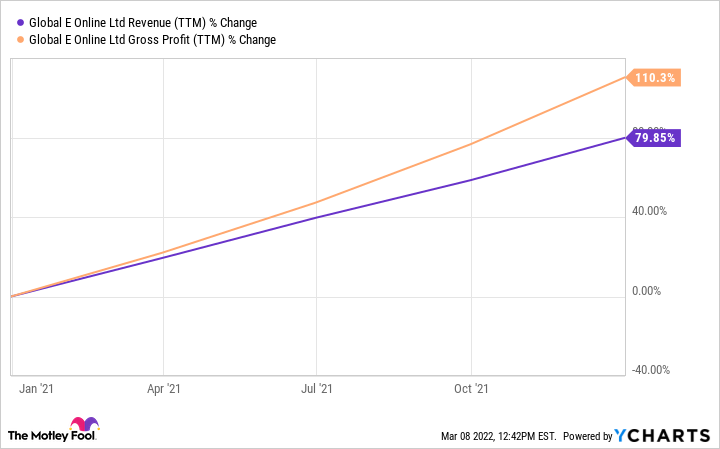

The company appears to be firing on all cylinders, growing gross merchandise volume by 87% and revenue by 80% year over year in 2021.

Global-e stock trades at more than a 50% discount to its 52-week highs (despite this incredible growth) due to the sell-off hammering the high-growth technology market. With this drop now factored in, Global-e's potential in the e-commerce market might prove to be much larger than its current market capitalization of $5 billion, especially considering its recent partnership withShopify.

This partnership enables Shopify-based merchants -- like DTC surgical scrubs specialistFigs-- to merge onto the Global-e platform and find customized, local solutions for each of the international markets they target. Considering that Shopify already accounts for 10% of e-commerce sales in the U.S., this partnership could be a win-win as Shopify expands internationally and Global-e grows alongside this success.

Global-e is also seeing improving margins on top of rapid growth.

This time frame, although admittedly brief, does highlight the improving efficiencies across the company. That improvement helps support management's guidance for $40 million in EBITDA in 2022.

This guidance shows that true profitability might not be far off despite the company being in a high-growth mode. Even with Global-e's price-to-sales ratio of 18, the company's growth rates, improving margins, and partnership with Shopify have it well-positioned to one day become a multibagger from today's prices -- and make it an excellent candidate for dollar-cost averaging.

Source: fool.com

Comments