Recap: Mid-Life Crisis

When I used the term "peak Facebook" in my previous article, I wasn't saying that Facebook is dead - rather the opposite: Facebook is at its peak. Of course, the implication is that it's downhill from here, which I was intentionally implying.

These two things occurred almost simultaneously and mark Facebook's mid-life peak (I'll elaborate on that term in a minute):

- Facebook changed its name to "Meta"

- Facebook saw its users drop for the first time ever

The latter is a quantitative fact that points to Facebook's adoption being "as-good-as-it-gets." The former is qualitative but equally important as the hard numbers: Even the CEO, who is coincidentally approaching middle-age himself, is trying to change the company's image. While I'm certainly being tongue-in-cheek about this analogy, big changes really do seem to coincide with mid-life crises. Consider Zuckerberg's new policy of calling his employees "Metamates" and his trend-chasing with Reels as a response to the popularity of TikTok. The point is that even its founder knows that Facebook has reached its potential, and now it is time for the company to step away from its reliance on this single platform.

If anything, the name change is bullish for Meta, the company. Yet it is still bearish for Facebook, the company's primary source of revenue. The name change represents a fundamental change in FB as a stock: Facebook is no longer a growth asset but a value asset; Meta's endeavors represent potential future growth.

Investing In FB Is Now Speculating

Here is our first criticism to address: "Facebook isn't the only thing Meta does." This statement, while true, hides an important idea: If you are investing in FB for growth, you are speculating on non-Facebook endeavors, as Facebook's growth has at least slowed considerably, if not peaked. More specifically, you are banking on the metaverse. Even more specifically, you're banking on Meta's version of the metaverse versus its many potential competitors, such as Roblox (RBLX).

An investment in FB at this point is then speculation. No metaverse model has yet proved to be profitable. The metaverse concept has yet to be implemented to where we can see how unique selling propositions differ among the major players.

Even if you assume that the metaverse will be the next hot thing, investing via FB is likely a poor idea just based on the audience. The metaverse idea is most likely to appeal to a younger audience. Meta's audience tends to be older. In my opinion, Meta will find it difficult to leverage this older demographic.

To put it another way, consider Meta's metaverse as an already established platform but a company separate from FB. Would it make sense for FB and this hypothetical metaverse company to merge? I think news of the merger would be met with confusion: The audience doesn't match the product. It would be akin to Microsoft (MSFT) acquiring TikTok to leverage its cloud enterprise business instead of LinkedIn (which was a perfect audience-to-platform match, in my opinion).

I am not saying that Meta's metaverse will not be successful, but I am saying that if you are long FB for this reason, you really need to have a good reason as to why Meta is more likely to pull off the metaverse idea as compared to other candidates. Meta lacks the background. It lacks the audience.

To me, the only reason to hold FB long is the Facebook platform. However, at present, Meta is diverting resources away from Facebook. I wouldn't invest in Michael Jordan during his baseball stint; I'd wait for him to return to basketball.

Facebook Is Failing Its Value Transition

The other common criticism I received was that I am overemphasizing a single quarter's results. Perhaps this quarter's earnings doesn't mean much in the long term. Indeed, every company has a bad quarter.

If this quarter was merely a one-off slip-up, then I doubt we would have seen $200B worth of value be wiped out in one day. Many investors saw what I see: The growth phase is over. There comes a time for every growth stock to become a value stock, and this - in my experience - coincides with a change in the emphasis of metrics.

Monthly and daily active users are important in the growth phase for a company such as Facebook, as users are the product. Don't forget that Facebook is essentially a B2B platform; the company's revenue comes from businesses advertising to the platform's users. MAUs are often the major selling point for advertisers and represent the competitiveness of a company attempting to court advertisers.

Once a company stabilizes, profitability becomes key. Investors want to know how a company is leveraging its assets. This shift occurring at the same time as Meta is diverting its attention away from its proven money-maker is not good for the stock.

Meta seems to be refusing to become a value stock, but its growth alternative is highly speculative. The metaverse is a gamble funded by value investors. In other words, the company is forcing all investors into this gamble; there is no way to invest in Meta's successful Facebook asset without exposing yourself to a highly unproven wager on the future of the internet.

Facebook Is Fragile

Another criticism I received was that Facebook still has billions of users and thus won't be disappearing anytime soon. Indeed, Facebook has nearly 2B daily active users. Let's do some quick math to see just how much 2B really is:

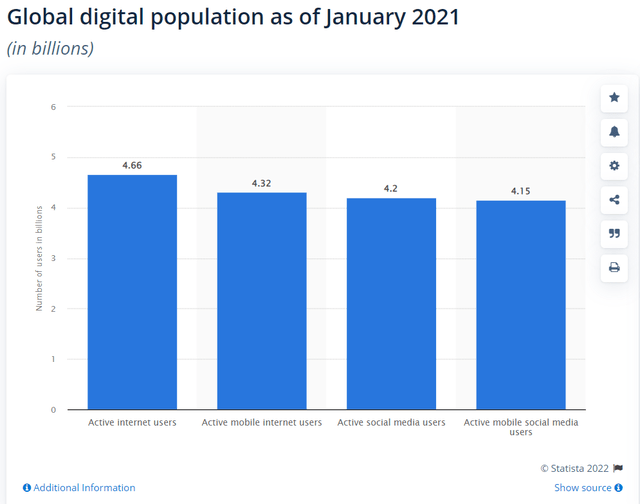

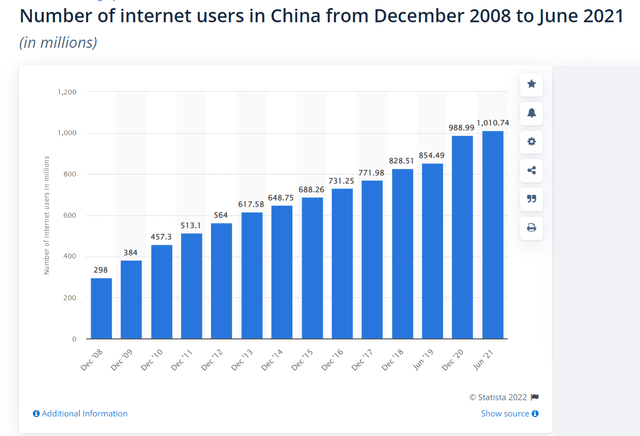

Subtract 1B internet users in China (because China bans Facebook) from the world total of 4.66B internet users, and you get 3.66B. Two billion users on Facebook implies that more than half the world's internet users are using the platform. That's a lot of penetration!

But Facebook is fragile still. Consider all of the potential threats to its status:

- New regional blocks (e.g., Russia)

- Border changes (e.g., China annexing Taiwan, which has thelargest Facebook penetration by percentage)

- New platforms taking market share in younger demographics (e.g., TikTok)

- Engagement falling among users (i.e., profit-per-user falling, resulting in lower EPS)

- Cannibalization (e.g., Meta's metaverse supplanting Facebook)

- Talent leaving for hotter tech or being siphoned into the metaverse venture

Thinking that Facebook is safe by mere merit of its number of users is the same thought process employed in the 1990s in regard to America Online. In fact, Facebook is even more fragile than AOL, as its revenue source - advertisers - is more fragile than AOL's (subscription fees). AOL died out quite suddenly due to competitors offering more flexibility at lower prices. Facebook has competitors coming at it from many more angles, and even Meta itself is working on a platform that could draw users away from Facebook.

I do not believe that Meta can reasonably fight all the competitors that come for the Facebook userbase. Although Facebook is a B2B business, its userbase is its lifeblood. Facebook's advertisers don't have multiyear contracts tying them to the platform and can easily divert their advertising budget to other platforms once they see the userbase leaving - or once they see engagement falling. With advertisers leaving, Meta's revenue and earnings naturally fall, and the stock price along with them.

If only Meta could find a way to shift its focus on raising engagement in a key group of Facebook users unlikely to leave the platform (i.e., the older demographic, which happens to have a lot of spending power) so as to create a cash-generating machine with a reliable future regardless of the future tech trends. But Meta's current focus is on creating those future tech trends. These two focuses are at odds within a single company.

Conclusion

An easy solution to the FB-and-Meta-under-the-same-ticker problem is a spin-off. But Zuckerberg, holding 58% of FB's voting shares, seems gung-ho on the metaverse. His renaming of Facebook to Meta (instead of creating a parent-child company, as Alphabet did with Google) makes implicit the unlikeliness of a spinoff in the near future, and we are left with a Frankenstein's monster of a stock in which investors must either (1) speculate on the questionable metaverse while investing in the digital advertising business that is Facebook or (2) be invested in "Peak Facebook" in order to gain exposure to the metaverse. Neither growth investors nor value investors benefit from this situation.

Even so, I still believe that FB investors can benefit by thinking of Meta and Facebook as separate companies combined into two stocks. If so, for now, these two facts must drive your FB investment:

- Facebook is losing users

- The metaverse is yet unproven

An investment in FB is thus an investment in a company on a downward trajectory plus a speculative bet on an experimental new technology. If you are investing for value, the speculation side is adding increased risk. If you are investing for growth, the underlying fundamentals are likely to drag your investment down while you wait for your payoff.

Overall, no matter what kind of investor you are, an investment in FB seems lose-lose to me.

Source:Seeking Alpha

Comments