Good afternoon my tiger friends, we had a very suspenseful week, it worth spending time to go over.

I opened a SPY PUT option as a hedge before the Fed meeting, and happily, the option was voided and the S&P rose sharply for 4 days in a row. I am currently holding $Apple(AAPL)$ 、 $Tesla (TSLA)$ and $Activision Blizzard (ATVI)$. The ATVI Sell Put with an exercise price of $80 that is being exercised this weekend, so I will raise to my ATVI position at $80 again, the combined cost is still $80, although the underlying stock is in a slight loss, but I did the ATVI Sell Covered Call at $82. I have been doing it for two months, and the premium has been covered the loss overall.

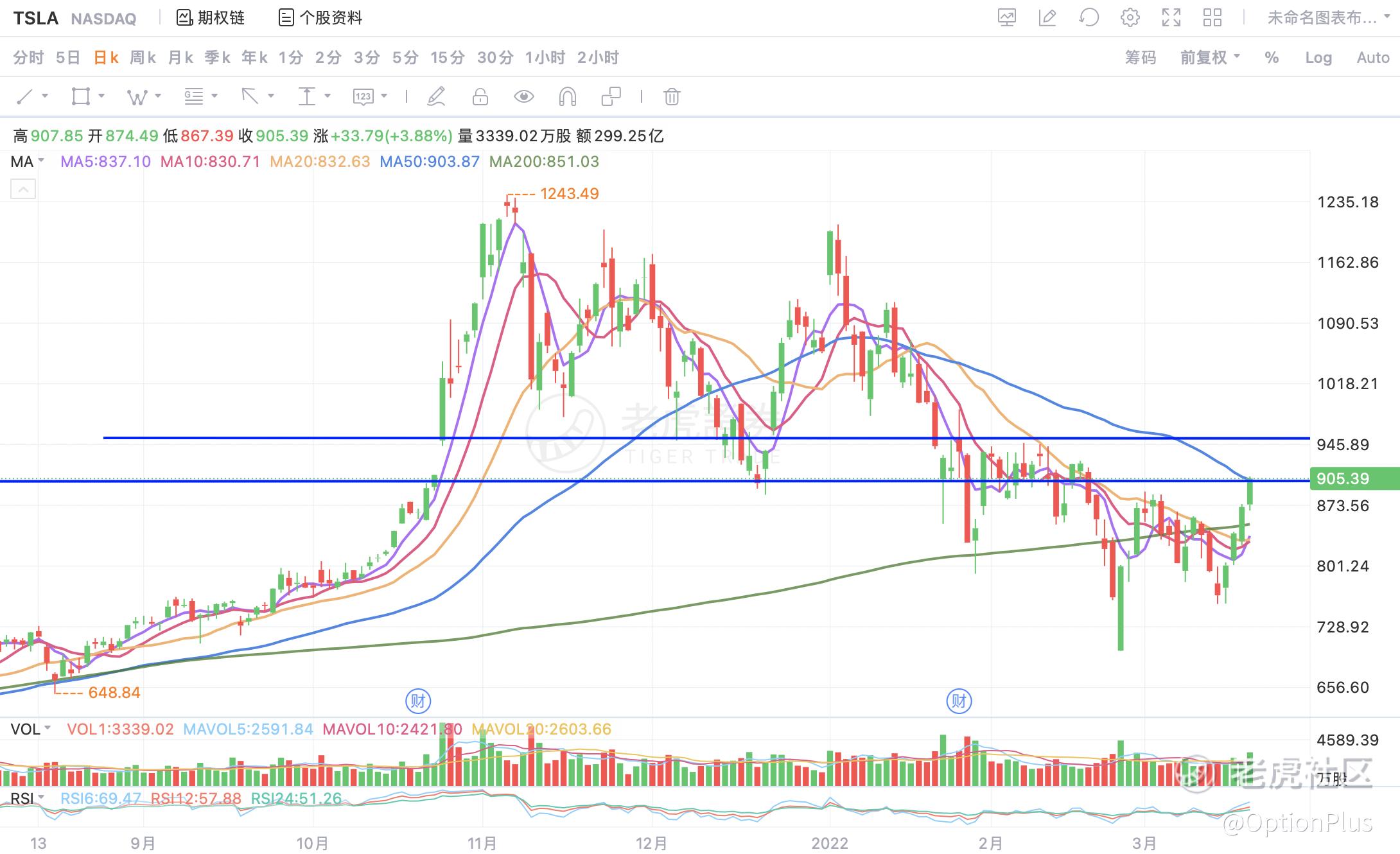

AAPL, my cost is still $155, the $150 Sell Put that expired this week was not successfully exercised. TESLA, cost at $960, I was bought through exercised in February, I set a Sell Put $780 and did not exercise.

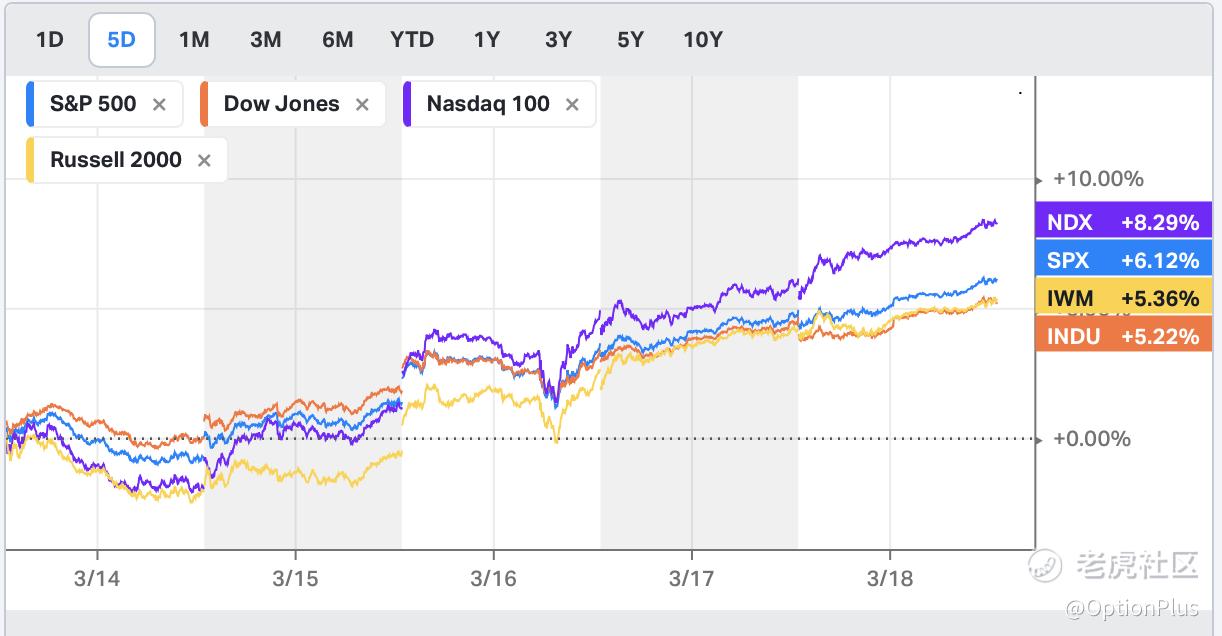

Let's talk about the indexes. The momentum has been to growth stocks pulling the market this week, and Nasdaq has far outperformed DJI, and Large growth stocks outperformed small ones again. It can be said that after the news of the Fed's interest rate hike price in, profitable growth stocks are full of motivation. First, they do have profits as a margin of safety. Second, they repair from the early killed stage.

In words, it has been pulled to the position close to the MA200-line of $4,470 for four consecutive days. I still think there will be a callback on correction level next week. The callback position is still near the trend line that broke through on Thursday, about $4,350-4,300.

After the correction, I am still optimistic and bullish. I have said that there will be a good market at least until April. However, it is the real upward trend for S&P to return to the dividing line between bull and bear, that stabilize above the MA200-line. I think it is possible for the index to consolidate between the $4470 and $4550 before deciding the direction.

Tesla is exactly like NASDAQ. Tesla's double bottom is typical, and the second bottom did not fall to $700, which showed its strength. Although TSLA rose above $900 on Friday, I think the $900 line will be repeated to confirm, maybe swings between $850 and $900. Then TSLA may enter a very suitable trading time for options in the coming weeks. I hold positions and will continue to Sell Covered Call above my cost, which is $960-1000. Then I'll do Sell Put under $850.

Comments

Thank you for sharing opportunities to use Options for different stocks and marketsconditions and how to read the Markets to better use different strategies! [666]