Share

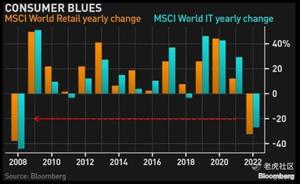

@吴家琦:What you need to Know: Monday Mayhem: A sea of red in Asian equities today, US/EU futures down as well post the May CPI inflation beat out on Friday; 2Y yield up to highest in 15Y; Gold and oil retreated; USDJPY touches 135 extending its 24Y low. Covid: China is walking back its plans to ease Covid restrictions. Authorities delayed the reopening for most schools in Beijing that was planned for today, while most districts in Shanghai suspended dine-in services at restaurants Commodities: US gasoline prices topped an average of USD5.0 on Saturday for the first time, according to AAA, as demand jumped to the highest this year, just over a week into the peak driving season. Week Ahead – FOMC: 50 bps hike by FED a foregone conclusion, some brokers calling for a 75bps hike after the breakout May CPI nos, Powell’s presser and the FOMC dot plot the key. Week Ahead – Other CBs: The BOE is up on Thursday and expected to deliver a fifth straight rate hike; he SNB also meets that day. The BOJ is forecast to stick with rock-bottom rates on Friday. Host of ECB speakers through the week. Week Ahead – Macro: OPEC, IEA Oil Reports are key this week, Germany’s ZEW survey/UK Jobs Data (Tues), US Retail Sales (Wed), China’s May Activity Data (Wed), Australia Job figures (Thurs). Day Ahead: UK April GDP, industrial production, Italy unemployment rate, ECB's Holzmann, Simkus, Guindos speak Consumers Suffering – Staple or Discretionary: The MSCI World Retailing Index is on track for its first negative year since 2008. The same inflation worries that have unsettled tech stocks are taking a toll on retailers, as disposable incomes get squeezed by higher costs for everything from transportation to labor.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments