Hey, this is AUStock_Pedia.

I would like to introduce some Australian companies that may be of some help to your investments.

The company I'm going to introduce is $Rural Funds Group(RFF.AU)$.

It went public on 14th February 2014.

[Company Profile]

Rural Funds Group is an Australia-based real estate investment trust (REIT). The Company owns a diversified portfolio of agricultural assets that are leased predominantly to corporate agricultural operators. It is primarily engaged in the development and leasing of agricultural properties and equipment.

The Company leases almond orchards, macadamia orchards, vineyards, cattle properties, cropping properties, agricultural plants and equipment, cattle and water rights.

[History & Events]

1997: David Bryant established RFM in 1997, recognising the potential to provide alternative investment opportunities in Australian agriculture.

1998: RFM established Lachlan Farming Limited, acquiring land and water rights at Hillston, New South Wales (NSW), to carry-out irrigated cotton farming.

2005: RFM established RFM RiverBank with the aim of providing returns generated by a combination of regular lease payments for land, infrastructure and water assets and the benefit of capital growth in these assets.

2006: The RFM Almond Fund 2006 was established at Hillston, providing investors with the opportunity to grow and sell almonds for the world market.

2013: The RFM vineyards were leased to Treasury Wine Estates (TWE) as part of RFM’s continuing strategy to remove operating risk and lease assets out to reliable counterparties on long-term leases.

2014: The company went public as RFF.

2016: RFF acquired Lynora Downs, a 4,880 ha cotton property in central Queensland.

2021: RFF acquired Comanche, a 7,600 ha breeding and backgrounding cattle property located in central Queensland.

[Main Business Segments]

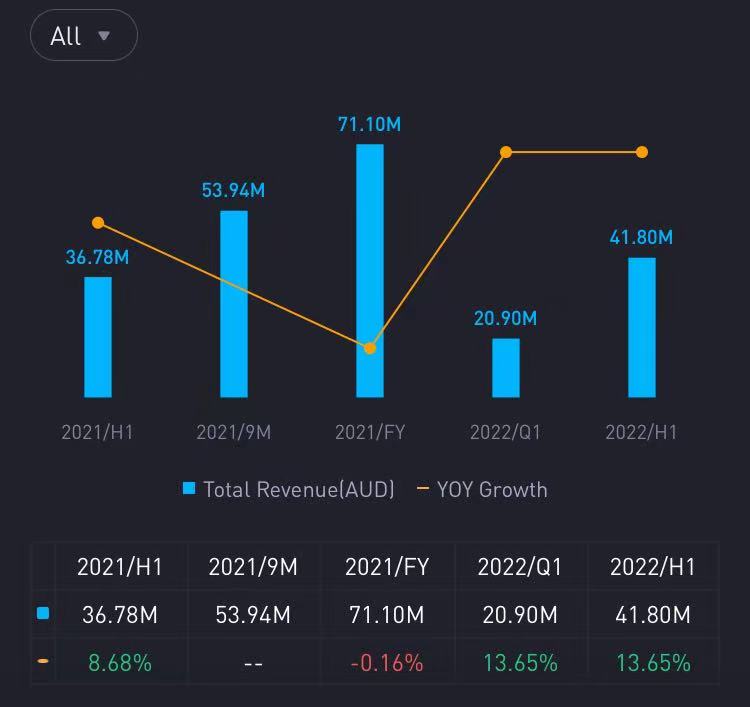

[Net Income & Total Revenue]

[Competitors]

Chas Everitt

ANAROCK

Dom Development

Comments

nice