When #adulting hit me on the head, one of the first types of assets I started investing in were REITs. As you know, REITs in Singapore are a popular investment vehicle. Naturally, I wanted in on the Singapore REITs bandwagon so I started investing in REITs. This was, of course, after I had researched REITs’ meaning, the different types of REITs (including REIT ETFs and REIT stocks) and how to buy REITs in Singapore.

I’m now here to share the fundamentals of REITs with you. Read on to find out more about investing in REITs and the top 7 Singapore REITs to consider.

What are REITs?

REIT stands for Real Estate Investment Trust. Simply put, a REIT is a company that owns and generates income from real estate. It’s a bit like mutual funds, in the sense that REITs put the capital from its many investors in a pool, so that each investor can earn dividends from real estate investments — all without needing to buy, manage or finance an actual property.

Real estate is big business in Singapore. Take a look at the list of Singapore’s richest billionaires and you’ll see that many of them made their fortune in real estate.

And I’m not just talking about the never ending land grabs by condo developers. We’re a highly urbanised, dense and land-scarce island, so tenants pay a premium for commercial and industrial spaces like retail shops, offices and warehouses.

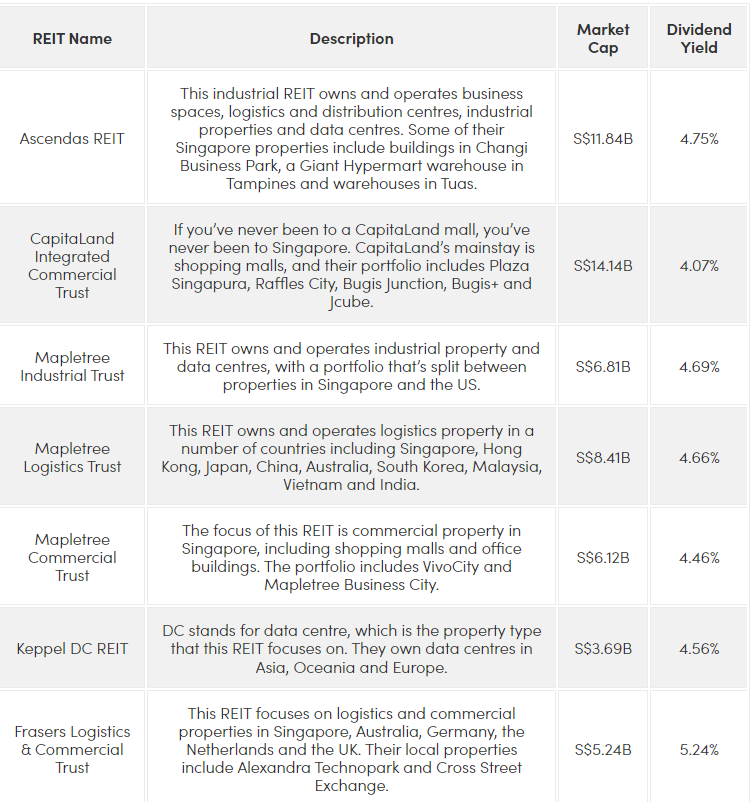

Here are some of Singapore’s top REITs:$ASCENDAS REAL ESTATE INV TRUST(A17U.SI)$ ,$KEPPEL DC REIT(AJBU.SI)$ $CapLand IntCom T(C38U.SI)$ $MAPLETREE INDUSTRIAL TRUST(ME8U.SI)$ $MAPLETREE LOGISTICS TRUST(M44U.SI)$ $MAPLETREE COMMERCIAL TRUST(N2IU.SI)$ $FRASERS LOGISTICS & IND TRUST(BUOU.SI)$

Should you consider to invest in REITs?

Should you consider to invest in REITs?

When you invest in a REIT, you’re investing in the companies that own and make money from property without having to buy the property itself.

The main draw of investing in REITs means that you don’t need to profit from a strong real estate market without having to fork out the cash for property, lock yourself into a highly illiquid property purchase or deal with the logistics of property ownership like searching for tenants.

In Singapore, REITs usually pay dividends, so they’re ideal for income investors looking for passive income. If you don’t need the dividends, you can reinvest them. Investing in REITs also helps you diversify your investment portfolio.

However, on the flipside, REITs, being property, are affected by interest rates, demand for property type (for example office building and/or malls during the Circuit Breaker), rental yield, tenant occupancy rate, and other property trends.

Overall, it makes sense to buy into REITs as the barrier to entry is lower, compared to plonking down a big deposit for an actual property. For REITs, one can generally be a passive investor, holding onto the investment and reaping the dividends. However, for actual property investment, time is spent actively managing the property and/or the tenant, navigating paperwork and so on. Of course, if one has the capital, much more can be earned from direct property investment due to appreciating prices and rental yield in land-scarce Singapore.

How do I choose which REIT to buy?

There are 2 key things to pay attention to when you buy REITs:

The growth of the REIT, the history of which you can check by looking at annualised returns, and;

The dividend payouts of the REIT, which are measured in terms of dividend yield.

As with any investment, when buying REITs you need to assess what portfolio needs you’re trying to fulfil.

Comments