Summary

Our thesis on Lucid has always been about its production ramp. However, given the worsening COVID lockdowns in China, we believe its FY22 production guidance is at risk.

In its Q1 earnings card, management also highlighted that its guidance is predicated on improved supply chain visibility in China from May.

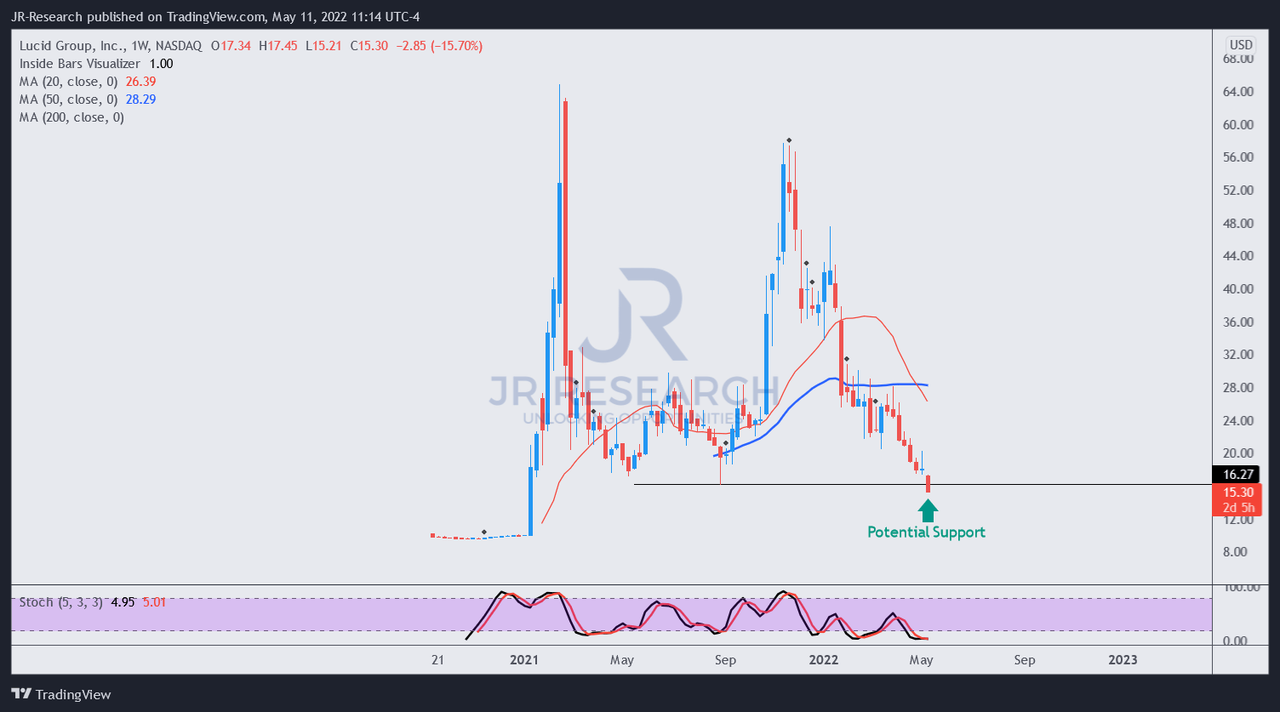

LCID stock is also testing a critical support level. If buyers fail to hold, it could face a steep selloff to force capitulation.

Therefore, we revise our rating on LCID stock from Buy to Hold until we get clearer visibility in China.

I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more.

A key takeaway from its Q1 print was its reiterated FY22 production target of 12K-14K. Notably, it was revised markedly downwards from its previous 20K guidance at its FQ4 card. However, the price action on LCID stock suggests that the market is not confident about Lucid meeting its guidance, despite management's assurance.

As a result, it has sent LCID stock down to a critical support level. Notably, the support level is also the last line of defense for LCID stock, and therefore it needs to consolidate at the current levels. Otherwise, a further breakdown below could send it to new lows to an undetermined support zone yet.

While we give credit to management for assuring us that it would achieve its production guidance for FY22, we think it's going to be a really tough ramp for Lucid. Management suggested that it has continued to see supply chain snarls in China. Notwithstanding, Lucid emphasized that it possesses a remarkable in-house engineering team with strong vertical integration capabilities. However, with the lockdowns in China continuing to impact supply chains, we believe Lucid's FY22 forecasts could be at significant risk.

Consequently, we revise our rating on LCID stock from Buy to Hold. We urge investors to give time for the stock to test the current levels and observe whether it can hold the line against the sellers.

Is Lucid Stock Forecasted To Go Up?

Lucid telegraphed that it has confidence in meeting its production guidance as it ramps manufacturing throughout the rest of FY22. However, the scale of Tesla's (TSLA) Giga Shanghai closure for three weeks in April should be a grim reminder of the challenges outside of Lucid's control.

Notably, the company highlighted that it delivered 360 vehicles and produced 700 vehicles in Q1. However, while it's a remarkable improvement from Q4's deliveries of 125 vehicles, it's still miles away from its 12K-14K production target for FY22.

Morgan Stanley (MS) was also skeptical of its production ramp, as it emphasized (edited): "Lucid's reiterated 12K-14K unit production guidance for 2022 seems to be more of a bull case than a base case. We forecast 9.9K deliveries for FY22 and believe that it may be on the aggressive side."

Furthermore, management was also careful as it reiterated its production guidance. CFO Sherry House added (edited):

As we said in our prepared remarks, we are reiterating our 12K-14K guidance for the balance of the year, so long as the supply chain logistics disruptions aren't material and our mitigation plans are effective. And we've been watching the China lockdown situation really closely. We have had a little bit of impact there. We had a couple of days that we did shut down, and we did have a little bit of slowing for about 1.5 weeks in April. But we have mitigation plans in place. We were able to get access to some warehouses. We're able to move production to another area of China in one case. And so long as things continue to progress and are resolved through the course of May, we're feeling comfortable with what we've stated. (Lucid's FQ1'22 earnings call)

However, we noted that Tesla's Shanghai plant could also be facing some supply chain issues as the COVID lockdowns visibility in China has not improved. In fact, it seems to have worsened. WSJ reported on May 10 that "Shanghai authorities are again tightening Covid-19 restrictions amid a renewed push by central government officials to eradicate the virus." It added that more residents had been sent for centralized quarantine. Furthermore, deliveries of non-essential goods have also been cut off.

Therefore, we believe that the risk to Lucid's production guidance seems to have increased, despite management's assurance.

While Lucid has tremendous financial backing from the Kingdom of Saudi Arabia (KSA), it will not move the production needle for Lucid. Having $5.4B of cash and equivalents on its balance sheet with a $267M revolving facility would not mean much if Lucid can't ramp production. The market will continue to mark up or down its stock based on its production ramp. If the lockdowns in Shanghai continue to worsen, the situation could get much worse for Lucid.

Is LCID Stock A Buy, Sell, Or Hold?

LCID stock is currently testing a critical support level that could break down if it fails to hold. It's also the last line of defense that LCID buyers need to defend. Failing which, investors could be looking at a steep sell-down to force capitulation before a potential consolidation at an undetermined support zone.

With LCID stock still priced at an NTM revenue multiple of 11.8x, the market will not cut the company any slack. It doesn't matter to the market now whether it has a long-term contract to deliver 100K vehicles to the KSA.

The market cares about whether Lucid can meet its FY22 guidance, which is increasingly at risk.

As such, we revise our rating on LCID stock from Buy to Hold.

Source:SeekingAlpha

Comments

Ev upside