Last week, the market slapped in my face. I was thinking that the rebound will last for 2-3 days, but the rebound only one day. However, I suggested that the market should not sit back and relax, and VIX was still high.

Otherwise, I choose a short target is that:【Options】If only PUT one, this is it!

There are still many second-tier tech stocks will release their earnings this week. They probably continue the trend of last week, accurately blasting high-valued growth stocks. So that short $ARK Innovation ETF(ARKK)$ is still a good hedge.

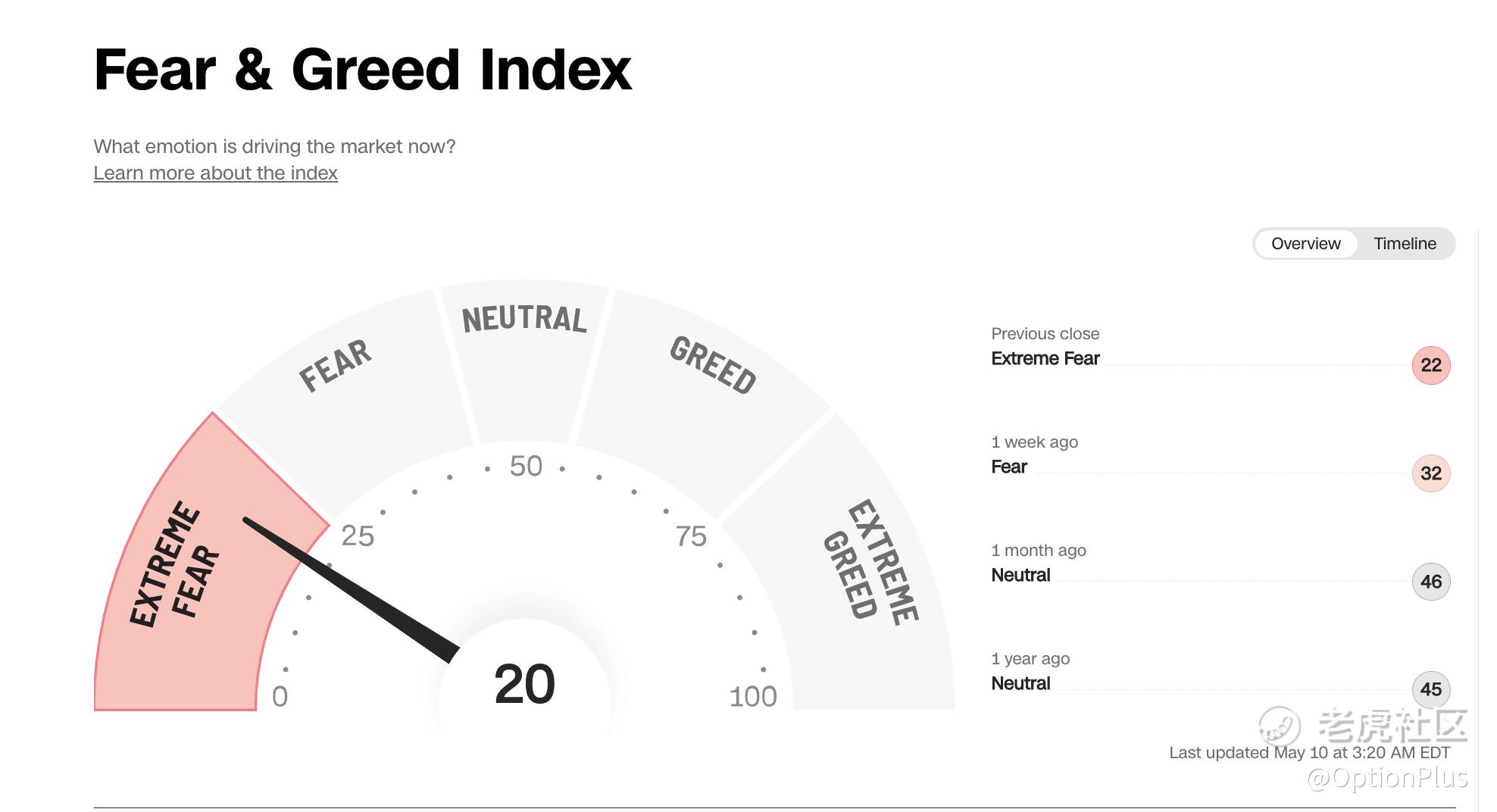

The indexes fell three consecutive trading days, the S&P 500 is below 4000 points, and the market was seriously oversold. CNN's Fear and Greed Index is extreme fear now. While the short-term RSI of the S&P 500 index was very lower than the average.

Tomorrow, there will be the most noteworthy April CPI. At present, the market expectation is 8.1%, and the CPI in March reached a 40-year high of 8.5%. Personally, I think the CPI was touch the peak in March and will not be higher than it in April. However the specific data depends we will see tomorrow night.

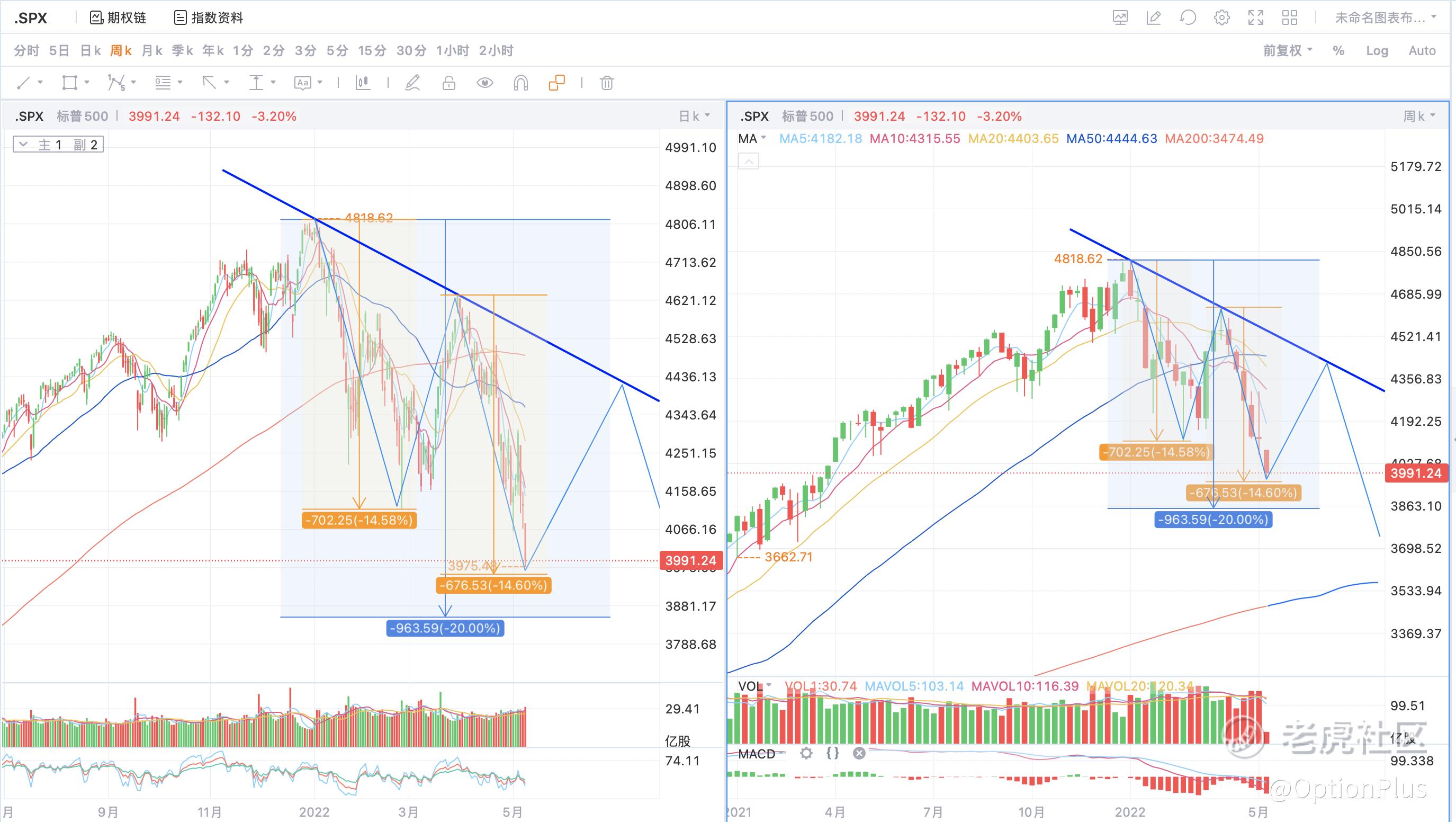

Let‘s see daily and weekly charts of S&P 500. I compare with the last decline round in March. I think it is close to the short-term bottom. If it declines 14.58% should be around $3950. At the same time, if it declines 20% which is bull-bear line, corresponds to around $3850, which still have 3.5%. The oversold sentiment may drive it to $3850 in one step, or it may start to rebound here, so I am ready to LONG now.

Will it continue to fall after rebound? It is not optimistic when it goes back to MA200-day line. There is a high probability that the market will continue to fall after a big rebound. The low point may be in the extension of the MA 200-week line this year, but I don't know whether it is in May or June or July.

Fundamentally, as I said in the previous review:Can the market really revival after hiked rates? I will do this!

All of the big results with good performances have been released. Many of them is worried about Q2 performance, there is no particularly fundamental benefits in next few weeks, but there is QT in June.

Moreover, the continuous tumble of small growth stocks also shows that the market has killed the high valuation during the stagflation period. Although the valuation has killed a lot, it is not particularly cheap (relative to the growth of sales revenues). I think there is a rebound demand for oversold market, but it should not be particularly optimistic, nor is it an absolute bottoming signal

Let's see my trading plan.

I closed ARKK's PUT last night. But I will buy another Put if the market rebounds a lot. Options are the best way to bet on rebound or hedge in a large fluctuating market. Options are paid at a small cost, and if I bet in the right direction, I will get excess returns.I

I hold $Tesla Motors(TSLA)$'s Sell Put with an exercise price of $800 and $750, and $Apple(AAPL)$'s Sell Put at strike of $150. Tesla is $787, and Apple $152 now. I am ready to be exercised to take over these two stocks this week. They are within my target price now.

I am more willing to take over Tesla than Apple. From Tesla's performance, both sales and supply chain are particularly in line with expectations. It can be said that everything is in Musk's plan. But Apple said that the supply chain and Shanghai problems will impact Q2 sales with a $4-8 billion.

I Sold another Tesla's $700 PUT last night, and I plan to buy it from $800, 750 and 700 in queues. Tesla which is a high beta stock, can easily fall too much, that gives us a chance to buy it.

This week, if SPX dries up to $3850, or NASDAQ goes straight to $11500, I will buy extra $Invesco QQQ Trust(QQQ)$ CALL to bet rebounded.

Comments