Earnings season will hit its stride this week, as seven Dow blue-chip names report:$IBM(IBM)$,$Procter & Gamble(PG)$,$Travelers(TRV)$,$Dow Chemical(DOW)$,$Johnson & Johnson(JNJ)$,$American Express(AXP)$And$Verizon(VZ)$.Otherwise, Netflix reports Tuesday and Tesla reports Wednesday, both after the bell.

Among them, I think there will be some interesting points for JNJ, LMT and IBM, I'll go through it roughly.

Before the marketopen on April 19th (Tuesday):$Johnson & Johnson(JNJ)$And$Lockheed Martin(LMT)$

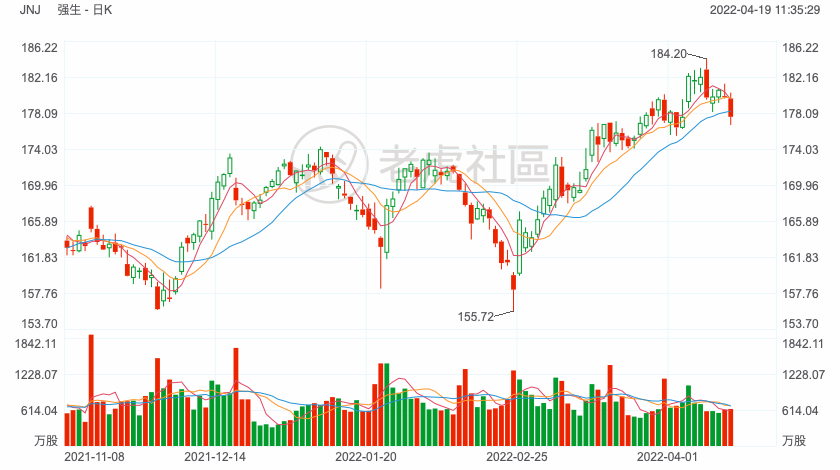

Johnson & Johnson,a biopharmaceutical giantsaid that it expected the company's Covid vaccine sales this year to exceed $3 billion last quarter. Investors will still pay attention to vaccine-related revenue and progress this quarter. Wall Street agreed that the pharmaceutical giant's quarterly revenue will show single-digit year-on-year growth.

Due to the demand for vaccines, Johnson & Johnson also outperformed the market this year after rising sharply in 2021, with a profit of 3.85% so far this year (until April 18th).

CNBC reporter Spencer Kimball said: “Johnson & Johnson’s quarterly results will give investors a first glimpse of the winter omicron wave’s impact on the demand for medical care, and how the company sees the pandemic progressing later this year. J&J could also provide updates on its consumer health business, which it’s spinning off into a separate publicly traded company.”

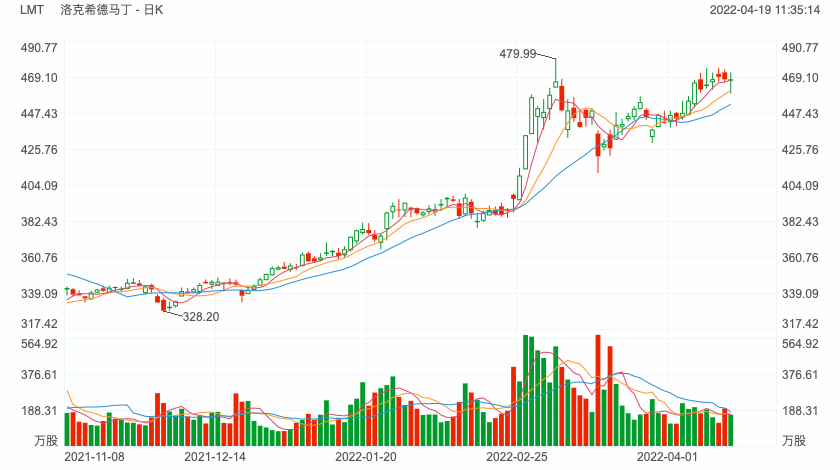

$Lockheed Martin(LMT)$, Due to the sudden Russian-Ukrainian war, the stock price of this military giant soared by 24% in the first quarter of this year. According to Refinitiv, analysts are predicting first-quarter earnings and revenue will fall slightly year-on-year.

However, in the current international situation, I think the revenue prospects of this defense giant will still be optimistic.

CNBC reporter Amanda Macias is watching: " Investors will get their first look at how the world’s largest weapons manufactured fared last quarter, as the Ukraine-Russia war began. Last week, Lockheed Martin attended meetings at the Pentagon to discuss the potential acceleration of production lines. The Javelin missile system, produced by Lockheed Martin and Raytheon, has proved to be one of the most effective weapons in the U.S. arsenal deployed to the fight in Ukraine.”

After hours on April 19th (Tuesday):$IBM(IBM)$

IBM's revenue is expected to fall about 20% in the first quarter from a year earlier, according to Refinitiv. However, the stock price performed not good this year. IBM stopped selling in Russia after the Russian-Ukrainian war began on March 3, and its financial report may have some guidance on the impact of the subsequent war on the revenue of technology companies.

Analyst Toni Sacconaghi Jr. said in a recent note that Russia could represent 1-2% of revenue. One risk is that companies hesitate to adopt IBM’s next-generation mainframe computers because of the war, said analyst Erik Woodring of Morgan Stanley, with the equivalent of a buy rating on the stock. If that happens, the company’s full-year forecast of revenue growth in the mid-single digits could suffer.”

There was Netflix report after market on Tuesday, which attracted more attention. Because there were many people talking about it, I won't repeat it.

Comments