Key Points

- Choosing the right investments can make or break your portfolio.

- S&P 500 ETFs can be a fantastic choice for many investors.

- By investing just a little each month, you could accumulate hundreds of thousands of dollars.

Investing in the stock market is one of the best ways to generate long-term wealth, but choosing the right investments can be tricky.

Exchange-traded funds(ETFs) can be a smart option for many people, as they're low-maintenance investments. Each ETF may contain hundreds or thousands of stocks, creating an instantly diversified portfolio, and all you have to do is invest consistently.

While there are seemingly endless ETFs to choose from, there's one type of fund, in particular, that could help you accumulate $100,000 or more with very little effort on your part:S&P 500ETFs.

Choosing the right ETF

S&P 500 ETFs can be a fantastic investment for a variety of reasons. This type of fund tracks theS&P 500 index, which means it includes the same stocks as the index and aims to mirror its performance.

The S&P 500 includes stocks from 500 of the largest and strongest corporations in the U.S., and it has a long history of earning positive average returns.

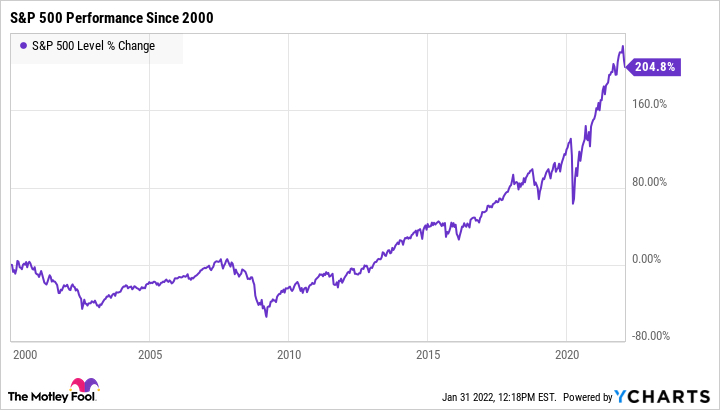

Although the index does experience short-term volatility, it has recovered from every crash it's ever experienced. Historically, it's also earned an average rate of return of around 10% per year.

If you invest in an S&P 500 ETF, your portfolio will experienceshort-term downturns. Over the long run, though, you're almost guaranteed to see positive average returns.

How much can you earn with an S&P 500 ETF?

The best part about investing in the stock market is that you don't need to have a lot of money to get started. By investing a little each month, you can potentially accumulate hundreds of thousands of dollars over time.

Say, for example, you have $1,000 to invest right now. Let's also say you invest that $1,000 in an S&P 500 ETF that's earning a 10% average annual return.

To earn as much as possible in the stock market, it's best to invest consistently and give your money as much time to grow.

In this scenario, say that you're investing $150 per month in addition to your initial $1,000 investment. Assuming a 10% average annual return, you'd have around $110,000 after 20 years.

If you want to earn even more, you can either boost your monthly contributions or continue investing for longer.

For example, if you were to invest $300 per month instead of $150 per month, you'd end up with around $213,000 after 20 years, all other factors remaining the same. Or, if you continued investing $150 per month but invested for 35 years, you'd have a whopping $516,000 in total.

Where to get started

There are many different S&P 500 ETFs to choose from, and most of them are similar. They all track the same index, so their performances will be roughly the same.

Some of the most popular funds include theVanguard S&P 500 ETF(NYSEMKT:VOO),iShares Core S&P 500 ETF(NYSEMKT:IVV), andSPDR S&P 500 ETF(NYSEMKT:SPY). These funds all have a long history and some of the lowest fees, making them more affordable options for investors.

Regardless of where you invest, maintaining a long-term outlook is key. By investing as much as you can afford each month and giving your money as much time as possible to grow, you can earn more than you may think over time.

Comments