$Meta Platforms, Inc.(FB)$ released its first earnings report after it changed companies's name, but it definitely didn't find a master to calculate

The worst is not only FB, but aslo SNAP, which will releases result tomorrow, but it has fallen by 17% in the aftermarket trading hours. FB successfully broke the two major sectors of social and metaverse, social stocks such as$Twitter(TWTR)$,$Snap Inc(SNAP)$,$Pinterest, Inc.(PINS)$ tumblled, and Metaverse as well, look at$Roblox Corporation(RBLX)$$Unity Software Inc.(U)$.

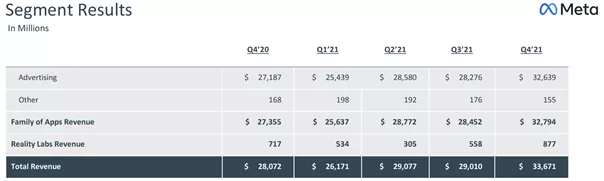

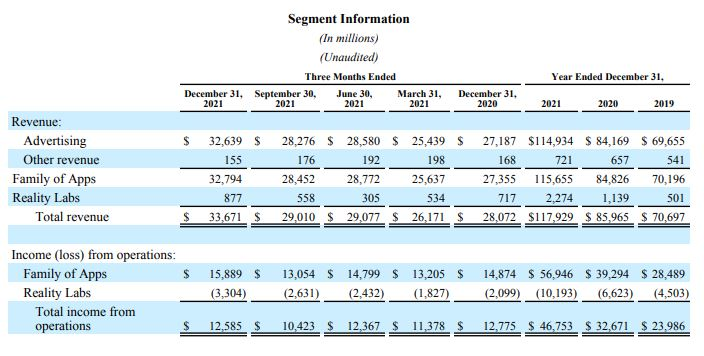

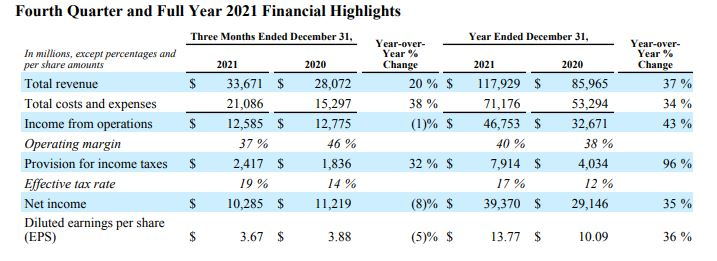

According to Meta's financial report, the revenue in the fourth quarter of 2021 was US $33.67 billion, slightly higher than the market expectation of US $33.4 billion (Refinitiv). However, the year-on-year growth rate of 20% was too low. Before the financial report, the market gave such a low expectation, which seemed no any hope, but FB could only beat a little. Compared with the year-on-year growth in Q1-Q3 2021 they were 47.6%, 55.6% and over 35%. The annual revenue in 2021 was US $117.9 billion, an increase of 37% compared with US $85.97 billion in 2020, exceeding the market's original expectation of an increase of 20%.

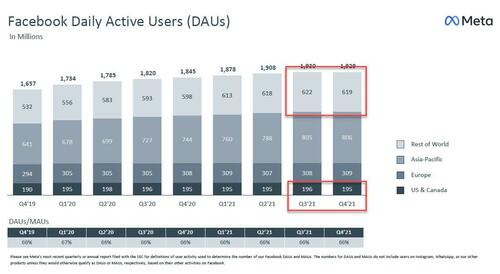

The operating data is terrible, and the number of users has stagnated. The core product Facebook has 1.93 billion daily active users in the fourth quarter, which is the same as the third quarter, up 5% year-on-year, less than the expected 1.95 billion; The number of monthly active users (MAUs) was 2.91 billion, which was less than the expected 2.95 billion; The average revenue per user (ARPU) was $11.57, up 14% year-on-year, slightly higher than the expected $11.38.

Facebook was ambushed by TikTok on the way to snipe Snap. The daily users of the whole application family including Facebook, Messenger, Instagram and WhatsApp were 2.82 billion, slightly higher than the 2.81 billion in the previous quarter; The monthly users were 3.59 billion, up 9% year-on-year, slightly higher than the 3.58 billion in the previous quarter.

Say the worst, Say something worthy of attention, The company disclosed the financial situation of metaverse for the first time, According to the latest financial report structure, in addition to the APP family that relies on advertising revenue, there is also a Reality Lab, namely Virtual Reality Lab, which includes FB's metaverse and AI/VR related hardware, software and content. In the fourth quarter of 2021, Reality Lab earned 877 million US dollars, accounting for only 2.6% of the total revenue, which is not worth mentioning. It can also be considered that the story of metaverse is a story at present. Reality Lab2021 earned $2.274 billion for the whole year.

Comments