$Palantir Technologies Inc.(PLTR)$, the most mysterious and favored data company in Silicon Valley, backed by government agencies and kept making various big orders, maintained a good growth in 2021. However, its stock price went down all the way, and plunged by 10% again after Q4 financial report yesterday.

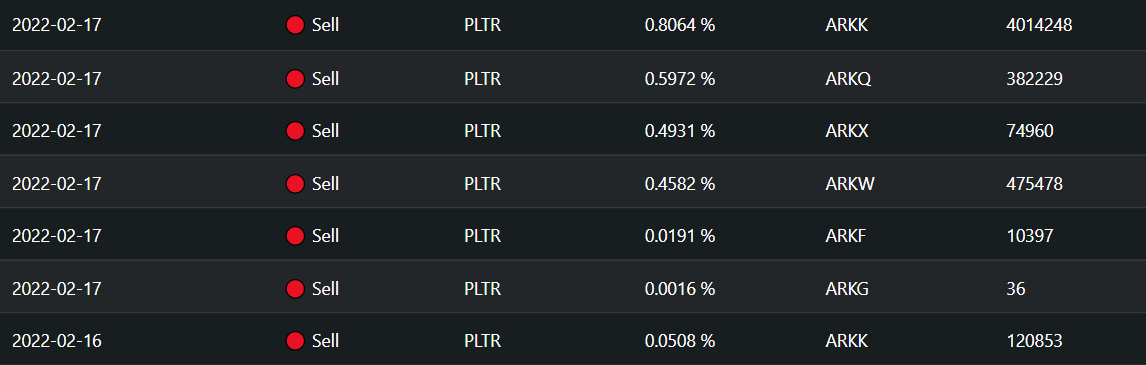

On that day,Ark Investment Fund sold nearly 5 million shares of Palantir and cashed out about 58 million US dollars, and Arkk's position dropped to 2.06%.

Actually, Palantir Q4 results isactually oK, its revenue is in line with expectations, and its revenue from commercial customers is growing at a faster rate, with commercial revenue accounting for more than 40%. However, the lower-than-expected profit still stung the market nerves.

In addition to the long process of killing valuation, the problems of growth stocks themselves seem to be infinitely enlarged in the eyes of picky investors.

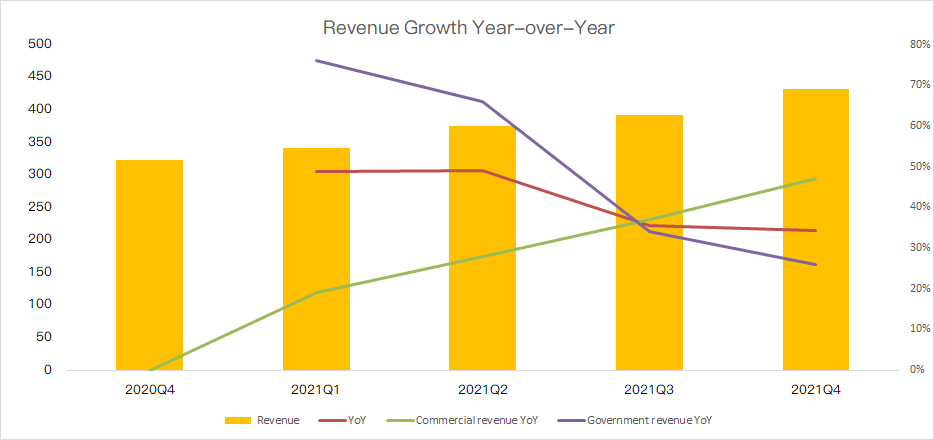

1) Revenue growth slows down, and the commercial business gap is widened.Revenue has dropped from 40% in Q1 to 34% in Q4. Although this is still in line with the 30% growth level predicted by the management, to be honest, this figure is not comparable to the name of "high growth" in the past. Compared with the 100% growth of SaaS enterprises like Snowflake, it seems a bit slow.

At present, Palantir's revenue still mainly comes from Government. In the fourth quarter, in addition to the extension of the Army Advantage Program and the Space Systems Command ("SSC") contract with a total value of about 160 million US dollars, two new orders were obtained.

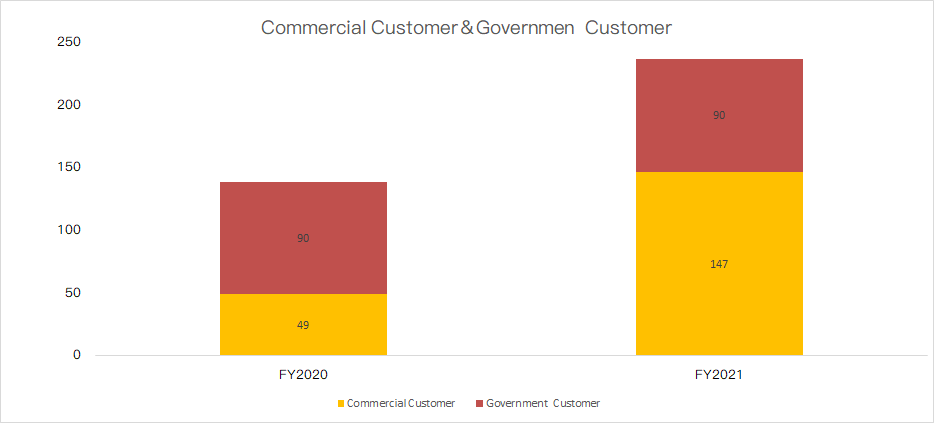

Cooperation orders with government agencies are often stable, and the main profit points come from geopolitical conflicts and some unexpected events. However, the world is peace & love inmost of the time, and this stability has limited Palantir's growth. According to the financial report, the growth rate of government revenue in the fourth quarter has dropped from 76% to 26%, and the number of government customers (90) has zero growth within one year.

Palantir understands the importance of business customers, and we have seen business revenue increase to 194 million in recent quarters from 132 million in the same period last year. At the current growth rate of nearly 50%, it will exceed government revenue in a few quarters.

The problem is that Palantir has long been lagged behind its competitors in the field of commercialization. Like other data analysis companies $Splunk Inc(SPLK)$ and $Datadog(DDOG)$ , their number of commercial customers has already exceeded 10,000, while Palantir has only 147 commercial customers, although the year-on-year increase is as high as 200%, which is still not in the same order of magnitude as its main competitors.

Obviously, Palantir's Achilles heel is the lack of highly viscous small and medium-sized business customers, which makes it impossible to form a sustainable subscription model based on cloud in a short time. Palantir's late start to commercialization makes it difficult to break through the growth ceiling in the face of peers accelerating their shift from traditional software companies to subscription-based cloud service companies.

2) Earnings missed expectations.

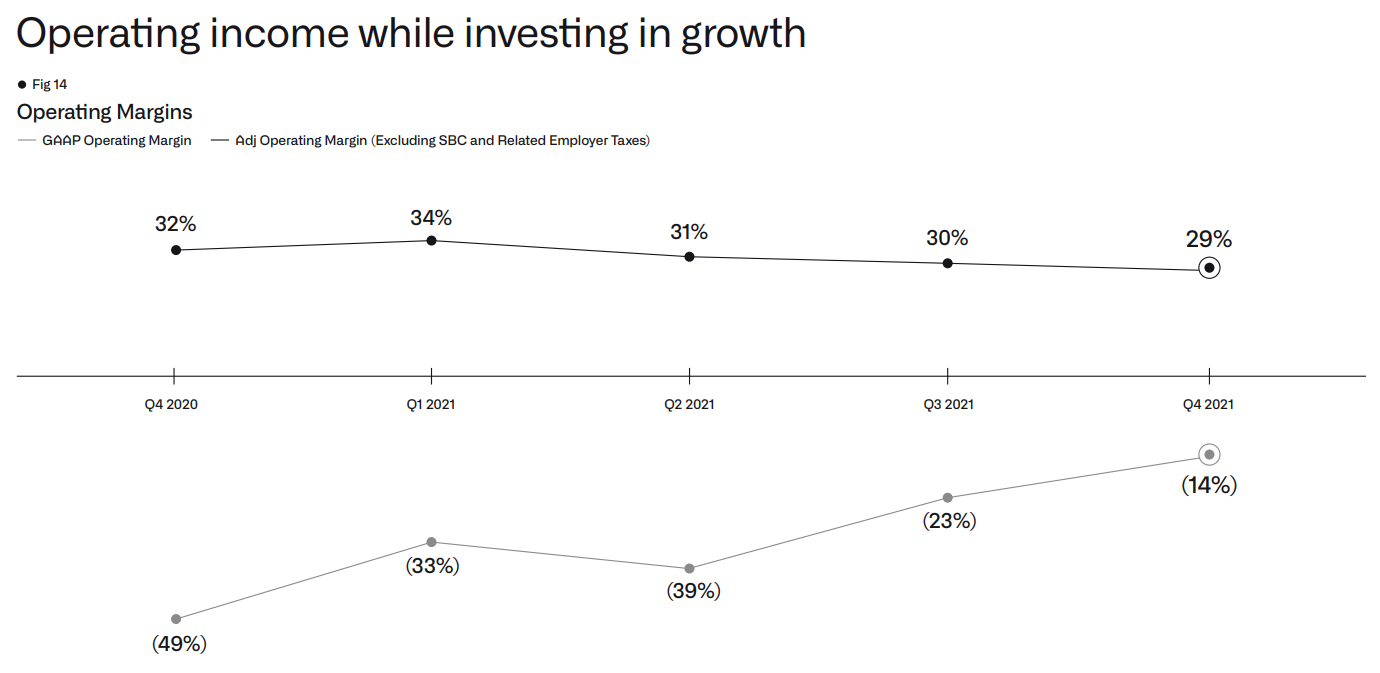

For a company that is still in the growth stage, the profitability problem is secondary to the commercialization problem. At present, Palantir's customer scale and revenue scale are not large, while the early software cost, sales and marketing cost and stock reward are relatively high, and there is great uncertainty in profit. Q4's operating profit margin has dropped to 29%, a new low in the past year.

For such high-growth software companies, we might as well pay more attention to their free cash flow, which can better reflect the sales cycle and operational capability.

SaaS enterprises generally have a process of falling growth rate and valuation in the post-epidemic era, such as $Zoom(ZM)$ , $Cloudera Inc.(CLDR)$ , $UiPath(PATH)$ , palantir and so on. Palantir's mystery is slowly disappearing in the process of commercialization. With the transformation from traditional software company to cloud service company, the valuation will move up. Of course, the valuation of growth stocks has always been controversial, and the best judgment is the dynamic balance between PE and profit growth.

Comments

if ARKK does well next months and years, she will be one of legends as she would have made 2 bold predictions that happened well.