One solid strategy for boosting your portfolio's long-term value is by investing in dividend stocks. Those recurring payments will generate cash flow you can make use of without selling your investments.

Related Reading:

Cash Flow is King: Factors Driving Returns Over The Next Decade

Three stocks that are excellent sources of recurring income are $(Novartis)$(NYSE: NVS), $(BCE)$(NYSE: BCE), and $(Kraft Heinz)$(NASDAQ: KHC).

Collectively, they can help diversify your portfolio, and at their current share prices, all yield more than double the S&P 500's average yield of 1.3%.

1. $(Novartis)$

Swiss drugmaker Novartis is the ideal type of investment to tuck away in your portfolio. It may not be an exciting hyper-growth business, but you can count on it for consistency. In the past five years, the company's revenues haven't deviated much: Its top line has stayed within the $48 billion to $54 billion range. And during that period, the lowest profit margin it achieved was over 15%.

But that doesn't mean that growth isn't on the horizon. The U.S. Food and Drug Administration approved the company's cholesterol drug, Leqvio, late last year. At its peak, it could generate more than $2 billion in annual sales for the business. But that's not all. Novartis believes it has more than 20 treatment candidates in its pipeline that could be potential blockbusters and that could earn regulatory approval by 2026.

The business has also generated free cash flow of more than $10 billion in each of the past four years, funds which thehealthcare companycan use to explore more opportunities and enhance its pipeline. In 2021, Novartis also spent $7.4 billion on its dividend -- which at current share prices yields 3.7% -- and another $3 billion on share buybacks.

Novartis has a strong business, and with a modest payout ratio of 30%, its stock could be an income investor's dream buy.

2. $(BCE)$

Canadian telecom giant BCE is an industry leader as well as a reliable dividend payer. There may not be much in the way of growth here, but it's pretty consistent. In 2021, its top line rose 2.5% to 23.5 billion Canadian dollars. And over the past four years its sales have been quite steady, ranging between CA$22 billion and CA$24 billion. Net earnings increased by 7.2% this past year to CA$2.9 billion as the business returns to pre-pandemic levels. That equates to a strong profit margin of 12%, which is typical for the business.

In 2022, management expects sales to grow by as much as 5%. The company is continuing to expand its 5G network, which it says now reaches 70% of Canada's population. While that's all good, the real value in the stock is as an income investment. At the current share price, BCE pays a dividend that yields an impressive 5.5% annually. It announced a 5.1% payout hike earlier this month when it released its year-end results.

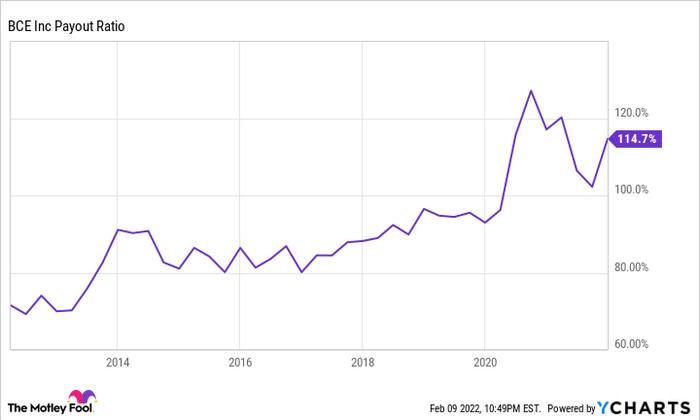

BCE Payout Ratiodata byYCharts.

Although the company's payout ratio is technically over 100% now, BCE has a history of paying out a high percentage of earnings. A return to something closer to pre-pandemic normal in terms of travel (and thus, roaming revenue) should help get that ratio back down in 2022. Historically, the company's free cash flow has been strong enough to support dividend payments.

BCE isn't a dividend stock I'd worry about -- the business is fairly stable, and it's among the leaders in Canada's telecom industry.

3. $(Kraft Heinz)$

Another stalwart that investors can count on is Kraft Heinz. The company's business is built on some popular household brands, including Oscar Mayer, Philadelphia, and of course, Kraft and Heinz. The company's products are essentials in many homes, and that can make the stock a relatively safe buy, especially in a year when inflation could weigh down other investments.

Food companies like Kraft with popular, widely-used products have greater flexibility to increase their prices to offset the impact of rising costs. And on the company'searnings callin October, management expressed confidence that it would be able to adjust for inflation. That's not something all companies can do, which could make Kraft particularly attractive to risk-averse investors over the long haul. It also doesn't hurt that Kraft's top customer is big-box chainWalmart.

The company's revenue of $26.3 billion over the past 12 months is remarkably similar to the $26 billion-plus in annual revenue it has generated in four of the past five years. Coupled with operating margins that are normally around 20%, that makes this business a fairly stable one.

While Kraft had to cut its dividend a few years ago and incurred a steep $10 billion loss in 2018 after recording impairment charges of more than $15 billion, the company's fundamentals remain strong, and its brands are top notch. And its payouts are also much more manageable now. Kraft has generated free cash flow of $3.2 billion over the past four quarters, which has been more than sufficient to cover its dividend payments of just under $2 billion during that time frame. Such an excess of cash flow wasn't common prior to the dividend cut. That makes its dividend -- which yields 4.6% at the current share price -- look a lot more attractive right now.

You may not be able to expect much growth from Kraft's business, but the stock can still make for a solid income investment tohang on to for t he long term.

Comments