Summary

- Despite the current share price weakness, Sea's business fundamentals are improving as it continues to focus on the growth of new markets.

- In 2022, Sea will be focusing on the luxury segment and monetise its platform by investing in advertising.

- Leading indicator shows strong traction in Brazil and potential expansion across the region.

- Gaming segment increasingly positioned with blockchain technology, investments in gaming studios to accelerate new game releases and Free Fire Max to increase engagement with gamers.

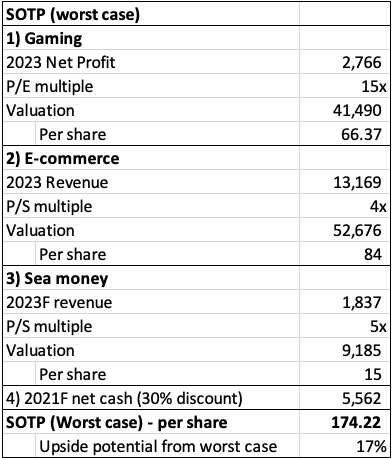

- My worse case target price of Sea based on SOTP valuation is $174.22, offering a 17% margin of safety at current price levels.

Sea Limited(NYSE:SE)has seen a serious correction from its all-time highs in November 2021, falling almost 58% in the few months since. In this article, I am to revisit my investment thesis with new factual evidence that Sea is still a high conviction idea, explain why the price action (in my view) is irrational, and how this may be a great opportunity for investors looking to add to a high quality compounder of the next decade.$:Sea Ltd(SE)$

The recent weakness in Sea's share price is due to the following reasons:

- Tencentselling$3 billion in Sea shares and cut its voting stake in the company resulted in worries of implications for Sea.

- After 3Q21 results, investors were worried about a slowdown or normalization of growth ingaming segment,specifically Free Fire.

- General sentimentsouring as technology and long duration stocks with high valuation tumbles in recent weeks.

- I have assumed that the gaming segment could have a worst case scenario of P/E at 15x, instead of global peers at 25x.

- I have assumed that Shopee's e-commerce P/S multiple to be 4x, which is in line with expected near term 40% growth in revenues.

- I have assumed that Sea money should be valued at a conservative 5x P/S multiple to incorporate worst case scenario if Sea money fails to gain traction.

- I have applied a 30% discount to expected net cash at 2021F.

That said, my article aims to reassure investors that Sea is currently pricing in very little at the current valuations. Based on my worst case SOTP valuation of Sea, I derived a worst case target price of $174.22, as shown below. This implies a margin of safety of 17% from current prices and thus, a great buying opportunity for investors with a decent time horizon.

Despite all the noise that is going on in the share price of Sea, the company has remained steadfast in its expansion and growth strategy.

Recall that Sea's e-commerce platform, Shopee, has expanded beyond its geographical region of Southeast Asia and Taiwan, to Latin America, Europe and even India. In my view, its ambition is to be a global e-commerce brand and is executing well towards its ambition. It is taking on incumbents in these regions, like MercadoLibre(NASDAQ:MELI)in these regions and as highlighted in my previous article, is outpacing these incumbents.

For 2022, with a presence in 16 markets across different regions, it aims to focus more on the luxury segment, invest in advertising.

By focusing on its luxury segment, Shopee will be able to increase the basket size of consumers as it moves up the ladder to sell more expensive items as consumer confidence in Shopee increases. Shopee is also looking to improve the consumer experience by building a sampling channel for products, especially in the beauty, FMCG segment. Consumers can purchase samples of products and they will receive discounts on their next purchase. This has proven to be successful as merchants managed to recruit almost 90% of new buyers when this initiative was launched in the 12/12 campaign last year.

I believe that advertising is a key monetization strategy for Sea currently given its huge scale in Shopee. In fact, Shopee Ads increased 300% from 1H21 to 2H21, clearly showing the strong demand for advertising on Shopee platform as consumers increasingly use it for online purchases. One example of this is that merchants can purchase the homepage banner ads to promote their campaign to Shopee users.

All these are done with the goal of eventually ensuring that its offerings and services are intricately linked to the lifestyle of its consumers. Once it is able to do this, it will remain as top mind share of consumers in their everyday lives and ensures that the entire ecosystem of products and services offered by Sea has a huge competitive advantage over peers.

Shopee has been expanding its operations in Brazil and analyzing the long term potential of Latin America markets, according to2 insidersfrom Shopee.

There are further evidence that Shopee is focusing on its new market asit is also moving key management personnel to Brazil.Pine Kyawmoved from Shopee's Vietnam unit to become Shopee Brazil country head, according to my checks on LinkedIn. Also, there are more than390 job openingsfor Shopee Brazil. Interestingly, there are also more than110 job openingsfor Shopee Mexico, which in my view, could be a leading indicator of future plans to ramp up operations there in Mexico as well.

In its3Q21 callin November, management also commented that Shopee Brazil is seeing strong interest from local sellers and the company is focused on increasing the number of local sellers in the near term. Since starting to introduce local sellers in 2020, Shopee Brazil has grown to more than 1 million local sellers in Brazil, highlighting the strong value add Shopee brings to local sellers to improve their online business. Also, according to App Annie, Shopee Brazil was ranked first by total time spent in the app and by downloads, and second by average monthly active users. I believe that these metrics tells us the momentum and continued growth in Shopee Brazil.

Furthermore, with evidence of Shopee's solid execution in Brazil, I think that Shopee could look outside of Brazil to other Latin America markets like Mexico. In fact, based on Morgan Stanley's Alphawise survey, they found that Shopee's mind share as a top e-commerce platform amongst consumers has increased from 6% in 2020 to37%in 2021.

Worst case scenario SOTP valuation

I have come up with the SOTP for Sea based on worst case scenarios:

Worse case scenario SOTP valuation for Sea Limited

Author

On the valuation multiple of 15x P/E given for the gaming segment, I believe that the 40% discount from the average of 25x P/E for top global gaming peers is reasonable for a worst case valuation for Sea's Garena.

On the e-commerce multiple of 4x P/S, I think this is a reasonable valuation given to the high growth e-commerce business should it fail on execution of its international expansion strategy. However, I am of the view that Shopee is currently doing well in its new markets like Brazil as mentioned earlier and its cautious expansion strategy of doing extensive evaluations before expanding into a country is good to control the risks of expansion into new markets.

On the Sea money multiple of 5x P/S, this very conservative given that this is a new business opportunity for Sea and one of the low hanging fruits as consumers increasingly use Shopee in their lives and thus, by extension, use Shopee pay or Sea money's other offerings as well.

Based on my worst case scenario SOTP valuation, there is currently 17% upside to these very conservative valuation multiples and as such, I do view current share price as a good entry point given the high margin of safety at the current valuations.

Base case SOTP valuation

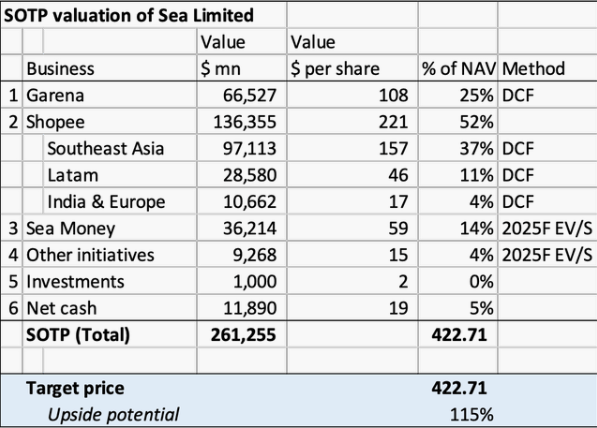

However, I am still standing by my valuation in myinitiation articleas a longer term price target for Sea, as can be seen below:

However, as my assumptions in the base case SOTP goes further out all the way to 2030, it could be a longer term price target for Sea once this valuation reset in growth and technology stocks end.

Conclusion

Based on my worst case SOTP valuation of Sea, I am of the view that there is a 17% margin of safety from current prices as my SOTP valuation is very conservative based on the multiples used for each segment. The worst case SOTP valuation implies a worst case target price of $174.22 and in my view, could present excellent opportunities for long term investors looking to add to the future global e-commerce brand.

Comments

By end of 2022, if none of its quarterly earnings indicate achange in positive direction, $98-107 is also high probable.

$115.x stands a high probability.....