The game between China and Vietnam revealed the current situation of Chinese football in the past 20 years once again: paralyzed youth training, weak youth foundation, less than 10,000 registered athletes in China, and only a handful of football fields around us.

After the game, a passage by Liu Jianhong, a well-known football commentator, was circulated, insinuating that not only football lost, but also the stock index.

Looking back at the past five years (2017-2021), it is rare that an index could outperform the US index, and Vietnam Ho Chi Minh Index is one of them. During this period, the S&P 500 index of US stocks rose by 112%, the VNINDEX index of Vietnam rose by 129%, and the Shanghai Composite Index rose by only 17.2% in five years.

Vietnam is one of the most developed countries in Southeast Asia. In the past few years, demographic dividends and policy dividends have attracted China and other countries to set up factories in Vietnam, which has driven the country's sustained high economic growth (GDP growth rate is between 6% and 7%) and gradually released corporate profits. The easing policy cycle combined with strong economic growth attracted a large amount of incremental funds, which made Vietnam's Ho Chi Minh Index lead the global emerging markets.

As a investor, how can we enjoy Vietnam's high growth dividend and better invest in Vietnam? The best way is to buy index ETFs directly.

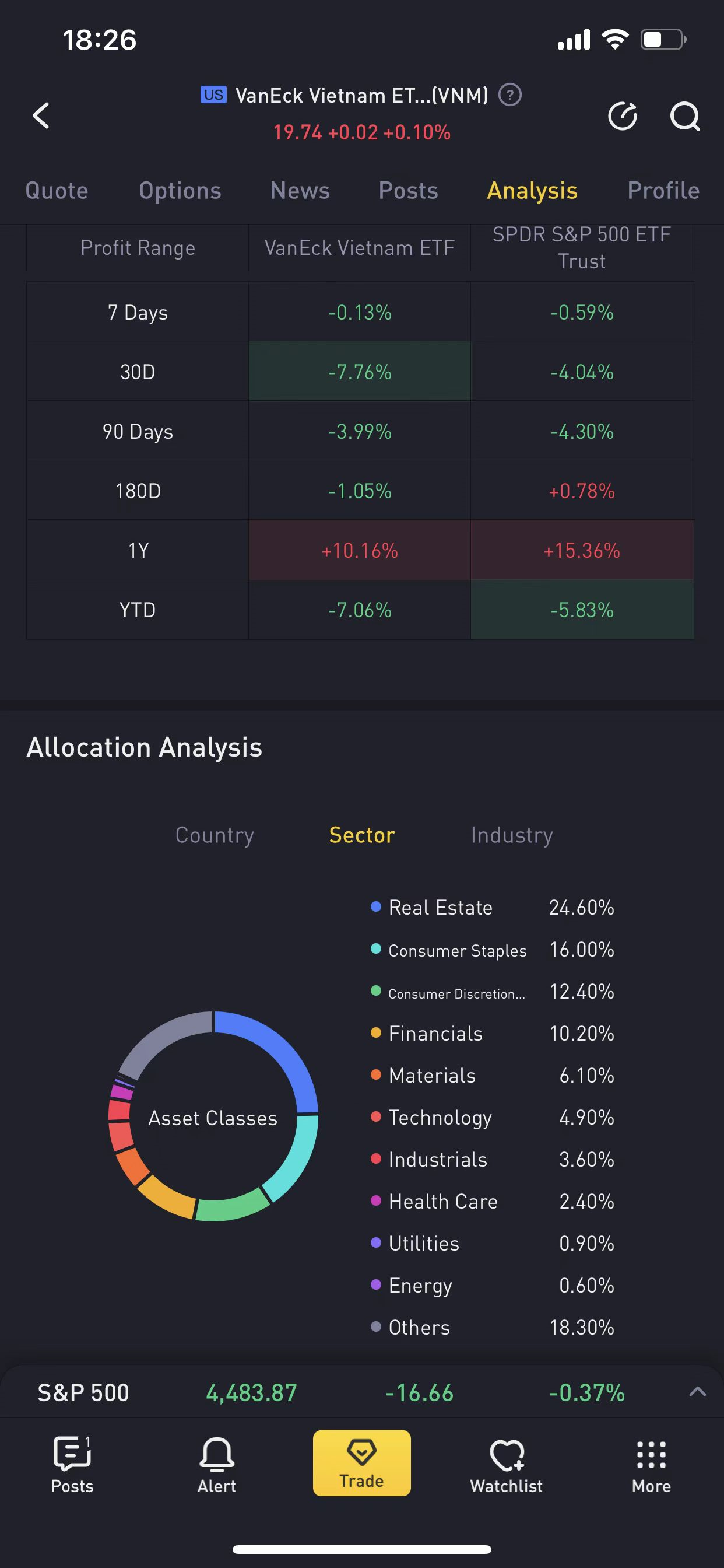

Although some other emerging market ETFs also hold a small number of Vietnamese stocks, the best performing Vietnamese ETF at present is VanEck Vectors Vietnam ETF (VNM), which is the only pure Vietnamese ETF that investors may find in the US stock market. The fund tracks the MVIS Vietnam Index, the MSCI Vietnam Index, which reflects the performance of the largest and most liquid companies operating in Vietnam.

VNM is a long ETF, which invests in stocks with various market values. The index also includes companies registered in Vietnam and elsewhere, but those companies derive at least 50% of their revenues from Vietnam. More than two-thirds of the companies held by the fund are registered in Vietnam, and another 20% are registered in South Korea. The real estate sector accounts for the largest proportion of the fund, close to 28% of net assets. The fund follows a mixed strategy and invests in growth and value stocks.

It is worth noting that the MVIS Vietnam Index here is compiled by Morgan Stanley, which is still different from the heavyweights of Ho Chi Minh Index, thus MVIS cannot fully reflect the fundamentals of Vietnamese enterprises.

Although investing in Vietnam's stock market has high returns, the risks of emerging capital markets are obvious, especially in 2022.After the Fed's interest rate hike cycle starts, emerging markets are facing the pressure of capital outflow. It is embodied in:

1) Financial markets in emerging markets are often fragile and highly dependent on foreign capital. Every move of the Federal Reserve will cause exchange rate fluctuations and affect capital inflows. Under the leadership of the US dollar, stock price trends may not be directly related to fundamentals. The prosperity of Vietnam's market depends on the large-scale expansion of the Federal Reserve since the outbreak.

2) In emerging markets, most enterprises are often in the growth period, the figures on the reports will be ugly, the internal management of enterprises will be chaotic, and it is difficult to have sustained high-gloss performance, which deviates from the value investment philosophy of looking for high-quality enterprises, and the probability of investing in emerging markets is high.

Generally speaking, Vietnam is a leader in emerging markets, similar to China, which developed rapidly in 1990s, with rapid urbanization and a large amount of FDI. The troika of investment, consumption and export drives GDP to keep at 6% all the year round. It is guaranteed by solid fundamentals, so it will be favored by foreign capital.

Indices: Vietnam Ho Chi Minh Index, Vietnam 30 Index

ETF:$VanEck Vietnam ETF(VNM)$$X TRFTSEVIET(03087)$

Futures:$富时越南30指数主连 2202(FVNmain)$

Comments