Hello traders and investors! Let’s look at $AMD(AMD)$ today, as it has been doing many bullish candlestick/chart patterns all around. It is a real Technical Analysis class.

Hello traders and investors! Let’s look at $AMD(AMD)$ today, as it has been doing many bullish candlestick/chart patterns all around. It is a real Technical Analysis class.

To start our Multi Time Frame Analysis(MTFA), let’s take a look at the 1h chart. First, it triggered an Inverted Head & Shoulders chart pattern, reversing the previous bearish sentiment, and trading above the 21 ema again. A good bullish reversal sign.

Now, we see that it is doing another chart pattern calledCup & Handle, another bullish chart pattern, and this reinforces the thesis on AMD for the short-term. Now, let’s see the daily chart for more clues:  In the D chart,AMD is trying to trigger a bullish pivot, by doing a higher high/low for the first time since it started its downfall. Recently, the 38.2% Fibonacci’s Retracement worked as a very good support level, and it seems the price respected this point, and it officially did a higher low (higher than the previous bottom near $ 100).

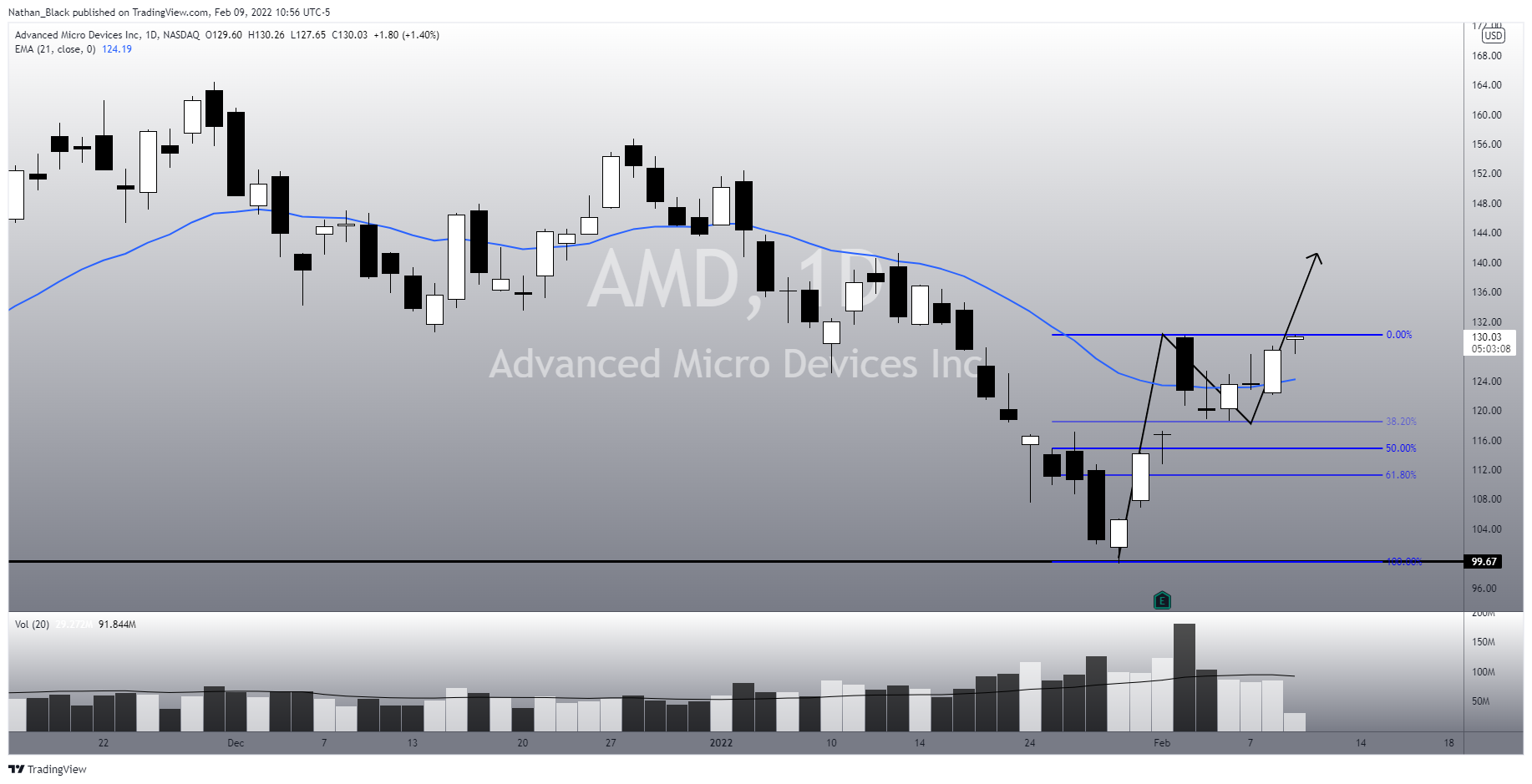

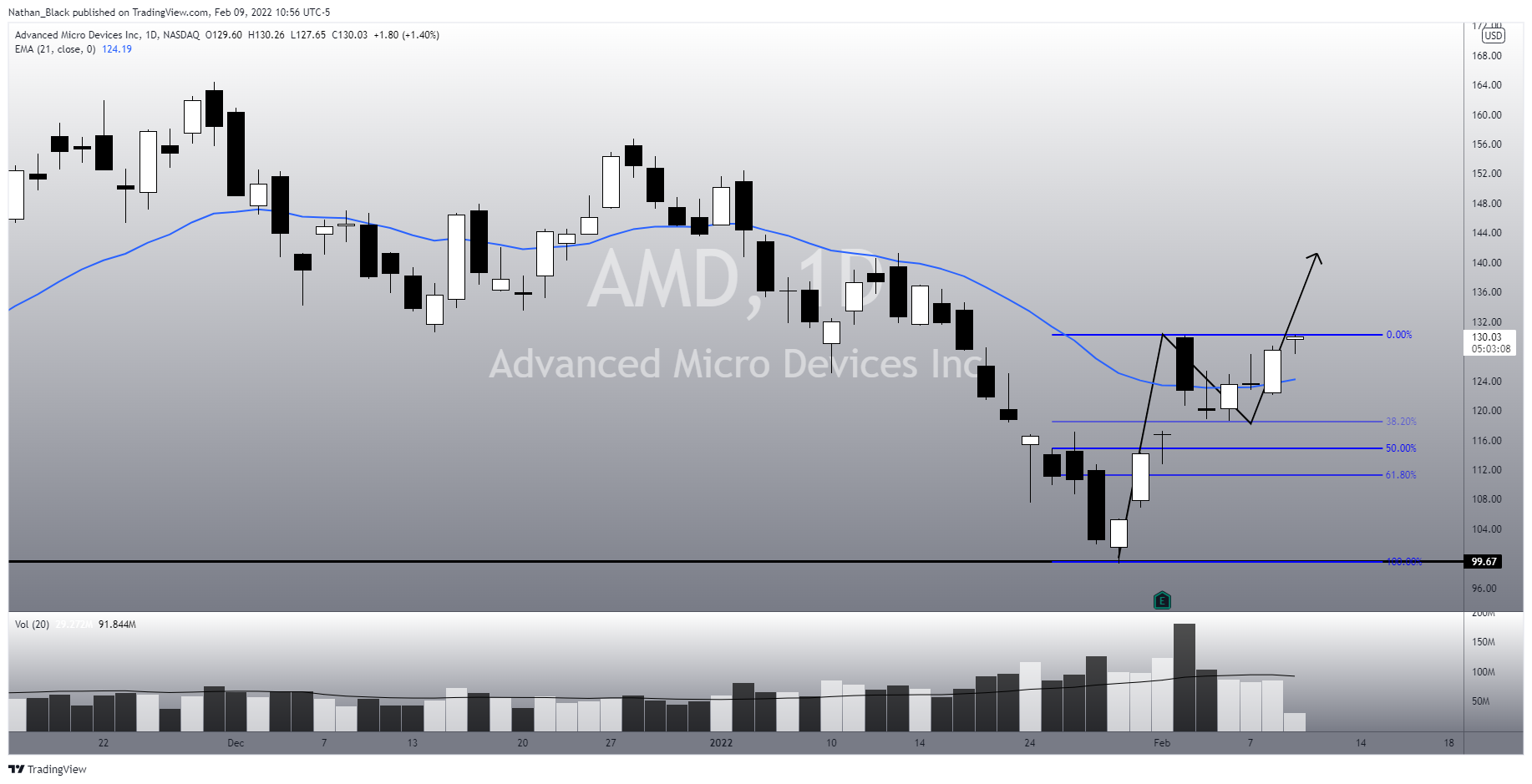

In the D chart,AMD is trying to trigger a bullish pivot, by doing a higher high/low for the first time since it started its downfall. Recently, the 38.2% Fibonacci’s Retracement worked as a very good support level, and it seems the price respected this point, and it officially did a higher low (higher than the previous bottom near $ 100).

Now, we are trying to break the $ 130 area, making it a true pivot point in the daily chart. There’re more clues in the weekly chart:

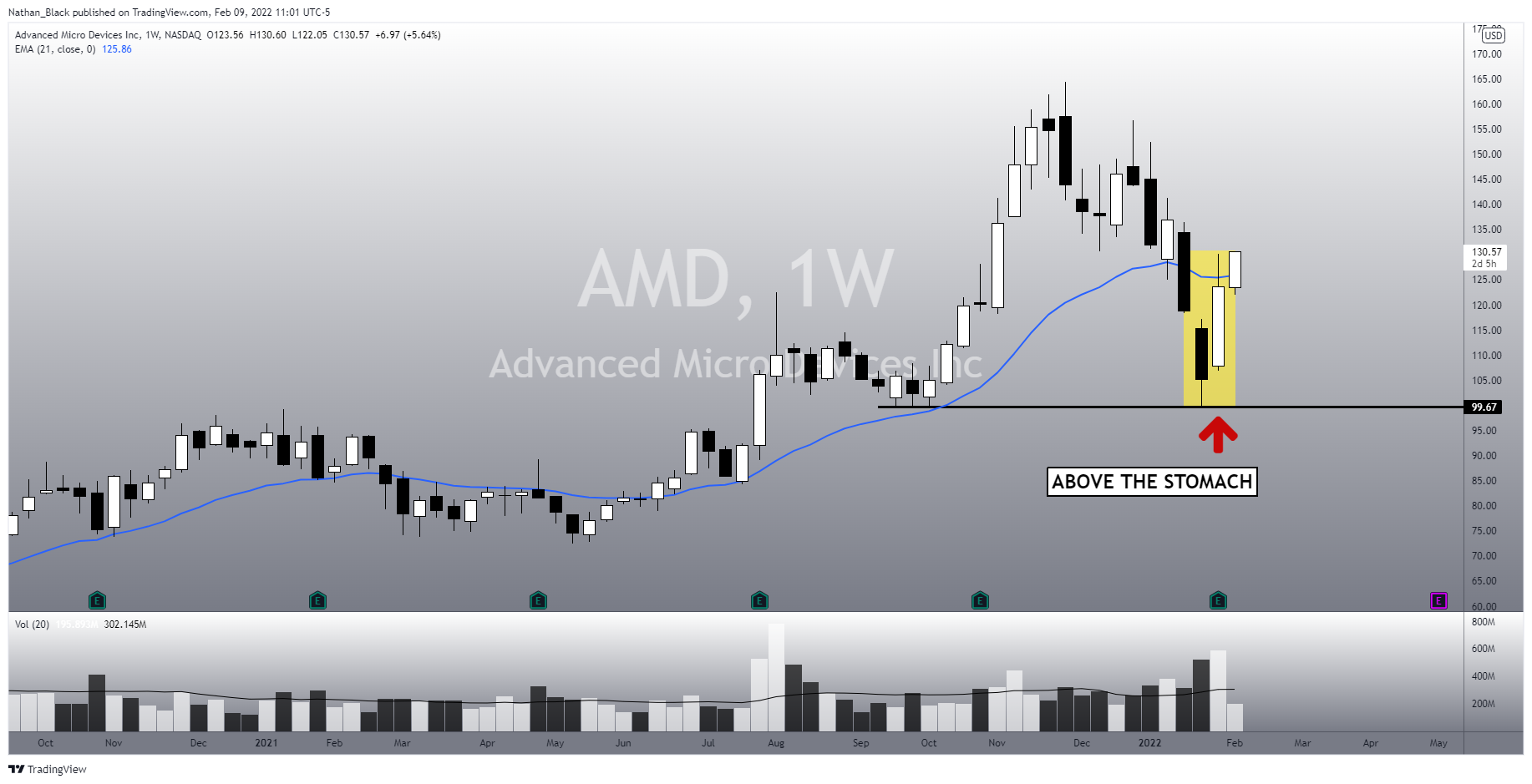

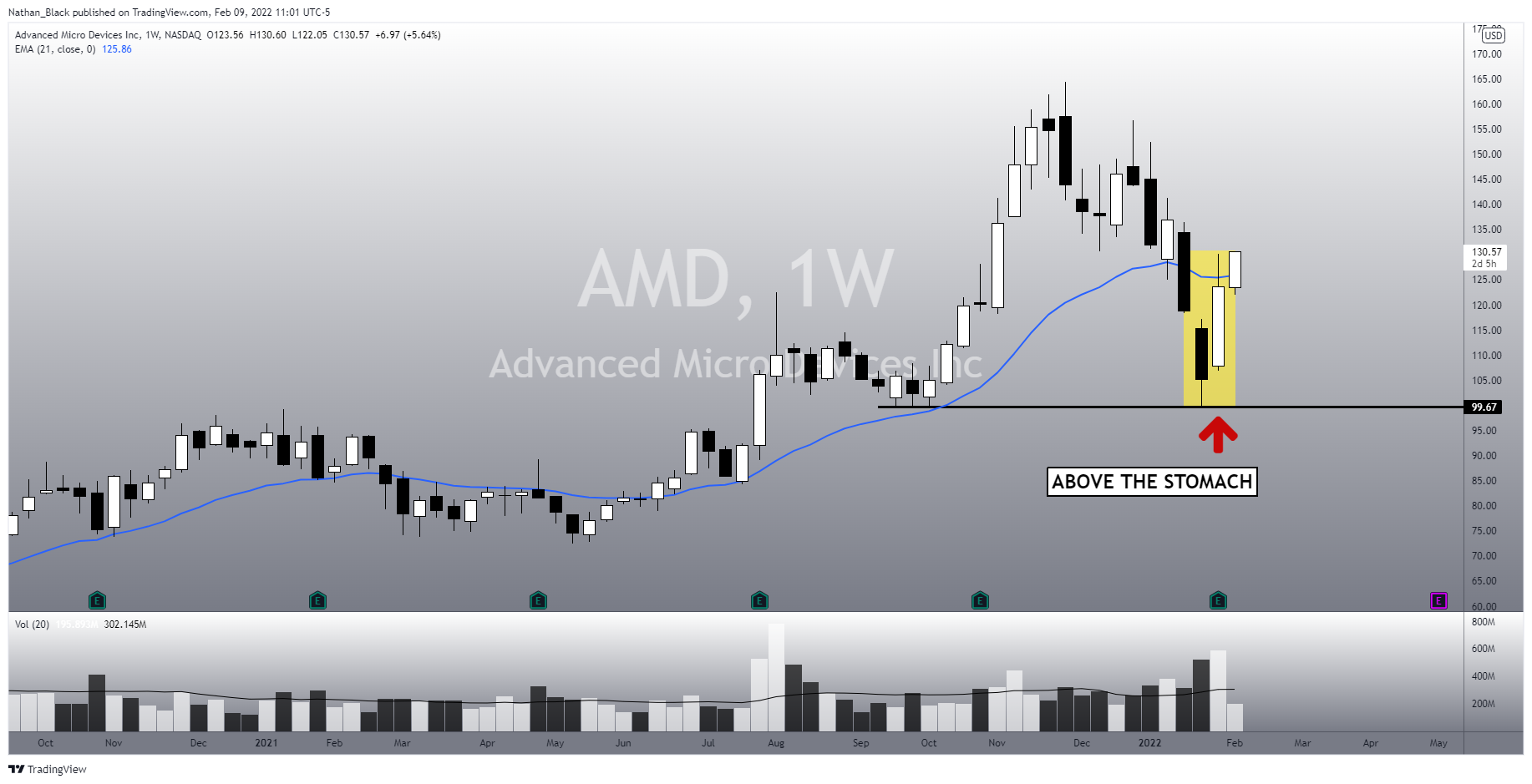

In the weekly chart, we see that the support at $ 99s is a very good one, and whenAMDretested it again two weeks ago, it bounced back up, and it did another bullish pattern, called Above the Stomach, which is a quite common pattern, but it seems few know it by its true name.

In the weekly chart, we see that the support at $ 99s is a very good one, and whenAMDretested it again two weeks ago, it bounced back up, and it did another bullish pattern, called Above the Stomach, which is a quite common pattern, but it seems few know it by its true name.

The volume was great, probably among the top 10 highest volumes in the history ofAMD.

It seems AMD is quite bullish for now, but we must watch out for bearish patterns, and keep our eyes on the next resistance, which is the $ 141.

If you liked this analysis, remember to follow me to keep in touch with my ideas. All the best to you.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments