KEY POINTS

- There was no company-specific news driving the cloud-based AI lending platform's rally.

- The stock could be reacting to strong Q2 results from fellow fintech specialist SoFi Technologies.

- There's also the possibility that SoFi's results ignited a short squeeze in Upstart shares.

What happened

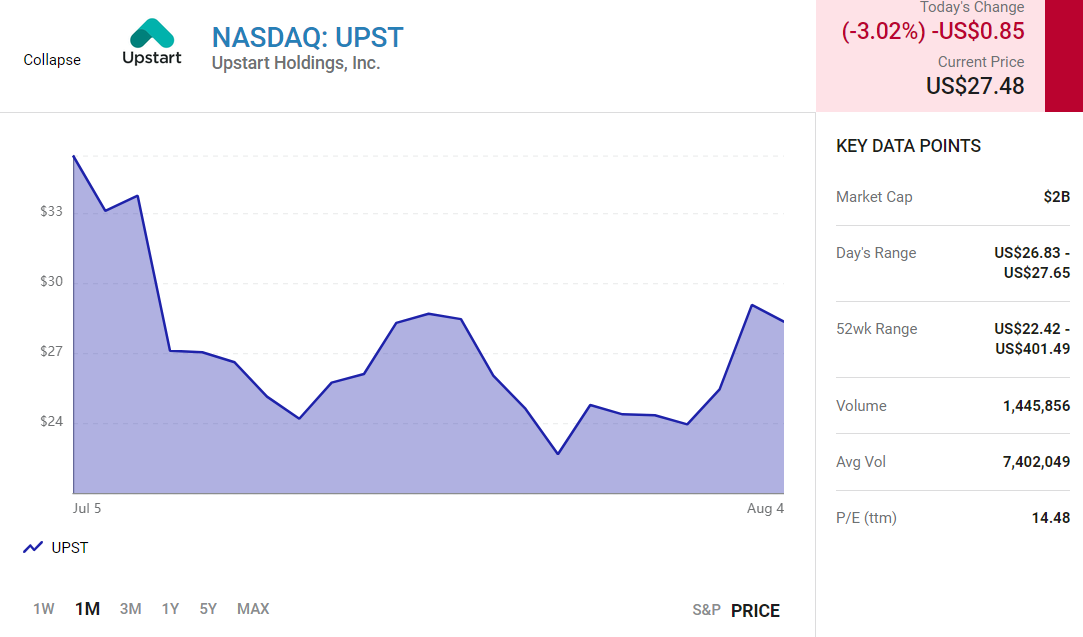

Shares of $Upstart Holdings, Inc.(UPST)$ surged by as much as 19.6% Wednesday. As of 2:23 p.m. ET, the stock was still up 15.5%.

The major market indexes were in rally mode, with a wide swath of stocks trading higher. While this trend no doubt contributed to the cloud-based AI lending platform's rise, blockbuster second-quarter results from anotherfintech stocklikely provided additional tailwinds.

So what

So what

While a check of all the usual sources turned up no company-specific news that could be driving Upstart higher, the stock was likely moving in sympathy withSoFi Technologies(SOFI-1.94%), which reported better-than-expected financial results. In Q2, SoFi generated record net revenue of $362.5 million, up 57% year over year, and its adjustedEBITDAsoared 81%. This resulted in a loss per share of $0.12.

To give those results context, analysts' consensus estimates were calling for revenue of $340.8 million and a loss per share of $0.14, so SoFi comfortably exceeded Wall Street's expectations on both counts. Perhaps more telling were SoFi's customer metrics: Its total members grew 69% year over year to 4.3 million, while total products used grew 79% to 6.6 million.

In light of those results, management raised its full-year outlook, forecasting that adjusted net revenue would rise by roughly 50% to $1.51 billion at the midpoint of its guidance range.

Now what

So what does all this have to do with Upstart? Like manyhigh-growth stockswith previously lofty valuations, Upstart has been hit hard in thebear market.Its stock is down by a whopping 92% from the peak it reached late last year, making it subject to big bounces.

To add insult to injury, Upstart stock got crushed when the company reported itsfirst-quarter resultsin May. While its performance was admirable, management's guidance for slowing growth sent the share price into a tailspin. It shed 56% of its value in a single day. With the benefit of hindsight, investors likely now view that as an overreaction, particularly in view of the strength of SoFi's results.

Comments

Okay

Buy

Ok